The telecom scene is house to some fairly low cost dividend payers that may assist pad your quarterly passive revenue stream. Undoubtedly, the times of excessive charges could also be numbered. And if they’re, buyers could have to return to inventory markets to attain yields above the 4.5% degree. The excellent news (for potential buyers) is that at this time’s American telecom shares are beneath important strain for numerous causes, together with macro headwinds.

As charges fall, shopper pressures ease, and the subsequent technology of linked units go surfing, search for corporations feeding the 5G (and past) wi-fi increase to discover a option to gravitate increased once more. Subsequently, this piece will use TipRanks’ Comparability Instrument to look at three Sturdy-Purchase-rated telecom shares that will make nice worth buys this season.

T-Cellular (NASDAQ:TMUS)

In the case of telecom companies, it’s laborious to call an organization doing half in addition to T-Cellular. The inventory has risen greater than 135% over the previous 5 years, whereas a few of its largest legacy rivals have sunk deeper into the crimson. Higher networks, decrease costs, and maybe buzzy promotions are key to rising market share.

Although T-Cellular’s friends have been taking steps to catch as much as the fast-running wi-fi king, T-Cellular is more likely to proceed main the pack because it seems to develop its main 5G wi-fi protection additional. Undoubtedly, T-Cellular stays the reigning king of 5G, and I don’t see anyone threatening the agency’s spot on the throne, at the very least not anytime within the close to future.

You don’t merely boast a best-in-class 5G community in a single day. It takes years, truly a long time, of dedication and rampant funding. These years of clever investments have helped T-Cellular construct a deep moat for itself. All issues thought of, I have to say I share Wall Avenue’s enthusiasm and bullishness on the inventory.

Transferring forward, T-Cellular appears to be positioning itself to supply higher connectivity to cater to the subsequent technology of (wi-fi) wearable units. With latest partnerships combining the most effective of 5G and spatial computing (or combined actuality headsets), it’s laborious to not view T-Cellular as a spatial computing enabler and one of many larger beneficiaries of the Metaverse’s rise.

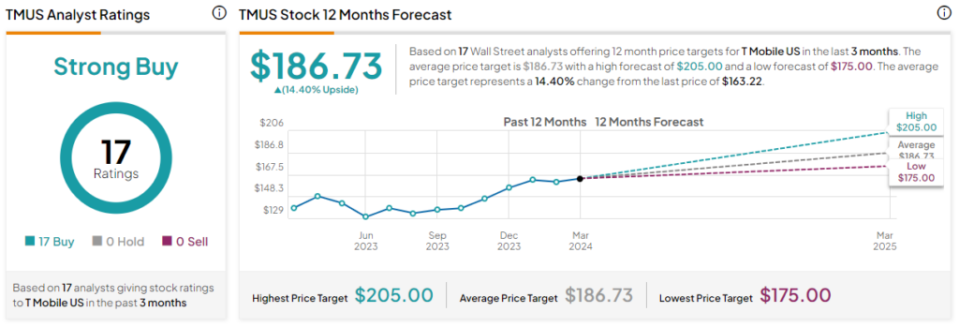

What Is the Value Goal for TMUS Inventory?

TMUS inventory is a Sturdy Purchase, in line with analysts, with 17 unanimous Buys assigned previously three months. The common TMUS inventory worth goal of $186.73 implies 14.4% upside potential.

Rogers Communications (NYSE:RCI)

Rogers Communications is a Canadian telecom agency that additionally boasts a powerful Sturdy Purchase ranking from analysts. Until you reside in Canada, although, you’ve in all probability not heard of the corporate.

In contrast to T-Cellular, which has been a profitable funding over time, Rogers Communications shares have been underperforming lately. Shares are down not simply over the previous 5 years but in addition the previous 10 years. The inventory is down 23.6% and 1%, respectively, over the previous 5 and 10 years.

That’s some severe underperformance, and whereas the buyers have collected a pleasant dividend (at this time, the ahead yield sits at 3.62%), I believe it’s secure to throw RCI inventory into the dud class. Even when adjusting for dividends, the inventory remains to be down almost 10% previously 5 years and up simply 40% in 10 years.

Nonetheless, the place some see a dud dividend, others might even see a possibility to unearth some fairly deep worth. In any other case, why would most analysts have an upbeat view of the Canadian telecom firm?

Maybe the largest purpose to stay with Rogers Communications is the progress following final 12 months’s merger with Shaw Communications, one other Canadian telecom agency. The deal, which confronted ample regulatory hurdles en path to completion, concentrated market energy (particularly in Western Canada) within the arms of 1 firm — a outstanding concern for regulators however a possibility for buyers.

Transferring forward, analysts see synergies and strategic alignment as main pluses behind the deal. Edward Jones analyst David Heger famous that Rogers appears to be scoring value financial savings quicker than anticipated in his latest sitdown with BNN Bloomberg. In mild of this, it’s laborious to not be bullish on the long-time Canadian laggard of a inventory that could be on the cusp of waking up.

Maybe the financial savings might be handed on to clients? If not, maybe shareholders stand to profit most, doubtless within the type of fats dividend raises within the agency’s future. Both method, Rogers inventory seems like a relative discount at simply 11.5 occasions ahead price-to-earnings (P/E), properly beneath that of TMUS, which fits for round 18 occasions ahead P/E.

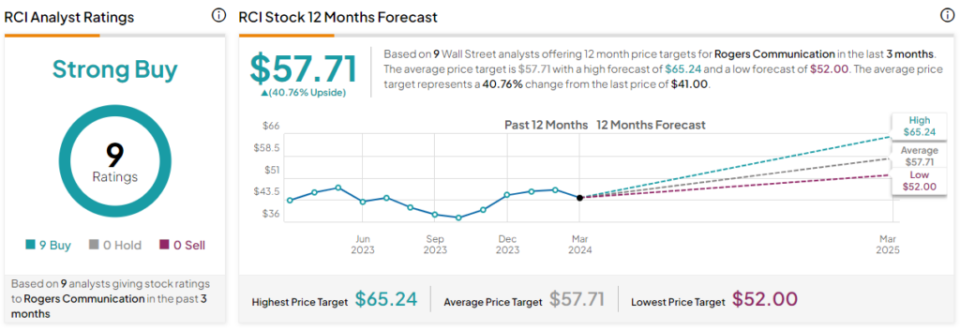

Maybe the largest draw to the inventory, although, is the implied upside potential, which sits at greater than 40% at writing.

What Is the Value Goal of RCI Inventory?

RCI inventory is a Sturdy Purchase, in line with analysts, with 9 unanimous Buys assigned previously three months. The common RCI inventory worth goal of $57.71 implies 40.8% upside potential.

American Tower (NYSE:AMT)

American Tower is an actual property funding belief (REIT) that leases cell towers to purchasers. Lately, headwinds have caught as much as the REIT, leading to a near-47% haircut in shares from peak to trough. Extra lately, AMT shares have been again on the ascent, due to lower-rate hopes, a quarterly consequence that noticed a gentle top-line beat (This autumn-2023 gross sales of $2.79 billion vs. $2.74 billion estimate), and upbeat steering for the 12 months forward.

Undoubtedly, with such a low bar and a extra upbeat tone for 2024, it’s laborious to not be bullish on the REIT because it seems so as to add to its newfound momentum that introduced shares up greater than 20% off final 12 months’s lows.

For the 12 months forward, American Tower appears able to money in on the expansion in information facilities. Given the profound rise of generative AI on the cloud (and its potential in edge computing), the info middle looks as if the place to be. As the corporate’s prior acquisition of information middle play CoreSite pays off, the stage could very properly be set for an epic comeback for an unappreciated cell tower REIT that’s about to get up once more.

At writing, shares commerce at 26.7 occasions ahead P/E, making it a tad pricier than the opposite two telecom performs on this piece. Regardless, I do discover the 3.32%-yielder to be a long-term winner because it faucets into the info middle to jolt development and diversify its enterprise additional.

What Is the Value Goal for AMT?

AMT inventory is a Sturdy Purchase, in line with analysts, with 12 Buys and one Maintain assigned previously three months. The common AMT inventory worth goal of $229.92 implies 16.4% upside potential.

The Backside Line

The telecom scene appears wealthy with alternatives for value-conscious buyers who like dividends or distributions. Whereas I’m a giant fan of all three, I’m most enticed by RCI inventory, as Wall Avenue sees probably the most beneficial properties (~40%) over the 12 months forward. Based mostly on its P/E, it’s additionally the most affordable of the trio.