Whereas there was a whole lot of pleasure surrounding the launch of Nvidia‘s (NASDAQ: NVDA) newest chips based mostly on its new Blackwell structure, each clients and buyers apparently might want to wait a bit longer. In keeping with reviews, the cargo of the chips might be delayed, though by how lengthy stays to be seen.

Given the robust demand that was anticipated for the chips, let’s take a better have a look at the difficulty and the influence it could have on the inventory.

Design flaw

As first reported by the tech publication web site The Data, a design flaw in its Blackwell B200 chip was discovered “unusually late” within the manufacturing course of. The problem is believed to stem from the corporate being one of many first to make use of Taiwan Semiconductor Producer‘s new CoWoS-L packaging know-how (“Chip on Wafer on Substrate with a Native silicon interconnect,” should you’re curious) and the position of the bridge dies connecting two graphics processing models (GPUs) being lower than good.

Consequently, Nvidia has apparently determined to revamp the design of its Blackwell GPUs, which is predicted to delay the beginning of shipments by three months or extra, in line with some reviews. Clients and companions have not directly confirmed the delays. Meta Platforms says it does not anticipate to obtain Blackwell GPUs this 12 months, whereas Tremendous Micro Pc executives say they do not anticipate any actual volumes from Blackwell till the March quarter.

Alphabet, Microsoft, and Meta all have big Blackwell orders value “tens of billions of {dollars}” that they wish to get crammed, in line with The Data. In the meantime, it was reported earlier this 12 months that Amazon was transferring its Nvidia AI accelerator orders from Hopper to Blackwell.

Whereas Hopper orders will seemingly assist fill a number of the void ensuing from the Blackwell delay, the chance is that there’s an air pocket if these clients simply wait on their massive orders.

UBS analysts, nonetheless, have come out and mentioned that, after chatting with Nvidia clients, the agency expects the chip delay to solely be between 4 to 6 weeks and that the delay might be “invisible” to most clients. That is a lot shorter than the preliminary delay that was reported, which has helped elevate the inventory off its current lows.

Is it time to purchase Nvidia inventory?

The size of the delay for Blackwell will seemingly have a big effect on Nvidia within the quick time period. A brief delay will seemingly be good for the inventory with hardly any influence on its 2025 outcomes, whereas a delay of three months or extra could be appeared upon unfavorably, particularly after the concept of a shorter delay has already been floated by a Wall Road analyst.

There is also the query of whether or not the design flaw might trigger a chip failure or whether or not it was simply resulting in less-than-expected manufacturing yields. Both means, it seems that the corporate’s resolution to delay manufacturing of the chip and repair any points is a great transfer.

Long term, the larger query surrounding the chip points is whether or not Nvidia has sped up its improvement timeline too rapidly. The corporate has minimize its deliberate improvement cycle for brand spanking new chip architectures from two years to at least one. This could preserve demand and costs excessive, however it’s additionally an aggressive schedule with restricted room for error or delays. Being on the forefront of recent know-how and delivering mass manufacturing of your merchandise are two separate issues that won’t at all times coincide sooner or later as effectively. So these are some dangers to contemplate.

That mentioned, with a lot of clients having completely big orders for its chips, demand is just not a difficulty for Nvidia. Clients are presently extra involved about falling behind within the synthetic intelligence (AI) race than overbuilding capability. As massive language fashions (LLMs) grow to be extra superior, they are going to want increasingly more computing energy, which implies extra GPUs might be wanted. For instance, Meta mentioned its Llama 4 LLM will seemingly want 10 occasions the computing energy of its earlier model to coach.

And that proper there may be the most important purpose to personal Nvidia. With a dominant market place within the GPU house, Nvidia will proceed to be the most important beneficiary of the continued push for extra computing energy.

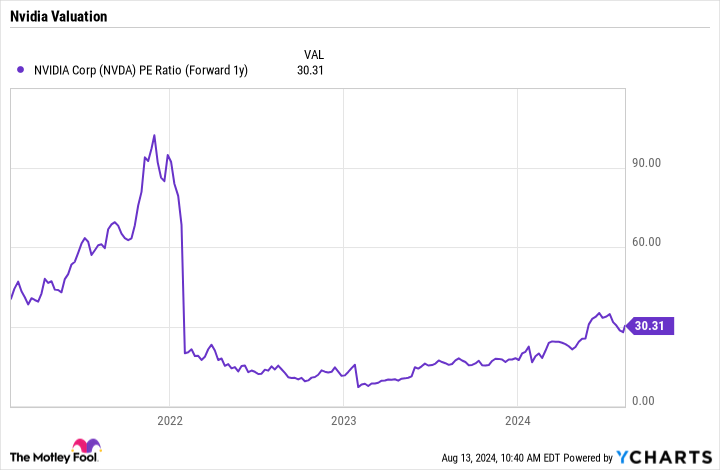

On the similar time, the inventory trades at a ahead price-to-earning (P/E) ratio of about 30 occasions based mostly on 2025 analyst estimates. For an organization with the expansion and long-term prospects of Nvidia, that valuation is sort of engaging.

NVDA PE Ratio (Ahead 1y) information by YCharts.

So whereas there are dangers related to the Blackwell delay, long-term buyers can nonetheless look to purchase Nvidia at present ranges.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, take into account this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Nvidia wasn’t one in every of them. The ten shares that made the minimize might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $763,374!*

Inventory Advisor offers buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 12, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Geoffrey Seiler has positions in Alphabet. The Motley Idiot has positions in and recommends Alphabet, Amazon, Meta Platforms, Microsoft, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

With Its Blackwell Chips Delayed, Ought to Traders Delay Shopping for Nvidia Inventory? was initially printed by The Motley Idiot