-

Financial institution of America says the current inventory market sell-off is unlikely to be the beginning of a brand new bear market.

-

Credit score markets stay secure, and solely three of 10 indicators of a market peak have flashed.

-

“A number of of our sentiment indicators recommend that sentiment didn’t hit euphoric ranges sometimes seen on the finish of bull markets,” BofA mentioned.

The inventory market’s current sharp sell-off is unlikely to rework right into a full-fledged bear market, in accordance with Financial institution of America.

The S&P 500 fell as a lot as 8% since its document excessive in July, whereas the Nasdaq 100 plunged greater than 10%. The sell-off was pushed by a weak July jobs report, the unwind of the yen carry commerce, and issues of an imminent recession.

However in accordance with Financial institution of America strategist Savita Subramanian, the tell-tale indicators of a inventory market peak have but to materialize.

As a substitute of this being a inventory market peak that is on the precipice of an enormous drawdown, it is greater than doubtless only a typical correction that happens on common each single 12 months.

For perspective, Subramanian pointed to inventory market historical past to focus on that pullbacks out there are frequent.

“5%+ pullbacks are frequent, occurring over 3 times per 12 months on common since 1930 (this marks the second this 12 months after April). Bigger corrections are much less frequent however nonetheless frequent, with 10%+ corrections occurring as soon as per 12 months on common (the final one was in fall 2023),” Subramanian wrote in a notice on Monday.

The truth that credit score markets stay secure provides Subramanian confidence that the current sell-off is a standard pullback slightly than the start of a real bear market.

“To date, credit score markets are subdued with a trough-to-peak widening of 70bp for high-yield spreads by final Friday,” Subramanian mentioned.

Sometimes throughout panics that evolve into bear markets, bond traders demand a better premium for his or her dangerous junk debt relative to Treasurys, however that has but to materialize.

The BofA US Excessive Yield choice adjusted unfold, which measures the distinction in yields between junk bonds and Treasury bonds, is at simply 3.93%, properly under its 5.33% common since inception in 1996.

For perspective, prior inventory market panics in 2020 and 2008 led the unfold to soar to 9.82% and 21.82%, respectively.

“The current unfold widening might be described as normalization from extraordinarily tight ranges towards truthful worth. Unfold widening past 450-475 could be regarding, in accordance with our credit score strategists,” Subramanian mentioned.

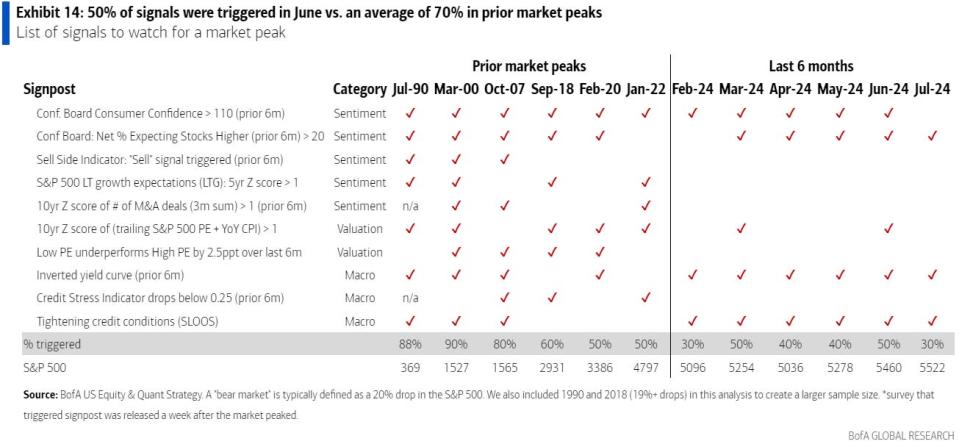

What’s extra, Subramanian tracks 10 indicators that, when most of them flash, indicators {that a} main inventory market peak has occurred.

However as of July, simply three of the ten indicators have flashed, in accordance with the notice, which was a stepdown from the 5 indicators that flashed in June.

“We noticed a most of fifty% of those indicators triggered in June, under the typical of 70% triggered in prior market peaks,” Subramanian mentioned.

The three inventory market peak indicators that flashed in July embrace the web proportion of respondents to the Convention Board survey exceeding 20 when requested in the event that they count on the inventory market to maintain rising, an inverted yield curve, and tightening credit score situations based mostly on the Senior Mortgage Officer Opinion Survey.

However seven different indicators tied to investor sentiment, valuations, and macro knowledge have but to flash.

“A number of of our sentiment indicators, together with our Promote Facet Indicator, recommend that sentiment didn’t hit euphoric ranges sometimes seen on the finish of bull markets,” Subramanian mentioned.

As a substitute of getting ready for a chronic market sell-off, Subramanian recommends traders go cut price looking and concentrate on shopping for top quality shares.

Learn the unique article on Enterprise Insider