Because the know-how sector takes on “further” harm because the broader markets roll over for August, growth-hungry cut price hunters could want to take into account the next bruised high-tech names—UBER, AVGO, and SAP—whereas they’re markedly cheaper than they have been simply two weeks in the past. Undoubtedly, the summer season market sell-off appears to have arrived a month or so early (usually, September is often the ugliest month for shares).

Subsequently, maybe the next Sturdy Purchase-rated tech names are worthy of your consideration. Let’s test with TipRanks’ Comparability Software to check the names because the market choppiness drags on.

Final week’s weak jobs information was fairly horrible, and it’s been inflicting stress on markets. Nonetheless, there could also be nothing extra to concern about renewed recession worries than the concern itself. Positive, shopper sentiment, preferences, and habits have modified in sudden and mysterious methods in recent times in response to inflation and different pressures.

Nonetheless, Uber’s newest quarter appears to counsel the patron is simply high quality. In mild of Uber’s extremely robust outcomes and return to profitability, I can’t assist however keep bullish on the inventory.

Uber’s newest quarter caught many abruptly. In spite of everything, a sluggish economic system ought to imply that fewer individuals are prepared to splurge on ride-hailing providers, proper? In a previous piece, I famous that the ride-hailers have been truly extra economically resilient than many gave them credit score for.

Have Uber Eats and rides gotten pricier of late in any case this inflation? Undoubtedly. Nonetheless, it’s nonetheless cheaper to “Uber” a journey than to personal a automotive. With all of the insurance coverage, parking, gasoline cash, upkeep, and different hidden prices, there must be no thriller why Uber inventory has been doing nicely, even when the economic system appears to be operating on empty.

With journeys and meals supply up 23% and eight%, respectively, and earnings again within the books, Uber inventory appears to be like like a purchase on the way in which up. Whether or not or not the patron is in for reduction or extra ache, Uber stands out as a service that customers nonetheless worth extremely on this difficult surroundings.

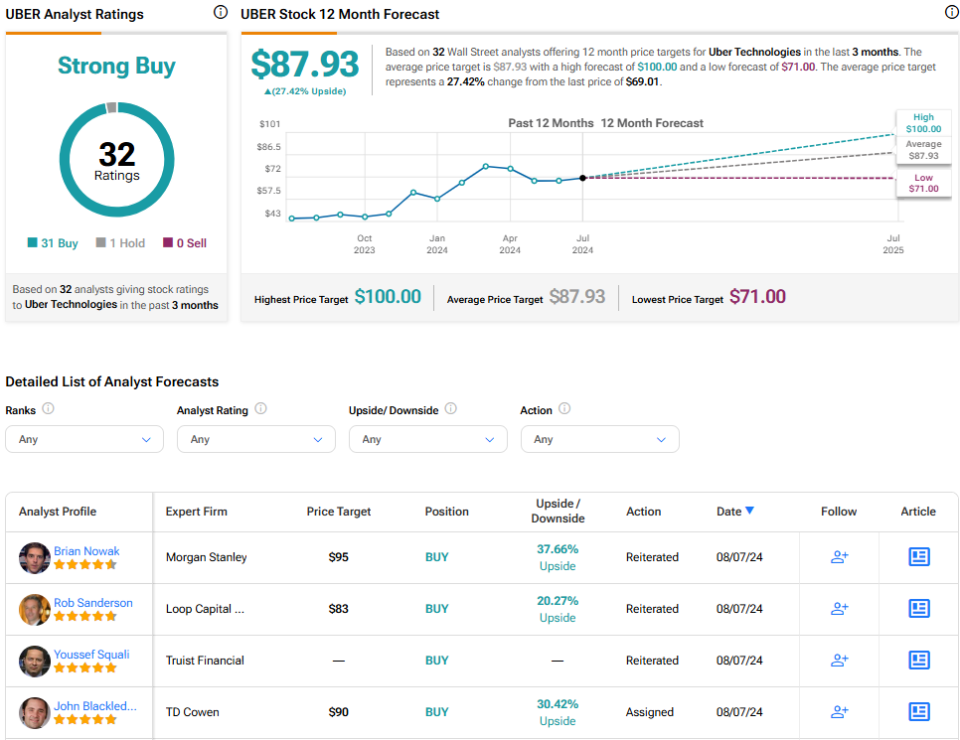

What Is the Value Goal for UBER Inventory?

UBER inventory is a Sturdy Purchase, in keeping with analysts, with 31 Buys and one Holds assigned up to now three months. The common UBER inventory worth goal of $87.93 implies 27.4% upside potential.

Broadcom was caught on the middle of the blast zone amid the most recent market-wide sell-off and sure soon-to-be correction. The most important semiconductor winners are giving again an enormous chunk of the features loved in current months. The place some see an AI bubble, I see nothing greater than a correction. Actually, it’s a wholesome one in terms of AVGO, which spiked upward again in June. Even after the 22% plunge, AVGO inventory remains to be up round 10% for the reason that begin of June. There’s nothing essentially improper with the Broadcom story or the inventory. As such, I’m staying bullish.

Again in early August, Rosenblatt analyst Hans Mosesmann hiked his worth goal within the identify by a whopping 45% (to $2,400 from $1,650), praising the agency for its AI infrastructure and networking companies. Projecting out to Fiscal Yr 2026, Mr. Mosesmann thinks high-teens development shall be within the playing cards. I feel he’s spot-on to pound the desk on the identify. That mentioned, the improve got here proper earlier than AVGO inventory plunged right into a nasty bear market.

So, what has modified for the reason that notable improve? Aside from the worth of admission and traders’ newfound distaste for AI shares, not a heck of rather a lot. As soon as traders fall again in love with AI shares, I don’t suppose a rebound gained’t be too far off for AVGO. At 22.6 occasions ahead price-to-earnings (P/E), the inventory trades consistent with the semiconductor business common of twenty-two.3 occasions, making it fairly valued.

What Is the Value Goal for AVGO Inventory?

AVGO inventory is a Sturdy Purchase, in keeping with analysts, with 23 Buys and one Holds assigned up to now three months. The common AVGO inventory worth goal of $196.36 implies 34.7% upside potential.

Shares of German enterprise software program agency SAP have been one of many resilient tech companies amid the brutal correction within the tech-heavy Nasdaq 100 (NDX). At writing, the inventory is down simply 5% from its all-time excessive, whereas the S&P 500 (SPX) is one dangerous day away from falling right into a correction itself. As a not too long ago found AI winner who’s seemingly attaining a powerful stability between financial savings and funding, I view SAP as one of many AI shares that may dodge and weave previous punches thrown within the Tech sector’s means. As such, I’m staying bullish on the identify.

After its newest earnings, SAP introduced mass layoffs as a part of its restructuring plans. With 9,000-10,000 jobs to be reduce, traders have the suitable to be nervous. In spite of everything, Intel’s (INTC) newest layoff was met with a historic meltdown within the inventory. Whereas layoffs will at all times be unlucky and disappointing to listen to about, traders appear considerably enthused that such cuts will price €3 billion ($3.26 billion) however enhance 2025 estimated earnings from €10 billion to €10.2 billion.

And in contrast to Intel, issues appear to be going nicely over at SAP, with a cloud migration shifting alongside and AI bets (suppose its enterprise AI copilot named Joule) that might repay long run.

Berenberg’s Nay Soe Naing believes SAP “shall be one of the resilient software program names within the second half,” and he’ll most likely be confirmed proper. SAP inventory has already been resilient within the first month of the 12 months. And because the agency takes a cost-conscious method whereas persevering with to innovate on AI, it’s giving traders precisely what they need: deliberate AI funding that gained’t break the stability sheet.

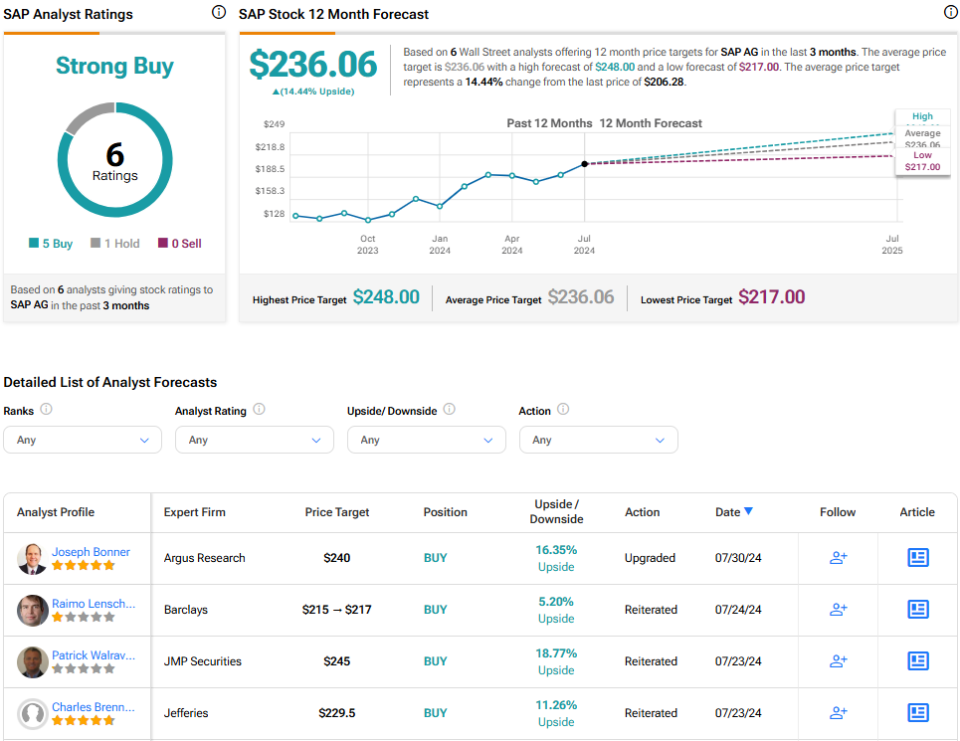

What Is the Value Goal for SAP Inventory?

SAP inventory is a Sturdy Purchase, in keeping with analysts, with 5 Buys and one Maintain assigned up to now three months. The common SAP inventory worth goal of $236.06 implies 14.4% upside potential.

Conclusion

Don’t let the tech correction scare you out of high-quality development shares which have what it takes to maintain on gaining. Whether or not we’re speaking about Uber and its return to development and earnings in a troublesome surroundings, Broadcom and its still-hot AI tailwinds, or SAP and its resilience in software program, the next trio appear greater than worthy of their Sturdy Purchase suggestions.

Of the three, analysts see AVGO inventory as having probably the most room to run, with a whopping 34.7% in implied upside from present ranges. I’m inclined to agree that AVGO is one of the best wager whereas AI shares are out of favor.