On this piece, I evaluated two semiconductor shares, Taiwan Semiconductor Manufacturing (NYSE:TSM) and Broadcom (NASDAQ:AVGO), utilizing TipRanks’ Comparability Device to see which is the higher purchase. A more in-depth look suggests a bullish view of TSM and a impartial view of Broadcom.

Taiwan Semiconductor Manufacturing manufactures and sells semiconductors for a number of finish markets, together with gaming consoles, servers, tablets, and computer systems, the automotive market, the Web of Issues, and different digital client electronics. Then again, Broadcom’s chips goal the renewable vitality, automotive, army and aerospace, industrial, and robotics markets.

Shares of TSM have soared 71% year-to-date and are up 76% over the past 12 months. In the meantime, Broadcom inventory has jumped 49% year-to-date and is up over 100% within the final 12 months.

The differing 12-month returns of TSM and Broadcom are suggestive of the considerations some People could have with holding Taiwanese shares.

China has lengthy seen Taiwan as a part of its territory — though Taiwan guidelines itself. In consequence, China has been rising its threats towards and army workout routines across the small island. In fact, uncertainties like which are sufficient to make many buyers nervous, however there’s extra to the story when evaluating TSM and Broadcom.

We’ll examine their price-to-earnings (P/E) ratios to gauge their valuations towards one another and that of their business. For comparability, the semiconductor business is buying and selling at a P/E of 68.8x versus its three-year common of 34.6x.

Taiwan Semiconductor Manufacturing (NYSE:TSM)

At a P/E of 34.4x, Taiwan Semiconductor Manufacturing is buying and selling at a steep low cost to Broadcom and plenty of different U.S. semiconductor names. Plus, with out TSM, among the world’s best-known semiconductor names wouldn’t have any merchandise. Thus, a bullish view appears acceptable.

The most important distinction between TSM and Broadcom is that TSM operates as a foundry, that means it manufactures chips for different corporations like Intel (NASDAQ:INTC). The truth is, TSM is the world’s largest contract chipmaker, and it’s the one that truly manufactures these artificial-intelligence chips which have pushed Nvidia’s (NASDAQ:NVDA) inventory value larger and better in recent times.

On Tuesday, TSM shares popped after DigiTimes reported that Intel had chosen the corporate to fabricate its new 3-nanometer chips for its new pocket book computer systems. DigiTimes had reported in Might that TSM was already at a 95% utilization price for its 3-nanometer manufacturing, so including Intel’s chips could properly deliver the corporate to full utilization or near it.

Given how excessive TSM’s utilization charges are working and the way cash-rich its clients are, it’s clear that the corporate has the pricing energy to boost costs, so we are able to count on income progress to stay sturdy. The corporate can also be constructing three new fabrication services in Arizona in order that it may well help much more clients whereas tapping into U.S. incentives for home semiconductor manufacturing.

Some buyers should still be involved about the truth that TSM is a Taiwanese firm. Nevertheless, it’s price noting that TSM’s U.S.-listed American depository receipt (ADR) shares are buying and selling at greater than a 20% premium to the corporate’s Taiwan-listed inventory — the widest hole in over 10 years.

As that hole grows wider, it suggests buyers could also be turning into much less involved about these long-running geopolitical considerations. Moreover, as TSM strikes a few of its manufacturing exterior Taiwan, the potential dangers related to investing within the firm fall.

Subsequently, this could possibly be a great time to purchase this deeply discounted inventory earlier than it begins to method valuations in line of main U.S. chipmakers like Broadcom and Nvidia.

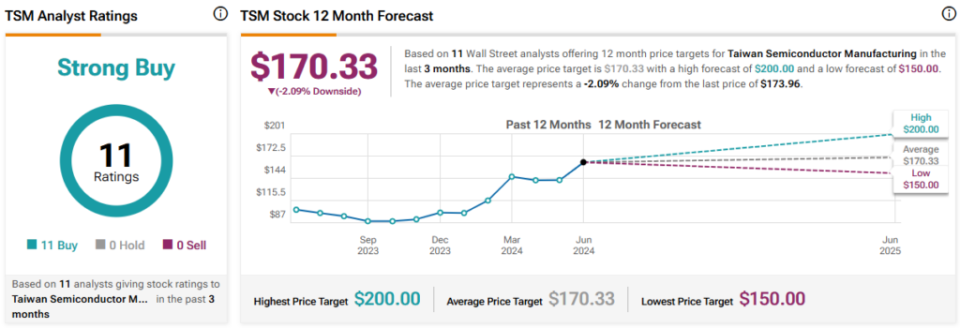

What Is the Worth Goal for TSM Inventory?

Taiwan Semiconductor Manufacturing has a Robust Purchase consensus score based mostly on 11 Buys, zero Holds, and nil Promote scores assigned over the past three months. At $170.33, the common TSM inventory value goal implies draw back potential of two.1%.

Broadcom (NASDAQ:AVGO)

At a P/E of 74.6x, Broadcom is buying and selling at a premium to its business however consistent with prime AI chipmakers like Nvidia, which is at a P/E of 76.5x. On the present valuation, Broadcom is buying and selling roughly consistent with its final two peaks in December 2020 and February 2021, when it was buying and selling at a P/E just under 80x. Thus, a impartial view appears acceptable — pending a extra engaging entry value.

Broadcom is basically a fabless semiconductor firm, that means it outsources its chip manufacturing to foundry operators like TSM. The truth is, TSM manufactured 90% of Broadcom’s semiconductors as just lately as 2022, though Broadcom does function three small fabs that characterize a minuscule a part of its enterprise, in accordance with its 2022 annual submitting.

Broadcom shares acquired a major bump following the most recent earnings report on June 12, which was accompanied by an announcement a few 10-for-one inventory break up. AVGO inventory has pulled again since then, falling roughly $100. Nevertheless, a steeper drop appears possible ultimately, particularly contemplating that its Relative Energy Index was over 70 this week (though it lastly got here down right now), which suggests overbought territory. The draw back is that we would have to attend some time to see a greater value.

Broadcom will conduct its 10-for-one inventory break up on July 12, and the shares will begin buying and selling at their split-adjusted value on July 15. For buyers on the lookout for bargains, the issue with inventory splits like this one is that they have a tendency to briefly inflate an organization’s share value as extra buyers pile into the inventory.

A inventory break up doesn’t really change the corporate’s worth. It simply makes the shares extra accessible to retail buyers who don’t have a large portfolio and gained’t or can’t actually afford to pay $1,660 for a single share. At $166 per share, Broadcom inventory appears rather more moderately priced, however the general valuation is identical as a result of there are 10 instances extra shares when the value is minimize to one-tenth of the present value.

As soon as we get previous the inventory break up and its related noise, it appears possible {that a} extra engaging entry value will come round.

What Is the Worth Goal for AVGO Inventory?

Broadcom has a Robust Purchase consensus score based mostly on 21 Buys, two Holds, and nil Promote scores assigned over the past three months. At $1,886.43, the common Broadcom inventory value goal implies upside potential of 13.7%.

Conclusion: Bullish on TSM, Impartial on AVGO

Taiwan Semiconductor Manufacturing and Broadcom are each glorious semiconductor corporations with long-term observe information of success and brilliant futures. Nevertheless, TSM isn’t getting its share of the glory for being the corporate that manufactures so lots of the chips which have made Broadcom and plenty of others into AI darlings.

Sooner or later, TSM might earn a P/E a number of consistent with Broadcom, Nvidia, and others, so this looks as if a good time to purchase. Then again, Broadcom’s valuation already seems to be full, so endurance is required for a greater entry value.