On this piece, I evaluated two synthetic intelligence (AI) shares, SoundHound AI (SOUN) and C3.ai (AI), utilizing TipRanks’ Comparability Software to see which is best. A more in-depth look suggests a impartial view of SoundHound and a bearish view of C3.ai.

SoundHound AI supplies conversational intelligence through its impartial voice-AI platform, which allows companies to offer conversational experiences to their clients. In the meantime, C3.ai is an enterprise AI firm that gives software-as-a-service functions enabling clients to develop, deploy, and function large-scale enterprise AI functions throughout infrastructures.

SoundHound AI inventory has surged 128% year-to-date, bringing its 12-month return into the inexperienced at 97%. However, C3.ai shares are off 6.5% year-to-date and have tumbled 35% over the past 12 months.

With such a dramatic distinction of their share-price performances year-to-date, the sizable hole between their valuations isn’t any shock. Since neither firm is worthwhile, we’ll use their price-to-sales (P/S) ratios to gauge their valuations in opposition to one another.

We will additionally examine them to the broader utility software program trade, which is buying and selling at a P/S of 8.7x, in keeping with its three-year common.

SoundHound AI (NASDAQ:SOUN)

At a P/S of 32x, SoundHound AI is actually not low cost, buying and selling at a large premium to the applying software program trade, though the truth that it’s an AI inventory suggests some premium is warranted. Nonetheless, primarily based on this valuation and different elements, a impartial view appears applicable.

First, SoundHound AI will not be worthwhile, which ought to give traders pause, particularly with a market capitalization of $4.5 billion. The corporate’s web revenue margins aren’t very encouraging both, standing at -186% for the final 12 months and -194% for 2023. Whereas they’re trending in the precise route every year, warning appears warranted for now.

What’s notably worrisome is that the corporate projected profitability in 2023 however got here up quick, posting a web lack of $88.9 million and an adjusted lack of 40 cents per share for the 12 months.

In reality, firm insiders seem to have been taking earnings, as SoundHound AI inventory has climbed this 12 months. The roughly $737,000 in Informative Promote transactions are solely a part of the story, as fairly a couple of Auto Promote transactions additionally recommend insiders won’t count on the inventory to rise extra within the close to time period.

However, SoundHound AI is increasing its partnership with top-10 automaker Stellantis (STLA), which owns many well-known car manufacturers like Dodge, Ram, and Jeep. The corporate’s voice AI expertise is being added to extra of the corporate’s car manufacturers in Europe, which bodes properly for the long run. In reality, SoundHound’s AI voice assistant is already reside and in manufacturing in Stellantis’ Peugeot, Vauxhall, and Opel autos in 11 markets.

Nonetheless, the dearth of earnings means that such a excessive valuation and premium versus the applying software program trade won’t be warranted, at the very least for now. SoundHound AI seems to be like an organization that has but to develop into its present valuation, and it could possibly be a while earlier than that occurs at present ranges.

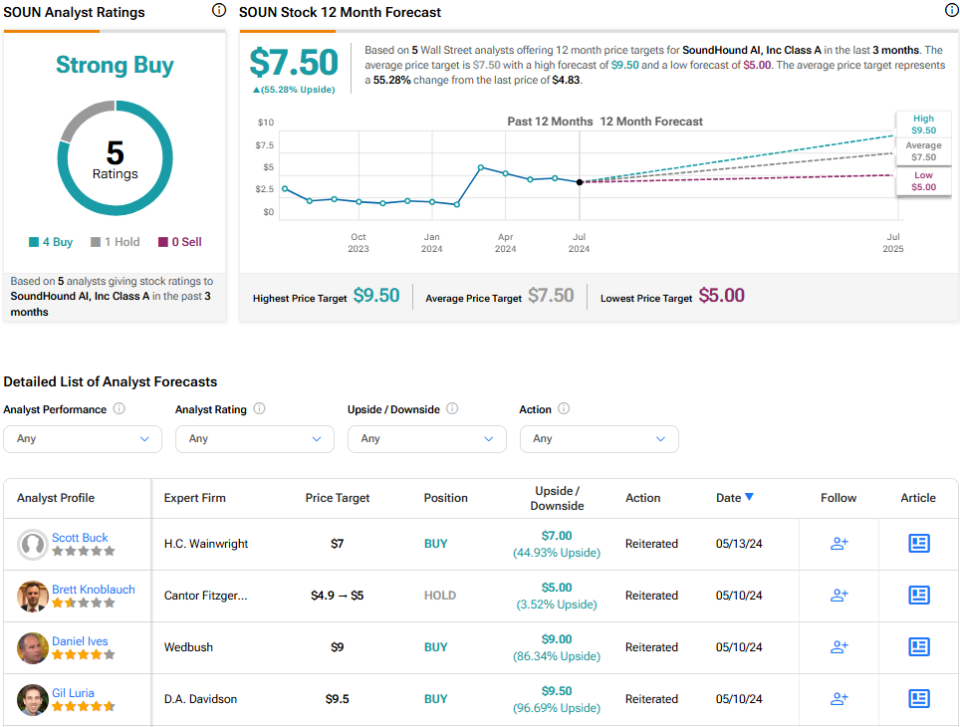

What Is the Value Goal for SOUN Inventory?

SoundHound AI has a Robust Purchase consensus ranking primarily based on 4 Buys, one Maintain, and 0 Promote scores assigned over the past three months. At $7.50, the common SoundHound AI inventory worth goal implies upside potential of 55.3%.

C3.ai (NYSE:AI)

At a P/S of 11.4x, C3.ai seems to be far more moderately valued than SoundHound. Nonetheless, its profitability prospects look even worse than SoundHound’s, so a bearish view appears applicable.

On a net-income-margin foundation, C3ai truly seems to be higher than SoundHound, provided that its margin improved from -101% within the fiscal 12 months that led to April 2023 to -90% within the newest fiscal 12 months.

Nonetheless, the corporate’s web losses are widening, rising from $268.8 million to $279.7 million year-over-year. In the meantime, regardless of its extraordinarily unfavorable web revenue margins, SoundHound’s web losses have narrowed from $116.7 million in 2022 to $88.9 million in 2023.

Moreover, there appear to be no projections for when C3.ai will develop into worthwhile. Thus, a key query is whether or not the corporate can ever be worthwhile. The truth that it serves the enterprise market is encouraging, however whether or not its companies are distinctive stays to be seen.

C3.ai does have strategic partnerships with Microsoft (MSFT) through Azure and Adobe (ADBE), however such partnerships should not uncommon within the AI area. It is going to be attention-grabbing to see whether or not Microsoft continues this partnership in mild of its shut and rising ties with OpenAI.

Thus, C3.ai stays a little bit of a show-me story for now, though this might change.

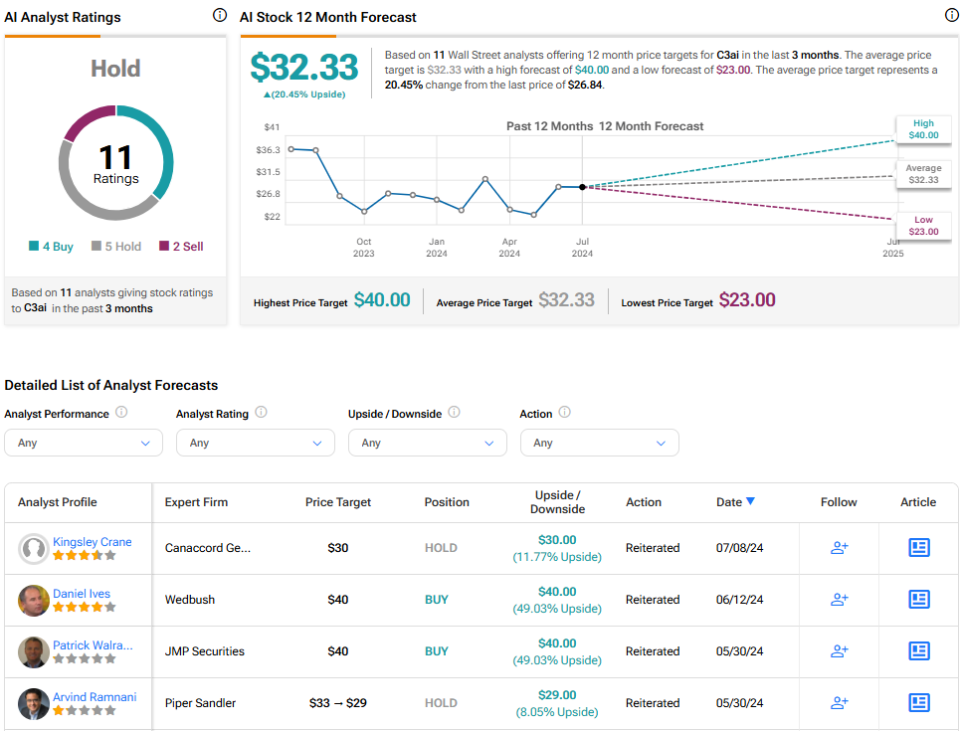

What Is the Value Goal for AI Inventory?

C3.ai has a Maintain consensus ranking primarily based on 4 Buys, 5 Holds, and two Promote scores assigned over the past three months. At $32.33, the common C3.ai inventory worth goal implies upside potential of 20.5%.

Conclusion: Impartial on SOUN, Bearish on AI

Each SoundHound AI and C3.ai have the potential for long-term excellence, but it surely simply feels a bit early to take a dive into these shares. I’d prefer to see extra progress towards profitability earlier than turning into extra constructive on both of them.