Taiwan Semiconductor Manufacturing Co (NYSE:TSM) noticed its shares rise to a report on Thursday within the Taiwan Inventory Alternate. The rally boosted Taiwan Semiconductor’s market capitalization to over $946 billion within the U.S. inventory trade as of Friday.

Traders are optimistic that Taiwan Semiconductor will profit from strong demand for synthetic intelligence (AI) and high-performance computing (HPC) chips, the Taiwan Occasions experiences.

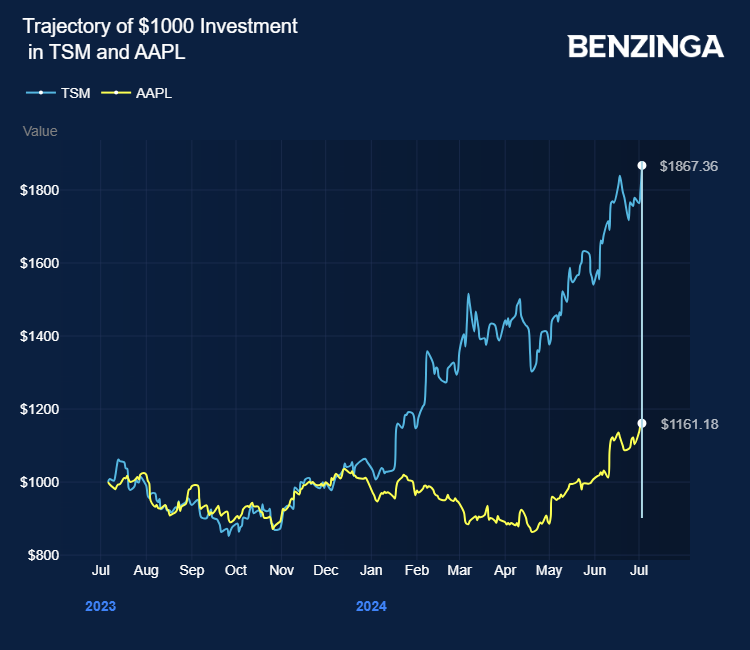

Taiwan Semiconductor has surged 69.48% this 12 months, solidifying its place as probably the most worthwhile inventory on the native trade and the world’s Tenth-largest firm by market capitalization.

Analysts anticipate a constructive earnings report from Taiwan Semiconductor, which is anticipated to drive its share value additional.

As a main advanced-chip provider for U.S. Massive Tech corporations, Taiwan Semiconductor is anticipated to information over 10% quarterly income development in its upcoming earnings convention on July 18.

A number of analysts are bullish on the prospects of Taiwan Semiconductor. UBS has raised its full-year capital expenditure estimates for Taiwan Semiconductor to $32 billion for this 12 months and $37 billion for subsequent 12 months, citing demand for demand for 2nm and 3nm applied sciences.

UBS analyst Lin Lijun expressed optimism over Taiwan Semiconductor’s place as the first CoWoS provider in 2025.

Taiwan Semiconductor income is anticipated to develop by a low to mid-20 % year-on-year, with the second half of the 12 months outperforming the primary.

Wall Avenue brokerages elevated their value targets for Taiwan Semiconductor in June, citing anticipated earnings development from AI demand and projected value hikes in 2025. Goldman Sachs forecasts elevated costs for 3- and 5nm chip manufacturing.

Taiwan Semiconductor inventory gained 81% within the final 12 months within the U.S. inventory trade. Traders can achieve publicity to the semiconductor sector by way of VanEck Semiconductor ETF (NASDAQ:SMH) and iShares Semiconductor ETF (NASDAQ:SOXX).

Worth Motion: TSM shares traded larger by 1.00% to $184.31 on the final examine Friday.

Disclaimer: This content material was partially produced with the assistance of AI instruments and was reviewed and revealed by Benzinga editors.

Picture by Jack Hong by way of Shutterstock

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Inventory Market Recreation with the #1 “information & every part else” buying and selling software: Benzinga Professional – Click on right here to begin Your 14-Day Trial Now!

Get the newest inventory evaluation from Benzinga?

This text What’s Going On With Taiwan Semiconductor Inventory On Friday? initially appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.