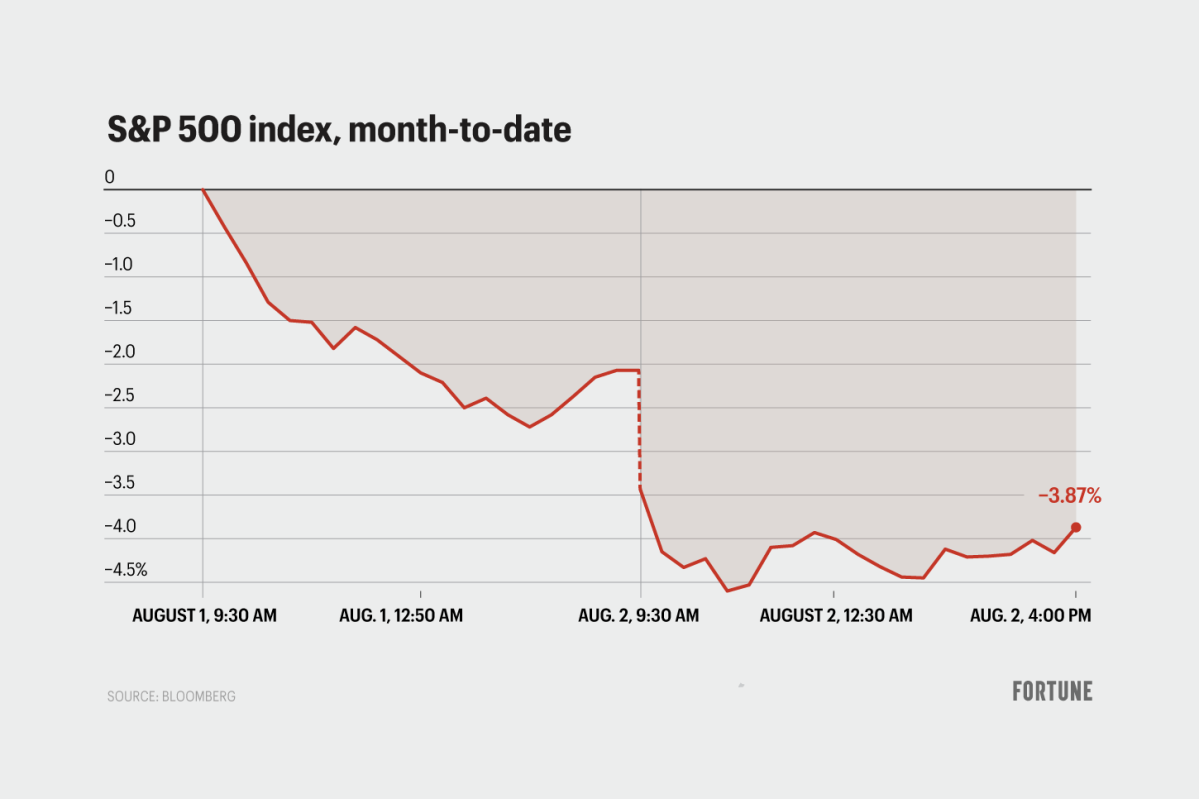

What a method to finish the week. The market plunged once more Friday, with the Dow closing down 600 factors, the Nasdaq dropping 2.4% and the S&P off 6% from its current all-time excessive.

Market watchers pointed to a few essential culprits for the swoon:

-

A weak jobs report reignited recession fears on Wall Avenue. The rise of the unemployment charge to 4.3% actually appeared to spook buyers. The brand new knowledge from the Labor Division triggered the so-called Sahm Rule, which signifies the probably begin of a recession as soon as the unemployment charge’s three-month shifting common exceeds that measure’s lowest level over the trailing 12 months. “We utterly flipped from a place the place a weaker economic system was bullish to [one where] a weaker economic system is bearish,” mentioned Jay Hatfield, the CEO of Infrastructure Capital Advisors.

-

Brief-term merchants drove a worldwide sell-off. Based on Hatfield, short-term buyers like hedge funds bought in droves over the previous two days. He thinks they’re hesitant to remain lengthy on shares now that earnings season is over. That mentioned: “We predict the prospect of recession stays terribly low,” Hatfield mentioned, “and the sell-off is irrational.”

-

Buyers needed a charge reduce. Hatfield agreed with buyers who criticized the Federal Reserve for not slicing charges on Wednesday. He in contrast FED chair Jerome Powell, who mentioned a reduce could possibly be “on the desk” for September, to Inspector Clouseau, the fictional detective constantly outwitted in The Pink Panther movies. “One among their three mandates is to be behind the curve,” Hatfield mentioned of Powell’s Fed. “So till it is totally apparent to everybody else within the investing world that they need to reduce, they are not going to chop.”

One issue specialists say probably wasn’t at play? Steep losses from mega-cap names, Hatfield added, had been probably not an enormous driver of the market dip. Intel shares plunged 26% after the corporate reported an enormous earnings miss and introduced mass layoffs, whereas Amazon’s inventory fell 9% after a disappointing earnings name. However Apple, America’s largest firm, emerged from Friday’s session barely up.

This story was initially featured on Fortune.com