-

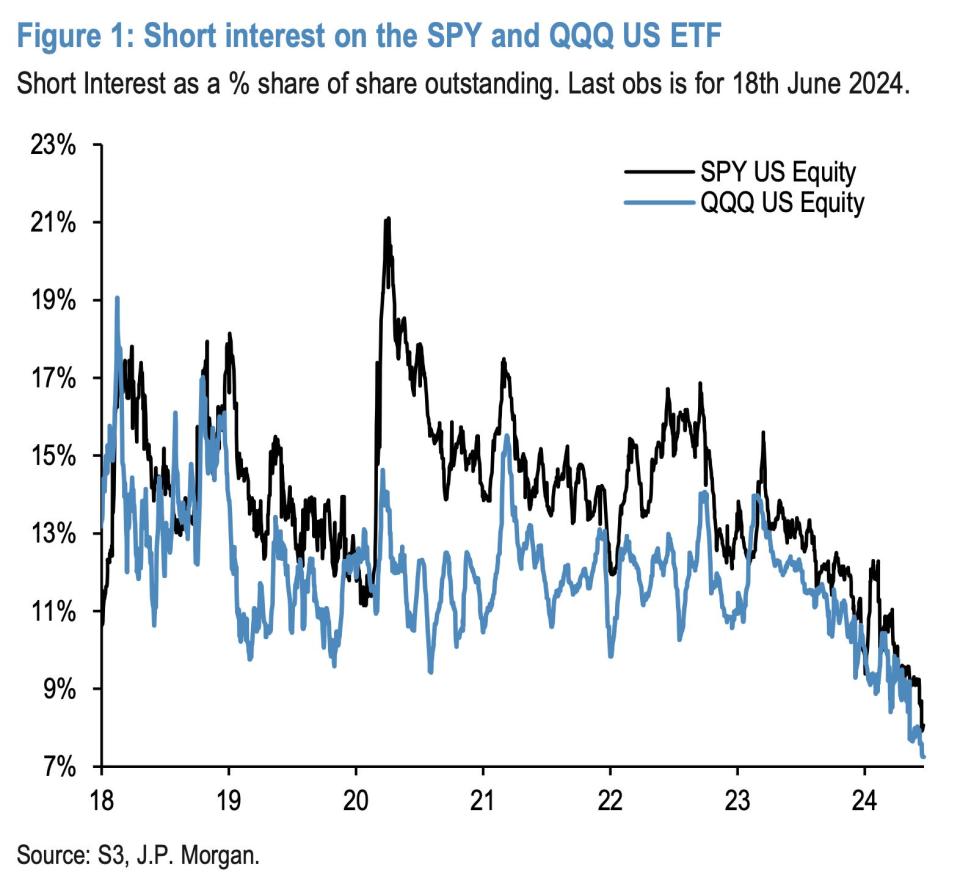

Brief bets in opposition to funds that observe main US indexes have declined to file lows, JPMorgan stated.

-

There are three fundamental causes quick sellers are withdrawing from the market.

-

Low ranges of short-selling may spark volatility out there if adverse information hits.

Nonstop highs within the US inventory market have turned quick promoting into a troublesome commerce, and bets in opposition to US indexes have tumbled, JPMorgan stated in a notice on Thursday.

Because the S&P 500 and Nasdaq have hit a streak of file highs this 12 months, quick curiosity in funds that observe the indexes has dropped, the financial institution stated.

“The declining quick curiosity on SPY and QQQ ETFs to successive file lows has been offering a gradual move help to US equities over the previous 12 months serving to to suppress volatility, thus performing as an implicit quick vol commerce,” analysts led by Nikolaos Panigirtzoglou stated.

In line with them, three fundamental elements have made this an particularly onerous market to commerce in opposition to.

First, quick bets are costly to keep up when a inventory or fund is climbing, a danger that is particularly related in at this time’s bull run. Synthetic intelligence pleasure, the potential for price cuts, and a resilient financial system have all factored right into a buying and selling frenzy.

Because of this, the S&P is up nearly 15% year-to-date and the Nasdaq has posted a 32.3% acquire.

Second, regulators have added restraints to quick promoting, by mandating transparency and including prices to quick sellers that focus on equities, JPMorgan stated.

Lastly, trade gamers are more and more backing out as they face a rising wall of engaged retail traders, with Gamestop’s well-known meme rally in 2021 being one of the best illustration.

“It’s no secret that the lengthy/quick fairness enterprise mannequin has come below strain and curiosity in basic inventory pickers has waned,” famed short-seller Jim Chanos wrote final November, in a letter explaining why he was exiting the enterprise.

In line with JPMorgan, quick positions are additionally disappearing from particular person shares, with a transparent decline within the prime seven main equities.

Although this withdrawal has underpinned the fairness market’s blowout run increased, it’d result in hassle forward, the financial institution added.

“Given how low their quick curiosity is in the meanwhile, this implicit quick vol commerce seems to be fairly prolonged by historic requirements, posing a vulnerability to US equities in a situation the place adverse information begin reversing the previous 12 months’s decline briefly curiosity,” analysts wrote.

Although unnamed by JPMorgan, analysts have lengthy been warning of plenty of market-denting information. That features the prospect of higher-for-longer rates of interest, a resurgence in inflation, earnings fallout, or a geopolitical rupture.

Learn the unique article on Enterprise Insider