The inventory market has gotten off to a red-hot begin in 2024. The S&P 500 has risen 11%, and constructive investor enthusiasm would not look like slowing down.

What I discover encouraging is that these sturdy returns are unfold out throughout many various sectors. One firm that’s performing significantly properly is restaurant chain Chipotle Mexican Grill (NYSE: CMG).

Chipotle is a distinguished holding of hedge fund supervisor Invoice Ackman, the CEO of Pershing Sq. Capital Administration. In March, Chipotle’s Board of Administrators accepted a 50-for-1 inventory break up. Importantly, shareholders nonetheless have to approve the break up on the firm’s annual assembly on June 6.

Let’s dive into the ins and outs of inventory splits, and assess whether or not you need to scoop up shares of Chipotle proper now.

Why is Chipotle splitting its inventory?

Inventory splits are an attention-grabbing idea. A typical false impression about inventory splits is that the inventory turns into cheaper after the break up goes into impact. In actuality, this isn’t the case.

When a inventory break up happens, an organization will increase its excellent shares by the ratio within the break up. Within the case of Chipotle, present shareholders would obtain 50 shares for each one share that they personal.

For the reason that variety of excellent shares rises, the inventory worth is lowered by the identical a number of. Given this dynamic, inventory splits don’t inherently change the market capitalization of the corporate.

For Chipotle, there are a few apparent the reason why administration is pursuing a inventory break up. In 2018, Chipotle was experiencing some operational challenges. The corporate appointed Brian Niccol as its chief govt officer in hopes that the meals business veteran could lead on a turnaround. Since Niccol assumed the CEO place in March 2018, Chipotle inventory has risen 926%.

At this time, the shares commerce for roughly $3,200. This places the inventory handily out of attain for many retail traders. Throughout Chipotle’s first-quarter earnings name, administration spoke concerning the proposed inventory break up, stating that it “will make our inventory extra accessible to our staff, in addition to a broader vary of traders.”

Once more, whereas the break up would not truly change the worth of Chipotle, the decrease inventory worth causes traders to understand shares as extra inexpensive and thereby tends to spur some new shopping for exercise.

How is Chipotle performing?

It is no secret that the macroeconomy has been going through a troublesome battle with inflation for nearly two years now. Certainly, whereas inflation has cooled to three.4%, costs stay elevated in sure areas and are weighing on the buyer.

Particularly, meals and grocery costs have been significantly cussed. Since Chipotle is a fast-casual restaurant and in the end a client discretionary sort of buy, you would possibly suppose the enterprise is struggling proper now.

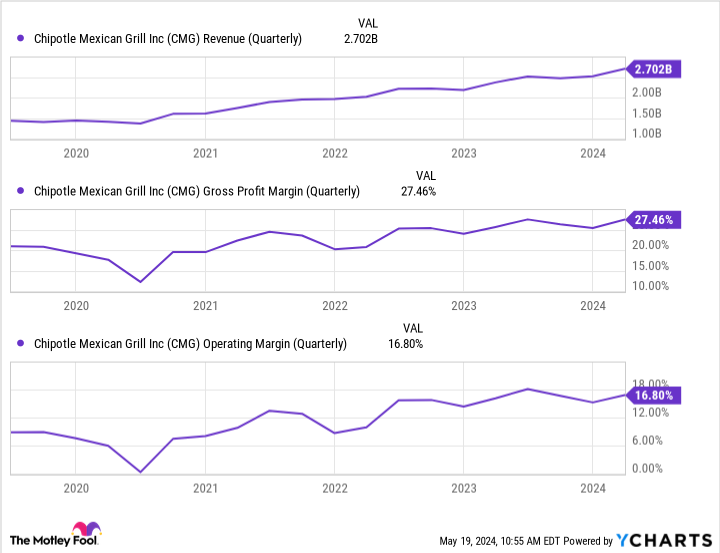

Nevertheless, the charts beneath illustrate a vastly totally different story. Not solely are gross sales of Chipotle hovering, however working margins are additionally increasing at a powerful price.

There are a few causes. First, Chipotle is investing closely in digital operations. Individuals are more and more choosing digital platforms in nearly each services or products in right this moment’s world.

Through the first quarter, digital gross sales represented greater than one-third of Chipotle’s income. And on the finish of the primary quarter, Chipotle boasted practically 40 million rewards members that it might probably attain via its app.

Bringing expertise into the labor-intensive restaurant atmosphere may end up in extra automation and enhanced order effectivity and success. If executed correctly, these investments repay within the type of repeat purchases and engaged clients.

This has helped Chipotle construct extremely sturdy model fairness whereas additionally reaching enviable pricing energy over the competitors. This interprets into repeat clients, which might be seen within the firm’s financials.

For the quarter ended March 31, Chipotle’s same-store gross sales elevated 7% yr over yr. By comparability, comparable gross sales at McDonald’s solely rose 2% yr over yr within the first quarter.

Is Chipotle inventory to purchase proper now?

One disadvantage of Chipotle inventory is valuation. With a price-to-earnings (P/E) ratio of 68, shares of Chipotle are expensive. Nevertheless, I feel the corporate has earned its premium valuation and nonetheless presents a compelling funding alternative for long-term traders.

Bear in mind, ought to the inventory break up be accepted by shareholders and go into impact in June, there’s a good probability that some momentum will enter Chipotle and shares might surge. Whereas it would look such as you’re shopping for Chipotle inventory at a decrease share worth, you’d truly be paying a good increased valuation.

Contemplating the corporate has managed to develop in an in any other case risky financial system, coupled with its innovation efforts, I see even higher days forward for Chipotle. I feel the investments in a digital platform will in the end generate vital margin growth and money circulate era in the long term — offering Chipotle with sturdy, sustainable monetary flexibility.

Regardless of a hefty price ticket, I feel now is an effective time to scoop up some shares earlier than the break up.

Must you make investments $1,000 in Chipotle Mexican Grill proper now?

Before you purchase inventory in Chipotle Mexican Grill, think about this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 finest shares for traders to purchase now… and Chipotle Mexican Grill wasn’t one in all them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $584,435!*

Inventory Advisor gives traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Might 13, 2024

Adam Spatacco has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Chipotle Mexican Grill. The Motley Idiot has a disclosure coverage.

Up 926%, Is This Scorching Invoice Ackman Inventory a Purchase Earlier than Its 50-For-1 Cut up? was initially revealed by The Motley Idiot