Within the restaurant house, traders are consistently looking out for what firm may turn out to be the subsequent Chipotle Mexican Grill (NYSE: CMG). And for good motive — Chipotle’s inventory is up over 7,000% because it IPO’d again in 2006.

The newest contender is Cava Group (NYSE: CAVA), a Mediterranean restaurant fast-casual idea that has been rising its restaurant base rapidly. The corporate reported robust income progress within the first quarter.

Let’s take an in depth have a look at Cava’s most up-to-date earnings report and see whether or not the inventory makes good sense for traders now.

A surge in income

Cava noticed income for its fiscal Q1, which ended April 21, soar 30% to $256.3 million. The expansion was aided by the corporate having 323 areas at interval finish versus 263 on the finish of its fiscal Q1 a 12 months in the past. Identical restaurant gross sales grew 2.3%, though the corporate mentioned that adjusting for vacation shifts, it could have seen 4.3% progress. Cava noticed a 3.5% profit from menu worth will increase and blend, whereas visitor site visitors was down -1.2%.

Notably, the corporate was dealing with troublesome comparisons, as a 12 months in the past it noticed identical restaurant gross sales progress of 28.4%. Its restaurant stage margins (RLM) ticked down barely to 25.2% from 25.4%. This metric helps measure the profitability of its eating places earlier than company prices. Meals prices as a proportion of income went down, however labor prices rose.

The corporate flipped to a revenue, with earnings per share of $0.12 versus a lack of $1.30 a 12 months earlier. Adjusted EBITDA, in the meantime, practically doubled to $33.3 million. Cava additionally generated $38.4 million in working money circulation on the quarter and free money circulation of $4.7 million. That is vital, because it reveals the corporate can self-fund its restaurant enlargement plans, which is without doubt one of the long-term key drivers for the inventory.

Because of its stable begin to the 12 months, Cava additionally raised its full-year steering. It now expects identical restaurant gross sales progress to return in between 4.5% to six.5%, from an earlier vary of three% to five%, and for adjusted EBITDA of between $100 million to $105 million, up from a previous outlook of $86 million to $92 million. Cava additionally elevated its anticipated restaurant openings for this fiscal 12 months to between 50 to 54, up from an earlier view of 48 to 52 new areas.

The corporate mentioned it does see a possible site visitors headwind as the thrill that got here with its IPO final 12 months begins to fade. Nevertheless, it’s anticipating the launch of a brand new grilled steak providing to assist increase comps, given the favorable reception the dish has had in take a look at markets in Boston and Dallas. Cava may even look to roll out a loyalty program by year-end, though its potential optimistic impact shouldn’t be contemplated in its present steering. The steak rollout will, nevertheless, be a slight headwind to its restaurant stage margins.

In the meantime, its enlargement plans proceed to stay on observe, with areas now in 25 states and the District of Columbia. It mentioned its current entry into the Midwest with a gap in Chicago was met with robust outcomes.

Time to purchase the inventory?

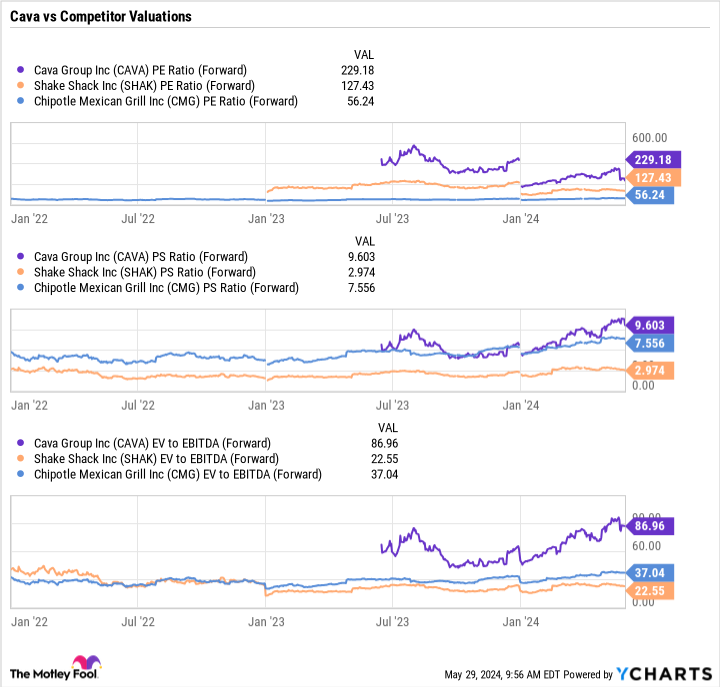

Regardless of a stable first quarter, Cava shares had been falling following its newest report. One motive might be the inventory’s valuation which, at a ahead price-to-earnings (P/E) of 230 occasions and a price-to-sales of 9.6 occasions, shouldn’t be low cost. Even at an enterprise worth to EBITDA foundation, the inventory trades at a hefty 87 a number of. In comparison with different rising quick informal ideas similar to Chipotle and Shake Shack, the inventory is pricey.

Nevertheless, Cava has lower than a tenth of the variety of eating places that Chipotle has within the U.S. at the moment. If the idea can stay widespread and garner the identical attraction all through the U.S., Cava may probably develop to turn out to be the dimensions that Chipotle is right now (practically an $87 billion market cap) over the subsequent 15 to twenty years. Be aware that Chipotle had below 500 areas in 20 states on the time of its IPO in 2006.

That might imply numerous upside for Cava inventory, which at the moment has a few $9 billion market capitalization. It is not straightforward projecting out a restaurant chain’s success over the subsequent twenty years, as tastes do evolve. However the substances are in place for Cava to probably be an enormous winner regardless of its present costly inventory.

Must you make investments $1,000 in Cava Group proper now?

Before you purchase inventory in Cava Group, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Cava Group wasn’t one in all them. The ten shares that made the minimize may produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… if you happen to invested $1,000 on the time of our suggestion, you’d have $671,728!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Could 28, 2024

Geoffrey Seiler has positions in Shake Shack. The Motley Idiot has positions in and recommends Chipotle Mexican Grill. The Motley Idiot recommends Cava Group. The Motley Idiot has a disclosure coverage.

Transfer Over, Chipotle — Cava Sees Income Surge. Time to Purchase the Inventory? was initially printed by The Motley Idiot