To purchase and promote shares efficiently means it’s important to discover and browse the bullish indicators – and that in flip means it’s important to know the indicators to learn. It’s probably not a trick, although, since every thing a inventory investor must know is wrapped up within the gathered information of the inventory markets.

That gathered information, nonetheless, presents an imposing roadblock. It’s the aggregated information from 1000’s of buyers buying and selling 1000’s of shares, making thousands and thousands of transactions daily. The Wall Road professionals, who construct their careers watching particular person shares and sectors, have years to spend studying the ins and outs of the market information; for the common investor, there’s the TipRanks Good Rating.

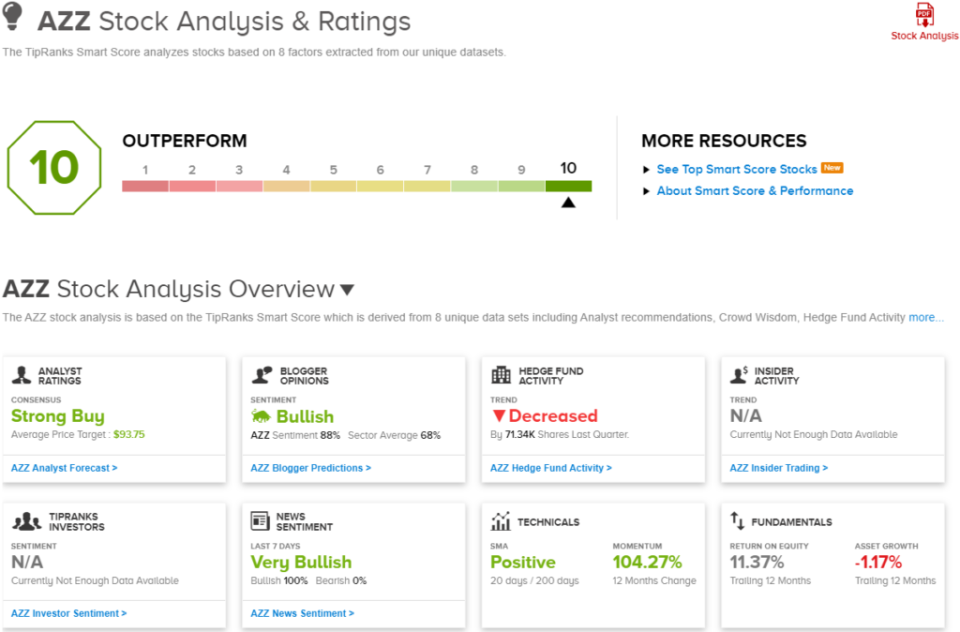

The Good Rating is a knowledge assortment and collation software, based mostly on a complicated AI algorithm, utilizing pure language processing to collect all the info from the markets – and to make use of it to fee each inventory in response to a set of things which can be identified by previous outcomes to efficiently predict future outperformance.

Based mostly on that comparability, each inventory is given a easy rating, on a scale of 1 to 10, with a ‘Excellent 10’ indicating a inventory that has the entire indicators lined up proper.

We’ve used the TipRanks database to drag up a few these ‘Excellent 10s,’ shares that the analysts see as sending bullish indicators. Listed here are the main points, together with feedback from a number of the Road’s inventory analysts.

Northern Oil and Gasoline (NOG)

The primary title on our record is Northern Oil and Gasoline, one of many US power business’s unbiased firms. Northern’s operations embody the acquisition of land holdings in hydrocarbon-rich areas; the exploration of these holdings; the event and exploitation of recoverable power reserves; and the manufacturing of usable crude oil and pure gasoline. Northern owns over 300,000 acres in main power areas such because the Williston Basin, the Permian Basin, and the Marcellus Shale of Appalachia.

Northern’s portfolio is predicated round high-quality land holdings with a low breakeven worth and practically 10,000 wells. Northern doesn’t function the wells itself; reasonably, the corporate owns the lands and the sources beneath and controls the wells, which in flip are operated by greater than 100 third-party actors, each private and non-private. The most important share of Northern’s holdings is within the Williston Basin, roughly 178,200 acres, whereas the gas-rich Appalachian holdings complete some 54,200 acres, and the Permian holdings come to almost 40,000 acres. The Permian Basin holdings generate some 45% of NOG’s manufacturing, whereas the Williston accounts for 41%. Manufacturing within the Appalachian area accounts for 14% of the corporate’s manufacturing. The shortage of correlation between the scale of a regional holding and its contribution to Northern’s complete manufacturing displays, partly, the relative density of the power reserves in these areas. Crude oil makes up 59% of Northern’s output, and pure gasoline makes up 41%.

Within the first quarter of 2024, Northern reported an organization file in quarterly manufacturing, producing 119,436 Boe per day and realizing $396.3 million in complete revenues. Nevertheless, this determine was down virtually 32% year-over-year and missed the forecast by $109.7 million. The corporate’s quarterly earnings seemed higher, with the non-GAAP EPS coming in at $1.28 per share and beating the forecast by 11 cents and, based mostly on an adjusted internet earnings of $130.5 million.

Trying on the firm’s prospects, Financial institution of America analyst Noah Hungness likes the potential for future enlargement. He writes, “In our view, NOG is nicely positioned as the most important public non-op firm to take part in massive future M&A. NOG’s capability to leverage its first mover benefit that constructed a ~120 mboed public non-op oil and gasoline firm is not going to be replicated over the following few years and is in a novel area to work with operators to finish bigger offers that we anticipate could come from aftershocks of the historic wave of M&A we noticed final yr.”

These feedback again up Hungness’s Purchase score on Northern Oil and Gasoline, whereas his $48 worth goal suggests the shares will acquire 29% on the one-year horizon. (To observe Hungness’s observe file, click on right here)

This inventory’s Sturdy Purchase consensus score is predicated on 11 current critiques that embody 9 to Purchase and a couple of to Maintain. The shares are at the moment buying and selling for $37.26 and their $49.50 common goal worth implies a one-year upside potential of 33%. (See NOG inventory forecast)

AZZ, Inc. (AZZ)

There are such a lot of completely different merchandise in our day-to-day lives, equipment, and instruments, that it’s straightforward to take them without any consideration – and it’s simpler to miss simply how wondrous the expertise behind them is. Take metals, for instance: the essential materials for many home equipment and instruments in your house. Most steel merchandise would quickly corrode simply from the oxygen within the ambiance if it weren’t for the assorted coating applied sciences exemplified by AZZ.

This firm is a number one supplier of commercial coating tech, offering the protecting coatings and applied sciences that make metals viable on most of our world’s primary instruments, from residence home equipment to manufacturing facility flooring machine instruments. AZZ is the main supplier for hot-dip galvanizing expertise in North America, a method whereby metal or iron gadgets are dipped in molten zinc with a view to type an alloy floor layer that stops corrosion and extends the steel’s life. As well as, AZZ can also be a serious supplier of precoat metals for coil-coated steel options, one other cost-effective expertise to offer steel surfaces enhanced climate and corrosion resistance.

AZZ’s fiscal yr 2024 ended this previous February 29, and in April, the corporate reported its fiscal 4Q24 outcomes. The earnings launch confirmed a quarterly high line of $366.5 million, up virtually 9% from the prior yr and greater than $15 million forward of the estimates. The corporate’s fourth-quarter backside line was reported as a non-GAAP EPS of 93 cents; this was up from simply 30 cents in fiscal 4Q23, and was 23 cents higher than had been anticipated. The corporate’s sound outcomes have been pushed by a 13.4% y/y improve in precoat metals gross sales, which hit $212.1 million. Metals coatings gross sales have been up 3.3% y/y.

This inventory has caught the eye of Jefferies analyst Laurence Alexander, who notes that will increase in on-shore manufacturing are benefiting AZZ by way of a ripple impact. “As the most important unbiased North American supplier of steel coatings, AZZ advantages from robust secular tendencies in favor of reshoring and infrastructure upgrades and a cyclical restoration in metals demand,” Alexander mentioned. “Development >GDP, >20% margins and >$5/share avg. FCF earlier than dividends ought to help vital a number of enlargement, in our view–and a path to double by 2026.”

The analyst goes on to offer AZZ shares a Purchase score with a $105 worth goal that factors towards a one-year potential acquire of 33%. (To observe Alexander’s observe file, click on right here)

Whereas there are solely 4 current analyst critiques on this inventory, all of them agree that it’s one to Purchase – making the Sturdy Purchase consensus score unanimous. The shares are priced at $79.12 and the $93.75 common goal worth suggests an 18.5% upside within the subsequent 12 months. (See AZZ inventory forecast)

To seek out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely necessary to do your individual evaluation earlier than making any funding.