For the reason that election of Margaret Thatcher’s Conservative authorities in 1979, Britain has undergone a terrific experiment. Economically, the UK turned the exemplar of neoliberalism in Europe. Politically, the UK has quietly transitioned to a postnational state, present process one of many biggest demographic transformations within the West.

Though the landslide victory of Tony Blair’s “New Labour” in 1997 might have appeared like a return to the mannequin of European social democracy that Britain exemplified after the Second World Battle, Blair’s “Third Means” represented somewhat the embrace of neoliberalism by the institution Left, summed up properly by their spokesman Peter Mandelson’s declaration that “we’re all Thatcherites now”.

Underneath the management of each the Conservative Celebration and New Labour, Britain has transitioned from a standard industrial and manufacturing powerhouse to a extremely financialised rentier economic system. The consequences have been profound. The common Briton is significantly worse off and whole areas have been left behind on the similar time London has change into a booming centre of worldwide finance. The UK has been denationalised by many years of mass-immigration and cultural leftism, and has change into the prime instance of “anarcho-tyranny”, the place the state punishes minor offences and acts of dissent in opposition to the liberal consensus with excessive pressure, whereas critical crime runs uncontrolled in main cities.

The Rentier Regime

The basic transformation within the British economic system for the reason that Eighties is the motion away from an economic system that made issues to an economic system that made cash . As much as then, Britain’s financial may had been centered on its manufacturing. Britain was the birthplace of the economic revolution, and the twin growth of its colonial empire and speedy advances in engineering allowed for the creation of an enormous buying and selling community, the place colonies supplied the uncooked supplies and markets for British manufacturing. Northern English cities like Manchester, Sheffield and Newcastle turned manufacturing powerhouses serving the world.

Britain has shifted from an entrepreneurial capitalism to rentier capitalism: an financial system organised round income-generating property. On this system, possession of sought-after scarce property — land, pure assets, mental property — is the supply of a good portion of financial exercise, and the regime is dominated by vastly rich rentiers. Wealth is constructed round having somewhat than doing.

In his ebook Rentier Capitalism, the financial geographer Brett Christophers confirmed that the primary results of Thatcherite-era reforms had been to open up new revenue streams to rentiers that had little or no productive results. The sample since then has been the privileging of rentier accumulation over funding in productive financial exercise. The share of UK GDP coming from manufacturing was 32% in 1973, right this moment it’s underneath 9%. The UK right this moment is producing some huge cash, however not a lot else.

Quite a few developments have empowered rentiers and disempowered renters for the reason that first Thatcher authorities: following the monetarist prescriptions of the Chicago faculty of economics, Thatcher’s authorities privatised huge portions of public property and deregulated monetary markets, which allowed for a large progress in interest-bearing credit score (family debt elevated from 37% to 70% of GDP underneath Thatcher). The massive discoveries of oil and fuel in Britain’s North Sea, in addition to the emergence of latest rent-generating digital applied sciences and platforms has additionally led to the swelling of rentier portfolios.

Successive governments have amended tax coverage to favour rentiers. For instance, in 2016 the Conservative authorities launched “The Patent Field”, which allowed firms to pay a considerably decrease company tax of simply 10% on income earned from mental property. This has principally benefited company giants like GlaxoSmithKline, the UK pharmaceutical firm who reported that this transformation led to them conserving an additional £458 million per yr.

The UK was additionally the primary authorities to pioneer Public Non-public Partnerships, underneath which public companies and infrastructure are outsourced to non-public firms to gather rents, although a lot of the monetary threat stays with the state. These PPP schemes haven’t solely led to very large windfalls for the non-public firms working them, however have been proven again and again to price the federal government greater than if it funded public tasks straight. A report on “The UK’s PPPs Catastrophe” notes that:

Since 1992 PPPs yielded public property with a capital worth of $71 billion. The UK authorities pays greater than 5 instances that quantity underneath the phrases of the PPPs used to create them.

Not solely this, however a lot of this big hire extraction from the British public to non-public finance is offshored and avoids taxation. In 2011, the UK Public Accounts Committee reported that traders had been extracting enormous income from British taxpayers by shopping for up contracts for colleges and hospitals funded by means of PPPs, and taking the proceeds offshore. The committee reported that many PPP contractors are based mostly in offshore tax havens, making a mockery of the idea held by the UK Treasury that these contractors would profit the British economic system by paying tax.

The Thatcher authorities additionally gave enormously beneficiant phrases for the oil firms which extracted British North Sea oil. The invention of plentiful oil and fuel reserves within the North Sea can take plenty of credit score for funding the financial growth within the Eighties, serving to to masks the contraction that was taking place in the true economic system on this interval.

However whereas international locations like Norway invested giant oil discoveries into long-term investments like sovereign wealth funds, Thatcher’s authorities used it to fund cuts within the larger charges of revenue tax. One economist estimated that had the three% of nationwide revenue that was being generated from oil and fuel extraction been invested in ultra-safe property, it might conservatively have been valued £450bn by 2008. As an alternative, this cash was used to fund a terrific money giveaway for the best earners in British society, a lot of which was then invested again into property property and used to inflate the housing market, somewhat than stimulate actual financial progress.

Privatisation, deregulation and financialisation has led to Britain changing into, within the phrases of the Monetary Occasions, a “rentier’s paradise”. All of the whereas, this transformation and the massive wealth switch it introduced has been subsidised by the British public, most of whom have seen declining or stagnant residing requirements for many years. The UK is a rentier regime — all coverage for the reason that Eighties will be understood as favouring rentiers, even (and infrequently) on the expense of the nationwide curiosity.

London’s monetary black gap

London had traditionally been the seat of British finance and authorities, however underneath Thatcher, the financialised economic system started to more and more decouple from the normal economic system whereas changing into the driving pressure behind the brand new mannequin’s financial progress. The best ranges of the UK authorities and the Financial institution of England got here to more and more serve the pursuits of the London monetary elite. The brand new mannequin adopted in Britain was:

Very a lot influenced by individuals with monetary market backgrounds. They knew lots concerning the Metropolis and capital markets however comparatively little about manufacturing and regional industries. Markets to them had been all about transactions, not manufacturing, labour or supplies. Trade was a part of an ageing overseas house for them. Finance was their new world.

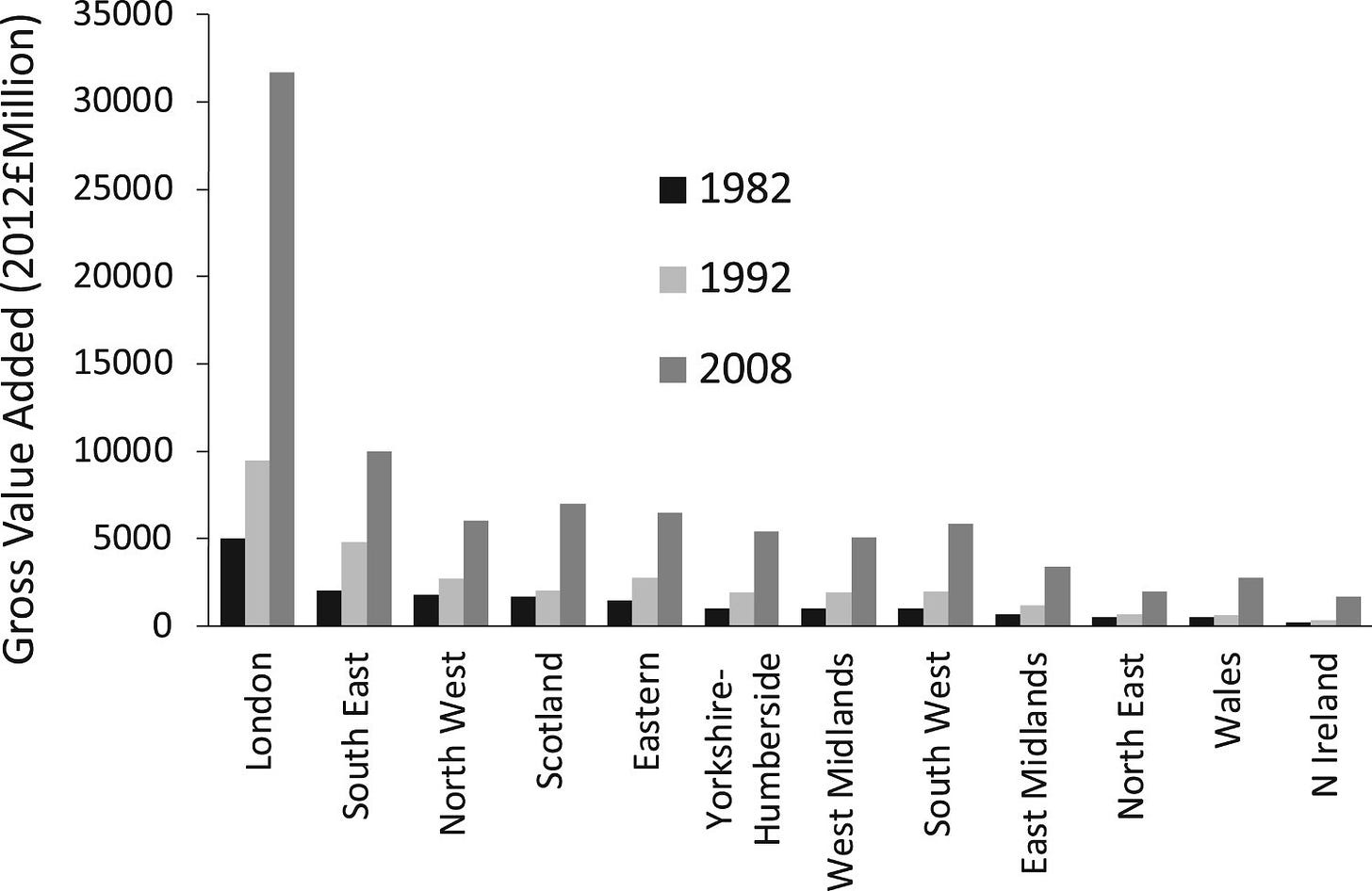

The graph under demonstrates the explosion in London-based monetary companies in delivering progress for the British economic system

In addition to permitting the expansion of economic companies in London, the deregulation of successive Thatcherite-Blairite governments has made London an unlimited centre of hypothesis. Property in London has change into an particularly well-liked commodity for the world’s elites to take a position on. In 2015, it was reported that non-resident consumers had spent over £100 billion on UK property within the earlier six years. International consumers now account for 41% of exercise on the London property market. Most of the excessive finish residential properties snapped up by oligarchs are left empty — London now has over 34,000 properties categorised as “long-term vacant”.

Listening to that London is each a booming monetary centre and the highest vacation spot for the world’s tremendous wealthy, anybody could be forgiven for assuming that that is an unmitigated good for the UK’s economic system. However there may be good proof that the London monetary centre has change into a black gap on the remainder of Britain and its extra conventional economic system.

It was typical knowledge of the neoliberal reformers {that a} progress within the monetary sector would profit different sectors of the economic system: not solely is there more cash fluctuating in quest of funding alternatives, however a bigger finance sector means extra data circulating concerning the markets it research, extra environment friendly markets, and thus simpler investments.

For the reason that 2008 monetary crash, a lot has been realized that challenges this assumption. A 2015 research by the Financial institution of Worldwide Settlements concluded that:

The expansion of a rustic’s monetary system is a drag on productiveness progress. That’s, larger progress within the monetary sector reduces actual progress. In different phrases, monetary booms should not, usually, growth-enhancing, seemingly as a result of the monetary sector competes with the remainder of the economic system for assets.

Referring particularly to Britain, the authors of The Finance Curse write that:

‘Financialisation’ has crowded out manufacturing and non-financial companies, leeched authorities of expert employees, entrenched regional disparities, fostered large-scale monetary rent-seeking, heightened financial dependence, elevated inequality, helped disenfranchise the bulk and uncovered the economic system to violent crises. Britain is topic to ‘nation seize’ with the economic system constrained by finance, and the polity and media underneath its affect.

In 2018, a trio of economists tried to place a quantity on the price of this ‘finance curse’. They concluded that in only a 20 yr interval, from 1995 to 2015, extreme financialisation price the UK economic system £4.5 trillion in unrealised progress.

Deregulation has additionally allowed the UK to change into a world centre for monetary fraud. A 2016 report estimated that monetary fraud prices the UK £193bn per yr — greater than the complete price range of the Nationwide Well being Service. Margaret Hodge, the previous head of the UK’s Public Accounts Committee, named Britain as “the nation of selection for each kleptocrat, criminal and despot on the planet”. In a single excessive profile case that demonstrated this function London now serves, the town was on the centre of a large Russian money-laundering scheme the place Russian insiders laundered as a lot as $80 billion in soiled cash, passing it by means of fictitious firms registered in London.

The Metropolis of London — the deregulated, semi-independent monetary district of London — can also be on the centre of the world’s “shadow banking” economic system, which is now estimated to account for half the world’s property. Britain has created, for the reason that Nineteen Fifties, a deeply advanced monetary ecosystem which makes use of deregulated offshore British jurisdictions just like the Cayman Islands and Jersey, permitting the world’s tremendous wealthy to cover their wealth and enterprise actions from tax and regulation.

Deregulation by the British authorities of the “Eurodollar market” of offshore buying and selling — executed consciously at a time of British colonial decline to try to keep British monetary energy — allowed the Metropolis of London to change into “the primary nerve centre of the darker international offshore system that hides and guards the world’s stolen wealth.” The Metropolis of London thus advantages from depriving the world of a whole bunch of billions in misplaced taxation and facilitating fraud and deceit on a large scale.

An ignored manner by which financialisation drags down the remainder of the economic system is in how the rentier state treats the nationwide foreign money. The try to make Britain a hub for inflows of overseas cash has made successive governments need a “sturdy” or overvalued pound sterling relative to different currencies.

The impact of this overvalued pound contributed considerably to the decline of British manufacturing — exporters endure from an overvalued foreign money, as their merchandise change into much less reasonably priced to different international locations. From 1950 to 1970, Britain’s share of the world’s manufacturing fell from 25% to 10%. Whereas this has usually been offered as an inevitable function of modernisation, in the identical interval Germany grew its share from 7% to twenty%. The important thing distinction is that in Germany, financial insurance policies have consciously been set to favour the expansion of trade, whereas Britain has handled industrial pursuits as subordinate to finance and banking.

In leaning on finance to switch the financial progress as soon as supplied by industrial output and innovation, Britain adopted the course of different as soon as nice empires. Earlier capitalist hegemons like Genoa and the Netherlands additionally inspired monetary hypothesis and tried to construct their economies on usury as they went into decline.

For Britain, this has allowed the nation to keep up a degree of financial may that its residents had been accustomed to, however it is a precarious state of affairs. The economist Philip Pilkington explains how this affair with worldwide finance works:

Britain is allowed to run giant commerce deficits as a result of its commerce companions are eager to carry British-domiciled monetary property. This in flip permits Britons to stay past their means. Foreigners ship Britain items they’d in any other case be unable to afford, Britain sends sterling in return and as an alternative of dumping sterling onto overseas change markets — thereby driving down its worth and rendering the products much less reasonably priced for Britons — the foreigners purchase British monetary property. Britain is a probably somewhat low-income nation residing the lifetime of a high-income nation, and the entire present is saved on the highway by the financiers within the Metropolis. A intelligent association — however clearly an unstable one.

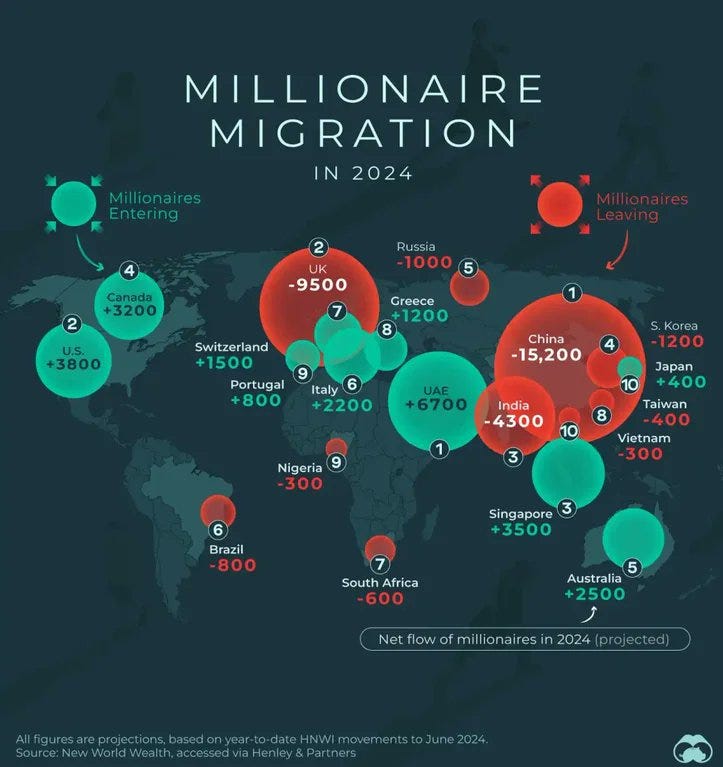

There’s already motive to suppose this precarious relationship is in jeopardy. The wealthy are fleeing the UK in droves — 9,500 millionaires are set to depart the UK in 2024. The UK is barely behind China worldwide for millionaire emigration, however outpaces it per capita by an element of 14.

On the similar time, many heavy hitters throughout the British economic system are being bought to American capital. Blackrock has simply finalised a deal to amass the UK-based information supplier Preqin for $3.2 billion. To economists like Pilkington, this is one other part in Britain’s lengthy decline and retreat from the world stage, the ultimate consolidation of a post-war settlement which made the UK a subordinate associate to america:

Within the Eighties and Nineties, Britain managed to carve out a spot on the planet by changing into a serious monetary centre. Nevertheless it has lengthy been well-known that the Metropolis of London is simply an outpost of Wall Avenue. For the reason that 2008 monetary disaster, the Metropolis has waned in significance with increasingly more British firms being listed on the New York Inventory Alternate. Now the financialised British economic system is being actively weaponised in opposition to the nation to asset-strip its firms and place them underneath American possession.

Left Behind

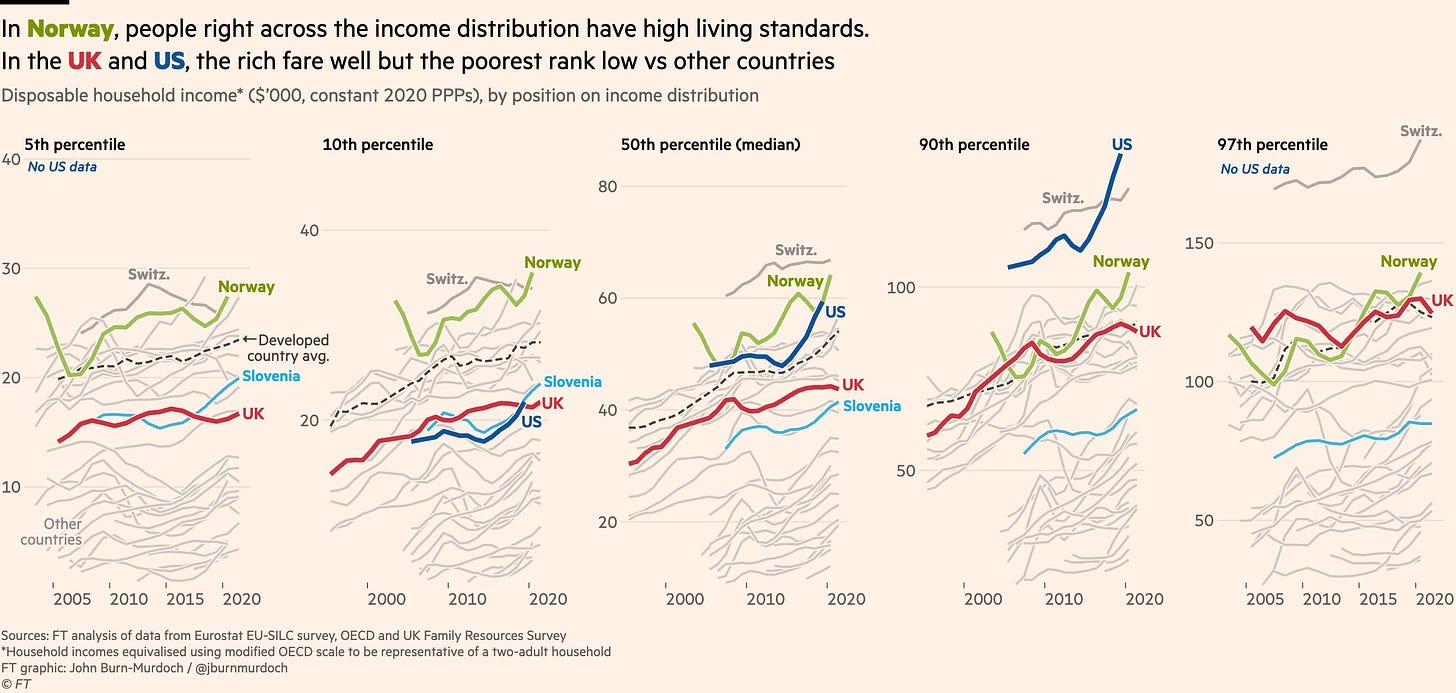

A 2022 piece within the Monetary Occasions painted a bleak image of the financial actuality for many Brits that’s masked by well-liked measures of financial well being like GDP. Though Britain has many rich individuals, the common individual will not be very properly off in comparison with different developed international locations. Actually, the lowest-earning bracket of households in Britain had been 20% worse off than their counterparts in Slovenia. The British center class can also be quickly declining in its residing commonplace relative to the remainder of Europe:

In 2007, the common UK family was 8 per cent worse off than its friends in north-western Europe, however the deficit has since ballooned to a document 20 per cent. On current tendencies, the common Slovenian family will likely be higher off than its British counterpart by 2024, and the common Polish household will transfer forward earlier than the top of the last decade.

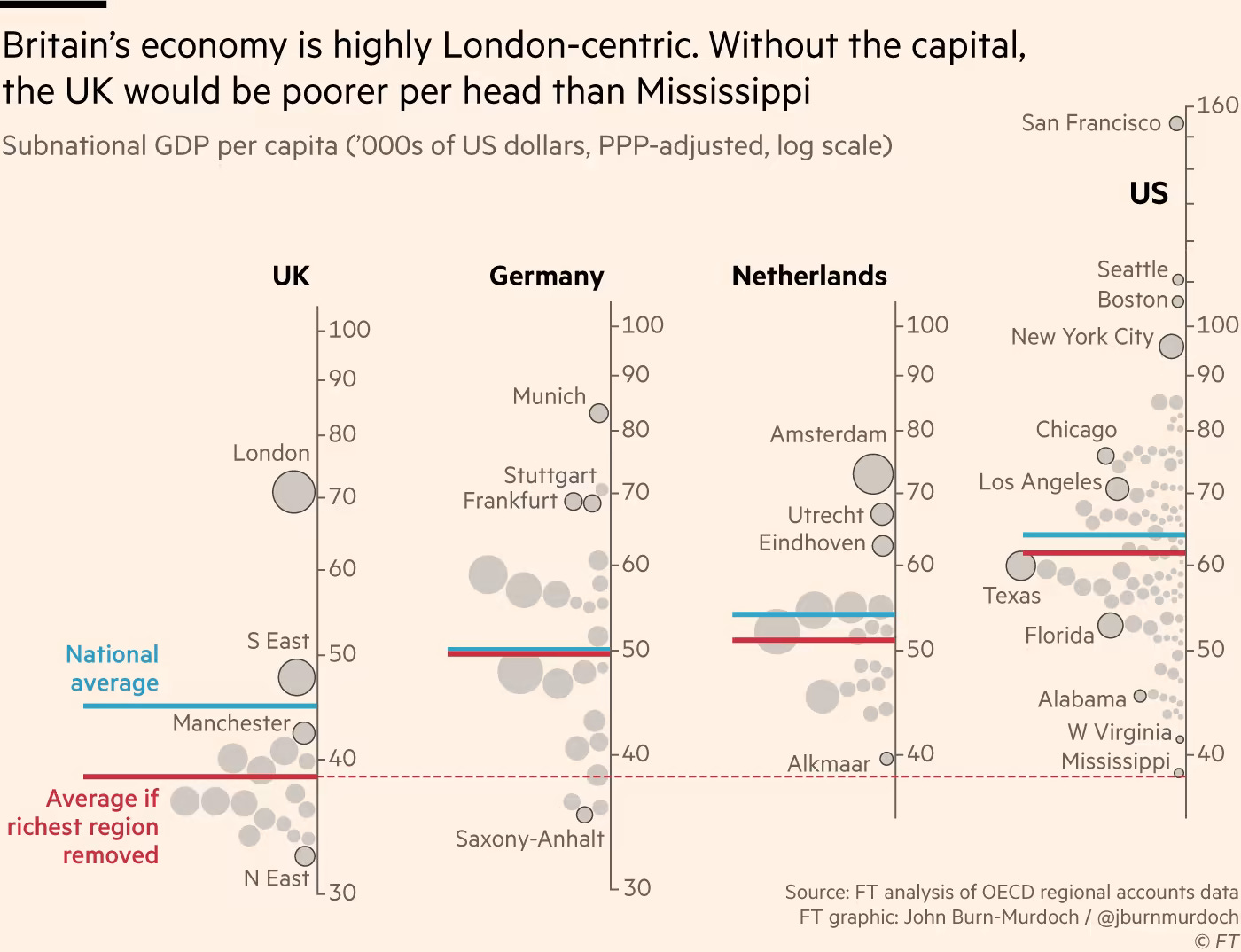

Britain is, within the authors phrases, a poor nation with some very wealthy individuals. One other solution to put it is perhaps that Britain is poor nation with one very wealthy area. Knowledge offered by the identical writer exhibits that eradicating London would take 14% off common British residing requirements, sufficient to depart the rest of Britain poorer than each state within the US.

This displays how a lot Britain’s common decline has been masked by the expansion of finance capitalism. The British economic system has been stagnant for the reason that 2008 monetary disaster. Within the interval since, actual wages have declined by 3%. For comparability, actual wages in Germany grew by nearly 9% in the identical interval. This has been coupled with a price of residing disaster and persistently excessive inflation since 2021, in addition to a rising price in rents. Greater than a 3rd of individuals in Britain spend over half their revenue on hire, 80% spent over a 3rd. Right here too, the shift to a rentier economic system has been devastating.

Within the common election that gained her energy in 1979, one in all Margaret Thatcher’s extra well-liked guarantees was the “proper to purchase”, promising over 5 million tenants of social housing the precise to purchase their dwelling from the native authorities at a lot lowered charges. The common low cost obtained by these availing of the scheme was 44%, an incredible discount contemplating how a lot the worth of many of those homes would inflate since — in southern England in 1981 the common valuation of a Proper to Purchase property was just below £20,000. Most gross sales had been financed by lending.

This coverage embodied Thatcher’s ethos as a lot as any, flogging off public assets at a reduction, funded by non-public credit score, and instilling within the thousands and thousands of latest owners a spirit of risk-taking individualism and independence from the welfare state.

Within the following decade, rents rose considerably on those that didn’t avail of the Proper to Purchase. In impact, poorer renters subsidised by means of larger rents the power of their wealthier neighbours to change into owners. Since Proper to Purchase, the variety of social housing obtainable has plummeted, as has constructing of those homes. 40% of ex-council flats bought by means of statutory Proper to Purchase are actually non-public rental properties. So, whereas lower-middle class Britons received to expertise reasonably priced dwelling possession within the Eighties, thousands and thousands of youthful individuals now exist in precarity round housing, compelled into overly costly privately rented lodging with no hope of affording a house.

The scheme additionally took away energy from native authorities, who can now do little about native housing issues apart from flip to the London authorities. This was one of many largest privatisation schemes ever undertaken, a serious step within the transition to a rentier economic system, and a basic instance of politicians cashing in on brief time period achieve on the expense of long-term issues. Very like the money giveaway taken from North Sea oil, Thatcher’s authorities took from future generations for brief time period abundance.

After all, no housing disaster will be defined simply by provide, and housing is likely one of the sectors of the economic system most clearly affected by many years of mass-immigration.

The Migration State

I’ve beforehand written on Britain’s demographic transformation by means of mass-immigration. I gained’t restate the evaluation offered there, however on this context it’s value discussing how Britain’s transformation right into a migration state went hand in hand with its embrace of neoliberalism.

The left in Britain, as in the remainder of Europe, has been eager to current a story of Britain as a traditionally multicultural nation. On the similar time, the Dissident Proper , in its give attention to the unconventional modifications affecting Europe after the Second World Battle generally miss simply how latest the unconventional demographic modifications of European nations are. The 1980’s …

Internet-immigration to the UK exploded underneath the New Labour authorities after 1997, and continued with successive Conservative governments for the reason that 2010s, now at a historic excessive. This was largely ideologically pushed, as former Labour advisor Andrew Neather admitted his celebration wished to rub the precise’s nostril in range, and “make the UK actually multicultural.”

However New Labour’s embrace of neoliberal financial prescriptions additionally drove this new strategy to immigration, as Labour shifted from its conventional Keynesian financial strategy to prioritise labour market flexibility and counter-inflation. Labour representatives spoke of the mass-migration of individuals as a needed a part of residing in a world, financialised economic system, evaluating it to the free motion of capital. A particular advisor to the celebration mirrored on the change in immigration coverage as coming from

the reorientation on financial coverage of the centre left—away from Keynesian demand administration in the direction of a extra express embrace of globalisation—lent itself extra firmly in the direction of embracing immigration too. The emphasis on expertise and training and openness to international markets meant that you simply had individuals extra open to arguments about migration being an essential element of a profitable economic system.

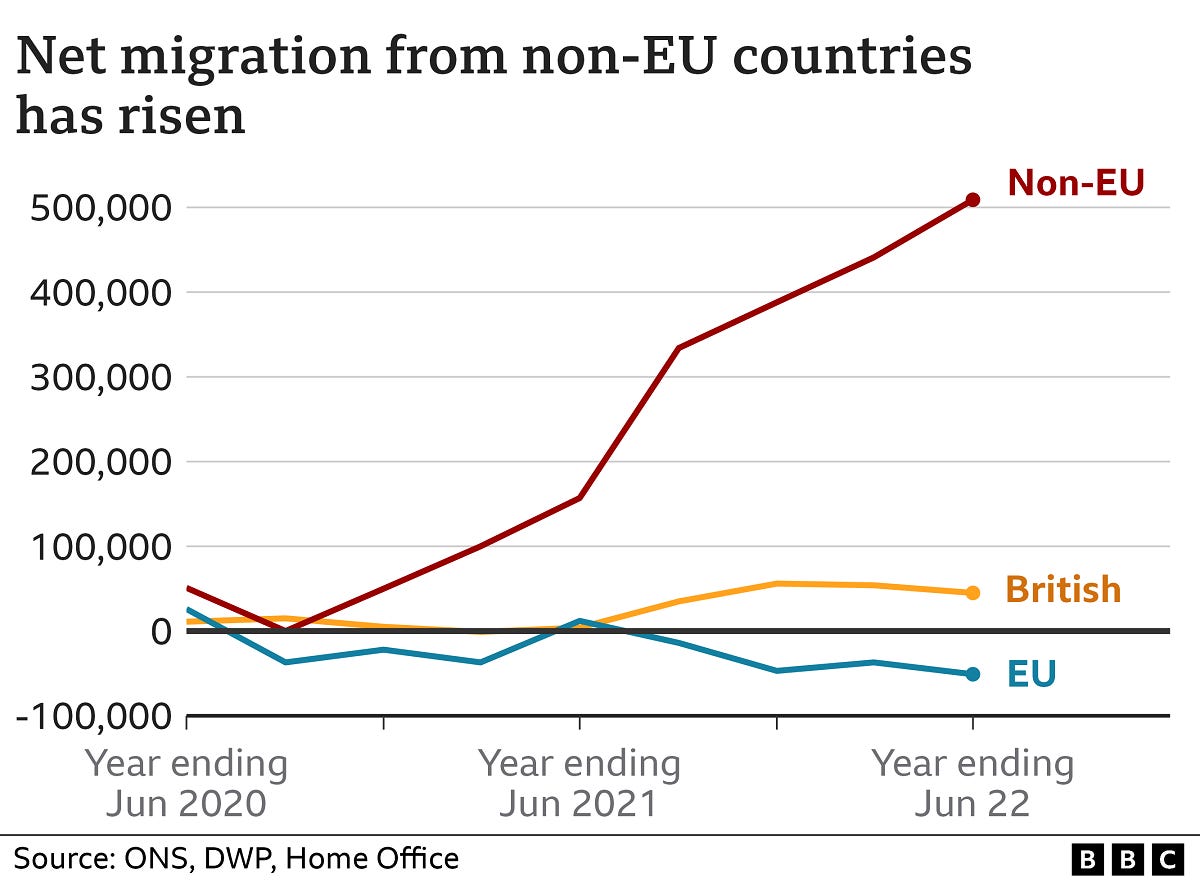

What started as New Labour coverage has change into cross-party consensus in Britain. Internet migration was 685,000 in 2022. Whereas a serious motivation for a lot of who voted to depart the European Union was an opposition to mass-immigration, the Tories have responded by growing immigration. Actually, the primary results of Brexit on immigration has been to easily swap EU migrants with much more culturally incompatible non-EU migrants.

Evidently, after many years of betrayal, voters involved about immigration are finally prepared to desert the Conservative Celebration in droves. Although at this level, the change to British demographics has been huge. The 2021 census of England and Wales confirmed that 10 million individuals, or one-sixth of the inhabitants, had been born outdoors the UK.

In 2010, the demographer David Coleman produced an evaluation which forecast White Britons changing into a minority by 2066. Since immigration has expanded vastly since then, this determine can seemingly be revised ahead. Minority standing is already a each day actuality for a lot of White Britons, who’re now a minority in main cities like Manchester, Birmingham, Leicester, and London — the place two thirds of the capital’s residents are ethnic minorities.

Anarcho-Tyranny

One other defining function of the postnational British state is anarcho-tyranny, the growing breakdown of the state’s functionality to keep up legislation and order and its failure to prosecute essentially the most primary crimes, mixed with the more and more tyrannical policing of civil society and suppression of liberties as soon as taken without any consideration.

British police are actually extra incompetent than they’ve ever been: an investigation into their potential to research crime discovered that greater than half the forces studied failed to satisfy primary requirements. Not one of many 43 constabularies studied made the highest class of “excellent”. Most Britons not anticipate the police to research crimes like mugging or bike theft, and lots of not trouble reporting all these crimes. This can be a right assumption: between 2015 and 2023 in England and Wales the proportion of crime ensuing within the offender being caught by the police and brought to courtroom fell from 16% to five.7%. Police now remedy fewer than 3% of burglaries. Most criminals have little likelihood of ever dealing with punishment within the UK.

In distinction, the state has confirmed completely dedicated to policing the speech of White Britons, particularly if it issues criticism of multiracial liberal pluralism. A 2017 article in The Telegraph reported that greater than 3,300 individuals had been detained and questioned within the earlier yr over “trolling” on social media and different on-line boards. Two notably egregious examples of this sort of policing got here in 2018: first, a 19-year-old lady was convicted of sending a “grossly offensive” message after she posted rap lyrics that included the N-word on her Instagram web page. Then, the YouTuber Depend Dankula was discovered responsible of a hate crime for posting a video that confirmed his pug elevating its paw in what he referred to as a Nazi salute.

British police additionally monitor “non-crime hate incidents”, encouraging the general public to report in the event that they take offence to somebody’s speech on the premise of their “protected traits”. The police are instructed that within the case of those experiences “the sufferer doesn’t should justify or present proof of their perception, and law enforcement officials and employees mustn’t straight problem this notion.” Nearly 120,000 of those incidents had been recorded within the 5 yr interval from 2014 to 2019.

The best tyranny has been reserved for nationalists. This yr, Sam Melia, an activist and organiser with Patriotic Various, was sentenced to 2 years in jail for “inciting racial hatred”. Melia had arrange a gaggle referred to as the Hundred Handers on Telegram, which posted graphics supposed for members to obtain and print as stickers. The stickers contained messages like “its OK to be white”, “love your nation” and “cease anti-white rape gangs”.

The prosecution used supplies present in a search of Melia’s home, reminiscent of a ebook by Oswald Mosley, as “key indicators of Melia’s ideology that underpinned his need to unfold his racist views in a deliberate method.” Thus, Melia’s non-public studying materials was used as proof that he harboured views the prosecution thought-about racist.

On the trial itself, the prosecution acknowledged the language on the stickers had been lawful, however had been produced as a physique of labor supposed to fire up racial hatred. The jury was additionally instructed to disregard any consideration of whether or not the statements on the stickers had been really true, as reality isn’t any defence in instances reminiscent of this. The jury duly discovered Melia responsible, after which he was sentenced to 2 years in jail.

The ideological commitments of the stewards of the British state haven’t solely led them to focusing on political dissidents, but additionally to masking up crime on a large scale. We now know that British police and state establishments ignored and helped conceal the best baby sexual abuse scandal in British historical past, with a sequence of pedophile “grooming gangs” composed of Asian, principally Pakistani males ignored for years.

A report into the worst of those, within the city of Rotherham in South Yorkshire, discovered that 1,400 kids had been sexually abused from 1997 to 2013, predominantly by males of Pakistani origin. It revealed that council employees and others knew of the abuse however turned a blind eye to what was taking place and refused to determine the perpetrators on account of their concern of being branded as racist.

The identical conclusion was reached after an 8 yr investigation by the Impartial Inquiry into Baby Sexual Abuse, which discovered that grooming gangs nonetheless existed throughout the nation, however investigations into them had been nonetheless being hampered by authorities’ fears of pursuing so many non-white criminals.

The Finish?

I’m publishing this on July 4 2024, the day of a UK common election. By the point you learn this, it’s seemingly the Conservative Celebration may have suffered its worst electoral defeat ever, handing a landslide majority to the Labour celebration. A long time of betrayal of their patriotic voter base has introduced them to some extent of absolute fatigue. The Thatcher-Blair-Cameron neoliberal consensus which has ruled Britain for nearly half a century now has transitioned the nation from a proud and cohesive nation right into a postnational financial zone, more and more subservient to American finance capital and in a state of terminal decline.

The prospects of reversing these tendencies is bleak, particularly if political energy shifts to a political Left equally dedicated to range and the repression of patriotic sentiment. However leaving the Conservative celebration within the dustbin of historical past could also be a begin to what stays of the English, Scottish and Welsh nations reasserting themselves.

Notes

Davis, Aeron. Chapter, bubbles and bailouts: The within historical past of the Treasury since 1976. Manchester College Press, 2022. Pg. 82-83.

Cecchetti, Stephen G., and Enisse Kharroubi. “Why does credit score progress crowd out actual financial progress?.” The Manchester Faculty 87 (2019): 1-28.

Christensen, John, Nick Shaxson, and Duncan Wigan. “The finance curse: Britain and the world economic system.” The British Journal of Politics and Worldwide Relations 18, no. 1 (2016): 255-269.

Baker, Andrew, Gerald Epstein, and Juan Montecino. “The UK’s finance curse? Prices and processes.” SPERI report (2018).

Eglene, Ophelia. Banking on Sterling: Britain’s Independence from the Euro Zone. Lexington Books, 2011.

Quoted in Consterdine, Erica. Labour’s immigration coverage: the making of the migration state. Springer, 2017. Pg. 130