Expertise shares have delivered excellent positive factors to traders for the reason that starting of 2023, with a 69% soar within the worth of the Nasdaq-100 Expertise Sector index over this era. Synthetic intelligence (AI) has performed a central position on this super rally.

Expertise firms, huge and small, have been benefiting from the adoption of AI. Tremendous Micro Laptop (NASDAQ: SMCI) and Taiwan Semiconductor Manufacturing (NYSE: TSM) have each obtained a pleasant raise because of the proliferation of AI.

Nonetheless, the red-hot rally in expertise shares has not too long ago come to a halt. The Nasdaq-100 Expertise Sector is down 11% prior to now month because of a variety of components reminiscent of rising considerations a couple of recession within the U.S. following a weak jobs report and fears that AI will not ultimately stay as much as the hype.

However the latest quarterly outcomes from the businesses talked about above recommend in any other case. These tech gamers point out that AI-related infrastructure spending continues to stay stable, so it could be a good suggestion to purchase shares of those AI firms within the wake of the latest market sell-off. Let’s take a look at the the explanation why.

TSMC inventory is just too enticing to overlook out on proper now

AI has given the semiconductor business an enormous increase. The marketplace for AI chips is predicted to clock an annual progress charge of 38% over the following decade, producing annual income of $514 billion in 2033. Taiwan Semiconductor Manufacturing, popularly referred to as TSMC, is among the finest methods for traders to capitalize on this chance.

TSMC is a foundry that manufactures chips for fabless semiconductor firms reminiscent of Nvidia and AMD. It additionally makes chips for system producers reminiscent of Apple, and even Intel has been tapping TSMC to fabricate superior chips regardless of having its personal manufacturing strains. So, TSMC stands to realize from the proliferation of AI in a number of markets reminiscent of information facilities, smartphones, and private computer systems.

TSMC’s progress has been accelerating because of the strong demand for its superior chips from the shoppers talked about above. The Taiwan-based foundry big reported a 33% year-over-year enhance in income for the second quarter of 2024 to $20.8 billion. That marked a big acceleration over the 13% year-over-year progress TSMC reported in Q1.

For the third quarter, TSMC is forecasting income of $22.8 billion on the midpoint of its steering vary. That may translate to year-over-year progress of virtually 32%, suggesting that the demand for the corporate’s chips is about to stay wholesome. As such, the 15% pullback in TSMC inventory prior to now month presents a wise shopping for alternative for traders, particularly contemplating that analysts have raised their earnings progress expectations from TSMC recently.

Additionally, TSMC is at the moment buying and selling at 29 occasions trailing earnings, which is a slight low cost to the Nasdaq-100 index’s common earnings a number of of 31 (utilizing the index as a proxy for tech shares). Shopping for this AI inventory proper now appears to be like like a no brainer contemplating its terrific progress and enticing valuation.

AI server demand is driving beautiful progress for Supermicro

The chips manufactured by TSMC which can be deployed in information facilities to sort out AI workloads should be mounted on server racks — leading to super demand for Supermicro’s choices prior to now yr.

Supermicro manufactures server and storage options, and the corporate has been gaining floor within the AI server market because of its modular choices that permit information heart operators to cut back power prices. Its income within the not too long ago concluded fiscal yr 2024 greater than doubled yr over yr to $14.9 billion from $7.1 billion within the earlier yr.

Nonetheless, Supermicro inventory fell 20% in a single session following its outcomes after it missed Wall Road’s earnings expectations on account of its narrowing margins. The corporate has been investing aggressively to boost its manufacturing capability to fulfill the booming demand for AI servers, and that is exactly why its non-GAAP gross margin was right down to 14.2% in fiscal 2024 from 18.1% within the previous yr.

The corporate has been increasing its manufacturing capability at a number of places across the globe because it goals to ramp up the manufacturing capability of liquid-cooled servers, that are gaining traction in AI information facilities to cut back electrical energy consumption and enhance efficiency. Mordor Intelligence estimates that liquid-cooled information facilities may obtain annual progress of 23% by 2029.

So, Supermicro is doing the suitable factor by specializing in capability growth proper now appropriately capable of seize an even bigger share of this fast-growing alternative. What’s extra, the general AI server market is predicted to clock 30% annual progress by 2033, and Supermicro is rising at a a lot sooner tempo than this house.

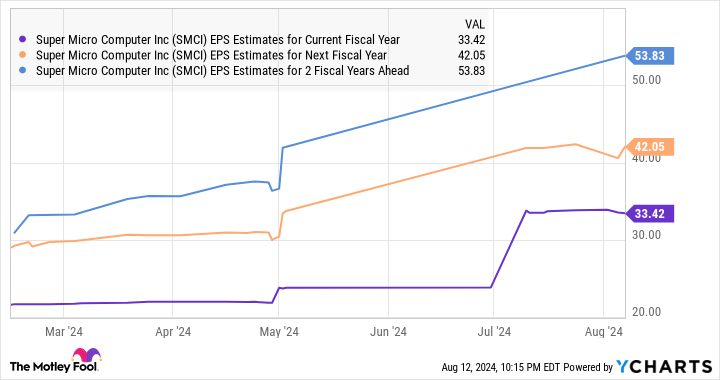

This means that the corporate is gaining market share in AI servers, and that is why sacrificing margins within the quick time period appears to be like like the suitable factor to do contemplating the long-term alternative at hand. Supermicro administration believes that its margins will return to the traditional vary by the top of fiscal 2025. Analysts stay bullish about its bottom-line progress prospects following fiscal 2024’s earnings soar of 87% to $22.09 per share.

Most significantly, Supermicro is now buying and selling at simply 24 occasions trailing earnings and 13 occasions ahead earnings — a pleasant low cost to the Nasdaq-100 index. Buyers ought to contemplate including this fast-growing firm to their portfolios whereas it stays crushed down.

Must you make investments $1,000 in Taiwan Semiconductor Manufacturing proper now?

Before you purchase inventory in Taiwan Semiconductor Manufacturing, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they consider are the 10 finest shares for traders to purchase now… and Taiwan Semiconductor Manufacturing wasn’t certainly one of them. The ten shares that made the minimize may produce monster returns within the coming years.

Think about when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $763,374!*

Inventory Advisor supplies traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 12, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Superior Micro Units, Apple, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and quick August 2024 $35 calls on Intel. The Motley Idiot has a disclosure coverage.

Inventory Market Promote-Off: The Finest Synthetic Intelligence (AI) Progress Shares to Purchase Proper Now was initially printed by The Motley Idiot