(Bloomberg) — US inflation in all probability picked up modestly in July, however not sufficient to derail the Federal Reserve from a extensively anticipated interest-rate minimize subsequent month.

Most Learn from Bloomberg

The buyer value index on Wednesday is anticipated to have risen 0.2% from June for each the headline determine and the so-called core gauge that excludes meals and vitality. Whereas every could be an acceleration from June, the annual metrics ought to proceed to rise at among the slowest paces seen since early 2021.

The current easing of value pressures has bolstered Fed officers’ confidence that they’ll begin to decrease borrowing prices whereas refocusing their consideration on the labor market, which is exhibiting higher indicators of slowing.

The July jobs report confirmed US employers considerably scaled again hiring and the unemployment fee rose for a fourth month, triggering a key recession indicator and contributing to a world inventory market selloff.

Ought to the CPI are available as anticipated, it will point out that inflation stays on a downward pattern, and economists reckon a slight pickup is due after June’s surprisingly low studying. They see the reversal largely stemming from what’s referred to as core providers excluding housing — a key class watched by policymakers. Some forecasters are additionally flagging an upside threat to items costs given larger transport prices.

Nonetheless, the long-awaited slowdown in shelter prices that began in June ought to proceed. That class contains a few third of the general CPI and is a giant determinant of the broader inflation pattern.

The producer value index — due a day earlier than the CPI — can be scrutinized for classes that feed by means of to the Fed’s most popular inflation gauge, the private consumption expenditures value index.

What Bloomberg Economics Says:

“July’s CPI will probably be delicate, with the year-over-year change in core CPI edging additional down. Markets could rally round this information, however we predict the implication for Fed’s most popular value gauge — the core PCE deflator — can be extra combined when the CPI knowledge are taken account along with PPI.”

—Anna Wong, Stuart Paul, Eliza Winger, Estelle Ou and Chris G. Collins, economists. For full evaluation, click on right here

One other report within the coming week is anticipated to point out a pickup in total retail gross sales in July, however as soon as sure elements are stripped out to drill right down to the management group — which is used to calculate gross home product — gross sales ought to sluggish notably.

Different knowledge on the agenda embrace the most recent readings on inflation expectations, small enterprise sentiment, industrial manufacturing and new house building. Regional Fed presidents Raphael Bostic, Alberto Musalem, Patrick Harker and Austan Goolsbee are scheduled to talk.

Talking on Saturday, Fed Governor Michelle Bowman mentioned she nonetheless sees upside dangers for inflation and continued power within the labor market, signaling she will not be able to assist a fee minimize when US central bankers subsequent meet in September.

Wanting north, housing begins for July will reveal whether or not the Financial institution of Canada’s back-to-back fee cuts are serving to to stoke funding in new constructing. Canadian wholesale and manufacturing gross sales for June are anticipated to say no.

Elsewhere, key knowledge within the UK from wages to inflation, manufacturing and retail numbers from China, and certain choices to maintain charges unchanged in Norway and New Zealand are among the many highlights.

Click on right here for what occurred up to now week, and beneath is our wrap of what’s arising within the international financial system.

Asia

China’s knowledge blast on Thursday will probably present the financial system did just a little higher in July versus June however remains to be principally limping alongside.

Industrial output development could have accelerated to five.5%, a tempo that’s nonetheless sluggish sufficient to pull the year-to-date tally down a tad.

The identical goes for retail gross sales, that are seen choosing as much as 2.6% whereas pulling the seven-month tempo down to three.5%. Mounted asset funding is seen holding regular, whereas the decline in property funding is forecast to reasonable.

The nation’s credit score development probably slowed in July, regardless of a minimize in the important thing fee from the Individuals’s Financial institution of China and a discount in mortgage prime charges.

Elsewhere, Japan’s second-quarter GDP is anticipated to have rebounded to a 2.3% enlargement on an annualized foundation, and Taiwan and Kazakhstan additionally get second-quarter GDP figures.

Australia will publish wage value figures, shopper confidence and the NAB enterprise confidence survey, all on Tuesday.

India’s shopper inflation is forecast to sluggish beneath 4% in July, whereas its industrial output development could have decelerated in June. Commerce statistics are due from India and Indonesia.

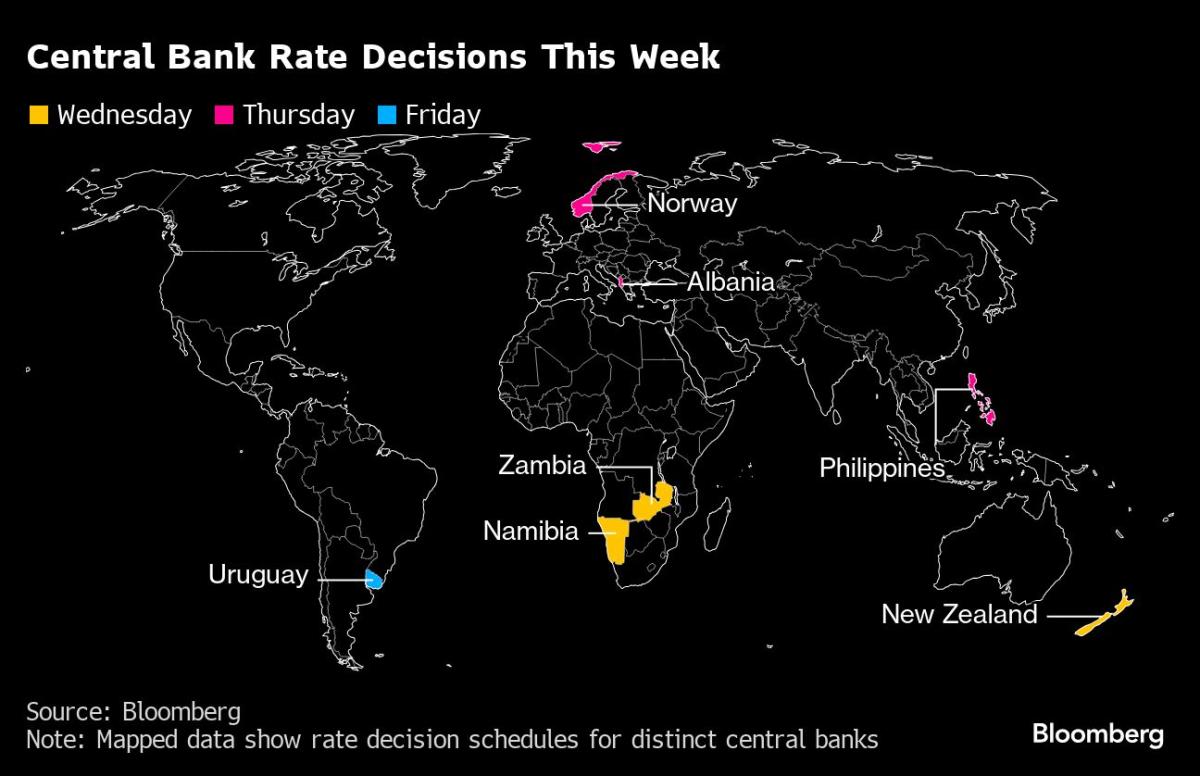

Amongst central banks, the Reserve Financial institution of New Zealand is anticipated to carry its official money fee at 5.5% when it meets on Wednesday, though a minimize hasn’t been dominated out. Central bankers within the Philippines collect a day later.

Europe, Center East, Africa

The UK will take middle stage, with 4 days of releases informing the Financial institution of England on the financial system in the identical month it delivered an preliminary fee minimize and signaled there’s extra to come back.

Knowledge on Tuesday that’s more likely to present slowing wage development could also be among the many most important, although inflation the next day will even be watched for proof of lingering pressures — specifically the providers measure which will are available with value development nonetheless caught above 5%.

Month-to-month GDP on Thursday is predicted to disclose hardly any development in June, although second-quarter output due the identical day might present 0.6% enlargement. On Friday, retail gross sales will in all probability present a rise for July after a drop the earlier month.

The Nordics are additionally probably to attract focus, most importantly Norway. Norges Financial institution on Thursday is anticipated to maintain its fee at 4.5%, according to a extra aggressive stance taken in June, when officers successfully postponed financial easing till 2025.

Core inflation has slowed sooner this yr than officers forecast, however the energy-rich financial system has additionally coped higher than anticipated with the very best credit score prices since 2008; wage pressures stay excessive and the labor market has softened solely marginally.

Towards that backdrop, buyers will search for any indicators of concern concerning the krone, the worst performer within the Group of 10 currencies to date this yr.

In Sweden, knowledge on Wednesday will present whether or not underlying inflation within the largest Nordic financial system continued to sluggish in July. That can present key proof for policymakers who’re extensively anticipated to proceed with financial easing this month after beforehand signaling as many as three fee cuts within the second half of the yr.

Inflation numbers will even be launched in Denmark and the Czech Republic on Monday, whereas second-quarter GDP numbers are due in Poland on Wednesday and Switzerland on Thursday.

The euro zone could have a comparatively quiet week. Germany’s ZEW investor confidence index on Tuesday, together with euro-zone industrial manufacturing and Dutch GDP on Wednesday, are among the many principal gadgets due. European Central Financial institution officers are largely on vacation, and far of southern Europe can be off on Thursday.

Turning south, Zambia on Wednesday is poised to lift charges for a seventh straight time to curb double-digit inflation and assist the kwacha.

The identical day, Namibia is ready to maintain its fee at 7.75% consistent with South Africa’s unchanged stance final month. The Namibian greenback is pegged to the rand, which suggests financial coverage is usually guided by the South African Reserve Financial institution’s actions.

Nigerian knowledge on Thursday will probably present inflation eased for the primary time in 19 months, helped by favorable annual comparisons together with measures to scale back the price of meals, together with a 180-day window to import wheat and corn responsibility free.

Additionally on Thursday, Israel’s inflation in all probability quickened to three.1% in July, forecasts present, because the struggle in Gaza strains the financial system and authorities spending soars. That consequence would exceed the goal vary of 1% to three% for the primary time since November.

Latin America

Argentina is because of report July inflation knowledge, and economists surveyed by the central financial institution see the month-to-month determine slowing to three.9% from 25.5% as lately as December. Annual inflation could sluggish for a 3rd month, to roughly 263%.

Additionally from Argentina, the Financial system Ministry will report its July finances steadiness, presently driving a six-month streak of surpluses.

The central banks of Brazil, Colombia and Chile publish surveys of economist expectations within the coming week. Chile additionally publishes a separate ballot of merchants, who accurately referred to as Banco Central de Chile’s July 31 fee pause.

Uruguay’s new central financial institution chief Washington Ribeiro and his colleagues could maintain their key fee at 8.5% after July inflation drifted barely larger, to five.45%. Inflation has been inside the financial institution’s 3% to six% goal vary for the previous 14 months.

Brazil, Peru and Colombia will report June GDP-proxy knowledge, with Colombia additionally posting April-June output figures.

All three economies expanded sooner than anticipated in April and Could, offering optimistic development carryover for the total second quarter.

Since slumping in mid-2023, Colombia’s financial system has subsequently posted quarter-on-quarter prints of 1% and 1.1%. Yr-on-year forecasts vary from 2.8% to three.3%.

–With help from Irina Anghel, Robert Jameson, Brian Fowler, Ott Ummelas, Laura Dhillon Kane, Monique Vanek, Paul Wallace and Niclas Rolander.

(Updates with Bowman in tenth paragraph)

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.