-

Meta reported first-quarter earnings on Wednesday.

-

Mark Zuckerberg talked about Meta’s plans to take a position extra in AI.

-

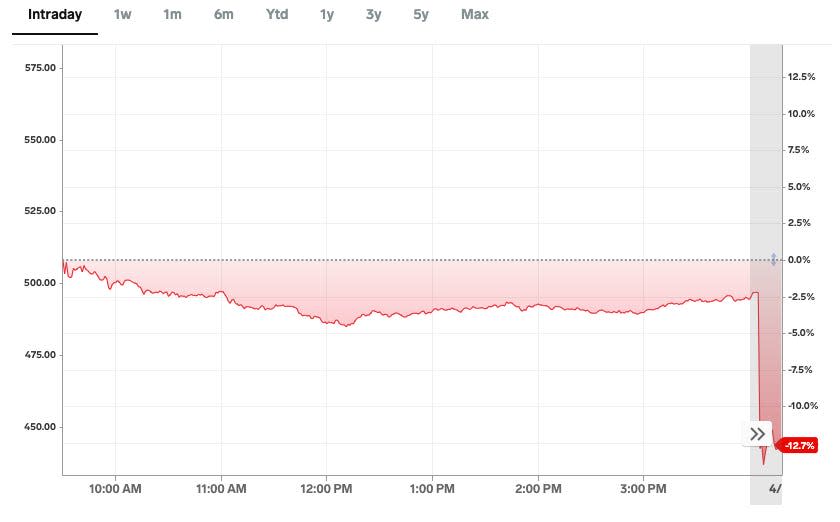

Shares tumbled 17% in after-hours buying and selling.

Meta reported first-quarter earnings on Wednesday after the closing bell.

The corporate reported income and earnings-per-share that beat consensus analyst estimates. However shares slid after Meta gave a variety for second-quarter gross sales that was on the sunshine facet of forecasts and stated it should spend greater than it anticipated this yr.

The report is Meta’s first with out monthly- and daily-average-user numbers particularly damaged out for Fb. The corporate as a substitute reported total “Household of Apps” outcomes that additionally included Instagram and WhatsApp. The mixed group noticed $36 billion of income, beating the consensus estimate of $35.5 billion.

Meta’s inventory fell as a lot as 17% in after-hours buying and selling, having slipped 0.5% on Wednesday. It had beforehand gained a strong 39% in 2024.

CEO Mark Zuckerberg’s fundamental deal with the investor name was Meta’s plans to take a position extra considerably in AI. He additionally overvalued the corporate’s current partnership with Ray-Ban.

Meta’s inventory exhibits no signal of restoration because the Q&A ends.

Shares stay down practically 17% in after-hours buying and selling as the decision attracts to an in depth.

Meta CFO Susan Li is fairly tight-lipped about TikTok

Li says Meta has been following the potential for a TikTok ban carefully, but it surely’s too quickly to touch upon the way it might affect Meta’s enterprise — for instance, Instagram Reels.

The decision strikes on to the Q&A portion

Time for buyers and analysts to (attempt to) get extra particulars.

Zuckerberg seems to take a dig at Apple’s Imaginative and prescient Professional

Zuckerberg hypes up Meta’s Ray-Ban AI glasses. The corporate launched new kinds and options on Tuesday.

“You recognize, I used to assume that AR glasses would not actually be a mainstream product till we had full holographic shows. And I nonetheless assume that that is gonna be superior and is the long-term mature state for the product. However now, it appears fairly clear that there is additionally a significant marketplace for modern AI glasses and not using a show,” he says.

It may very well be seen as a dig at Apple’s Imaginative and prescient Professional headset, which has been accused of being clunky and uncomfortable. Or it might simply be one other step ahead in Zuck’s current trend journey.

Zuckerberg begins the decision by getting straight into Meta’s AI plans and spending

He says the corporate plans to take a position “considerably extra” in AI, however warns it’s going to take “a number of years” to construct “the main AI.”

“Realistically, even with shifting a lot of our present assets to deal with AI, we are going to nonetheless develop our funding envelope meaningfully earlier than we make a lot income from a few of these new merchandise,” he says.

The CEO says Meta has a “sturdy monitor document of monetizing” its work, particularly after spending time increase its merchandise over time. However that does not appear to reassure buyers proper now, with shares slumping even additional in postmarket buying and selling.

The decision kicks off.

Mark Zuckerberg and CFO Susan Li are right here to debate the outcomes.

Meta’s AI plans are going to value them greater than they anticipated.

Heading into the decision, buyers have been in search of information about Meta’s future AI plans, however — no matter they’re — they are going to value far more than the corporate predicted only a few months in the past.

“Our full-year 2024 capital expenditures can be within the vary of $35-40 billion, elevated from our prior vary of $30-37 billion as we proceed to speed up our infrastructure investments to help our synthetic intelligence (AI) roadmap,” the report says, noting Meta plans to “make investments aggressively to help our formidable AI analysis and product growth efforts.”

Complete bills can be within the vary of $96-99 billion, up from a previous $94-99 billion forecast attributable to greater infrastructure and authorized prices.

Nonetheless, Max Willens, senior analyst at market analysis agency Emarketer, a sister firm to Enterprise Insider, says it isn’t shocking Meta modified its steering.

“Corporations investing on this area, particularly on the scope Meta is investing in it, might wrestle with prices within the close to time period,” Willens says.

Meta inventory falls 10% in after-hours coaching after gentle 2nd-quarter income forecast.

Meta beats 1st-quarter gross sales and EPS estimates, however points weaker-than-expected 2nd-quarter steering.

1st quarter

-

Income: $36.46 billion, +27% y/y, estimate $36.12 billion

-

Promoting income: $35.64 billion, +27% y/y, estimate $35.57 billion

-

Household of Apps income: $36.02 billion, +27% y/y, estimate $35.53 billion

-

Actuality Labs income: $440 million, +30% y/y, estimate $494.1 million

-

Different income: $380 million, +85% y/y, estimate $300.1 million

-

-

Household of Apps working earnings: $17.66 billion, +57% y/y, estimate $17.76 billion

-

Actuality Labs working loss: $3.85 billion, -3.7% y/y, estimate loss $4.51 billion

-

Working margin: 38% vs. 25% y/y, estimate 37.2%

-

EPS: $4.71 vs. $2.20 y/y, estimate $4.30

-

Common Household service customers per day: 3.24 billion, +7.3% y/y, estimate 3.16 billion

2nd quarter

Goldman Sachs says Meta’s platforms supply ‘sizable alternative’ forward.

Meta seems to be geared for energy as it is a key beneficiary of a strong promoting setting, Goldman Sachs stated.

The financial institution expects continued funding in digital channels, advertiser verticals to recuperate, and digital merchandise to increase, similar to short-form video monetization.

Meta’s Instagram Reels is a chief instance of this, with the platform reaching income neutrality

“We nonetheless see a large alternative for Reels to stay a key income development tailwind for META within the coming years because the CPM hole closes additional and as Reels continues to extend as a % of whole advert impressions,” analysts led by Eric Sheridan stated.

Goldman Sachs charges Meta at “Purchase” and holds a 12-month value goal of $555.

JPMorgan sees Meta as ‘constructed for the long run.’

JPMorgan considers Meta one in all its high picks amongst web shares for its scale, development, and profitability.

“We imagine Meta’s digital possession of the social graph, sturdy aggressive moat, and deal with the person expertise place it to develop into a permanent blue-chip firm constructed for the long run,” analysts led by Doug Anmuth wrote final week.

The financial institution expects Meta promoting to proceed outperforming, bolstered by AI investments and Instagram Reels income expansions. Value self-discipline will proceed on by 2024, even when investments begin rising.

Nonetheless, the financial institution did notice some room for concern after this quarter’s earnings, as Meta might have to search out new catalysts for additional growth.

“META stays well-owned, however there may be rising warning into earnings on almost-certain development deceleration past 1Q attributable to robust comps & notion of lack of latest drivers vs. ’23. We imagine slower development is well-anticipated, & doubtless taken under consideration in META’s undemanding a number of,” the financial institution wrote.

JPMorgan charges Meta at “Chubby” with a $535 value goal.

Wells Fargo says AI upside is accelerating Meta’s development.

Meta is an accelerating development story led by rising AI upside, uplifting all the things from the agency’s advert instruments to shopper messaging merchandise, Wells Fargo stated.

The financial institution initiatives above-consensus income development, with Meta boosted greater by a wholesome e-commerce setting.

“Mixed with a newfound urge for food for effectivity, we imagine META needs to be a gentle earnings compounder at an inexpensive a number of,” analysts led by Ken Gawrelski stated.

Nevertheless, income might reasonable into the second-quarter, and Meta should exhibit one other product-cycle catalyst to maintain momentum rolling, the financial institution wrote.

“We view WhatsApp as an under-appreciated asset w/ sizable potential, ought to Meta invoke extra direct monetization past Click on-to-Message adverts,” Gawrelski wrote.

Wells Fargo charges Meta at “Chubby” with a $600 value goal.

RBC Capital spotlights Meta’s rising lead within the advert enterprise.

The Canadian financial institution touted a big ramp up in advert volumes throughout Meta companies, with Instagram Reels promoting taking middle stage.

In actual fact, advert hundreds on Reels jumped 22% from January’s 16.4%, outpacing declining volumes amongst rivals similar to TikTok.

“Whereas slower development out of Fb is to be anticipated going ahead, we imagine few others within the area can come near matching META’s scale for incremental spend, and we due to this fact anticipate META to no less than preserve share going ahead,” analysts led by Brad Erickson wrote final Thursday.

The financial institution additionally considers Meta to be buying and selling at a reduction to the broader web section, a spot that can persist or slim primarily based on whether or not the agency can exhibit stability within the advert enterprise.

Nevertheless, some pullback might happen within the first half of the yr given China’s financial slowdown, which might affect advert spending. Nonetheless, the agency provides different positives, analysts stated.

RBC charges Meta at “Outperform” with a $600 value goal.

Financial institution of America sees Meta’s AI belongings as under-appreciated.

Financial institution of America expects to see upside in Meta’s first-quarter report, citing greater advert spending that was boosted by seasonal occasions, similar to Easter.

In the meantime, Meta’s AI belongings stay under-appreciated, and the agency will profit by spotlight its rising capabilities within the area, the financial institution stated in a notice final week.

“We stay constructive on Meta and reiterate our thesis that Reels, Messaging, and AI pushed advert enhancements are nonetheless early, and will result in constructive product surprises & income momentum in 2024,” analysts Justin Submit and Nitin Bansal stated.

Meta additionally seems to be to be the largest winner amid a doable TikTok ban, which has now made its means by the Senate.

Financial institution of America charges Meta at “Purchase” with a $550 value goal.

Meta’s consensus first-quarter income estimate is $36.12 billion.

1st quarter

-

Income estimate: $36.12 billion

-

Promoting rev. estimate: $35.57 billion

-

Household of Apps income estimate: $35.52 billion

-

Actuality Labs income estimate: $494.1 million

-

Different income estimate: $286.4 million

-

-

Adjusted working earnings estimate: $13.45 billion

-

Working margin estimate: 37.2%

-

EPS estimate: $4.30

-

Fb each day energetic customers estimate: 2.11 billion

-

Fb month-to-month energetic customers estimate: 3.08 billion

-

Advert impressions estimate: +17.1%

-

Common Household service customers per day estimate: 3.16 billion

-

Common Household service customers per 30 days estimate: 3.97 billion

2nd quarter

Full-year 2024

Learn the unique article on Enterprise Insider