Markets reversed earlier positive factors and are actually declining midmorning Tuesday’s as buyers maintain their breath and await the March client worth index (CPI) report, which is able to point out if inflation continues to chill.

All 3 main indices switched course, impacting corresponding ETFs. SPY, the SPDR S&P 500 ETF Belief misplaced 0.5%, whereas QQQ, the Invesco QQQ Belief, slid 0.4%. QQQ usually mirrors the tech-heavy Nasdaq’s efficiency because of their large tech publicity.

The a lot awaited inflation gauge is ready to be launched at 8:30 AM on Wednesday and is predicted to rise .3% from the earlier month, based on economists polled by the Dow Jones.

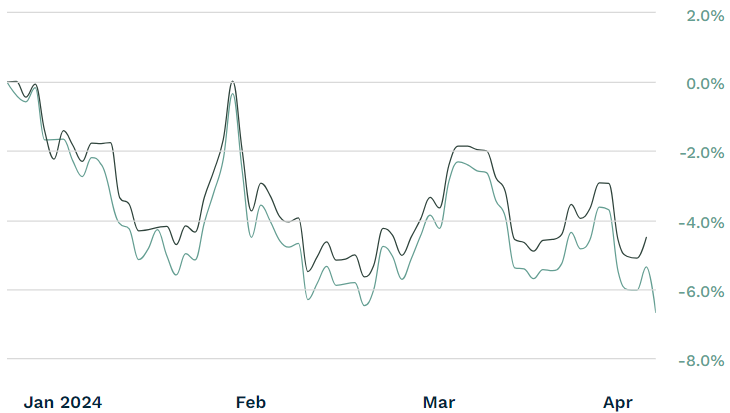

Bond ETFs, that are extremely delicate to rates of interest, climbed Tuesday morning. TLT, the iShares 20+ Yr Treasury Bond ETF, jumped practically 1% early within the buying and selling session as bond yields sank. Bond ETFs have been below strain all 12 months as buyers have been involved about price cuts within the present “larger for longer” setting.

The CPI report could influence bond ETFs additional on Wednesday; a warmer than anticipated report would make buyers consider price cuts gained’t be on the desk for a very long time (if in any respect), inflicting yields to sink. If the CPI report is available in decrease than anticipated or in step with forecasts, yields might retreat even additional. Yields and costs have an inverse relationship, so when yields drop, costs rise.

TLT YTD Complete Returns

At the moment, markets are forecasting a 56% likelihood that the Fed will reduce charges at its June coverage assembly, based on the CME Fed Watch Software.

Gold costs hit contemporary highs on Tuesday as buyers search for a protected haven amid considerations over charges. As commodity costs surge this 12 months, these holding commodity ETFs of their portfolio have been capable of make the most of the massive positive factors. GLD, the SPDR Gold Belief, spiked greater than half a proportion level, whereas the ETF is up over 12.5% this 12 months up to now.

GLD 1-Yr Efficiency

Gold costs have been propelled by price reduce expectations. Gold costs have a tendency to maneuver in the other way of rates of interest. When rates of interest drop, gold costs rise as buyers search for a greater return than mounted revenue can provide, whose yields drop when rates of interest fall.

Questions nonetheless stay nevertheless if gold’s rally will proceed in the long term.