Some investing developments come and go, leading to a number of winners and many potential losers. However different developments take maintain and do not let go, making loads of buyers rich. One current instance of an investing development with endurance that has yielded unbelievable outcomes is the migration to cloud computing. Amazon‘s Amazon Net Companies (AWS), Microsoft‘s Azure, and Alphabet‘s Google Cloud introduced in a mixed income of $64 billion for these three corporations in simply the final reported quarter.

Earlier than the arrival of the cloud, it was the web that offered a permanent development. A permanent development that dominated a lot of the twentieth century was the auto. What all three of those developments have in frequent is their emphasis on effectivity and practicality. Automobiles have develop into extra environment friendly and sensible than most different types of transportation. Making information and communications simply accessible on-line anyplace on a regular basis topped issues like encyclopedias, sending a letter, utilizing a telephone operator, shopping for a newspaper, and so forth. Connecting to the workplace remotely, eliminating on-premises servers, and analyzing reams of information carries on the neverending have to be extra environment friendly and efficient.

Synthetic intelligence (AI) shares these traits and affords the newest instance of a permanent development and buyers are clearly excited. However that does not imply that each one AI shares are good buys. Many will not generate the success that interprets into life-changing wealth for buyers. To extend your possibilities of success, diversified investing that focuses on high quality corporations is important. Famed investor Peter Lynch summed it up nicely: “Know what you personal and why you personal it.”

1. UiPath

I personal UiPath (NYSE: PATH) as a result of it exemplifies the effectivity development referenced above. For instance, a big firm managing tons of of incoming invoices every day by e-mail would possibly use staff spending lengthy hours downloading the invoices and manually getting into the info into their accounts payable software program. Alternatively, it may use UiPath’s robotic course of automation (RPA) to carry out these features, liberating staff to deal with different extra value-added duties.

Latest earnings experiences recommend UiPath is the extra widespread of the 2 choices for an increasing number of corporations. UiPath reported report gross sales of $1.3 billion final 12 months (24% progress) from 10,800 prospects. Its gross sales and money stream have risen steadily because it went public in 2021 (see chart under).

This progress has allowed UiPath to construct a fortress steadiness sheet with $1.9 billion in money and investments towards zero long-term debt. The corporate is not worthwhile but on a typically accepted accounting ideas (GAAP) foundation as a result of, like many rising tech corporations, it’s investing again into the corporate to develop additional.

That makes UiPath inventory tough to worth. It trades with a price-to-sales (P/S) ratio below 10, which is way decrease than highfliers like Palantir Applied sciences (NYSE: PLTR) and SoundHound AI (P/S ratios of 24 and 29, respectively). The valuation, terrific capital place, and potential make UiPath a fascinating inventory to maintain within the AI basket.

2. Palantir Applied sciences

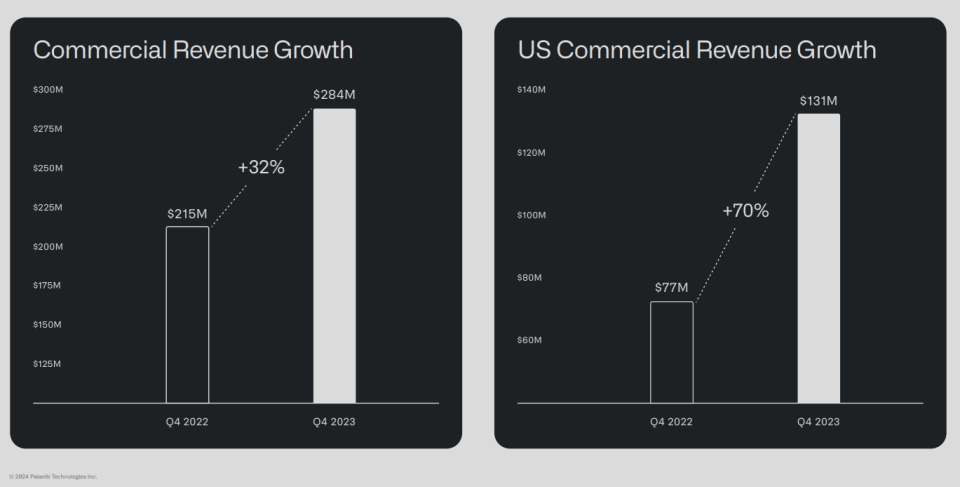

Talking of Palantir, it’s doing unbelievable issues with AI. Sure, its inventory is on the costly aspect, however it’s proving many critics improper. The knock towards Palantir was that it could not be worthwhile. Effectively, it simply reported its fifth straight GAAP-profitable quarter. Rising its business enterprise was additionally a wrestle at occasions. Palantir’s early focus was on authorities work, however this market is proscribed (albeit coveted). The personal sector is a a lot bigger potential market. As you’ll be able to see under, business progress is booming.

At its coronary heart, Palantir’s software program helps companies and governments by serving to them centralize, visualize, analyze, and use their information to make higher choices. The corporate’s latest product, aptly named Synthetic Intelligence Platform (AIP), takes it to a different degree. As corporations understand they have to leverage AI to maintain up with opponents, it’ll drive demand.

Palantir reported $2.2 billion in gross sales in fiscal 2023 (up 17%) and $731 million in free money stream. The corporate is long-term debt-free and has $3.7 billion in money and investments. As talked about, Palantir inventory trades at 24 occasions gross sales, which isn’t low-cost. So it is clever to dollar-cost common, diversify, and look ahead to dips to make your buys.

3. Arm Holdings

There’s a good purpose that Nvidia tried to purchase Arm Holdings (NASDAQ: ARM) for $40 billion in 2020 (regulators finally blocked the merger). Arm is important to the semiconductor market, which powers AI. Superior chips are wanted to course of immense quantities of information at excessive speeds with environment friendly energy utilization. Arm does not manufacture the chips; it designs them (growing what it calls the chip’s structure) and receives royalties and license charges when others use its mannequin. Thus far, $280 billion value of chips utilizing Arm structure have been shipped.

Arm’s prospects embody tech giants like Apple, Nvidia, Amazon, Samsung, and plenty of others. You seemingly use Arm’s expertise every day with out realizing it — 99% of smartphones use CPUs with Arm designs. Arm’s income was $824 million final quarter with 14% year-over-year progress. This progress is alright, however the huge scoop was the huge enhance in remaining efficiency obligations (just like backlog), which rose 38% to $2.4 billion. This reveals that the AI race is growing demand quick.

The enterprise mannequin can be fascinating. Arm does not have important manufacturing overhead and tools prices in comparison with chip producers, which signifies that the next proportion of income is transformed to bottom-line earnings. Arm posted a 30% free money stream margin final quarter.

Just like UiPath and Palantir, Arm inventory is tough to worth. It has few true friends and has been a public firm for lower than a 12 months (It was additionally publicly traded within the Nineties and 2000s earlier than being purchased by SoftBank in 2016). Its market cap is $128 billion, which is fairly excessive for a corporation anticipated to report $3.2 billion in gross sales when it experiences its fiscal 2024 fourth-quarter outcomes (for the quarter ending March 31) someday in early Might. However Arm is a must have inventory for the long run. What works for me is shopping for a little bit at a time after which pouncing when the inventory dips.

AI is an enchanting area that covers a large space. Not all corporations will succeed, and never all shares will probably be super investments, however many will. These are three to contemplate for the lengthy haul.

Do you have to make investments $1,000 in UiPath proper now?

Before you purchase inventory in UiPath, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and UiPath wasn’t one in all them. The ten shares that made the lower may produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of April 4, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Bradley Guichard has positions in Alphabet, Amazon, Nvidia, and UiPath and has the next choices: lengthy January 2025 $2 calls on SoundHound AI. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Microsoft, Nvidia, Palantir Applied sciences, and UiPath. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Right here Are My 3 Prime Synthetic Intelligence Shares to Purchase Proper Now was initially printed by The Motley Idiot