There is not any denying McDonald’s remains to be the king of the restaurant enterprise. Its 40,000 shops collectively did $119.8 billion price of enterprise final 12 months, producing $25.5 billion of income and $8.5 billion of web revenue for the corporate. No different title even comes near matching these numbers.

From an investor’s standpoint, nonetheless, measurement is not every thing. Certainly, measurement may even be a disadvantage by advantage of constructing it more durable to tack on extra development. In some circumstances, a brand new McDonald’s location’s prime competitor may very well be one other close by McDonald’s restaurant that is already up and operating.

In case you’re in search of a extra promising guess from the quick-service restaurant area, contemplate Cava Group (NYSE: CAVA) as an alternative.

What’s Cava?

With solely 323 eating places as of the primary quarter, Cava is not precisely the family title that McDonald’s is. In locations the place Cava’s been working for a while, although, shoppers are in love with its Mediterranean fare. Its pita wraps and bowls are perfect for the fast-casual mannequin whereas feeding the demand from evolving shopper preferences.

Whereas the hamburger has dominated the quick-service restaurant panorama for many years, their well being drawbacks are lastly catching up with them. The enriched bread used to make most hamburger buns and closely processed pink meats are falling out of favor. Shoppers are more and more prepared to pay even a small premium for contemporary, pure elements like those Cava makes use of.

The actual draw right here, nonetheless, is the delicacies itself. It is comparatively undiscovered by most U.S. shoppers who’re discovering that, as soon as they fight it, they prefer it. Its well being advantages are simply an added marketability bonus.

In different phrases, that is the “one thing else” shoppers seem to have been ready for from the fast-casual restaurant trade.

Cava’s received the outcomes to show it

And Cava’s numbers again the declare up.

Take its first-quarter outcomes for instance. Throughout the three-month stretch ended April 21, Cava grew its prime line 30.3% 12 months over 12 months to $256.3 million, whereas same-store gross sales improved 2.3% towards a really powerful comparability of 28.3% within the year-ago interval.

Higher nonetheless, regardless of its younger age and small measurement, Cava Group is more and more worthwhile. The primary quarter’s earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA) of $33.3 million doubled 12 months over 12 months, and web revenue of $14.0 million utterly reversed the year-ago lack of $2.1 million. Cava logged this profitability whereas opening 14 new eating places in the course of the quarter.

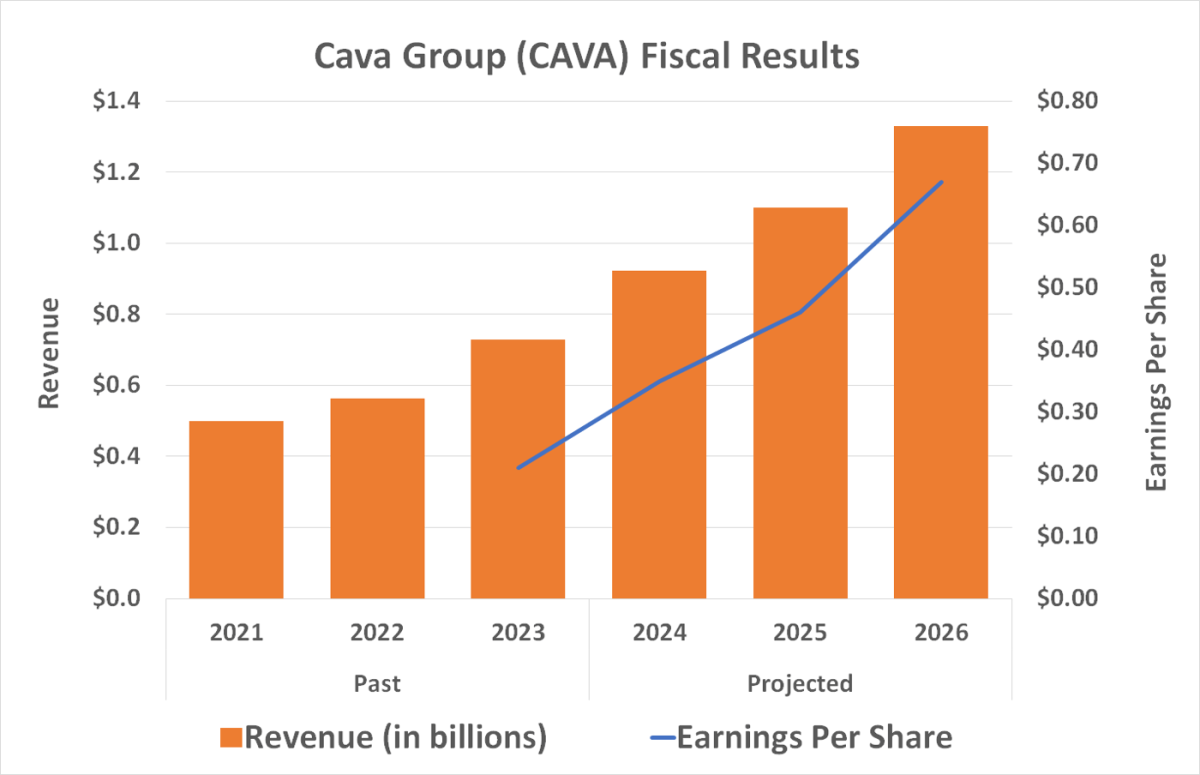

Total, the primary quarter’s numbers lengthen present traits which can be anticipated to final not less than by way of subsequent 12 months. In Might, the corporate raised its full-year EBITDA outlook from a earlier vary of $86 million to $92 million to a revised vary of $100 million to $105 million. Identical-store gross sales development forecasts had been lifted, too. Analysts are additionally collectively calling for top-line development of not less than 20% this 12 months and subsequent 12 months with per-share earnings anticipated to greater than double throughout that two-year span. All of it factors to 1 heck of a tailwind.

The kicker: Cava Group is actually debt-free. As of April, its solely long-term obligations to talk of had been working lease obligations largely stemming from rents it is agreed to pay the landlords for its restaurant places. Because the numbers above present, although, Cava eating places are inclined to function profitably early on.

Extra necessary to buyers, Cava enjoys the monetary flexibility of not being beholden to bondholders who count on to obtain common curiosity funds whether or not or not paying them is within the group’s finest curiosity on the time.

Extra reward than danger

So, is Cava a assured winner? No, there is not any such factor, particularly in a enterprise as fiercely aggressive because the restaurant trade. The inventory’s additionally very costly relative to its earnings. Younger development shares are usually uncomfortably unstable as nicely, and Cava Group is not any exception.

However, the potential reward right here is greater than well worth the premium for risk-tolerant buyers. There is a huge quantity of room for Cava to proceed increasing its footprint for years to come back and lots of causes to imagine it will likely be ready to take action.

Do you have to make investments $1,000 in Cava Group proper now?

Before you purchase inventory in Cava Group, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 finest shares for buyers to purchase now… and Cava Group wasn’t one in all them. The ten shares that made the reduce may produce monster returns within the coming years.

Take into account when Nvidia made this record on April 15, 2005… when you invested $1,000 on the time of our advice, you’d have $641,864!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 6, 2024

James Brumley has no place in any of the shares talked about. The Motley Idiot recommends Cava Group. The Motley Idiot has a disclosure coverage.

Neglect McDonald’s: Purchase This Unstoppable Restaurant Development Inventory As an alternative was initially revealed by The Motley Idiot