As earnings season comes into full bloom, some companies outdoors huge tech are capturing the eye of traders.

Espresso chain Starbucks (NASDAQ: SBUX) is a intently adopted firm as a result of its tendencies can provide distinctive insights into the well being of the financial system and client buying habits.

Final week, Starbucks launched outcomes for its second quarter of fiscal 2024, ended March 31. Total, the report did not go away a lot to be desired, and shares have cratered 14%.

Let’s dig into Starbucks’ earnings report and analyze why I see a distinct espresso chain inventory as the higher purchase.

Challenges throughout the board

Analyzing retail companies may be daunting. For starters, when a retail firm studies income progress, it may be deceptive, as a result of traders usually will not be informed how a lot of this progress is derived merely from worth will increase.

Furthermore, contemplating retail companies are always opening and shutting places, it may be laborious to evaluate an organization’s natural progress tendencies. For that reason, probably the most vital metrics for retail companies is same-store gross sales.

Identical-store gross sales may be seen as a extra helpful metric than income progress as a result of it measures exercise from shops which were open for no less than one yr. This gives traders with an vital view of the corporate’s foot site visitors, and the way these tendencies could result in additional growth or closures of the retail outlet in query.

For the interval ended March 31, same-store gross sales declined by 4% yr over yr. Of notice, comparable gross sales dropped each domestically within the U.S. and internationally — together with main markets reminiscent of China.

Along with a deceleration in same-store gross sales, administration cited one other problem throughout the earnings name — and I discovered this one to be fairly regarding. Starbucks’ CEO Laxman Narasimhan admitted that the espresso chain is struggling to spur demand apart from a each day inflow of morning commuters.

The place is the loyalty going?

Over the past couple of years, inflation has been unusually excessive. Because of this, the Federal Reserve has instituted various rate of interest hikes. The mix of upper costs and rising borrowing prices have undoubtedly weighed on client pricing energy.

One space the place Starbucks could also be shedding some momentum is worth. I believe that Starbucks is falling behind with shoppers as a consequence of its costs. Though costs of products and companies have risen throughout the board over the past couple of years, Starbucks is perceived as a luxurious model — and its meals and drinks are costly in comparison with alternate options.

A smaller chain known as Dutch Bros (NYSE: BROS) has demonstrated some spectacular progress over the previous few years, and I think that some espresso fans are choosing this in lieu of Starbucks.

For the interval ended March 31, Dutch Bros reported that same-store gross sales rose 10% yr over yr. Furthermore, income for the quarter elevated 40% yr over yr. By comparability, Starbucks’ income progress throughout the quarter was flat.

Given the sturdy working outcomes, Dutch Bros raised its full-year 2024 income and revenue steering. Unsurprisingly, that is a lot totally different than Starbucks, which lowered its steering following the poor earnings tape.

Is Dutch Bros inventory a purchase proper now?

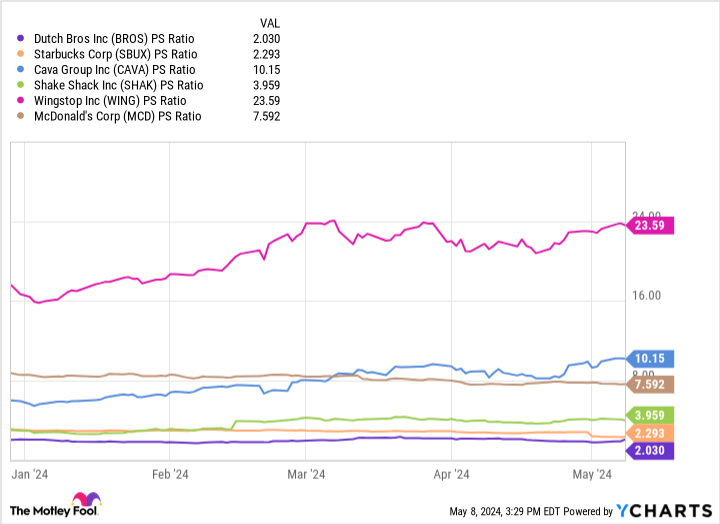

The chart benchmarks Dutch Bros towards a cohort of restaurant-adjacent firms. With a price-to-sales (P/S) a number of of two, Dutch Bros is the least costly inventory within the peer set based mostly on this measure.

Whereas this would possibly seem as if Dutch Bros is dust low-cost, I would warning traders from such pondering. Whereas Starbucks is going through some headwinds in the intervening time, it’s nonetheless a a lot bigger and financially sturdy operation. And but when trying on the P/S multiples above, Dutch Bros is definitely in keeping with Starbucks.

Nevertheless, contemplating the corporate’s natural progress and constructive outlook, I believe the premium is warranted for Dutch Bros. Usually, for any retail enterprise, the most important problem shall be growth. For now, Dutch Bros is basically a West Coast operation. Contemplating Starbucks has places in 80 international locations, Dutch Bros has a protracted strategy to go earlier than it reaches commensurate scale.

I believe traders which can be in search of some progress alternatives outdoors the plain sectors reminiscent of expertise, healthcare, or power could need to contemplate Dutch Bros. So far as client discretionary companies are involved, the corporate has established itself as greater than a distinct segment participant. Whereas the inventory is likely to be a little bit expensive in the intervening time, I believe long-term traders will nonetheless reap appreciable upside.

Must you make investments $1,000 in Dutch Bros proper now?

Before you purchase inventory in Dutch Bros, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 greatest shares for traders to purchase now… and Dutch Bros wasn’t considered one of them. The ten shares that made the reduce might produce monster returns within the coming years.

Think about when Nvidia made this checklist on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $550,688!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Could 6, 2024

Adam Spatacco has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Starbucks and Wingstop. The Motley Idiot recommends Cava Group. The Motley Idiot has a disclosure coverage.

Overlook Starbucks: Purchase This Different Scorching-Scorching Espresso Chain Inventory As a substitute was initially revealed by The Motley Idiot