It’s arduous to look previous Nvidia (NASDAQ:NVDA) nowadays, but it surely’s vital to keep in mind that there are additionally loads of different nice semiconductor (chip) shares on the market. The VanEck Semiconductor ETF (NASDAQ:SMH) allows traders to realize publicity to each Nvidia and different engaging alternatives inside the semiconductor house.

I’m bullish on SMH based mostly on its robust portfolio of prime semiconductor shares, that are performing effectively and harbor important long-term progress potential, in addition to its unbelievable observe report of producing robust returns for its holders. We’ve coated SMH beforehand; it has carried out effectively since then and continues to appear to be a compelling alternative for the long run.

What Is the SMH ETF’s Technique?

SMH is the biggest devoted semiconductor ETF. In accordance with sponsor VanEck, SMH invests within the “MVIS US Listed Semiconductor 25 Index (MVSMHTR), which is meant to trace the general efficiency of corporations concerned in semiconductor manufacturing and tools.”

VanEck highlights the truth that these are extremely liquid shares, trade leaders, and firms with international scale.

Portfolio of Compelling Semiconductor Shares

SMH owns 26 shares, and its prime 10 holdings make up 76.2% of the fund. Beneath, you’ll discover an outline of SMH’s prime 10 holdings utilizing TipRanks’ holdings software.

Whereas the fund isn’t notably diversified, it offers traders substantial publicity to Nvidia (which has a big weighting of 24.6%) and different prime semiconductor shares, together with Taiwan Semiconductor (NYSE:TSM), Broadcom (NASDAQ:AVGO), Qualcomm (NASDAQ:QCOM) and extra.

Had been it not for Nvidia’s 209.6% achieve over the previous yr, it’s probably that we’d be listening to extra about Broadcom and its 111.8% achieve. However the semiconductor and software program infrastructure large is now knocking on the door of turning into one of many world’s 10 largest corporations and is worthy of loads of consideration by itself accord. The inventory is a long-term winner that has generated an unbelievable whole return of three,168% over the previous decade.

It’s additionally an underrated dividend progress inventory that has elevated its dividend payout for 13 straight years and grown this payout at a formidable 17.5% CAGR over the previous 5 years. Moreover, like Nvidia, Broadcom has a inventory break up of its personal arising.

The corporate lately introduced that it’s going to execute a 10-for-1 inventory break up, which is able to go dwell on July twelfth. Whereas inventory splits don’t essentially make a elementary distinction, they will drive appreciable curiosity and momentum in a inventory, as we lately noticed with Nvidia. They’ll additionally make the inventory extra accessible to smaller traders and retail traders.

Along with Broadcom, Taiwan Semiconductor is one other one of many many engaging chip shares amongst SMH’s prime holdings.

Taiwan Semiconductor is the world’s largest and most superior chipmaker. Main semiconductor corporations just like the aforementioned Nvidia, Broadcom, Qualcomm, and others go to Taiwan Semiconductor to fabricate the cutting-edge chips that they design and develop. This makes Taiwan Semiconductor a lovely picks-and-shovels play inside the semiconductor house. The $786.1 billion firm has seen its inventory achieve a cool 75.2% over the previous yr and hit a new all-time excessive.

Subsequent, Qualcomm, which is up 93.8% over the previous yr, has made a reputation for itself, as the corporate is creating cutting-edge semiconductors for every part from smartphones to cars and Web of Issues gadgets.

Extra prime 10 holdings, ASML (NASDAQ:ASML) and Lam Analysis (NASDAQ:LRCX), are among the many few corporations on this planet offering the high-tech instruments and tools which are used within the semiconductor manufacturing course of, making them essential elements of the semiconductor worth chain with extensive moats (aggressive benefits).

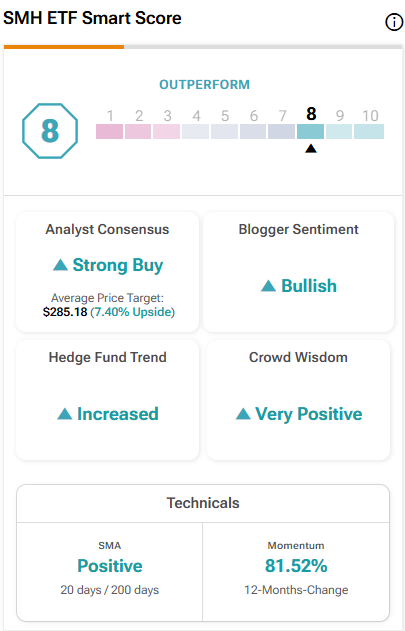

One factor that Broadcom, Taiwan Semiconductor, and Qualcomm all have in frequent is that all of them function “Excellent 10” Sensible Scores. The Sensible Rating is a proprietary quantitative inventory scoring system created by TipRanks. It offers shares a rating from 1 to 10 based mostly on eight market key elements. A rating of 8 or above is equal to an Outperform ranking. Seven of SMH’s prime 10 holdings function Outperform-equivalent Sensible Scores of 8 or above.

Moreover, SMH boasts an Outperform-equivalent ETF Sensible Rating of 8.

Sensational Lengthy-Time period Efficiency

SMH owns a powerful assortment of highly-rated semiconductor shares, and it has additionally generated glorious returns for its holders for a very long time, giving it a observe report that’s arduous to beat.

As of Might 31, SMH has delivered an enviable annualized three-year return of 25.5%. This stellar return simply trumps that of the broader market. The Vanguard S&P 500 (NYSEARCA:VOO) returned 9.6% on an annualized foundation over the identical timeframe. It even beats the robust efficiency of the tech-focused Expertise Choose Sector SPDR Fund (NYSEARCA:XLK), which delivered an annualized return of 15.9% over the identical time span.

Over an extended five-year timeframe, SMH has generated a scorching annualized return of 38.6%. This quantity once more handily beats the broader market and XLK (VOO returned an annualized 15.8% over the identical timeframe, whereas XLK returned an annualized 25.2%). Be aware that these are each nice returns, and SMH nonetheless beat them by a substantial margin.

Even going again 10 years, SMH has produced an outstanding annualized return of 27.8%, once more beating each the broader market and the tech-focused XLK. VOO returned an annualized 12.7% over the identical timeframe, whereas XLK returned an annualized 20.3%.

How Excessive Is SMH’s Expense Ratio?

SMH incorporates a affordable expense ratio of 0.35%, that means that an investor within the fund can pay $35 on a $10,000 funding yearly. This isn’t the bottom price on the market, as many broad market index funds cost decrease charges. Nevertheless, it’s on par with its friends and affordable sufficient for a sector-specific ETF, particularly one that’s performing in addition to SMH.

Is SMH Inventory a Purchase, In accordance with Analysts?

Turning to Wall Road, SMH earns a Average Purchase consensus ranking based mostly on 21 Buys, 5 Holds, and 0 Promote scores assigned previously three months. The common SMH inventory worth goal of $285.18 implies 7.5% upside potential from present ranges.

Investor Takeaway

In conclusion, I’m bullish on SMH as a result of it supplies traders substantial publicity to Nvidia and prime semiconductor shares like Broadcom, Taiwan Semiconductor, and others. Plus, its phenomenal returns over the previous three, 5, and 10 years give it an unassailable observe report.