Tech scion David Ellison’s months-long quest to win management of Paramount International moved nearer to the end line Sunday, in a deal that marks a brand new chapter for the long-struggling media firm and guardian of one in every of Hollywood’s oldest film studios.

Paramount International board members on Sunday accredited the bid by Ellison’s Skydance Media and its backers to purchase the Redstone household’s Massachusetts holding agency, Nationwide Amusements Inc., stated two sources near the deal who weren’t approved to remark.

A spokesperson for Paramount declined to remark.

The Redstones’ voting inventory in Paramount could be transferred to Skydance, giving Ellison, son of billionaire Oracle Corp. co-founder Larry Ellison — a key backer of the deal — management of a media operation that features Paramount Photos, broadcast community CBS and cable channels MTV, Comedy Central and Nickelodeon.

The proposed $8.4 billion multipronged transaction additionally consists of merging Ellison’s manufacturing firm into the storied media firm, giving it extra heft to compete in right this moment’s media atmosphere.

The settlement, which mints Ellison as a Hollywood mogul, got here collectively over the past two weeks as Ellison and his financing companions renewed their efforts to win over the Redstone household and Paramount’s unbiased board members.

Learn extra: So the Paramount and Skydance deal is again on monitor. What occurred and what’s subsequent?

Redstone has lengthy most popular Ellison’s bid over different these of potential suitors, believing the 41-year-old entrepreneur possesses the ambition, expertise and monetary heft to carry Paramount from its doldrums.

However, in early June, Redstone bought chilly ft and abruptly walked away from the Ellison deal — a transfer that surprised trade observers and Paramount insiders as a result of it was Redstone who had orchestrated the public sale.

Inside a few week, Ellison renewed his outreach to Redstone. Ellison in the end persuaded her to let go of the leisure firm her household has managed for almost 4 many years. The sweetened deal additionally paid the Redstone household about $50 million greater than what had been proposed in early June. On Sunday Paramount’s full board, together with particular committee of unbiased administrators, had signed off on the deal, the sources stated.

Learn extra: David Ellison’s journey from belief fund child to media mogul vying to purchase Paramount

Below phrases of the deal, Skydance and its monetary companions RedBird Capital Companions and personal fairness agency KKR have agreed to supply a $1.5-billion money infusion to assist Paramount pay down debt. The deal units apart $4.5 billion to purchase shares of Paramount’s Class B shareholders who’re wanting to exit.

The Redstone household would obtain $1.75-billion for Nationwide Amusements, an organization that holds the household’s Paramount shares and a regional movie show chain based in the course of the Nice Despair, after the agency’s appreciable money owed are paid off.

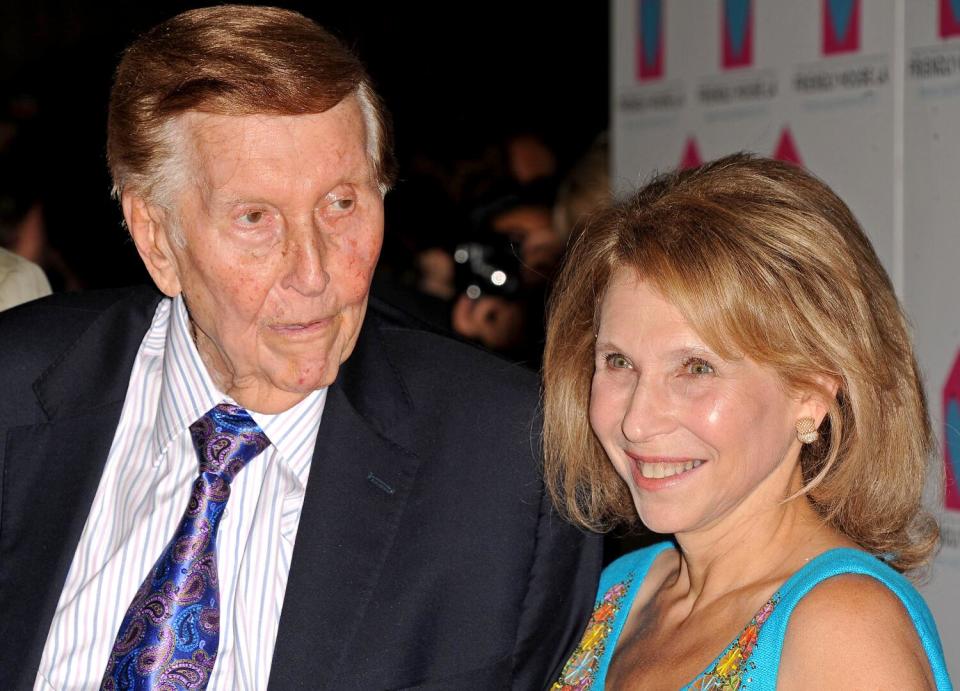

The proposed handoff alerts the top of the Redstone household’s almost 40-year reign as one in every of America’s most well-known and fractious media dynasties. The late Sumner Redstone’s Nationwide Amusements was as soon as valued at almost $10 billion, however pandemic-related theater closures, final 12 months’s Hollywood labor strikes and a heavy debt burden despatched its fortunes spiraling.

Within the final 5 years, the New York-based firm has misplaced two-thirds of its worth. Its shares are actually value $8.2 billion based mostly on Friday’s closing value of $11.81 a share.

The struggles in some ways prompted Shari Redstone to half together with her beloved household heirloom. Moreover, Nationwide Amusements was struggling to cowl its money owed, and the excessive rates of interest worsened the outlook for the Redstone household.

Learn extra: Shari Redstone was poised to make Paramount a Hollywood comeback story. What occurred?

Paramount boasts a few of the most historic manufacturers in leisure, together with the 112-year-old Paramount Photos film studio, identified for landmark movies equivalent to “The Godfather” and “Chinatown.” The corporate owns tv stations together with KCAL-TV (Channel 9) and KCBS-TV (Channel 2). Its once-vibrant cable channels equivalent to Nickelodeon, TV Land, BET, MTV and Comedy Central have been dropping viewers.

The handover requires the approval of federal regulators, a course of that might take months.

In Might, Paramount’s unbiased board committee stated it could entertain a competing $26-billion supply from Sony Photos Leisure and Apollo International Administration. The bid would have retired all shareholders and paid off Paramount’s debt, however Sony executives grew more and more cautious of taking up an organization that depends on conventional TV channels.

Earlier this 12 months, Warner Bros. Discovery expressed curiosity in a merger or shopping for CBS. Nonetheless, that firm has struggled with almost $40 billion in debt from earlier offers and is in comparable straits as Paramount. Media mogul Byron Allen has additionally proven curiosity.

Many in Hollywood — movie producers, writers and brokers — have been rooting for the Skydance takeover, believing it represents one of the best likelihood to protect Paramount as an unbiased firm. Apollo and Sony have been anticipated to interrupt up the enterprise, with Sony absorbing the film studio into its Culver Metropolis operation.

The second section of the transaction can be for Paramount to soak up Ellison’s Santa Monica-based Skydance Media, which has sports activities, animation and gaming in addition to tv and movie manufacturing.

Ellison is anticipated to run Paramount as its chief government. Former NBCUniversal CEO Jeff Shell, who’s now a RedBird government, might assist handle the operation. It is unclear whether or not the Skydance staff will carry on the three division heads who are actually working Paramount: Paramount Photos CEO Brian Robbins, CBS head George Cheeks and Showtime/MTV Leisure Studios chief Chris McCarthy.

Skydance has an current relationship with Paramount. It co-produced every movie within the “Mission: Unimaginable” franchise since 2011’s “Mission: Unimaginable — Ghost Protocol,” starring Tom Cruise. It additionally backed the 2022 Cruise mega-hit “High Gun: Maverick.”

Learn extra: Paramount International is on the market. Who’s shopping for and the way did we get right here?

Ellison first approached Redstone about making a deal final summer time, and talks grew to become identified in December.

Redstone lengthy considered Ellison as a most popular purchaser as a result of the deal paid a premium to her household for his or her exit. She additionally was impressed by the media mogul , believing he might grow to be a next-generation chief who might take the corporate her father constructed to the next degree, in accordance with folks educated of her pondering.

Larry Ellison is alleged to be contributing funding to the deal.

David Ellison was interested in the deal due to his previous collaborations with Paramount Photos and the attract of mixing their mental properties in addition to the cachet of proudly owning a historic studio, analysts stated. Paramount’s wealthy historical past incorporates in style franchises together with “Transformers,” “Star Trek,” “South Park” and “Paw Patrol.”

“Paramount is without doubt one of the main historic Hollywood studios with a large base of [intellectual property], and so it appears to us that it is extra about utilizing the capital that Ellison has and what he’s constructed at Skydance and leveraging that into proudly owning a significant Hollywood studio,” Brent Penter, senior analysis affiliate at Raymond James, stated previous to the deal. “To not point out the networks and all the pieces else that Paramount has.”

Learn extra: David Ellison’s journey from belief fund child to media mogul vying to purchase Paramount

The settlement prepares to shut the books on the Redstone household’s 37-year tenure on the firm previously often called Viacom, starting with Sumner Redstone’s hostile takeover in 1987.

Seven years later, Redstone clinched management of Paramount, after merging Viacom with ultimately doomed video rental chain Blockbuster to safe sufficient money for the $10-billion deal. Redstone lengthy considered Paramount because the crown jewel, a perception that took root a half-century in the past when he wheeled-and-dealed over theatrical exhibition phrases for Paramount’s prestigious movies to display at his regional theater chain.

Below Redstone’s management, Paramount gained Academy Awards within the ’90s for “Forrest Gump” and “Saving Non-public Ryan.”

He pioneered the concept of treating movies as an funding portfolio and hedging bets on some productions by taking over monetary companions — a method now broadly used all through the trade.

In 2000, Redstone expanded his media empire once more by buying CBS, a transfer that made Viacom one of the crucial muscular media corporations of the time, rivaling Walt Disney Co. and Time Warner Inc. Simply six years later, Redstone broke it up into separate, sibling corporations, satisfied that Viacom was extra valuable to advertisers due to its youthful viewers. Redstone additionally needed to reap dividends from two corporations.

After years of mismanagement at Viacom, which coincided with the elder Redstone’s declining well being, and boardroom turmoil, his daughter stepped in to oust Viacom high administration and members of the board. Three years later, following an government misconduct scandal at CBS, Shari Redstone achieved her aim by reuniting CBS and Viacom in a virtually $12-billion deal.

The mixed firm, then referred to as ViacomCBS and valued at greater than $25 billion, was imagined to be a TV juggernaut, commanding a significant proportion of TV promoting income by means of the dominance of CBS and greater than two dozen cable channels.

However adjustments within the TV panorama took a toll.

Learn extra: The strikes are over, however Hollywood’s misplaced 12 months is a tipping level for the trade

As client cord-cutting grew to become extra widespread and TV promoting income declined, ViacomCBS’ largest asset grew to become a severe legal responsibility.

The corporate was late to enter the streaming wars after which spent closely on its Paramount+ streaming service to attempt to meet up with Netflix and even Disney. (In early 2022, the corporate was renamed Paramount International in a nod to its moviemaking previous and to tie in with its streaming platform of the identical identify.)

The corporate’s eroding linear TV enterprise and the decline of TV advert income, in addition to its struggles making an attempt to make streaming worthwhile, can be main challenges for Ellison as he takes over Paramount. Although conventional TV is declining, it nonetheless brings in money for Paramount.

And streaming is a complete totally different financial proposition from tv, one that gives slimmer income. In the meantime, the corporate additionally faces bigger trade questions on when — if ever — field workplace income will return to pre-pandemic ranges.

“It is a firm that’s floating on hope,” stated Stephen Galloway, dean of Chapman College’s Dodge Faculty of Movie and Media Arts. “And hope isn’t an important enterprise technique.”

Learn extra: Her father as soon as dismissed her as a light-weight. Now Shari Redstone will run the present at ViacomCBS

This story initially appeared in Los Angeles Instances.