Perhaps you’ve seen the trending inventory tickers in the present day and observed that Coupang (NYSE:CPNG) inventory was on a rocket experience larger. There’s nothing mistaken with momentum, however traders ought to look into the explanation for the transfer and make their very own selections. I’m bearish on CPNG inventory, and as we delve into what’s truly occurring with Coupang, you would possibly determine to search out higher funding alternatives elsewhere.

The simplest method to describe Coupang is as South Korea’s model of Amazon (NASDAQ:AMZN). It’s a well-liked e-commerce firm with an order-fulfillment service referred to as Rocket Supply.

CPNG inventory was on the transfer in the present day, and you could be tempted to go all-in on the South Korean Amazon. Nonetheless, you’ll want to be taught all the related info earlier than making any funding selections. In any case, a inventory will be susceptible to a pullback if a rally isn’t actually justified.

A Greater Firm May Threaten Coupang

Earlier than we get into the headline information, there’s a growth that potential Coupang traders can’t afford to disregard. Particularly, an enormous firm is reportedly taking steps to compete straight with Coupang.

This firm is far greater than Coupang — and no, it’s not Amazon. Reasonably, it’s China-based e-commerce large Alibaba (NYSE:BABA), which has a $184.13 billion market cap, versus Coupang’s $38.16 billion market cap.

Right here’s the news, courtesy of Nikkei’s Kotaro Hosokawa (through TheFly). Apparently, Alibaba plans to take a position $1.1 billion “over the following three years to create a logistics community in South Korea.” With this transfer, Alibaba intends to tackle Coupang “by leveraging low costs and speedy deliveries.”

For an e-commerce enterprise, being threatened by Alibaba in Asia can be like being threatened by Amazon within the U.S. It’s simply unhealthy information for Coupang.

Moreover, Alibaba has the capital assets to trigger issues for Coupang. Reportedly, Alibaba will construct a logistics middle in a 180,000-square-meter lot this yr, in addition to a name middle with 300 workers. Plus, Alibaba plans to determine a “buying division to promote native merchandise abroad, aiming to spice up exports for 50,000 small South Korean companies over three years.”

In the present day, the market is just ignoring this information, as short-term merchants are obsessing over a brand new growth with Coupang. Nonetheless, big-picture thinkers shouldn’t simply dismiss the risk that Alibaba will pose to Coupang within the coming years.

Why Was Coupang Inventory Up 11.5% In the present day?

So, right here’s the catalyst that brought on CPNG inventory to rally 11.5% in the present day. As The Korea Instances reported, Coupang plans to extend its month-to-month Wow service (which is analogous to Amazon’s Prime service) membership charge from 4,990 South Korean gained beforehand to a brand new value of seven,890 gained (equal to roughly $5.74).

If this doesn’t look like a giant deal, keep in mind that $5.74 will be some huge cash for households in numerous areas of the world. Furthermore, it is a 58% enhance within the month-to-month Wow service charge.

Absolutely, Coupang’s prospects at the moment are saying “wow” to the “Wow” service, however not in a great way. This most likely ought to go with out saying, however The Korea Instances acknowledged, “Many customers [are] displeased with [the] steep value hike.”

Let’s put this into perspective. Definitely, some prospects haven’t been notably blissful about Amazon’s Prime membership value hikes all through the years. Nonetheless, at the least Amazon had the sense to make these value will increase considerably gradual — not 58% abruptly.

My level is that this might backfire in a giant manner. Within the rapid time period, inventory merchants are most likely over-focused on the revenue-generating potential of Coupang’s Wow service value hike. If the corporate loses offended prospects, although, then there might be long-term harm to Coupang’s backside line. That’s the very last thing Coupang wants as Alibaba makes main strikes to steal a few of the firm’s market share in South Korea.

Is Coupang Inventory a Purchase, In line with Analysts?

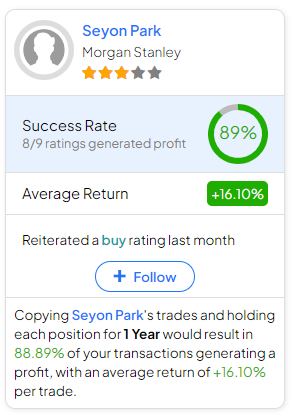

On TipRanks, CPNG is available in as a Reasonable Purchase primarily based on three Buys and two Maintain rankings assigned by analysts up to now three months. The common CPNG inventory value goal is $21.75, implying 2.35% upside potential.

In the event you’re questioning which analyst you need to comply with if you wish to purchase and promote CPNG inventory, probably the most worthwhile analyst protecting the inventory (on a one-year timeframe) is Seyon Park of Morgan Stanley (NYSE:MS), with a median return of 16.1% per score and an 89% success fee. Click on on the picture beneath to be taught extra.

Conclusion: Ought to You Contemplate Coupang Inventory?

Coupang is actually an intriguing firm that is perhaps in comparison with Amazon. But, even the mammoth Amazon didn’t have the audacity to lift its subscription service charge by 58% abruptly. Actually, Coupang’s large value hike is both a superb transfer or simply reckless and grasping.

Personally, I don’t take into account it to be a superb transfer. Coupang must preserve its prospects blissful, particularly with Alibaba threatening to make a transfer into Coupang’s house turf. Consequently, although CPNG inventory is rapidly shifting larger, I’m not contemplating proudly owning it now.