Each shopper desires to discover a discount; it’s one of many thrills once we go trying to purchase issues. Discovering what we wish at a cheaper price than we deliberate on spending – that’s at all times a bit thrilling. And this holds true for the inventory markets, too. It’s the attract behind worth shares.

Based on Financial institution of America, the worth inventory section, sometimes priced decrease than their underlying strengths would counsel, has badly lagged the expansion shares to this point this yr. The financial institution’s analysis fairness and quant strategist Savita Subramanian describes worth shares as ‘uncared for and buying and selling at very low multiples,’ and factors out a number of sectors, together with power shares, as a spot for value-minded traders to search for alternatives.

Subramanian’s colleague, Financial institution of America inventory analyst Kalei Akamine, has been taking that stance ahead and giving a more in-depth take a look at three value-priced power shares. All three are members of the S&P 500 worth index, and the BofA view holds that these are worth shares to think about proper now.

Based on the TipRanks database, the broader Wall Road tackle these picks is evident – they’re Purchase-rated and supply sound, double-digit upside potential. Let’s look into the main points and discover out simply why Financial institution of America believes they’re compelling portfolio decisions.

ConocoPhillips (COP)

We’ll begin with ConocoPhillips, one of many world’s largest impartial oil and gasoline exploration and manufacturing corporations. With a market cap of $131 billion, ConocoPhillips oversees a worldwide operation from its Houston, Texas base; the corporate has actions in North America, Europe, Africa, the Center East, and the Asia-Pacific area.

Zooming out, we discover that ConocoPhillips is deeply concerned within the manufacturing of most types of fossil gas. The corporate’s ops embrace all phases of discovery, exploitation, transport, and distribution/advertising of hydrocarbon fuels and different merchandise, together with crude oil, pure gasoline, pure gasoline liquids, liquified pure gasoline (LNG), and bitumen, also referred to as pure asphalt. ConocoPhillips maintained a mean each day manufacturing final yr of 1,826 thousand barrels of oil equal, and as of this previous Dec 31, claims roughly 6.8 billion barrels of oil equal of proved reserves in its land holdings and areas of operation. The corporate’s largest crude oil and pure gasoline manufacturing area was the ‘Decrease 48’ of the US.

For return-minded traders, this firm maintains a stable dedication to placing capital again into shareholders’ arms. In 2023, the corporate returned $11 billion to its shareholders, in achievement of its coverage to return upwards of 30% of its money from operations.

In the latest reported quarter, 1Q24, ConocoPhillips had gross sales and working revenues that got here to $14.5 billion. This was greater than $480 million lower than had been anticipated, and was based mostly on complete manufacturing for the quarter of 1,902 Mboe/d. The corporate’s backside line got here to $2.03 per share by non-GAAP measures, in step with expectations.

The oil and gasoline sector within the US has seen a number of high-profile mergers and acquisitions over the previous yr, and BofA analyst Akamine believes it is a web optimistic for ConocoPhillips. He writes, “We imagine that the present M&A cycle has reshaped the aggressive panorama in US E&P to the good thing about names with dimension and progress. With Concho, Pioneer and Hess acquired because the flip of the last decade, there may be now a vacuum for prime quality massive cap oil publicity. We predict that might proceed to push traders into COP, the most important impartial E&P by manufacturing and market cap…”

Laying out his view of the inventory for the long-term, the analyst provides, “In our view, COP’s asset combine and useful resource depth are the undervalued points of the funding case. The depth of the US portfolio has allowed COP to supply peer-leading visibility, with a ten yr plan the place goal is 4-5% manufacturing CAGR. Whereas that sounds modest, there’s a compounding impact that generates vital money movement progress.”

These feedback help Akamine’s Purchase score on the shares, and his $147 value goal implies a one-year upside of 31%. (To look at Akamine’s observe document, click on right here.)

Total, this oil and gasoline big will get a Sturdy Purchase consensus score from the Road, based mostly on 15 latest evaluations that embrace 13 to Purchase towards simply 2 to Maintain. The shares are priced at $112.15, and the $147.85 common goal value is barely marginally extra bullish than the BofA take. (See ConocoPhillips’ inventory forecast.)

Devon Power (DVN)

Subsequent up is Devon Power, an Oklahoma-based impartial exploration & manufacturing agency. Devon focuses its actions on pulling recoverable power merchandise from onshore property positioned within the Continental US. The corporate operates in 5 states – Texas, New Mexico, Oklahoma, Wyoming, and North Dakota – and is lively in a few of the nation’s richest power areas, together with the Williston Basin, the Delaware Basin, and the Eagle Ford formation.

Devon, a ~$30 billion firm, has labored to develop a steady asset portfolio, one that’s designed to advertise robust future manufacturing progress whereas working in an environmentally accountable method. The corporate generated stable manufacturing numbers in the course of the first quarter of this yr, registering a mean each day output of 319,000 barrels of oil, 165,000 barrels of pure gasoline liquids, and 1 billion cubic ft of pure gasoline. In all, this got here to 664,000 barrels of oil equal per day, beating the beforehand printed steerage determine by 4%.

This manufacturing led to complete revenues of $3.6 billion, down 5.8% YoY, however in step with the forecasts, whereas the underside line EPS determine, at $1.16 by non-GAAP measures, was a nickel above the estimates. The corporate completed Q1 with $1.15 billion in money property available, a stable improve from the $887 million reported in 1Q23 – and from the $875 million reported in 4Q23.

Checking in with analyst Akamine, we discover the BofA power knowledgeable bullish on Devon – citing that transferring ahead, the corporate is primed to outperform. Akamine writes, “Our Purchase score on DVN displays a restoration story centered round DVN recentering its drilling program to its finest property within the New Mexico Delaware – and searching for to reestablish itself as one of many sector’s main operators… With ’24 preliminary steerage set on the again of a challenged quarter in 3Q23, we imagine DVN has reset the trail to ‘beat and lift.’ At 1Q24 outcomes, DVN raised FY24 oil steerage, crediting robust nicely efficiency within the Permian, and seems to have gotten a few of that operational momentum again. By means of YE24, we count on to see Permian oil stabilize round 212mbd, which might set the stage for robust FY25 steerage.”

Alongside along with his Purchase score, the analyst places a $64 value goal right here, suggesting a 37% upside potential for the subsequent 12 months.

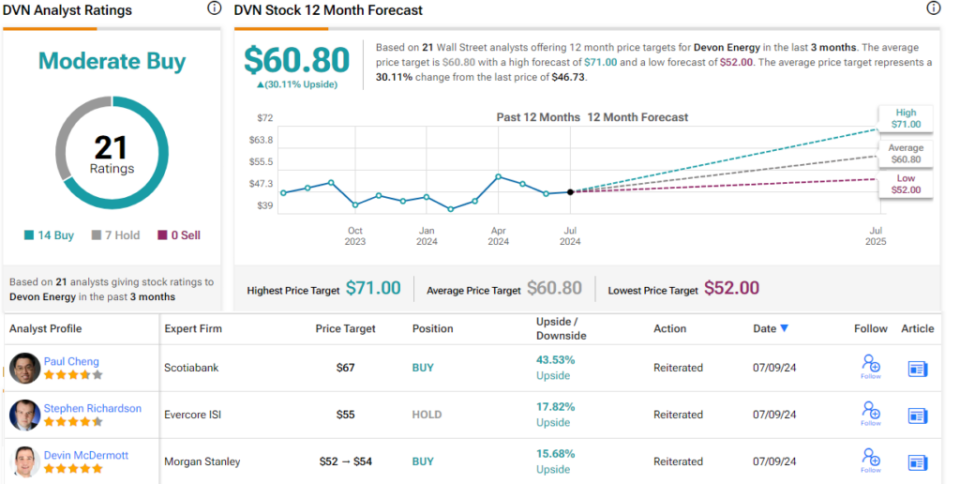

Devon Power has earned a Reasonable Purchase score from the Road’s consensus, based mostly on 20 suggestions that break right down to 14 Buys and seven Holds. The shares are priced at $46.73 with a mean value goal of $60.80, indicating potential for a one-year acquire of 30%. (See Devon’s inventory forecast.)

EOG Assets (EOG)

Final on our BofA-backed record is EOG Assets, one other of the North American large-cap impartial power corporations. EOG, with its market cap of ~$72 billion, is lively within the northern and southern Nice Plains, in addition to the Appalachian Mountain area. The corporate has productive oil and gasoline exploration and extraction operations ongoing within the Appalachian Basin, within the Eagle Ford formation, the Midland Basin, and the Permian Basin, and within the Williston, Powder River, and DJ Basins. As well as, the corporate has an offshore operation within the Columbus Basin, close to the island nation of Trinidad & Tobago. EOG is predicated in Houston, Texas, close to the epicenter of the twenty first century power renaissance.

On the manufacturing facet, EOG beat the midpoint of the 1Q24 steerage on crude oil, pure gasoline liquids, and pure gasoline, and noticed modest good points from 4Q23. The corporate’s crude oil manufacturing in Q1 got here to 487.4 MBbld; pure gasoline liquids reached 231.7 MBbld, and pure gasoline output got here to 1,858 MMcfd. The corporate’s complete manufacturing within the quarter, transformed to crude oil equal volumes, was reported at 1,028.8 MBoed.

These manufacturing figures underpinned EOG’s quarterly income of $6.12 billion. That was up a modest 1.3% year-over-year, however beat the forecast by nearly $1.8 billion. The corporate’s backside line earnings determine, at $2.82 per share by non-GAAP measures, was 24 cents per share higher than had been anticipated.

This firm doesn’t simply generate stable hydrocarbon manufacturing figures; it additionally generated loads of money in 1Q24. EOG’s money movement from operations was listed as $2.9 billion. After deducting $1.7 billion in capital expenditures, the corporate reported $1.2 billion in free money movement.

Once we seek the advice of one final time with BofA’s analyst Akamine, we discover that he likes this firm for its mixture of long-term endurance and money era. The power analyst says, “EOG’s portfolio helps drilling on the present tempo within the Permian Basin for 19 years, twice so long as the peer common. Put up COVID, valuations have calibrated round FCF yields, which undervalues longer dated stock. However because the trade depletes core places and appears to replenish by means of costly M&A, we see EOG more and more nicely positioned and deserving of a premium a number of.”

Akamine goes on to price these shares as a Purchase, and he places a $151 value goal right here to level towards an upside of 19.5% on the one-year time-frame. (To look at Akamine’s observe document, click on right here.)

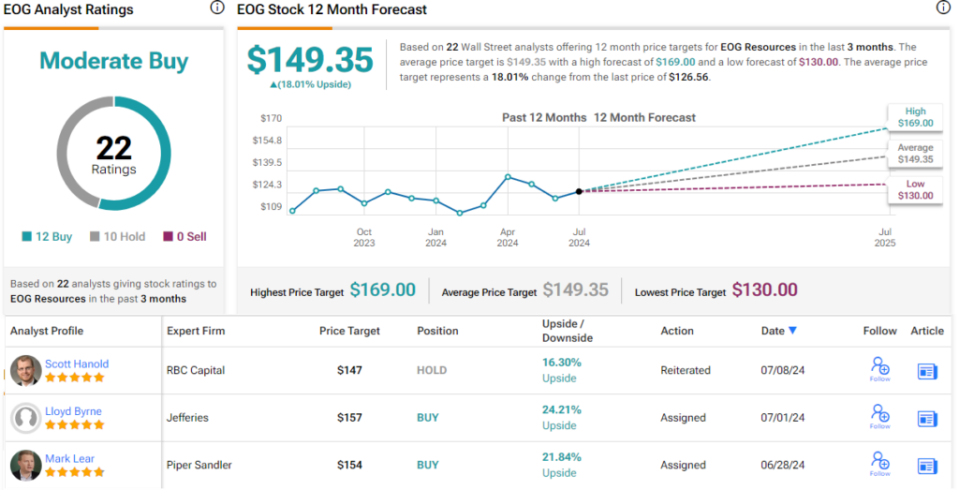

From the Road as an entire, EOG has a consensus score of Reasonable Purchase, based mostly on 22 evaluations with a 12 to 10 breakdown favoring the Buys over the Holds. The inventory is presently buying and selling for $126.56 and its $149.35 common value goal implies a one-year upside potential of 18%. (See EOG’s inventory forecast.)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Finest Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is rather necessary to do your personal evaluation earlier than making any funding.