Chipmaking large Nvidia entered “correction territory,” after shares briefly fell 10% from their most up-to-date all-time closing excessive.

Shares had recovered by Wednesday’s shut once they have been solely about 8% off the excessive.

The corporate, which makes graphics processing items — or GPUs — has been a key beneficiary of the bogus intelligence increase, which boosted demand for its chips.

Nvidia GPUs are generally used for compute-intensive AI functions, corresponding to OpenAI’s ChatGPT AI chatbot. Its server chips are additionally a key element of knowledge facilities.

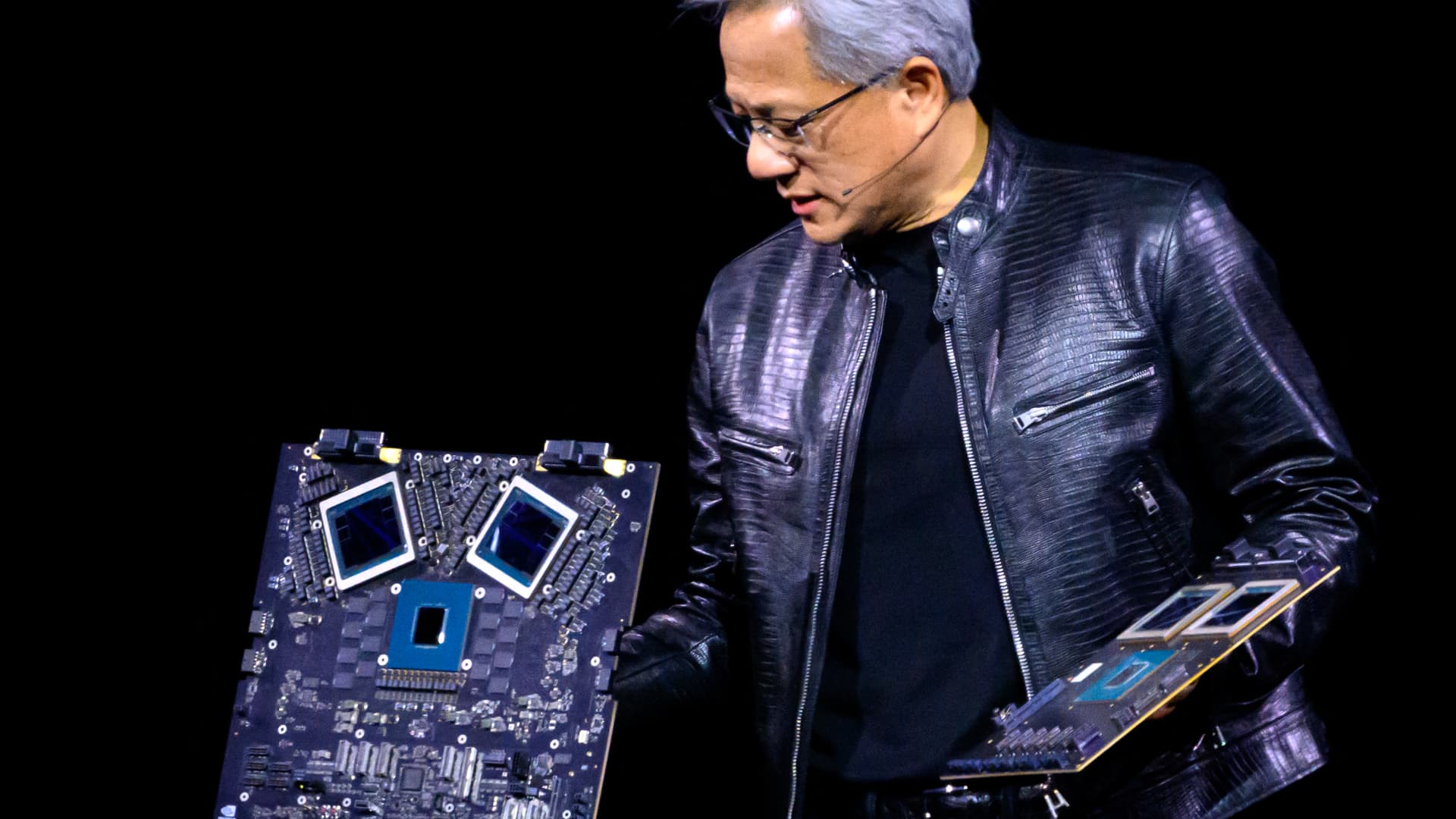

Nvidia founder and CEO Jensen Huang shows merchandise onstage throughout the annual Nvidia GTC Convention on the SAP Heart in San Jose, California, on March 18, 2024.

Josh Edelson | Afp | Getty Pictures

The corporate’s monetary efficiency has been on a tear prior to now yr. It reported a 486% bounce in non-GAAP earnings per diluted share within the December quarter, citing big chip demand, because of the recognition of generative AI fashions.

The inventory has come beneath stress for the previous two weeks, nonetheless. On Tuesday morning, shares have been 10% from their final all-time closing excessive of $950 apiece, which they hit on March 25. The inventory closed at a value of $853.54 on Tuesday, down 2% for the session.

Nvidia’s shares closed up 1.97% on Wednesday.

Nvidia’s share value efficiency prior to now month

Definitions of what constitutes a market correction range, however it’s usually thought-about to be a sustained drop of 10% or extra from all-time highs.

Nvidia declined to touch upon this story.

What is the motive for the decline?

The precise motive for the downward transfer hasn’t been instantly clear. Traders may very well be taking revenue on the inventory, after a wild achieve of greater than 200% for the shares within the final 12 months. And on Tuesday, rival chipmaker Intel unveiled a brand new AI chip referred to as Gaudi 3, aimed toward powering giant language fashions — the cornerstone know-how behind generative AI instruments like OpenAI’s ChatGPT.

Intel stated the brand new chip is over twice as power-efficient as Nvidia’s H100 GPU — the U.S. chip large’s most superior graphics card — and may run AI fashions 1½ instances quicker than Nvidia’s GPU.

Analysts at D.A. Davidson stated in a analysis notice that they count on a “shrinking” of the scale of AI fashions, together with alternate options like Mistral’s Giant mannequin and Meta’s LLaMA system, to drive down demand for Nvidia’s inventory over time.

“Though NVDA (Impartial-rated) ought to ship a spectacular 2024 (and maybe into 2025), we proceed to consider current traits arrange a major cyclical downturn by 2026,” D.A. Davidson analysts stated within the notice Tuesday.

“A mix of shrinking fashions, extra regular development in demand, maturing hyperscaler investments, and elevated reliance by their largest clients on their very own chips don’t bode properly for NVDA’s out years.”

— CNBC’s Ganesh Rao contributed to this report.