-

Mizuho mentioned Nvidia’s upcoming earnings report is the subsequent huge catalyst for AI shares.

-

Demand for Nvidia’s GPU chips stays sturdy regardless of potential delays of its Blackwell chip, in keeping with the financial institution.

-

Mizuho raised Nvidia’s worth goal to $132, representing potential upside of 26% from Thursday’s shut.

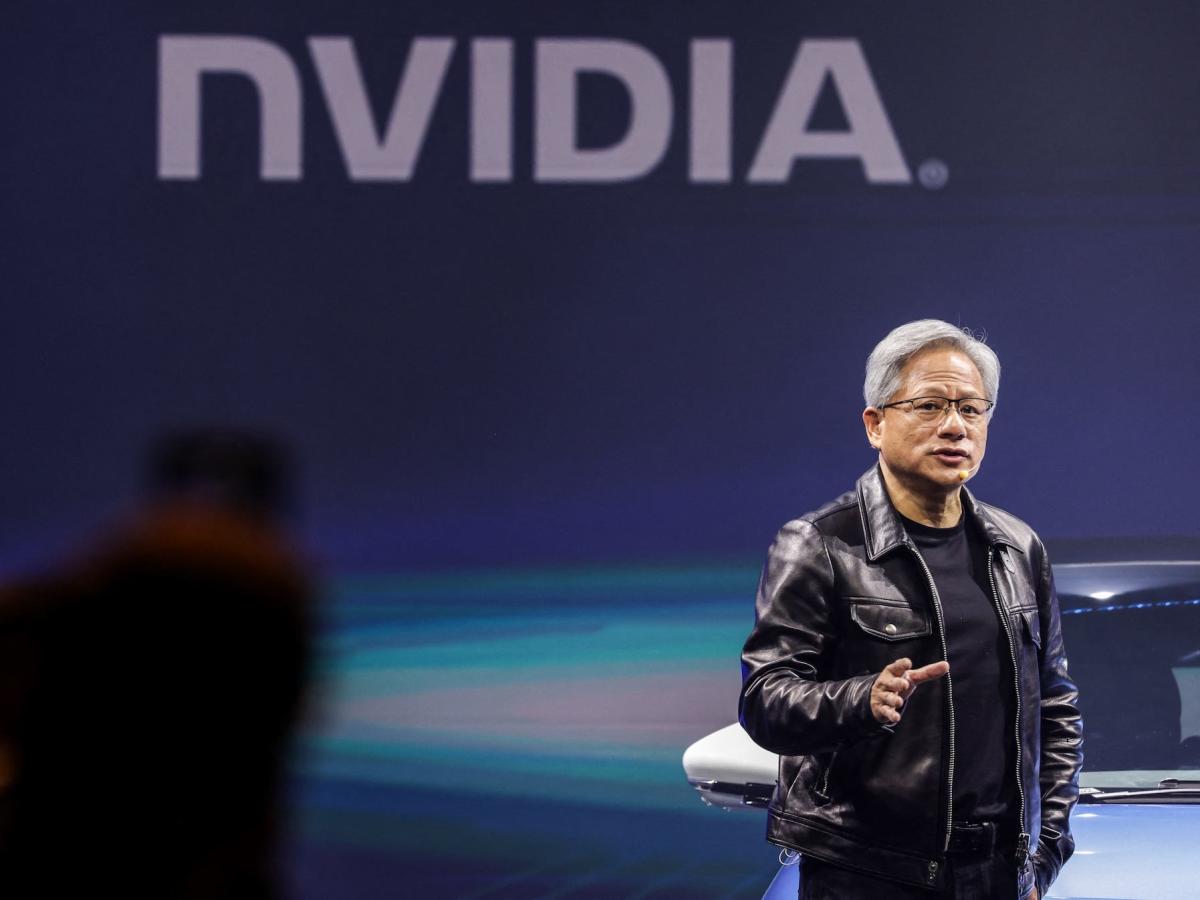

Nvidia inventory is down almost 20% over the previous month, however there’s huge upside forward for traders and its upcoming earnings report can be a serious catalyst for AI shares, in keeping with Mizuho.

The financial institution mentioned mentioned in a observe this week that traders ought to ignore the noise associated to potential delays of Nvidia’s next-generation Blackwell chip, arguing that it’s nonetheless seeing relentless demand for its GPU chips.

Nvidia’s capability for its present era H100 and H200 chips stays “tight”, Mizuho mentioned, and any delays for Blackwell will not influence demand however will merely delay income for the corporate by about two to a few months.

“Demand stays unchanged,” Mizuho managing director Vijay Rakesh mentioned. “NVDA continues to guide the cost.”

The financial institution elevated its Nvidia worth goal to $132 from $127.50, representing potential upside of 26% from Thursday’s shut.

Maybe most essential is Nvidia’s means to boost costs on its next-generation chips, which ought to enhance the common promoting worth of its AI-enabled GPUs, Rakesh mentioned.

For Nvidia’s Blackwell NVL72 GPU rack, the price may very well be upwards of $3 million, whereas its GB200 superchips might value someplace between $50,000 and $70,000 every, in keeping with Mizuho.

That might be an enormous bounce from Nvidia’s H100 chips, which value round $40,000, and its H100/B100 GPU rack, which prices round $300,000 to $400,000, in keeping with the financial institution.

These huge worth will increase ought to proceed to be a tailwind for Nvidia into 2025 and past, with Mizuho elevating its earnings estimates for Nvidia in 2026 and 2027 when the corporate releases its next-generation Rubin-based GPU chips.

By 2027, Mizuho expects Nvidia to generate almost $200 billion in income, greater than triple the $61 billion it generated in 2024.

“We proceed to see NVDA because the winner within the AI GPU area, with AMD being the 2nd participant,” Rakesh mentioned. “We’d observe NVDA studies earnings on August twenty eighth, which we see as the subsequent main catalyst for AI-related names.”

Learn the unique article on Enterprise Insider