The inventory market has handsomely rewarded Nvidia‘s dominant place in synthetic intelligence (AI) chips with beautiful positive aspects of greater than 222% prior to now 12 months. And the corporate has justified this red-hot rally with terrific development quarter after quarter.

Such phenomenal development in Nvidia’s income and earnings comes all the way down to the truth that it controls a whopping 98% share of the AI chip market. Market analysis agency Gartner estimates that the AI semiconductor market might generate $71 billion in income in 2024. If Nvidia manages to maintain its stranglehold over this market, it might witness an enormous leap in its information heart income from the earlier fiscal 12 months’s ranges of $47.5 billion.

So there’s a stable probability that Nvidia might proceed to go greater and stay a prime AI development inventory going ahead. Nevertheless, in the event you missed Nvidia’s terrific run-up prior to now 12 months and are fearful in regards to the inventory’s valuation, there’s a stable different to purchase: ASML Holding (NASDAQ: ASML).

Let’s take a look at the explanations ASML is without doubt one of the greatest AI shares to purchase proper now.

ASML Holding’s machines have made Nvidia’s AI dominance attainable

ASML’s excessive ultraviolet (EUV) lithography machines often is the largest purpose Nvidia has dominated the AI chip market. These machines enable Nvidia’s foundry accomplice, Taiwan Semiconductor Manufacturing Firm, also referred to as TSMC, to fabricate chips utilizing superior, smaller course of nodes.

Based on ASML, “chipmakers use our NXE techniques to print the extremely advanced basis layers of their 7 nm, 5 nm, and three nm nodes.” Nvidia’s massively in style H100 AI GPU (graphics processing unit) is manufactured on a 5-nanometer (nm) course of node, whereas the upcoming Blackwell era of chips is reportedly going to be manufactured on a 4nm course of from TSMC.

Moreover, Nvidia’s not too long ago introduced Rubin chips, that are anticipated to be launched in late 2025, are anticipated to be manufactured utilizing a 3nm course of. Not surprisingly, chipmakers and foundries are lining as much as purchase ASML’s superior chipmaking tools to satisfy sturdy AI-driven demand. The Dutch semiconductor tools producer will ship its newest EUV machine to Intel and TSMC later this 12 months.

Priced at a whopping $380 million, this machine will enable ASML’s clients to fabricate chips that might be 1.7 occasions smaller than the earlier era of machines. These chips are anticipated to be deployed for AI-related workloads. The transistors are extra carefully packed collectively on chips manufactured utilizing smaller course of nodes, permitting electrons to maneuver sooner and leading to extra computing energy. Additionally, because the electrons must journey a smaller distance, the warmth generated in these superior chips is decrease and they’re extra energy environment friendly.

In the meantime, chipmakers’ investments to develop their manufacturing capacities might be a tailwind for ASML. For example, a TSMC-backed chipmaker not too long ago introduced that it’ll make investments $7.8 billion in a brand new chip plant in Singapore. Furthermore, the rising demand for AI chips is prone to encourage chipmakers to purchase extra EUV lithography tools.

Information Bridge Market Analysis estimates that the worldwide EUV lithography market might generate $40.5 billion in income in 2031 as in comparison with $9.4 billion final 12 months. Provided that ASML has a monopolistic place within the EUV lithography market, the corporate appears ready to continue to grow at a wholesome tempo over the long term.

The corporate’s development is about to speed up

ASML completed 2023 with income of 27.6 billion euros, a rise of 30% from the earlier 12 months. The corporate is anticipating the same stage of income this 12 months because the semiconductor trade’s income fell in 2023, prompting ASML’s clients to carry off on new tools purchases this 12 months as they work by means of the underside.

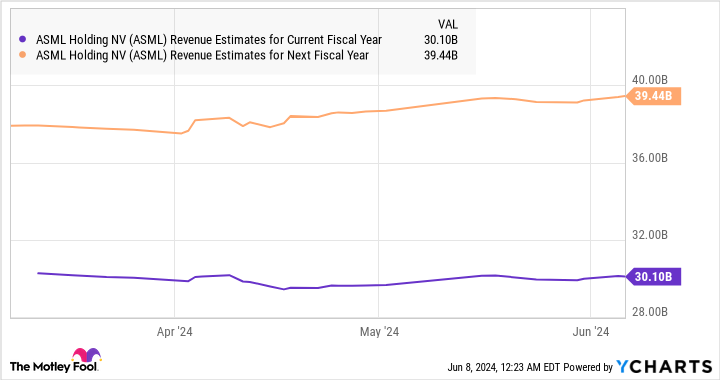

ASML is anticipating to return to development from 2025, and its enormous order backlog of 38 billion euros goes to play a key function in driving that turnaround. The next chart signifies that ASML’s prime line might shoot up by 30% subsequent 12 months.

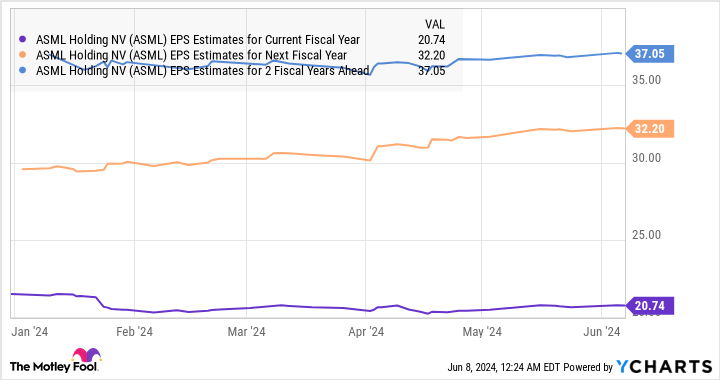

Analysts predict the corporate to ship wholesome bottom-line development as properly, because of the spectacular momentum that its enterprise is anticipated to realize.

Shares of ASML have gained 44% prior to now 12 months, which is decrease than the 52% positive aspects clocked by the PHLX Semiconductor Sector index. Nevertheless, the scenario might change going ahead because of catalysts similar to AI that would drive stronger demand for the corporate’s choices.

With ASML buying and selling at 14 occasions gross sales proper now, which is a giant low cost to Nvidia’s gross sales a number of of 38, buyers can get their arms on this AI inventory at a comparatively engaging valuation. Take into account grabbing this chance earlier than ASML inventory begins hovering based mostly on the crucial function it is enjoying within the AI chip market.

Do you have to make investments $1,000 in ASML proper now?

Before you purchase inventory in ASML, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they imagine are the 10 greatest shares for buyers to purchase now… and ASML wasn’t one in all them. The ten shares that made the lower might produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $740,690!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of June 10, 2024

Harsh Chauhan has no place in any of the shares talked about. The Motley Idiot has positions in and recommends ASML, Nvidia, and Taiwan Semiconductor Manufacturing. The Motley Idiot recommends Gartner and Intel and recommends the next choices: lengthy January 2025 $45 calls on Intel and brief August 2024 $35 calls on Intel. The Motley Idiot has a disclosure coverage.

Missed Out on Nvidia’s Run-Up? My Greatest Synthetic Intelligence (AI) Inventory to Purchase and Maintain was initially printed by The Motley Idiot