On-line companies big Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) has made loads of millionaires through the years. You’d have greater than 1,000,000 {dollars} within the Google mother or father’s inventory right now in the event you invested simply $15,000 when it entered the general public inventory market in 2004. For those who put the identical money to work in a broad market tracker just like the SPDR S&P 500 ETF Belief (NYSEMKT: SPY) as an alternative, you’d have a complete return of simply $105,000:

The key sauce in million-dollar portfolios: Time and endurance

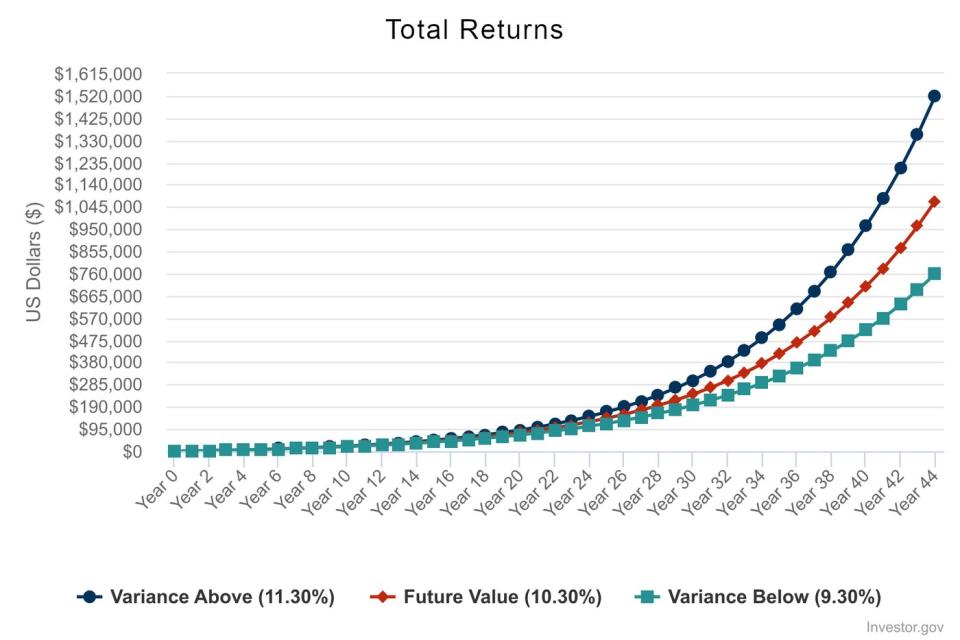

However you’ll be able to construct a million-dollar portfolio with out market-crushing stars. Take the index tracker’s compound common returns of 10.3% over that 20-year interval, commit to creating a modest funding each month, and let it run for a couple of extra years.

For instance, think about establishing an computerized funding of $100 monthly on the age of 20. There is not any seed cash to start out that portfolio, no contribution will increase over time, and also you’re sticking with that S&P 500 (SNPINDEX: ^GSPC) index tracker, mechanically reinvesting its dividends in additional shares of the exchange-traded fund (ETF) alongside the way in which.

$100 a month is not nothing, however the dedication is arguably sufficiently small to work for most individuals with a day job. 44 years later, on the affordable retirement age of 64, you should have invested a grand whole of $52,800 in a easy index ETF. And because of the magic of compound returns, you’d have about $1.07 million in your retirement account.

The larger they’re, the more durable they fall

Many diversified mutual funds or ETFs can deal with a long-term funding like the instance above. Set it, overlook it, and snigger all the way in which to the financial institution after a couple of many years.

However only a few single shares can carry that load. Oceans rise, empires fall, and even probably the most strong giants aren’t proof against sudden downturns, shifting client tastes, and technological progress. Let’s take a look at a few examples.

-

On the flip of the millennium, Common Electrical (NYSE: GE) boasted the second-largest market cap of all at $508 billion. By now, the economic empire has cut up into three separate corporations whose market caps add as much as about half of the January 2000 footprint.

-

Enron or Lehman Brothers are extra dramatic examples of crumbling empires, and the record is lengthy. Among the many 1,925 shares within the Russell 2000 index, solely 640 have a inventory market historical past of a minimum of 25 years.

-

As soon as, I purchased a sofa with a lifetime guarantee from what had as soon as been the biggest division retailer of all. Six months and a nasty vacation season later, Montgomery Ward filed for chapter and liquidated the entire enterprise. the corporate could not deal with the one-two punch of big-box retailers and the early years of on-line procuring. A lot for lifetime warranties.

Why Alphabet is constructed to final

In mild of those examples, it is clear that only a few corporations may be anticipated to thrive over a number of many years. Nonetheless, there are exceptions to the rule — and I imagine Alphabet is a type of uncommon survivors.

Constructed to thrive in quite a lot of financial environments because of the ultra-flexible Alphabet umbrella group, Alphabet has the flexibility to increase and discover in many various industries. If the web search and promoting revenues dry up, Alphabet would depend on the Android smartphone, YouTube video platform, and Google Cloud decentralized computing service within the brief time period. In the meantime, promising facet gigs just like the Waymo self-driving taxi service, Calico medical analysis group, or Verily well being knowledge unit may decide up the long-term baton. Or possibly Google Cloud will simply run with it as an alternative, powered by its synthetic intelligence experience.

Alphabet’s portfolio of potential enterprise stars will change over time, and I in all probability have not even seen their greatest concepts but. And that is precisely why I believe the corporate is able to run for many years to return. I do not suggest placing your whole nest egg in a single basket, except that basket holds a diversified fund — however in the event you completely must do it, Alphabet’s inventory is on the prime of my candidates record.

A versatile enterprise mannequin and confirmed success in constructing sturdy expertise options place Alphabet to match and even exceed the S&P 500’s long-term returns. And if the inventory can certainly outperform the common S&P 500 returns in the long term, you will attain your million-dollar retirement aim even sooner.

And a small increase to the return price would make an enormous distinction in 44 years — beating the Avenue’s common returns by a single share level offers you a $1.5 million portfolio ultimately:

Must you make investments $1,000 in Alphabet proper now?

Before you purchase inventory in Alphabet, take into account this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they imagine are the 10 greatest shares for traders to purchase now… and Alphabet wasn’t one among them. The ten shares that made the lower may produce monster returns within the coming years.

Contemplate when Nvidia made this record on April 15, 2005… in the event you invested $1,000 on the time of our advice, you’d have $652,342!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of Might 13, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Anders Bylund has positions in Alphabet. The Motley Idiot has positions in and recommends Alphabet. The Motley Idiot has a disclosure coverage.

Might Alphabet Inventory Assist You Retire a Millionaire? was initially printed by The Motley Idiot