(Bloomberg) — Micron Know-how Inc.’s greater than $62 billion synthetic intelligence-driven rally is about to face a check of whether or not it has jumped too far, too quick.

Most Learn from Bloomberg

Shares of the chipmaker are up roughly 65% this yr. A lot of that advance has come since Micron’s final quarterly report, with the inventory hitting a document excessive this month. Traders will search proof of earnings development and strong future demand within the subsequent launch due after Wednesday’s market shut. The inventory was up about 0.5% Wednesday afternoon in New York.

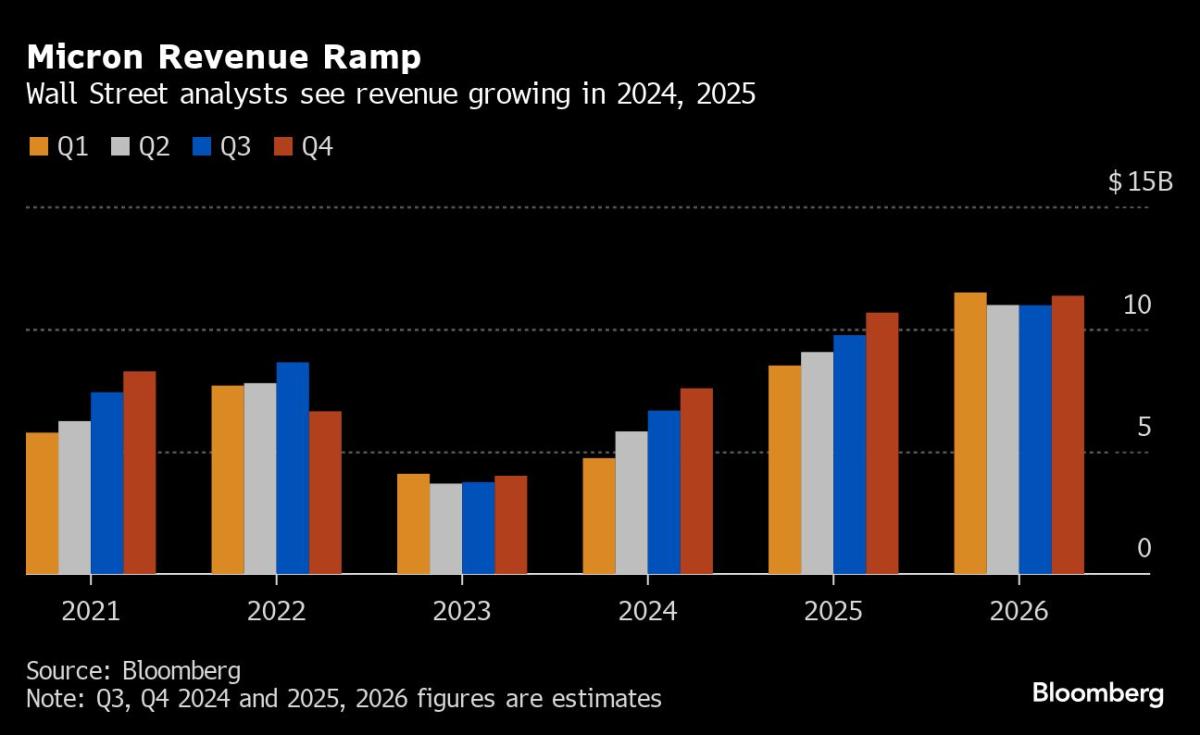

Expectations are lofty. Wall Avenue anticipates Micron to report $6.7 billion in income within the quarter, an almost 80% bounce from the identical interval a yr earlier. A miss might increase the danger of a selloff, with choices contracts signaling that the inventory might transfer 12% in both route within the buying and selling session following earnings, in response to information compiled by Bloomberg.

Micron has “ridden the coattails of the entire AI phenomenon,” mentioned Jay Woods, chief international strategist at Freedom Capital Markets. “They’re actually going to need to have a narrative that separates them from their friends.”

The place Micron stands out is in its reminiscence capabilities, utilized in AI purposes, which Wall Avenue sees driving future income. Analyst estimates for quarterly adjusted earnings per share are up 9.5% within the final three months, to 50 cents.

“We count on Micron to ship a beat-and-raise as we enter one of many largest reminiscence cycles in historical past,” Hans Mosesmann of Rosenblatt Securities Inc. wrote in a Tuesday notice. That development will probably be pushed by elements that embrace demand for synthetic intelligence purposes and a ramp-up in excessive bandwidth reminiscence chips that in flip reduces provide for conventional Dynamic Random-Entry Reminiscence elements, he added.

At $225, Mosesmann’s worth goal for Micron is the best on Wall Avenue, in response to information compiled by Bloomberg. The corporate total has 37 purchase scores, two holds and one promote.

Nonetheless, within the occasion of disappointment, any potential post-earnings weak spot could possibly be a very good time to snap up shares, in response to JPMorgan Chase & Co. analysts led by Harlan Sur.

“We’d use any near-term pull-back within the inventory to proceed to build up shares,” the analysts wrote in a June 24 notice, including that they see the present reminiscence section restoration sending the replenish from present ranges to $190 to $200 a share.

Tech Chart of the Day

Nvidia Corp. shares jumped 6.8% Tuesday, its finest one-day acquire since late Might, snapping a three-day shedding streak that erased greater than $400 billion in market worth. Shares had been decrease in intraday buying and selling Wednesday.

High Tech Information

-

OpenAI’s abrupt transfer to ban entry to its companies in China is setting the scene for an trade shakeup, as native AI leaders from Baidu Inc. to Alibaba Group Holding Ltd. transfer to seize extra of the sector.

-

Troubled French IT agency Atos SE mentioned that Onepoint, its largest shareholder, has withdrawn from bail-out talks and that billionaire Daniel Kretinsky’s EPEI has expressed an curiosity in restarting discussions.

-

Advantest Corp. stands to profit as a growth in AI growth makes chips extra complicated in coming years, boosting demand for the semiconductor testing gear it provides, the corporate’s chief mentioned.

-

The Biden administration plans to award $75 million in semiconductor subsidies to Entegris Inc., marking the primary grant to an organization centered on supplying components to chipmaking factories and the most recent in a broader push to deliver manufacturing again to the US.

-

SoftBank Group Corp. founder Masayoshi Son will sketch out plans to deliver AI-infused medical care to Japan, making a uncommon public look to drive dwelling his resurgent ambitions in synthetic intelligence.

Earnings Due Wednesday

–With help from Subrat Patnaik and Stephen Kirkland.

(Updates inventory strikes all through)

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.