Tech big Amazon (NASDAQ: AMZN) has been a sensational long-term funding, due to the corporate’s obvious disregard for staying in its lane. It went from being a web-based retailer for solely books to an e-commerce platform for the whole lot. After which it even went past e-commerce to develop enterprise operations for delivery logistics, digital promoting, cloud computing, healthcare providers, and extra.

One other firm with an ever-widening enterprise imaginative and prescient is Singapore’s Sea Restricted (NYSE: SE). The corporate has an e-commerce platform and a online game division, and presents monetary expertise (fintech) providers. And it isn’t content material to sit down in its core Asian markets. Slightly, it aspires to have a rising world operation.

Although Sea inventory is down 85% from its all-time excessive, I believe it is surprisingly a greater purchase than Amazon inventory at the moment. This is why.

However first, Amazon continues to be a fantastic firm

Do not misunderstand: Amazon continues to be a fantastic firm. The inventory is sitting close to an all-time excessive due to its hovering working earnings. Certainly, the chart under exhibits a powerful correlation between Amazon’s working earnings and its inventory value over the past 20 years.

Over the past decade, Amazon’s working earnings have largely soared due to the success of its Amazon Net Companies (AWS) cloud-computing providers — AWS provided 67% of the corporate’s working earnings in 2023. However working earnings pulled again in recent times because it invested closely in logistics to accommodate skyrocketing e-commerce demand.

Amazon’s working earnings are actually normalizing as investments wind down. Administration expects to earn $8 billion to $12 billion within the upcoming first quarter alone. Subsequently, I would not be stunned if Amazon inventory has extra upside.

In comparison with Sea inventory, Amazon is likely to be a safer wager for earning profits. That stated, Sea inventory may have extra upside if issues go proper.

Why Sea inventory is price shopping for right here

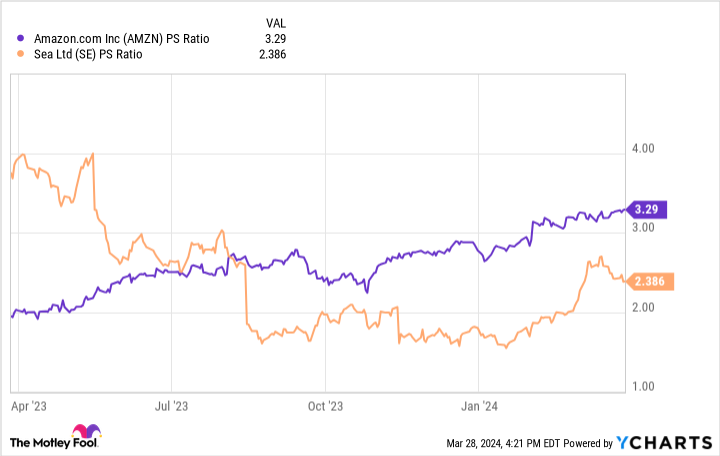

First, it is vital to notice that Sea inventory is cheaper than Amazon inventory by the price-to-sales (P/S) metric.

To worth a inventory equivalent to Sea at simply 2 instances gross sales means that traders do not imagine the corporate can develop — a minimum of not profitably. However I believe the corporate’s latest outcomes disprove each opinions.

Think about the chart under that breaks down the monetary outcomes for all three of Sea’s enterprise segments. Formally, the corporate calls these segments e-commerce, digital leisure, and digital monetary providers. Observe that the revenue column refers to adjusted earnings earlier than curiosity, taxes, depreciation, and amortization (EBITDA).

|

Phase |

Income development |

Revenue |

|---|---|---|

|

E-commerce |

24% |

($214) million |

|

Digital leisure |

(44)% |

$921 million |

|

Digital monetary providers |

44% |

$550 million |

Information supply: Sea’s press launch. Chart by writer.

One in every of Sea’s segments has declining income, and one other has an adjusted EBITDA loss. However as a complete, Sea’s income was up in 2023, and it was a worthwhile firm. Subsequently, the corporate can develop profitably as a result of it is doing it proper now.

Subsequently, the query is not whether or not this firm can develop profitably; the true query is whether or not it may seize a big alternative.

It is arduous to overstate the alternatives for Sea. The corporate does enterprise in rising economies which might be digitizing at a quick tempo, equivalent to Indonesia, Brazil, India, and extra. And with these markets comes the potential for development.

Take Sea’s concentrate on Brazilian e-commerce, for instance. In 2020, the corporate entered the market. In February, simply 4 quick years later, it had already opened its tenth distribution middle within the nation.

These Brazilian distribution facilities characterize vital funding on Sea’s half. However as talked about, it is a massive alternative. Analysis group Mordor Intelligence estimates that Brazilian e-commerce is a $53 billion market at the moment. However it predicts it is going to develop at an astonishing 19% compound annual development charge by means of 2029. Different analysis teams equally predict double-digit development. And Sea is constructing the infrastructure to capitalize.

Sea is spending closely on e-commerce. However it’s price noting that its development is turning into extra sustainable. In 2023, the enterprise section did have an adjusted EBITDA lack of $214 million. However this was virtually a $1.5 billion enchancment, which should not be neglected.

It is not simply e-commerce. Sea’s monetary providers division is clearly on fireplace. It expects a superb yr for its digital leisure division as nicely in 2024, which is fueled by its hit sport Free Fireplace. Administration expects a return to double-digit development this yr and will quickly relaunch within the huge market of India because it resolves regulatory points.

With solely $13 billion in trailing 12-month income, Sea has ample room for upside given the scale of its markets, development in these markets, and the sturdy demand for the services and products that it and its rivals supply.

With nearer to $600 billion in trailing 12-month income, I would say the upside potential for Amazon is way decrease at this level, which is why Sea is a promising firm for traders to contemplate shopping for at the moment.

Do you have to make investments $1,000 in Sea Restricted proper now?

Before you purchase inventory in Sea Restricted, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Sea Restricted wasn’t one among them. The ten shares that made the reduce may produce monster returns within the coming years.

Inventory Advisor offers traders with an easy-to-follow blueprint for fulfillment, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of April 4, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Jon Quast has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Amazon and Sea Restricted. The Motley Idiot has a disclosure coverage.

Love Amazon? This Different Inventory Would possibly Have Increased Upside. was initially revealed by The Motley Idiot