-

The hovering shares’ rising hole with the Fed’s continued pushback on rate of interest cuts must be fearful, says JPMorgan.

-

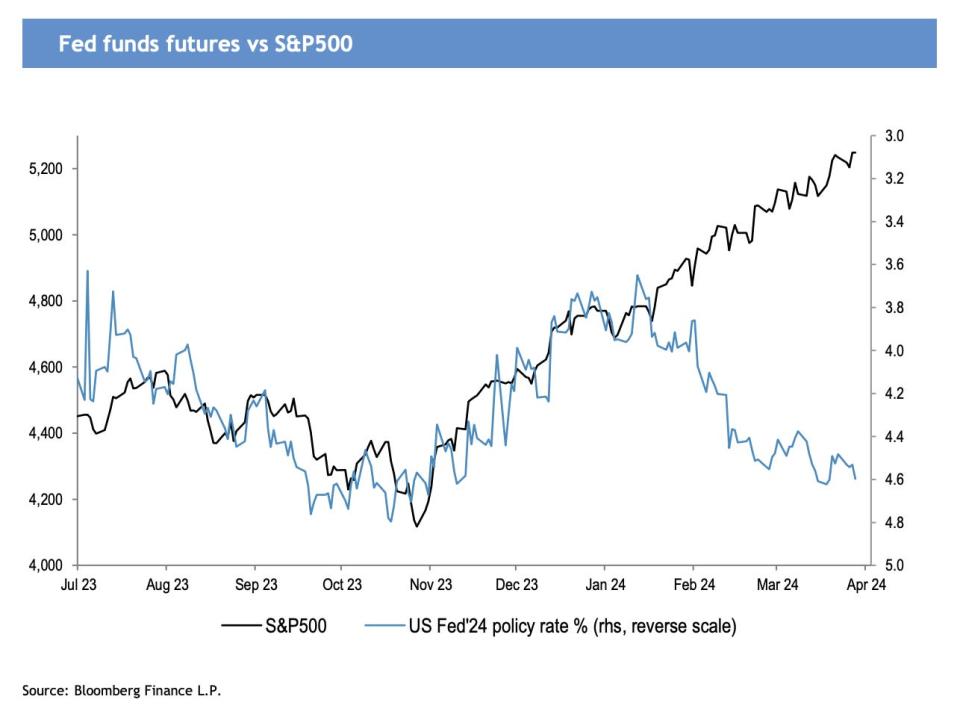

Fee-cut expectations have snapped again to 80 bps, paying homage to final October’s downturn within the inventory market.

-

Analysts highlighted anticipated market progress within the second half of the yr, however warned in opposition to assuming this may carry earnings projections for 2025.

The truth that shares are persevering with to set new data amid indicators of delayed interest-rate cuts is trigger for concern, says JPMorgan.

In analysis despatched to purchasers on Tuesday, JPMorgan’s Mislav Matejka and his group famous that shares have soared 30% since final October’s nadir, which was largely fueled by anticipations of an rate of interest minimize in March. Nonetheless, three months later, these projections have been pushed out significantly.

Taking a better look, Wall Avenue initially priced in an 80-basis-point fee minimize by the Fed throughout the October downturn. When the market surged, expectations had been revised to 180 bps in January at peak dovishness. Now, these predictions have recalibrated again to 80 bps.

“Equities are ignoring the newest pivot of a pivot, which is likely to be a mistake,” analysts wrote within the notice, including that company earnings might want to decide up pace to plug the hole.

JPMorgan additionally sees bond yields heading south within the second half of the yr, however there’s additionally an uptick in inflation swaps – which could additional delay a fee minimize. Mixed with less-than-expected returns for bonds once more, it flags “lots of complacency within the bond market with respect to the inflation threat.”

The AI-driven tech shares have powered the S&P 500 to achieve waves of rallies in 2024. In the meantime, inflation on the rise has sparked the Fed to push first fee minimize expectations from March to June. Regardless of this, some analysts predicted lower than 50% likelihood for a June minimize as a result of newest inflation indexes.

Matejka’s group additional identified that there is an assumption of market progress within the latter half of the yr, however this doesn’t suggest earnings projections for 2025 would transfer up.

On prime of that, they highlighted the market’s alarming complacency in the direction of draw back dangers, with recession odds at a mere seventh percentile, probably underestimated. Plus, the surge in cyclicals and defensives mirrors ranges seen throughout the post-International Monetary Disaster restoration in 2009-2010, signaling potential overallocation.

“That’s unlikely to be the template this time round, and will act as a headwind. The subsequent time bond yields fall we don’t consider the market may have as constructive a response because it did in Nov-Dec – we’d revert to a extra conventional correlation between yields and equities,” the group added.

Learn the unique article on Enterprise Insider