Nvidia (NASDAQ: NVDA) has been on an unbelievable run for the reason that begin of 2023. The inventory has risen round 700% and has been powered by spectacular income and earnings development alongside the way in which. A direct line could be drawn from this efficiency to synthetic intelligence (AI) demand.

However when huge hype surrounds a expertise, firms concerned in it may be caught up in an investing bubble. When this bubble bursts, it may take years (or a long time) to get well. So, is Nvidia the supplier of the long run? Or is it a bubble ready to burst?

May Nvidia be on the point of collapse?

Maybe one of the best comparability to at present’s AI gold rush is the web growth within the late Nineties and early 2000s. Firms like Cisco and Oracle had been spearheading the inventory market with the networking tools wanted to proliferate on the web. Nevertheless, that bubble burst, and it took Oracle almost twenty years to set a brand new excessive, whereas Cisco continues to be beneath its all-time excessive.

May this be in Nvidia’s future?

One of many main variations between what occurred within the early 2000s and what’s occurring now with AI is the pace of the buildout. The web did not go up in a single day, and the demand was lower than anticipated. For Nvidia, which builds the graphics processing items (GPUs) that do the heavy lifting of AI mannequin coaching, the demand does exceed expectations.

Nvidia is promoting billions of {dollars}’ value of GPUs each quarter, a quantity that has steadily risen over the previous few quarters. Moreover, with the large tech firms buying most of those GPUs and telling traders that 2025 can be one other yr of heavy capital expenditures because of constructing out the computing energy wanted for a number one AI mannequin, Nvidia is probably going in good condition from a requirement perspective.

Whereas the demand is there, the inventory may nonetheless be thought of overvalued and caught in a bubble if the enterprise cannot ship sufficient development. However is that the case?

Nvidia has premium margins that might come into query

Proper now, Nvidia lately traded for about 68 occasions trailing earnings, which could be very costly. However that is the unsuitable metric to make use of right here as a result of its enterprise is quickly evolving. As a substitute, I am going to use the ahead earnings ratio (P/E), which makes use of analyst projections for the following 12 months. It is not excellent, however it gives a greater image as a result of the market is a forward-looking machine.

From that perspective, Nvidia trades at about 43 occasions ahead earnings. Which nonetheless is not low-cost however is not as unhealthy. Through the use of these two metrics, traders can calculate that analysts venture about 59% earnings development over the following yr.

Buyers may have a look at the primary quarter’s outcomes and see 629% development in earnings per share (EPS) and conclude that this can be a breeze, however that is flawed considering. Beginning within the second quarter, Nvidia can be up in opposition to harder year-over-year comparisons, which could not present the identical spectacular development figures traders have seen over the previous yr.

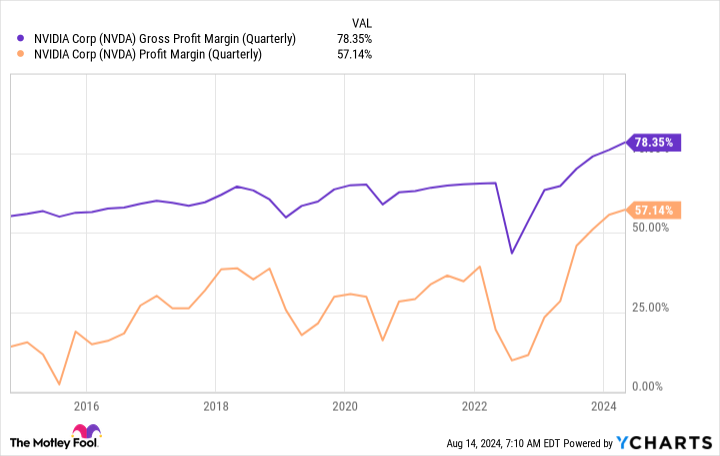

Moreover, its revenue margins are at unprecedented ranges.

These are ranges considerably above their historic ranges, which signifies that Nvidia can cost a premium for its merchandise as a result of it is the business chief. As large tech firms begin to design their very own {hardware} that may exceed Nvidia’s GPU efficiency on workloads particularly set as much as be optimized on a customized chip, these margins may fall.

This has already begun, as Apple lately used Alphabet‘s tensor processing unit (TPU) to coach its Apple Intelligence mannequin.

However does this represent a bubble? I do not suppose so.

Nvidia continues to be delivering nice merchandise and powerful development, so it is not a bubble. Nevertheless, I feel it’ll face more and more tougher challenges over the following yr. I contemplate the inventory costly, with challenges on the horizon. It would overcome them and proceed its historic run. Or it may get crushed. I am unsure which of those outcomes will happen, so I’ll keep on the sideline for now.

Do you have to make investments $1,000 in Nvidia proper now?

Before you purchase inventory in Nvidia, contemplate this:

The Motley Idiot Inventory Advisor analyst workforce simply recognized what they consider are the 10 finest shares for traders to purchase now… and Nvidia wasn’t one in every of them. The ten shares that made the lower may produce monster returns within the coming years.

Take into account when Nvidia made this checklist on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $763,374!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 12, 2024

Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Keithen Drury has positions in Alphabet. The Motley Idiot has positions in and recommends Alphabet, Apple, and Nvidia. The Motley Idiot has a disclosure coverage.

Is Nvidia the Way forward for AI or a Bubble Ready to Burst? was initially revealed by The Motley Idiot