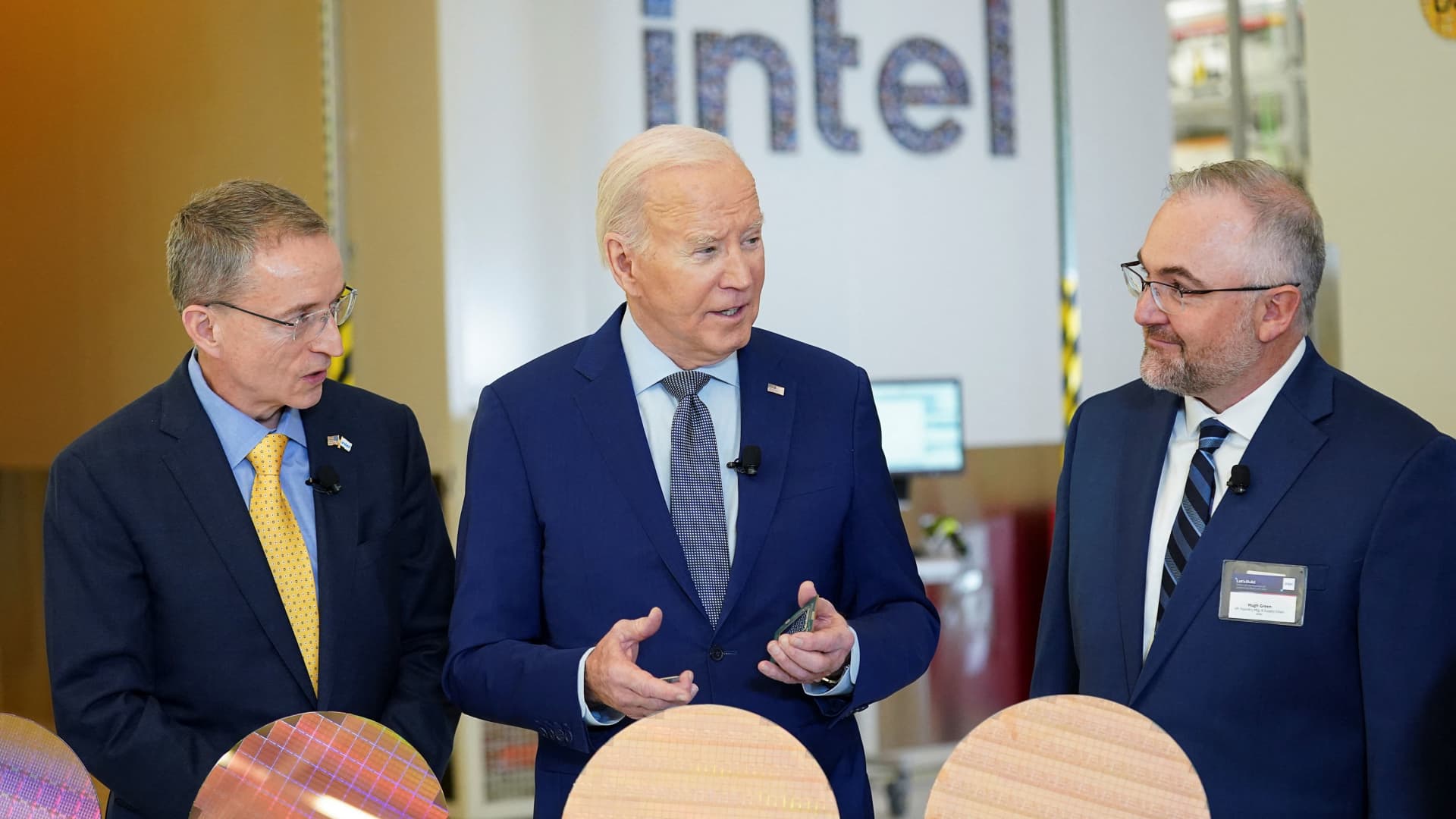

U.S. President Joe Biden excursions the Intel Ocotillo Campus, in Chandler, Arizona, U.S., March 20, 2024.

Kevin Lamarque | Reuters

Intel shares fell 4% at one level in prolonged buying and selling on Tuesday after the corporate revealed long-awaited financials for its semiconductor manufacturing enterprise, generally known as the foundry enterprise, in a SEC submitting.

Intel stated its foundry enterprise recorded an working lack of $7 billion in 2023 on gross sales of $18.9 billion. That is a wider loss than the $5.2 billion Intel reported in its foundry enterprise in 2022 on $25.7 billion in gross sales.

That is the primary time that Intel has disclosed income totals for its foundry enterprise alone. Traditionally, Intel has each designed its personal chips in addition to achieved its personal manufacturing, and reported closing chip gross sales to traders. Different American semiconductor corporations akin to Nvidia and AMD design their chips however ship them off to Asian foundries — usually Taiwan’s TSMC — for manufacturing.

Intel has been pitching traders underneath CEO Patrick Gelsinger on a plan the place it will proceed to make its personal processors, however would additionally begin an exterior foundry enterprise to make chips for different corporations. Intel’s function as one of many solely U.S. corporations doing cutting-edge semiconductor manufacturing on American soil was a giant motive why it secured almost $20 billion in CHIPS and Science Act funding final month.

A lot of Intel’s foundry income at the moment comes from its personal operations, the chipmaker stated on Tuesday. Intel additionally restated its merchandise divisions to report its prices as if it have been a so-called “fabless” firm that has to account for foundry as a value.

Intel stated the newly organized Merchandise division, which primarily consists of processors for PCs and servers, reported $11.3 billion in working revenue on $47.7 in gross sales in 2023.

Intel stated on Tuesday that it anticipated its foundry’s losses to peak in 2024 and ultimately break-even “halfway” between this quarter and the tip of 2030. The corporate beforehand stated that Microsoft would use its foundry providers, and that it has $15 billion of income for foundry already booked.

“Intel Foundry goes to drive appreciable earnings development for Intel over time. 2024 is the trough for foundry working losses,” Gelsinger stated on a name with traders on Tuesday.

Intel stated in a promo video that a lot of the dearth of profitability for its foundry enterprise was as a result of “weight of previous selections,” and individually, Gelsinger cited the corporate’s previous “gradual” adoption of a expertise known as EUV, which is used to take advantage of superior chips.