Key Takeaways

-

The Nasdaq hit a report excessive in intraday buying and selling Monday, July 8, 2024 as tech shares gained.

-

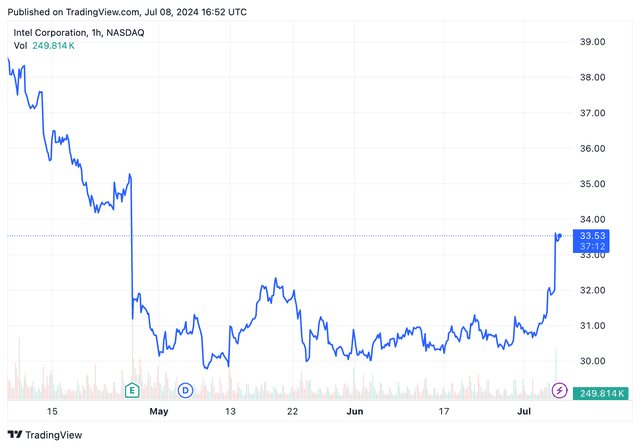

Intel shares surged after Melius Analysis urged the inventory might get a lift from synthetic intelligence within the second half of the 12 months.

-

Corning shares rose after the corporate raised its steering on sturdy demand.

The Nasdaq hit a report excessive in intraday buying and selling Monday, whereas the S&P 500 and Dow had been little modified as tech shares gained.

Corning (GLW) was the best-performing inventory within the S&P 500 after the specialty glass maker raised its steering on growing demand for its optical connectivity merchandise for generative synthetic intelligence (AI) purposes.

Intel (INTC) shares surged, together with shares of AMD (AMD) after Melius Analysis analysts urged the shares might see positive factors from AI within the second half of the 12 months.

Shares of IDEAYA Biosciences (IDYA) additionally jumped after the oncology medication agency reported optimistic leads to a Section-2 trial of its remedy for some bladder and lung cancers.

Photo voltaic shares gained as Financial institution of America upgraded SolarEdge Applied sciences (SEDG), arguing the inventory is undervalued.

Devon Power (DVN) shares fell because the power agency agreed to pay $5 billion to buy privately held Grayson Mill Power, increasing its attain into the Williston Basin.

Paramount International (PARA) shares declined as the corporate agreed to merge with Skydance Media, bringing an finish to months of negotiations.

Oil and gold futures fell, whereas the yield on the 10-year Treasury observe superior. The U.S. greenback gained on the euro, however declined versus the pound and yen. Costs for many main cryptocurrencies had been larger.

Learn the unique article on Investopedia.