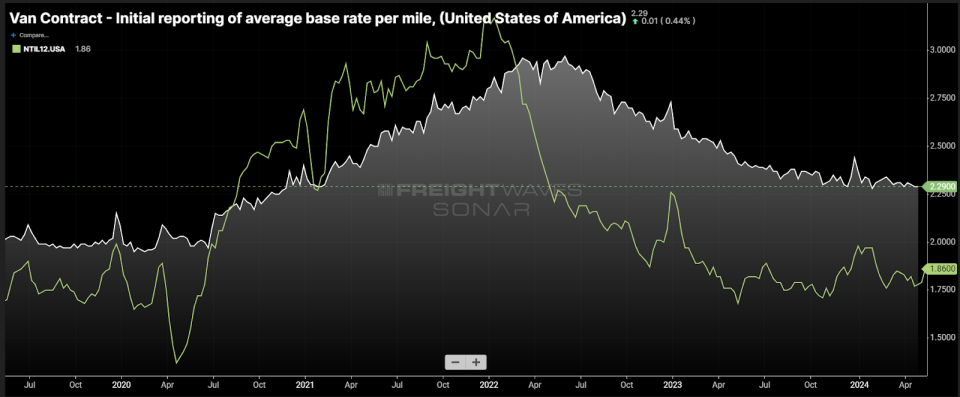

Chart of the Week: Van Contract Preliminary reporting of common base fee per mile, Nationwide Truckload Index eradicating estimated gasoline prices above $1.20/mile – USA SONAR: VCRPM1.USA, NTIL12.USA

Truckload contract charges (VCRPM1) proceed to point out robust elevation in relation to identify charges excluding estimated gasoline prices above $1.20 a gallon (NTIL12). This historic unfold — at present about 30% versus about 12% in 2019 — suggests there may be a rare quantity of potential disparity amongst charges within the truckload market that might go away a number of shippers and not using a truck when the market inevitably shifts.

Contract or long-term charges are typically negotiated on an annual foundation between shipper and transportation service supplier.

In an erratic capability atmosphere, these charges are topic to midterm renegotiation, each larger and decrease. That is the place the time period “paper charges” originates, as a result of they’re as skinny as paper by way of reliability.

On the spot

Spot charges are negotiated on an advert hoc or transactional foundation and are sometimes solely good for a matter of days.

The spot market is a spot the place shippers look to supply capability once they both don’t have a contract provider or their present carriers don’t have availability. In unfastened capability environments — comparable to the present one — it will also be a spot to get instant value financial savings or attempt different carriers to deepen their lists of potential suppliers.

From the provider perspective, the spot market is a spot to fill gaps of their networks — aka backhauls — or haul extra worthwhile freight. The previous is extra the use case in a market just like the one which we’re at present in, although there may be all the time this potential.

Too many vehicles for too lengthy

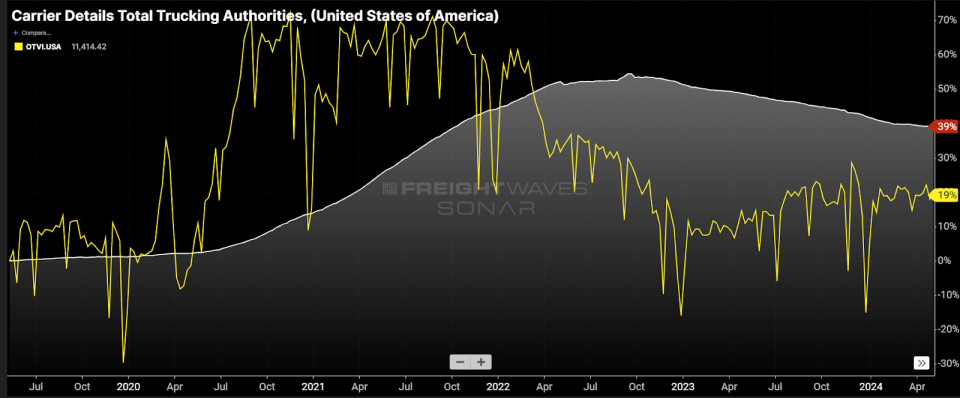

The present market is traditionally oversupplied, with capability having been inflated to an unsustainable degree by the pandemic-era consumption growth. The U.S. truckload market has been in a recession because the first half of 2022 however is transferring towards a extra balanced atmosphere almost invisibly.

an instance of provide and demand dynamics within the type of energetic motor provider of property working authorities issued by the Federal Motor Provider Security Administration versus the nationwide Outbound Tender Quantity Index (OTVI), capability is falling whereas demand is secure.

Whereas this isn’t an ideal comparability since an working authority will be one or 5,000 vehicles, it’s a good indication that capability is coming offline and the market is transferring towards equilibrium.

The present ratio of working authority to tender is about 31:1. Traditionally, the market has been tight when the ratio is under 24:1. The ratio peaked in early 2023 round 37:1 and was at its lowest in September 2020 round 16:1. That is in no way scientific however only a option to estimate the place we’re within the course of.

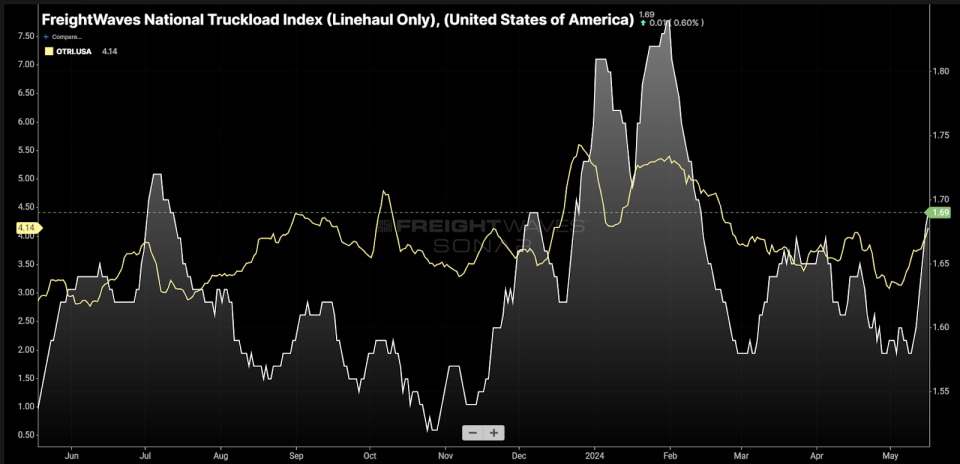

Chasing the underside

Throughout this prolonged downturn, charges have been pushed to ranges the place carriers are at or under prices as they bid towards one another to keep up sufficient quantity to help their fleets. The spot market is probably the most excessive model of this as it’s used as a final resort for a lot of asset-based suppliers.

Historically there are shippers, carriers and brokers who provide charges based mostly on the spot market charges that are largely under provider working prices. Shippers and brokers who’ve long-term charges at or close to spot market costs are on the most threat for elevated ranges of service failure later within the 12 months when the market is predicted to tighten.

It’s onerous to inform, however spot charges are already trending larger over the previous 12 months as capability has fallen out. That is telling, because it is a sign that the spot market is successfully the ground for pricing and it’s rising at a near-imperceptible fee.

Roadcheck

Worldwide Roadcheck came about this previous week, with security officers conducting inspection blitzes on gear. Many operators, particularly in a market the place charges are suppressed, keep away from driving throughout this week, which causes a short lived discount in capability. Spot charges have spiked 7% over the previous week.

Shippers noticed their service failure probabilities enhance throughout this time. Tender rejection charges elevated from 3.1% to 4.1% final week. There have been stronger jumps however shippers who’ve charges on the low finish of the spectrum had the largest publicity to this occasion.

Each spot and rejection charges remained comparatively low from a historic standpoint — the market nonetheless has loads of out there capability to recuperate from such an occasion — however that buffer is deteriorating.

Only a drop within the ocean, however a wave is approaching

Greater than the summer time delivery season, the fourth quarter will doubtless be a a lot tighter atmosphere with a lot much less predictable demand. Shippers’ sense of urgency can also be a lot larger as retail peak hits.

It is not going to take a lot to trigger a waterfall of service failures if carriers get the possibility to haul worthwhile freight. Probably the most determined carriers can have given the bottom charges and can doubtless be the primary to leap ship to make ends meet on the slightest signal of disruption.

The results of that may very well be crippling to corporations that chased the underside greenback or based mostly long-term fee targets on the spot market.

Concerning the Chart of the Week

The FreightWaves Chart of the Week is a chart choice from SONAR that gives an attention-grabbing knowledge level to explain the state of the freight markets. A chart is chosen from hundreds of potential charts on SONAR to assist members visualize the freight market in actual time. Every week a Market Skilled will put up a chart, together with commentary, reside on the entrance web page. After that, the Chart of the Week might be archived on FreightWaves.com for future reference.

SONAR aggregates knowledge from a whole lot of sources, presenting the information in charts and maps and offering commentary on what freight market specialists need to know concerning the trade in actual time.

The FreightWaves knowledge science and product groups are releasing new datasets every week and enhancing the consumer expertise.

To request a SONAR demo, click on right here.

The put up Historic trucking fee disparity might cripple service in late ’24 appeared first on FreightWaves.