Whereas synthetic intelligence (AI) is attracting buyers’ consideration, there’s one other large pattern they need to pay attention to: cybersecurity. Unhealthy actors have by no means had extra instruments, and the quantity of digital data that may be accessed can be rising. This is not a pattern that is going away, both; firms should guarantee they’ve top-notch safety or threat being the goal of a cyberattack, which might value hundreds of thousands and destroy confidence in an organization.

Because of this new actuality, the cybersecurity business is seeing a large growth. However with so many cybersecurity firms out there to select from, it is easy to get misplaced. One firm is my clear alternative, and it has the potential to turn into a a lot bigger drive on this business.

CrowdStrike has turn into a prime choose within the cybersecurity house

CrowdStrike (NASDAQ: CRWD) is my prime choose within the cybersecurity house for a lot of causes. First, it is a light-weight cloud-native program. This implies it may be simply deployed to all endpoints in a enterprise community shortly and does not take a lot bandwidth. Moreover, CrowdStrike has built-in AI into its product lineup since its launch.

Not like some firms that use AI as a buzzword, CrowdStrike’s platform is constructed on it. Its major product within the Falcon platform is endpoint safety. This protects community entry factors like laptops or cellphones from outdoors threats, and CrowdStrike makes use of AI to research exercise to know if it is regular or a risk. It will possibly terminate entry to an organization’s server with out human intervention if it detects a risk.

It additionally has its Charlotte AI, a generative AI product. This enables customers to automate workflows, speed up investigation time, and scale back the quantity of ability required to turn into a cybersecurity skilled. Primarily based on a buyer survey, Charlotte helps save round two hours per day by means of elevated effectivity.

CrowdStrike has a large product line that has slowly grown over the previous few years. As a substitute of getting to piece collectively cybersecurity options from numerous distributors, CrowdStrike is working towards changing into a one-stop store for all cybersecurity wants. With merchandise in endpoint safety, cloud safety, identification safety, risk intel, and extra, CrowdStrike covers many areas.

This technique has labored for CrowdStrike, as 64% of consumers make the most of at the least 5 modules, and 27% make the most of at the least seven. This exhibits loads of room for product growth amongst its shopper base, so upselling current prospects and signing new ones offers CrowdStrike two progress avenues.

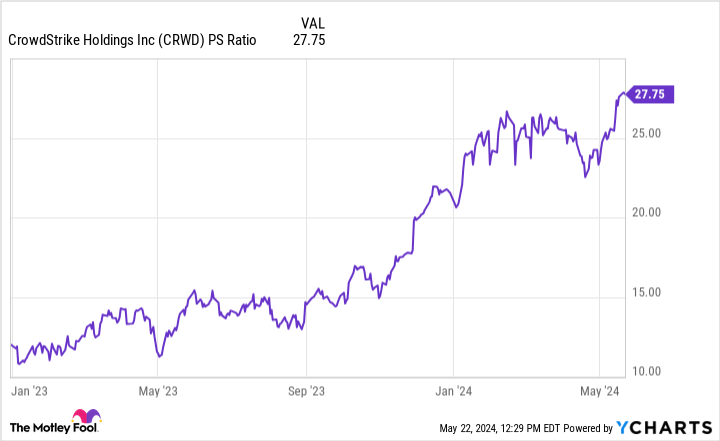

CrowdStrike’s inventory has gotten costly

Talking of progress, CrowdStrike has been delivering wonderful progress for a while. Within the fourth quarter of fiscal-year 2024 (ending Jan. 31), its annual recurring income (ARR) rose 34% yr over yr to $3.44 billion. Trying ahead to FY 2025, CrowdStrike expects income progress of 30% to almost $4 billion. Regardless of CrowdStrike getting bigger, its progress is hardly slowing down, which is a testomony to the demand within the cybersecurity business and CrowdStrike’s prowess. Wall Avenue analysts even consider it may possibly develop income at a 27% tempo in FY 2026 to over $5 billion.

CrowdStrike can be changing into more and more worthwhile every quarter.

So you have acquired an organization that’s an business chief in a quickly increasing area and has wonderful financials. It looks as if a no brainer purchase, proper?

Traders should additionally contemplate the worth tag of the inventory. It is no secret that CrowdStrike is a wonderful firm, and its inventory is priced accordingly.

A value of 28 occasions gross sales could be very costly, which is the first downside of CrowdStrike’s inventory. I am utilizing the price-to-sales (P/S) ratio as a result of CrowdStrike hasn’t reached most profitability but. To translate into the extra acquainted price-to-earnings (P/E) ratio, I am going to give CrowdStrike a synthetic 30% revenue margin — an incredible purpose for software program firms like CrowdStrike.

With that revenue margin, CrowdStrike would have a P/E of 93 at at this time’s costs. In the event you make the most of analysts’ FY 2026 income projection of $5.03 billion, CrowdStrike would commerce at 56 occasions earnings.

That is too costly for a lot of buyers’ style, and I would not blame them for not shopping for at at this time’s costs. Nevertheless, I might preserve CrowdStrike in your radar, because it’s too good of an organization to neglect about if the inventory value drops to extra affordable ranges.

The place to speculate $1,000 proper now

When our analyst crew has a inventory tip, it may possibly pay to hear. In any case, the publication they’ve run for twenty years, Motley Idiot Inventory Advisor, has greater than tripled the market.*

They simply revealed what they consider are the 10 finest shares for buyers to purchase proper now… and CrowdStrike made the checklist — however there are 9 different shares chances are you’ll be overlooking.

*Inventory Advisor returns as of Could 13, 2024

Keithen Drury has positions in CrowdStrike. The Motley Idiot has positions in and recommends CrowdStrike. The Motley Idiot has a disclosure coverage.

Here is My High Cybersecurity Inventory (and It is Not Even Shut) was initially printed by The Motley Idiot