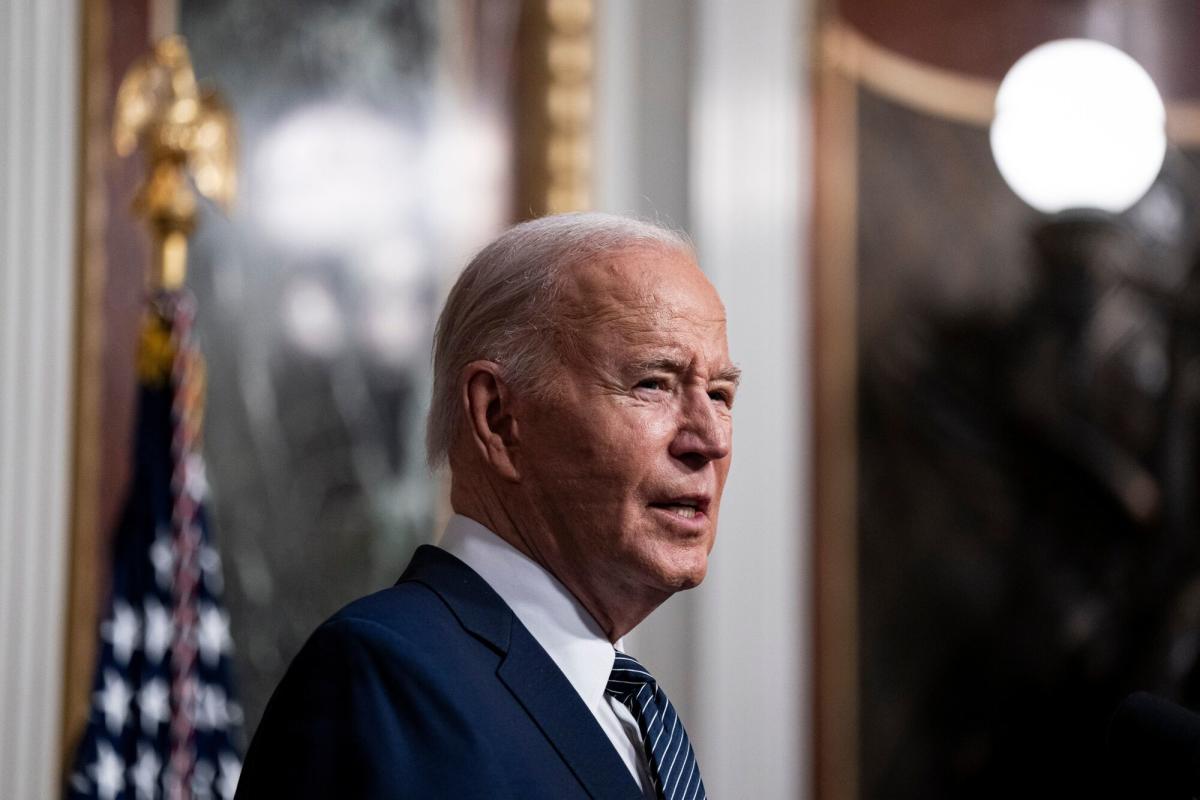

(Bloomberg) — The greenback slid and Treasuries rose after Joe Biden ended his reelection marketing campaign and endorsed Vice President Kamala Harris. European inventory futures pointed to features at open.

Most Learn from Bloomberg

A Bloomberg gauge of the US foreign money’s power shed 0.1%, whereas the 10-year Treasury yield dropped 2 foundation factors. The Mexican peso climbed, gold gained, Bitcoin rose to the very best in over a month.

The Euro Stoxx 50 contract rose 0.5%, together with extra modest features for US equities futures. It marks a divergence from losses in Asian shares that remained haunted by a weak tech sector.

Chinese language bonds have been a spotlight, gaining after the central financial institution minimize a coverage rate of interest. The yield on the 10-year sovereign observe dropped 2 foundation factors. The nation’s shares fell, as buyers continued to precise disappointment at an absence of sturdy stimulus measures from a latest main Communist Social gathering assembly.

Buyers have mulled for weeks a higher prospect that Donald Trump will win the November election following Biden’s weak debate efficiency, just for bets on a Trump win to speed up final week following an assassination try on the Republican candidate every week in the past. The query for buyers is whether or not to stay with such trades now that Biden has dropped his bid for reelection.

“Going through bombshell surprises for the second week in a row, the Asian market can be underneath intense scrutiny,” stated Hebe Chen, an analyst at IG Markets. “The accelerated wave of danger aversion may hit Asian shares tougher than the earlier week as buyers digest the unfamiliar political context. The foreign exchange market may even really feel the heightened strain.”

READ: Buyers Bear in mind ‘Shares Can Go Down Too’ in Return to Hedging

In China, banks minimize their predominant benchmark lending price for the primary time since August 2023, ramping up help for financial development following the PBOC’s price discount.

President Xi Jinping had unveiled sweeping plans to bolster the funds of China’s indebted native governments because the ruling Communist Social gathering introduced its long-term blueprint for the world’s second-largest economic system. These are centered round shifting extra income from the central to native coffers, reminiscent of by permitting regional governments to obtain a bigger share of consumption tax.

The Chinese language coverage motion suggests “the central financial institution is confronted with a dilemma: it must stimulate a sluggish economic system that’s affected by the housing disaster but in addition must fulfil its mandate of a ‘highly effective foreign money’ and venture a picture of sturdy long-term fundamentals,” analysts at Nomura Holdings wrote in a observe. “This operation twist might assist to realize some monetary stability, however it could additionally constrain the transmission channel and impose new headwinds for China’s economic system by stopping a crucial decline in long-term funding prices.”

The S&P 500 suffered its worst week since April final week, as tech shares fell forward of earnings. Including to the strain was CrowdStrike Holdings Inc., the agency behind a large IT failure that grounded flights and disrupted companies around the globe.

Tesla Inc. and Alphabet Inc. would be the first of the “Magnificent Seven” to report earnings on Tuesday. Analysts will possible press Elon Musk’s electric-vehicle big on the progress of its plans for robotaxis. And buyers will delve into the main points of Google’s guardian income increase from synthetic intelligence.

Elsewhere this week, merchants can be targeted on financial exercise information in Europe, US second quarter development and a Financial institution of Canada price resolution.

Key occasions this week:

-

Hong Kong CPI, Monday

-

Taiwan jobless price, export orders, Monday

-

Mexico retail gross sales, Monday

-

Israeli Prime Minister Benjamin Netanyahu embarks on go to to Washington, Monday

-

EU overseas ministers meet in Brussels, Monday

-

Singapore CPI, Tuesday

-

Taiwan industrial manufacturing, Tuesday

-

India’s finances for fiscal 12 months by way of March 2025, Tuesday

-

Turkey price resolution, Tuesday

-

Eurozone shopper confidence, Tuesday

-

Alphabet, Tesla, LVMH earnings, Tuesday

-

Malaysia CPI, Wednesday

-

South Africa CPI, Wednesday

-

Eurozone HCOB PMI, Wednesday

-

UK S&P International PMI, Wednesday

-

Canada price resolution, Wednesday

-

IBM, Deutsche Financial institution earnings, Wednesday

-

ECB Vice President Luis de Guindos speaks, Wednesday

-

Hong Kong commerce, Thursday

-

South Korea GDP, Thursday

-

US GDP, preliminary jobless claims, sturdy items, merchandise commerce, Thursday

-

G-20 finance ministers and central bankers meet in Rio de Janeiro, Thursday by way of Friday

-

Bitcoin 2024 convention in Nashville, Thursday by way of July 27

-

Japan Tokyo CPI, Friday

-

US private revenue, PCE value index, College of Michigan shopper sentiment, Friday

-

Mexico commerce, Friday

Among the predominant strikes in markets:

Shares

-

S&P 500 futures rose 0.2% as of two:38 p.m. Tokyo time

-

Nikkei 225 futures (OSE) fell 1.1%

-

Japan’s Topix fell 1.1%

-

Australia’s S&P/ASX 200 fell 0.6%

-

Hong Kong’s Hold Seng rose 0.7%

-

The Shanghai Composite fell 1%

-

Euro Stoxx 50 futures rose 0.4%

Currencies

-

The Bloomberg Greenback Spot Index was little modified

-

The euro was little modified at $1.0885

-

The Japanese yen rose 0.2% to 157.13 per greenback

-

The offshore yuan fell 0.1% to 7.2940 per greenback

Cryptocurrencies

-

Bitcoin fell 0.1% to $67,671.88

-

Ether was little modified at $3,501.58

Bonds

Commodities

-

West Texas Intermediate crude rose 0.5% to $80.54 a barrel

-

Spot gold rose 0.2% to $2,404.88 an oz.

This story was produced with the help of Bloomberg Automation.

–With help from Joanna Ossinger, Richard Henderson, Matthew Burgess, Ruth Carson, Winnie Zhu, Iris Ouyang and Cecile Vannucci.

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.