Given the S&P 500‘s latest surge past 5,300, surpassing some consultants’ year-end targets, is it prudent for traders to be involved a couple of potential overheating available in the market?

Goldman Sachs’ chief US fairness strategist David Kostin believes that now that the S&P has climbed above the 5,200 goal he’d predicted, there simply isn’t far more room on the prime this 12 months. Kostin believes that the present mixture of excessive inventory valuations and low projections for 2024 GDP and earnings development are prone to put a cap on inventory positive factors. “Base case is actually that the market will commerce at round this degree of a number of or actually, even decrease a number of as we come in the direction of the tip of the 12 months,” Kostin says.

However don’t panic; this isn’t to say traders ought to abandon hope for the inventory market. Regardless of the flat forecast from Kostin, the analysts at Goldman Sachs are pounding the desk on two shares, arguing they’re nicely positioned to ship good-looking returns within the 12 months forward – in a single case, as a lot as 108%.

We used the TipRanks database to take a better have a look at these two Goldman picks; every has a ‘Sturdy Purchase’ ranking on the Avenue, and loads of causes to draw traders. Listed here are the small print.

Fulcrum Therapeutics (FULC)

The primary inventory we’ll have a look at is Fulcrum Therapeutics, a Goldman choose from the realm of biopharmaceutical analysis. Fulcrum is concentrated on the event of recent therapeutic brokers for genetically outlined ailments with each extreme signs and excessive unmet medical wants. This can be a doubtlessly wealthy subject, as present therapies have already confirmed ineffective or inadequate; an organization that may efficiently create an efficient remedy on this space will make a dramatic affect on sufferers’ lives.

Fulcrum’s strategy is predicated on the underlying genetics of the illness situation. The corporate has a proprietary product improvement platform, which it has dubbed FulcrumSeek and makes use of to determine targets for the drug candidates. The targets can be utilized to modulate gene expression, assuaging signs and modifying the illness course by treating the recognized causes of genetic mis-expression.

The corporate has two drug candidate applications in its pipeline which might be within the medical phases, losmapimod and pociredir. The primary of those, a brand new compound underneath investigation within the remedy of facioscapulohumeral muscular dystrophy (FSHD), is the extra superior.

Losmapimod is at the moment the topic of the Section 3 REACH trial, and Fulcrum experiences that the drug is continuous to indicate progress. There are 260 sufferers enrolled in North America and Europe, and topline knowledge is predicted for launch by the tip of this 12 months. Early knowledge from the Section 2 research ReDUX4 confirmed that losmapimod demonstrated enhancements in purposeful, structural, and patient-reported outcomes.

In one other improvement that ought to curiosity traders, Fulcrum has just lately entered a collaboration and license settlement with Sanofi for the continued improvement and commercialization of losmapimod. Sanofi can pay $80 million up entrance in return for unique commercialization rights exterior of the US, and Fulcrum additionally stands to obtain as much as $975 million in regulatory and sales-based milestone funds and royalties going ahead. The 2 firms have additionally agreed to equally share the worldwide improvement prices of the drug.

On the pociredir monitor, Fulcrum is at the moment operating a Section 1b medical trial and has activated dosing cohorts 3 and 4. This drug is a possible remedy for hemoglobinopathies, together with sickle cell illness (SCD), and the Section 1b trial is evaluating the drug within the remedy of SCD. Every dosing cohort on this trial contains 10 sufferers.

For Goldman analyst Corinne Johnson, the important thing level to this firm is the losmapimod improvement program. The drug is at a complicated stage of medical testing, and Johnson sees loads of potential in its additional improvement. She writes, “We’re optimistic heading into 4Q24 topline knowledge for the Ph3 REACH research of losmapimod in facioscapulohumeral muscular dystrophy (FSHD) based mostly on a number of components. First, losmapimod has proven optimistic medical knowledge on the Ph3 REACH research major endpoint reachable workspace (RWS) within the prior Ph2b research ReDUX4 (together with the open-label extension) with a major correlation to muscle fats infiltration (MFI) and alignment with patient-reported outcomes (PROs). Collectively these knowledge present a concordance of proof for medical profit with the asset, which we view as de-risking. Second, our conversations with KOLs have proven assist for losmapimod in FSHD with potential for strong affected person uptake of the drug following approval. Final, losmapimod has a major medical improvement lead relative to opponents, setting it as much as be a first-in-class agent in FSHD.”

This upbeat long-term outlook on the chief product leads Johnson to fee the inventory as a Purchase, and she or he enhances that with a $15 value goal that implies a sturdy ~108% upside for the subsequent 12 months. (To look at Johnson’s monitor file, click on right here)

General, it’s clear that the Avenue agrees with the bullish tackle this one. FULC shares base their Sturdy Purchase consensus ranking on 9 critiques, together with 8 to Purchase towards simply 1 to Promote. The inventory is at the moment buying and selling for $7.21, and its $17 common value goal implies a one-year achieve of ~136%. (See FULC inventory forecast)

Marex Group (MRX)

Subsequent up on our listing is a monetary companies firm. Marex Group is a broker-dealer on the worldwide scene that gives a mix of market entry, liquidity, and infrastructure companies to a shopper base within the vitality, commodity, and monetary market communities. The corporate boasts greater than 4,000 world clients, together with producers and customers of commodities, in addition to asset managers and huge banks. Marex operates primarily in Europe and the US however is increasing its actions into the Mid East and the Asia-Pacific area.

The corporate has 5 main enterprise segments: Clearing, Company & Execution, Market Making, Options, and Company. The biggest of those is Company & Execution, which makes up 46% of the corporate’s annual income. Amongst its different actions, this section gives liquidity and matches consumers and sellers throughout varied securities markets. The Clearing section, producing 28% of revenues, handles the corporate’s Future Fee Service provider enterprise. Final 12 months, MRX was one of many US’s 10 largest FCM companies.

Marex operates out of 35 workplaces globally, by a bunch of branded subsidiary companies. Marex Group, because the mother or father firm, entered the general public buying and selling markets by an IPO in April of this 12 months, with the inventory hitting the market at $19 per share and three.846 million shares put available on the market by the corporate. The IPO, which included a big tranche of privately bought shares, raised roughly $292 million.

On Could 16, after the IPO mud had settled, Marex launched its monetary outcomes for 2023. The corporate generated $1.245 billion in revenues for the 12 months, up 75% from 2022. The corporate’s full-year, before-tax revenue got here to $197 million.

Goldman’s 5-star analyst Alexander Blostein is bullish on this new inventory, writing in his initiation word, “We count on MRX to ship a mean EPS development of ~20% by 2026 pushed by wholesome trade volumes, rising market share positive factors, and increasing margins as the corporate scales. Below our assumptions, MRX is about to see income development of ~13% by 2026, as the corporate continues to achieve share in markets and geographies it had not beforehand competed in (particularly Prime Brokerage Providers by the Cowen acquisition, Mounted Revenue swaps clearing at LCH, and APAC growth), with extra near-term tailwinds from increased charges and volatility. Because the enterprise scales, we see working margins of 18%/19%/20% in 2024/25/26.”

Trying forward, Blostein justifies an upbeat value goal by noting MRX’s potential for development, saying, “At ~8X 2024 P/E, MRX is meaningfully discounted relative to friends’ ~10Xaverage 2024 P/E, which we expect shouldn’t be warranted given the agency’s extra diversified product set by way of each merchandise and geographies, superior income development, and better ROE.”

Accordingly, the analyst charges MRX shares a Purchase, paired with a $33 value goal that suggests a 61% upside potential on the one-year horizon. (To look at Blostein’s monitor file, click on right here)

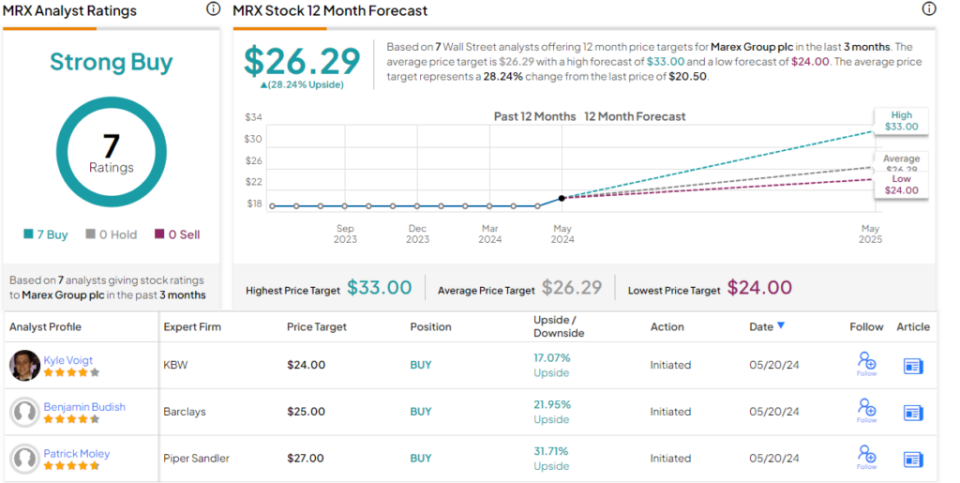

To date, all 7 of Marex’s inventory critiques are optimistic, making the Sturdy Purchase consensus ranking unanimous. The shares at the moment are buying and selling for $20.50, and the $26.29 common goal value means that MRX will achieve 28% over the subsequent 12 months. (See MRX inventory forecast)

To search out good concepts for shares buying and selling at engaging valuations, go to TipRanks’ Greatest Shares to Purchase, a device that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely essential to do your individual evaluation earlier than making any funding.