One of many oddest and most mysterious relationships that emerged out of the collapse of FTX final yr was Alameda Analysis’s uncommon relationship with Farmington State Financial institution, one of many smallest, rural banks in the US that got here below the management of Jean Chalopin in 2020. Chalopin is greatest generally known as the chairman of Deltec, one of many essential banks for Alameda Analysis – FTX’s buying and selling arm that performed a central function in its collapse — and nonetheless one of many essential banks for the biggest fiat-backed stablecoin, Tether (USDT). Chalopin had acquired management over Farmington through FBH Corp., the place Chalopin was listed as govt officer. Curiously, Noah Perlman, a former DOJ and DEA official who’s now Chief Compliance Officer at Binance and the son of Jeffrey Epstein affiliate and musician Itzhak Perlman, was additionally listed as a director of FBH Corp and has by no means publicly defined his reference to this Chalopin-controlled entity.

As Limitless Hangout reported final December, quickly after its acquisition by Chalopin’s FBH Corp., Farmington “pivoted to cope with cryptocurrency and worldwide funds” after a long time upon a long time of serving as a single department group financial institution in rural Washington. Quickly after its pivot into the crypto house, Farmington struggled to maneuver cash and sought approval to grow to be a part of the Federal Reserve system. It additionally modified its title from Farmington State Financial institution to Moonstone Financial institution. The approval of Farmington by the Federal Reserve has been deemed extremely uncommon and as having “glossed over Moonstone’s for-profit international pursuits.” Late final December, Eric Kollig, spokesman for the Federal Reserve, instructed reporters that he couldn’t remark “in regards to the course of that federal regulators undertook to approve Chalopin’s buy of the constitution of Farmington State Financial institution in 2020.”

Simply days after Farmington formally modified its title to Moonstone in early March 2022, FTX-affiliated Alameda Analysis poured $11.5 million into the financial institution, which was – on the time – greater than twice its complete web price. Moonstone’s Chief Digital Officer, Jean Chalopin’s son Janvier, later said that the funding from Alameda Analysis had been “seed funding … to execute our new plan of being a tech-focused financial institution.”

Upon Alameda’s taking a stake within the financial institution, Jean Chalopin said that this transfer “signifies the popularity, by one of many world’s most progressive monetary leaders, of the worth of what we’re aiming to attain. This marks a brand new step into constructing the way forward for banking.” Retailers like Protos have famous how uncommon it’s {that a} Bahamas-based firm like FTX was “capable of buy a stake in a federally accepted financial institution” with out attracting the eye of regulators.Washington State regulators have said that they have been “conscious” of Alameda’s funding in Farmington/Moonstone and defended their choice to not intervene or take additional regulatory motion.

Notably, the inflow of recent cash into the transformed Farmington was not unique to FTX/Alameda. A New York Occasions article on the matter famous that Farmington/Moonstone’s deposits – which had hovered round $10 million for a lot of a long time – shortly surged to $84 million, with $71 million coming from solely 4 new accounts throughout this similar comparatively brief interval in 2022.

As Limitless Hangout beforehand famous, the identical day the Alameda funding was introduced, Moonstone put in Ronald Oliveira as CEO. Oliviera had beforehand labored for the fintech firm Revolut, a “main digital different financial institution” financed by Jeffrey Epstein affiliate Nicole Junkermann. Roughly two months later, the financial institution employed Joseph Vincent as its authorized counsel. Instantly previous to becoming a member of Farmington/Moonstone, Vincent had served as the final counsel for Washington State’s Division of Monetary Establishments and its director of authorized and regulatory affairs for 18 years.

Shortly earlier than FTX’s collapse, which put Farmington/Moonstone below heavy scrutiny, Farmington/Moonstone partnered with a comparatively unknown firm referred to as Fluent Finance. Fluent Finance, each then and now, has evaded scrutiny from the media except for Limitless Hangout’s investigation into Farmington, revealed final December. Nonetheless, since FTX’s unraveling and the shuttering of Farmington/Moonstone within the months that adopted, Fluent Finance has been fairly busy, growing vital authorities partnerships within the Center East and trying to grow to be a central a part of the approaching Central Financial institution Digital Forex (CBDC) paradigm for each West and East.

A possible motive behind the shortage of media curiosity in Fluent Finance and their obvious success after the FTX scandal is the truth that Fluent, from its earliest days, has been working as an obvious entrance for a few of the strongest business banks on the planet and constructing out “trusted” digital infrastructure for the economic system to return. This investigation, an examination of Fluent’s previous and its present trajectory, could assist elucidate the true motives behind the efforts of Chalopin, Bankman-Fried and others to show the tiny Farmington State Financial institution into “Moonstone.”

Fluent Finance’s Deep and Early Connections to Wall Avenue Banks

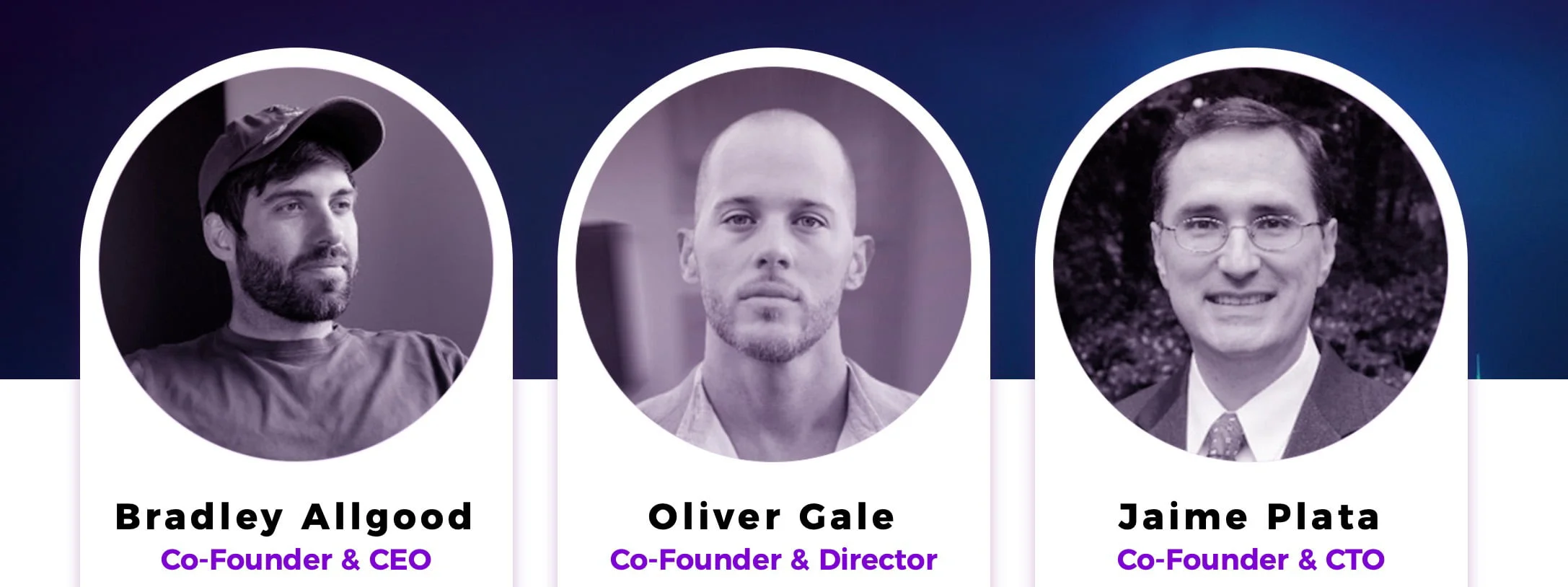

Fluent Finance was created in 2020 and was co-founded by Bradley Allgood, Oliver Gale and Jaime Plata. Allgood started his profession with the US Military and later went on to serve in NATO’s Governmental Operations division with an obvious give attention to NATO exercise in Afghanistan. After leaving NATO, Allgood “instantly jumped” into financial growth, particularly the creation and growth of Particular Financial Zones (SEZs), particularly one partnered with the Catawba Indian Reservation in South Carolina. That SEZ, formally named the Catawba Digital Financial Zone, was co-founded by Allgood in 2019 and he nonetheless serves as its head of Business Banking.

Sitting on simply two acres of land, the zone goals to “grow to be the worldwide registration hub for crypto firms” in addition to to “take an enormous chunk out of Delaware’s marketplace for firm registration and even to exchange it because the gold normal.” The zone is backed by a enterprise capital agency tied to Bradley Tusk, the previous Deputy Governor of Illinois below disgraced former Governor Rod Blagojevich and the previous marketing campaign supervisor for billionaire Mike Bloomberg. As well as, Tusk’s firms depend Google, the Rockefeller Basis and Ripple (XRP) amongst their purchasers. Tusk’s totally different VC companies have invested in Coinbase and Circle, the issuer of the USDC stablecoin, and Uber in addition to the financial zone co-founded by Allgood.

Shortly after leaving the navy, Allgood additionally labored on the early growth of digital transformation of governments, digital identities, individuals and property registries and the tokenization of carbon credit and commodities. Later motivated by “the sheer variety of unbanked and underbanked on the planet”, Allgood hosted roundtables world wide with central financial institution “regulators, tier one establishments, innovators, [and] know-how suppliers” and determined he may act as “a very good connector” for the totally different actors in his rising community.

Allgood claims to have spoken to a couple “actually senior” banking executives at HSBC, Citi and Barclays and to have educated “them on new progressive applied sciences for custody [and] higher digital identification.” After “constructing a workforce” of those “senior bankers from tier one monetary establishments,” Allgood and his workforce “went out into the market and began servicing the [cryptocurrency] house and serving to progressive firms discover properties and huge core banking methods and tier one monetary establishments.” Whereas working with these varied titans of finance and guiding their views on the way forward for banking, Allgood met his co-founders of Fluent Finance: Oliver Gale and Jaime Plata.

Oliver Gale is without doubt one of the co-founders of Central Financial institution Digital Currencies (CBDCs), having pioneered the primary CBDC undertaking within the Japanese Caribbean and, per Allgood, Gale “went on to do them in Nigeria” and helped create the extremely controversial e-Naira. Gale notably describes himself because the inventor of CBDCs and has beforehand collaborated with the UN, MIT and the IMF. Jaime Plata, Fluent’s different co-founder, “did the core banking methods of the Japanese Caribbean Central Financial institution in the course of the first CBDC [launch].” Apart from Gale and Plata, Allgood has revealed that different prime Fluent Finance executives, who are usually not listed on the corporate’s web site, hail from the Wall Avenue titan Citi – with the corporate’s CFO being “the CFO of Citi of all of Latin America” and its COO being “one of many senior, most senior, managing administrators from Citi.” He has additionally said that different necessary workers of Fluent embody the previous chief innovation officer of Common Electrical in addition to “an early board member at [the now collapsed crypto exchange] Celsius [that] helped them get to market.”

Fluent Finance was initially based with two essential and interrelated merchandise: the Fluent Protocol and the US+ stablecoin. Fluent has described the Fluent Protocol as “a monetary community that seamlessly bridges conventional finance and digital belongings,” whereas US+ is a “bank-led”, US dollar-pegged stablecoin “constructed on rules” and designed to be “forward-compatible with CBDC initiatives.” Fluent asserts that US+ resolves “the inherent flaws of web3-native stablecoins” by having US+ be operated by a community of banks partnered with Fluent Finance. Fluent has not made the identities of those banks out there to the general public.

“After we examined stablecoins, we knew that the shortage of institutional uptake of the know-how was on account of threat,” defined Allgood. “With that in thoughts, after we approached the design of US+, we did so by way of de-risking. We knew we wanted to offer real-time and clear reserves monitoring.” Fluent’s reply to offering the reserve metrics wanted to faucet into the closely regulated conventional finance market emerged by way of its partnership with Chainlink, first introduced in September 2022.

Chainlink is a blockchain oracle community, that means it connects blockchains to exterior methods. It was launched in 2017 on the Ethereum blockchain and later registered within the Cayman Islands as SmartContract Chainlink Restricted SEZC in March 2019. In December 2021, the previous Google CEO Eric Schmidt, who has unprecedented management over the Biden administration’s know-how insurance policies, joined Chainlink Labs as a strategic advisor. On the time, Schmidt commented that “it has grow to be clear that one among blockchain’s biggest benefits — a scarcity of connection to the world exterior itself — can be its largest problem.”

Fluent’s partnership with Chainlink handled regulatory requirements by offering a dependable approach for the Fluent Protocol to entry real-time, off-chain information from exterior sources. Fluent’s purpose was/is to offer proof of the dimensions, efficiency, and threat of its asset reserves so as to meet its stablecoin protocol liquidity necessities. Dependable affirmation and publishing of the state of those reserves was seen as essential by Allgood and others at Fluent so as to manufacture belief from each retail customers and membership banks.

Fluent is way from the one accomplice of Chainlink engaged on offering trusted stablecoin reserve structure. Amongst them is Paxos, the previous issuer of Binance’s BUSD and their very own PAX, and who just lately started offering infrastructure for PayPal’s PYUSD stablecoin. Paxos relied on Chainlink to offer on-chain Proof of Reserve Information Feeds for Paxos’ belongings, making certain verification that PAX tokens are 1:1 backed by US {Dollars}. This was taken a step additional with their gold-backed PAXG tokens, during which Chainlink claimed to have the ability to present verification of off-chain, bodily gold bars held in Paxos’ custody.

One other Chainlink accomplice is the XinFin Community, also called the XDC community, which makes use of Chainlink’s Worth Reference Information framework to introduce worth feeds for main nationwide currencies such because the Hong Kong Greenback, the Singaporean Greenback, and the United Arab Emirates Dirham. In October 2022, Fluent Finance introduced a partnership with Impel to deliver its US+ stablecoin to the XDC community. Impel itself is a startup birthed out of XinFin Fintech led by CEO and founder Troy S. Wooden. The corporate boasts a workforce of advisors together with XDC Community co-founders Ritesh Kakkad and Atul Khekade, along with very long time SWIFT worker André Casterman.

In March 2021, XinFin leveraged the DASL Crypto Bridge designed by LAB577 to deliver their XDC token to R3’s Corda blockchain. R3 started as a consortium of banks and isn’t solely intently linked to Fluent Finance, however, as shall be mentioned shortly, can be a serious driver of CBDC and stablecoin growth globally. Earlier than this XDC-Corda bridge was created, there was no liquidity or token of worth on the R3 Corda Community. This bridge opened up the chance for conventional monetary establishments, reminiscent of those who fund R3, to work together with cryptocurrency not directly with out having to function on under-regulated public networks that would land them in scorching water with regulators. It additionally provides entry to these already using Ethereum-based tokens (i.e. ERC20 or ERC721) to the enterprise networks and monetary establishments on the Corda community.

XDC co-founder and Impel advisor Atul Khekade remarked that the each authorities regulators and business banks had settled on XDC and Corda because the means by way of which many main banks would entry blockchain applied sciences:

“Regulatory businesses and monetary establishments have chosen each Corda and the XDC Community as appropriate platforms to interact with blockchain know-how […] They didn’t simply randomly throw a dart at a board.”

Fluent Meets Moonstone

In late October 2022, Fluent Finance, now deeply ensconced within the Web3 ambitions of main business banks, introduced its partnership with Farmington/Moonstone. In a press launch on the partnership, Fluent wrote that “Moonstone shall be a custody accomplice in Fluent’s rising community of banks, with plans to increase right into a full-node member quickly,” which might “permit Fluent and Moonstone to attach the standard monetary system to the rising Web3 economic system.”

On the time the partnership was introduced, Fluent’s CEO Bradley Allgood said the next:

“Moonstone Financial institution is now a key participant in Fluent’s monetary ecosystem and can function an preliminary custodian accomplice. Fluent plans to ultimately deliver Moonstone Financial institution on as a full-node accomplice, which can permit the financial institution to mint and burn US+. Collaborating with Moonstone is extremely thrilling and can assist Fluent deliver a protected and safe stablecoin to market whereas permitting for fast funds together with decrease charges. It is going to additionally clearly display the advantages that stablecoins can deliver to the banking sector, companies, and on a regular basis finish customers alike.”

Notably, this was – and stays – the one Fluent Finance press launch to call a member of Fluent’s consortium that helps its “bank-led” stablecoin, US+. As well as, given Allgood’s statements on the partnership, he clearly felt that partnering with Moonstone was a important a part of bringing US+ to market.

Nonetheless, with the collapse of FTX that November, Farmington/Moonstone got here below heavy scrutiny, even attracting the eye of U.S. Senators who cited Farmington/Moonstone’s relationship with FTX as motive to launch federal investigations into the relationships between banks and cryptocurrency companies. The numerous unanswered questions on Alameda’s relationship with Farmington/Moonstone, Chalopin’s involvement and potential connections to Deltec and Tether in addition to the obvious negligence of regulators precipitated main reputational and belief points for Farmington/Moonstone.

Just a few months after the FTX collapse, in January 2023, Farmington introduced it will drop the Moonstone title and return to its “unique mission as a group financial institution” and would discontinue “its pursuit of an innovation-driven enterprise mannequin to develop banking companies for industries reminiscent of crypto belongings or hemp/hashish.” Only a few days after that announcement, federal prosecutors seized $50 million from Farmington/Moonstone, which they alleged had been deposited as “a part of FTX founder Sam Bankman-Fried’s wide-ranging scheme to defraud traders by way of his huge cryptocurrency change enterprise.” That sum, considerably greater than what Alameda Analysis had initially invested, was greater than half of the financial institution’s whole belongings based mostly on the newest FDIC filings on the time of the seizure. The $50 million seized was all below one account below the title of “FTX Digital Markets,” per court docket information cited by native Washington newspapers.

Then, in Might, the financial institution introduced it will be promoting its deposits and belongings to the Financial institution of Japanese Oregon. The Federal Reserve subsequently took enforcement motion in opposition to Farmington in addition to its father or mother FBH Corp. a number of months later in August. In response to native newspapers, the Fed “issued a cease-and-desist order in opposition to the companies and directed them to take quite a lot of actions as Farmington closes its enterprise – together with preserving information and never buying any further brokered deposits.” The Fed asserted that Farmington had violated commitments it had made as a part of the approval course of which granted it entry to the Federal Reserve system. Nonetheless, it’s unknown which commitments have been allegedly violated, because the Fed has refused to return clear about its extremely uncommon and irregular approval of Farmington/Moonstone, even after its enforcement actions in opposition to the financial institution. Fluent Finance issued a press release after the Fed’s announcement and referred to Farmington for the primary time as a “prior tentative” collaborator and sought to distance itself from the financial institution. Most just lately, in November, FBH Corp., Jean Chalopin’s car for buying after which controlling Farmington, did not file an annual report in Washington State for 2023, that means that it is going to be terminated someday inside December.

Whereas 2023 couldn’t have been worse for Moonstone/Farmington, Fluent Finance managed to efficiently reinvent itself by partnering with the federal government of the United Arab Emirates (UAE) and R3, a blockchain firm that focuses on accelerating digital currencies (notably CBDCs) and is backed by a few of the largest banks on the planet.

Constructing the Rails for CBDC settlement within the UAE

In late July, a number of weeks earlier than the Fed introduced its enforcement motion in opposition to Farmington/Moonstone, Fluent Finance introduced that they might be opening an workplace in Abu Dhabi within the United Arab Emirates, an growth explicitly backed by the UAE Ministry of Economic system. In response to a press launch, “As a part of their transfer into the area, Fluent Finance is getting help from the workplace of the Ministry of Economic system, additional cementing their relationship with regulators and leaders within the area to unveil progressive options for cross-border funds.” The UAE authorities was explicitly backing Fluent Finance in order that the corporate may “advance the UAE’s commerce finance and cross-border funds panorama.”

Fluent’s new UAE entity, referred to as Fluent Financial Bridge, focuses on deposit tokens, i.e. business bank-issued tokens backed by deposits, with the express intention of connecting deposit token and CBDC methods inside the UAE and, ultimately, past. As beforehand talked about, Fluent is partnered with the corporate R3, which is at the moment below contract with the UAE’s Central Financial institution to construct out the nation’s CBDC system. Fluent Financial Bridge makes use of R3’s Corda DLT (distributed ledger know-how) so as to “deliver CBDC-compatible deposit token infrastructure for borderless funds.”

Just a few months later, in October, Fluent Finance – described in reviews from this era as a “US-based developer of a cryptocurrency-based fee platform” – joined an UAE authorities program referred to as NextGenFDI, which goals to supply a litany of incentives to international web3-focused firms to relocate to the nation. Experiences praising Fluent’s participation in this system famous that Fluent’s focus had moved to “mak[ing] cross-border commerce simpler” and that the corporate’s UAE-based Fluent Financial Bridge can be “utilized by importers and exporters to settle transactions by way of bank-issued cryptocurrencies, generally known as stablecoins or deposit tokens.” “I’m optimistic in regards to the prospects of the Fluent Financial Bridge, and the potential for digital currencies to enhance the effectivity and accessibility of world provide chains,” UAE Minister of State for Overseas Commerce Dr. Thani Al Zeyoudi was quoted as saying.

:quality(70)/cloudfront-eu-central-1.images.arcpublishing.com/thenational/CVJ5VDESGRAQBP2LQATMU2F4AQ.jpg)

Fluent’s collaboration with the UAE authorities was notably designed to align “with the [UAE’s] Ministry of Economic system’s TradeTech initiative, which, with the participation of the World Financial Discussion board, goals to advertise using superior know-how instruments in world provide chains, in addition to the nation’s complete financial partnership settlement programme, which goals to attain frictionless commerce between the UAE and different economies.”

Articles on the event additionally said that “by working with banks and regulators in Abu Dhabi, Fluent goals to spice up the transparency of cryptocurrency with the safety and regulatory construction of the standard banking system.” Claims have been made that Fluent has been piloting this program in Kenya, however Fluent’s web site makes no point out of any such program and no details about any such pilot is on the market on-line on the time this text was revealed. This implies that Fluent’s pilot in Kenya is working below a unique title with no overt ties to the corporate being publicized.

Just a few days later, Emirati information reported that Fluent Finance can be partnering with the UAE’s Ministry of Economic system to develop “deposit token-based tech” and “stablecoin applied sciences.” The corporate said that by “collaborating with banks and regulators[,] its platform offers the immediacy and transparency of cryptocurrency with the safety and regulatory construction of the standard banking system.” Allgood framed a lot of the collaboration as a key a part of the UAE’s effort to “modernize” multilateral commerce. He said that “The UAE has positioned itself as a world chief for digital belongings by way of their particular financial zone initiatives, regulation foresight, and world commerce growth with strategic MoUs [memorandums of understanding],” particularly MoUs with India and China, key members of the BRICS bloc. Since these reviews, much more MoUs have been signed between the UAE and BRICS international locations. For example, earlier this month, China’s central financial institution signed a $400 million “cooperation memorandum” with the UAE’s central financial institution that’s particularly centered on the interchange of the international locations’ respective CBDCs. As beforehand famous, the UAE’s coming CBDC, the digital dirham, is being developed by R3, which is intently tied to Fluent Finance.

A report in Gulf Enterprise on Fluent’s collaborations with the UAE famous that, with respect to the MoUS, “the agreements account for greater than $100bn in bilateral commerce, with a give attention to strengthening using new applied sciences and settlement with digital foreign money. Deposit tokens issued by business banks are poised to supply a borderless lacking hyperlink to speed up commerce settlement to central financial institution digital foreign money.” In different phrases, it appears that evidently Fluent is positioning itself as an accelerator for CBDCs through deposit tokens, associated infrastructure and its “low counterparty threat stablecoin” US+.

R3 – Accelerating Monetary Surveillance

Additional proof of Fluent’s intentions to speed up a CBDC-deposit token paradigm could be present in Fluent Finance’s cozy relationship with R3, a self-described “chief within the digitization of monetary companies” that’s accountable for the Corda DLT platform. As beforehand talked about, R3’s backers embody a few of the largest names in finance, amongst them a number of of the large business banks who had an early function within the creation of Fluent Finance.

Fluent’s reference to R3 was current early on, together with earlier than its ill-fated try and accomplice with Farmington/Moonstone. For example, Fluent’s early partnership with XDC in October 2022 was influenced by the truth that XDC was additionally “closely associated to R3” in addition to XDC’s give attention to “commerce finance” in keeping with Allgood. Notably, XDC can be very energetic within the UAE and was described by Emirati media as a “driving power” behind the nation’s ambition to grow to be “the successor to Silicon Valley” in articles revealed roughly a month earlier than Fluent introduced its partnership with the UAE’s Ministry of Economic system.

As well as, Fluent’s head of engineering Will Hester, who joined the corporate in April 2022, beforehand labored as R3’s tech lead and beforehand as a R3 software program engineer. Different Fluent workers, reminiscent of software program engineer John Buckle, had additionally beforehand labored for R3. As well as, Fluent Finance’s US+ makes use of a personal Corda community (Corda being a R3 product) to tokenize US+’s fiat foreign money (i.e. US $) reserves. Experiences on Fluent’s growth into the UAE observe that the corporate selected to make use of Corda so as to “introduce CBDC-compatible deposit token infrastructure for borderless funds.”

Whereas Fluent has been comparatively quiet about its business banking companions, what Allgood has revealed is an obvious affiliation between the early days of the corporate with HSBC, Citi and Barclays, suggesting that these banks may very well be among the many members of its banking consortium backing its US+ stablecoin. R3, which notably started as a consortium of economic banks, is backed by main banks together with HSBC, Citi and Barclays in addition to different prime names in finance together with BNY Mellon (which now holds the majority of the reserves for the USDC dollar-pegged stablecoin after the banking disaster earlier this yr), Deutsche Financial institution and Wells Fargo. R3’s relationship with Wells Fargo is especially notable as the corporate’s Corda platform is taking part in a important function in Wells Fargo’s pilot of a dollar-pegged stablecoin that shall be used “initially for inner settlement throughout the corporate’s enterprise.” The Wells Fargo dollar-pegged stablecoin on Corda is being pitched for primarily the identical use instances as Fluent’s US+.

Although R3 has appreciable ties to a coming digital greenback, by way of Wells Fargo, Fluent Finance and others, they’re additionally a key participant in quite a lot of CBDC tasks globally. As beforehand talked about, in April of this yr, the UAE introduced that it had chosen R3 to start implementing its CBDC technique. The corporate, which describes itself as having been “on the forefront of CBDC innovation since 2016,” can be concerned with CBDC growth in France, Kazakhstan, South Africa, Australia, Malaysia, Switzerland, Singapore, and Sweden and is partnered straight with the central banks of these international locations. R3 was additionally concerned in Italy’s Undertaking Leonidas, a wholesale CBDC trial between Italy’s central financial institution and the Italian Banking Affiliation. R3 was even named 2023’s CBDC accomplice of the yr by the publication Central Banking.

Nonetheless, R3 is targeted on way more than CBDCs, as evidenced by their Digital Forex Accelerator (DCA), which gives “an end-to-end answer that allows central banks, business banks, and financial authorities to points, handle, transact, and redeem CBDCs and privately-issued digital currencies.” In different phrases, R3’s DCA facilitates the creation of CBDCs for central banks and deposit tokens and stablecoins for business banks, all of which might seemingly be inter-operable with different currencies on R3’s Corda community. The central financial institution part of the DCA, the CBDC accelerator, was designed particularly to satisfy CBDC specs laid out by the Financial institution of Worldwide Settlements (BIS). R3’s CBDC accelerator, in addition to what it gives for deposit tokens, permits the issuer to “outline and configure a delegated programmability framework,” which is necessary provided that programmability is without doubt one of the most controversial parts of CBDCs.

One key partnership highlighting R3’s function in accelerating business banks’ forays into the digital foreign money period was solid in August 2022, when R3, together with The Depository Belief & Clearing Company (DTCC) –– a distinguished post-trade market service supplier within the world monetary companies business — introduced the profitable launch of its Undertaking Ion platform. This non-public and permissioned Distributed Ledger Know-how (DLT) platform was developed in collaboration with key business gamers (most of whom straight again R3) and know-how suppliers reminiscent of BNY Mellon, Charles Schwab, Citadel Securities, Citi, Credit score Suisse, Constancy, Goldman Sachs, J.P. Morgan, Robinhood Securities, and the State Avenue Company, amongst others. In 2011 alone, DTCC facilitated the settlement of nearly all of securities transactions inside the US and processed almost $1.7 quadrillion in transactions, solidifying its place because the world’s foremost monetary worth processor.

With a purpose to greatest make the most of the approaching issuance of trillions of {dollars} in extremely regulated stablecoins, R3 bought stablecoin issuer Ivno in October 2021. This acquisition got here solely 6 months after the completion of a collateral tokenization trial Ivno had held with 18 partnered banks together with Egypt’s CIB, Singapore’s DBS, Brazil’s Itaú Unibanco, Nationwide Financial institution of Canada, Natixis, Austria’s Raiffeisen Financial institution Worldwide and US Financial institution in addition to three unnamed securities exchanges.

Invo was removed from the one potential stablecoin issuer which have partnered with R3. For example, in September 2019, Fnality and Finteum each joined forces to leverage their Utility Settlement Coin (USC) on the Corda blockchain. Fnality, headed by CEO Rhomaios Ram, the previous International Head of Product Administration for Transaction Banking at Deutsche Financial institution, identifies as a wholesale funds agency, and boasts institutional shareholders reminiscent of Goldman Sachs, Barclays, BNY Mellon, CIBC, Commerzbank, DTCC, Euroclear, and ING, amongst others. In December 2023, Fnality, together with Lloyds Banking Group, Santander and UBS, executed the primary ever transaction settlement of digital central financial institution funds with balances of sterling utilizing an “omnibus account” on the Financial institution of England. The load of the second was not misplaced on Hyder Jaffrey, Managing Director at UBS: “The creation of a brand new systemically necessary world fee system is a as soon as in a era occasion.”

With the DTCC’s expertise in settling the lion’s share of dollar-denominated securities, and with Fnality and Ivno’s collaborations with a few of the largest gamers within the worldwide banking system, R3 have quietly positioned themselves as suppliers of doubtless important infrastructure inside the imminent world system of interoperable CBDCs and their business financial institution equivalents.

R3 accomplice Fluent Finance, and extra particularly its UAE-based Fluent Financial Bridge, is in search of to function the connective tissue between the deposit tokens and stablecoins to be issued by business banks each within the UAE, in addition to overseas, and CBDCs by making certain their compatibility. Certainly, Fluent’s web site – in each the previous and current – has promoted its merchandise’ “CBDC financial institution compatibility.” Given Fluent’s long-standing collaboration and affiliation with R3 and the banks behind it, Fluent Financial Bridge and its stablecoin protocol have seemingly been constructed with CBDCs operating on R3’s Corda in thoughts.

As well as, simply as R3 is growing CBDCs and different digital currencies far past the UAE, Fluent can be trying to increase its “financial bridge” and US+ far past the Emirates. In an interview Allgood gave to R3 on January 2023, he said that Fluent has been in talks with the UAE authorities to concern a US+ equal however for his or her native foreign money, the dirham (i.e. a bank-issued dirham stablecoin that may be interoperable with its R3-developed CBDC). He additionally claimed to be far alongside in growing a US+ equal for the Mexican peso.

As well as, in the identical interview, Allgood revealed that Fluent is “trying to do a US greenback stablecoin however with native banking in Africa” and is in talks with a number of banks throughout 36 totally different African international locations in pursuit of that specific undertaking. Allgood, whereas busy championing and constructing an interoperable community of CBDCs throughout the globe, has begun to show Fluent’s consideration past simply US+ and in the direction of the greenback system itself.

Constructing the Digital Greenback: The Artificial Deposit Token

The US, regardless of the launch of CBDC pilots in China, Japan, Russia, India, Israel, Saudi Arabia, the UAE, and elsewhere, has but to formally launch any type of government-issued digital greenback. In a June 2023 white paper titled “Central Financial institution Digital Forex International Interoperability Rules”, the World Financial Discussion board mirrored on the intense push by governments world wide to discover CBDC issuance. The paper makes point out of “over 100 international locations actively engaged in CBDC analysis and growth”, whereas quoting the managing director of the Worldwide Financial Fund, Kristalina Georgieva, making the excellence that “there is no such thing as a common case for CBDCs as a result of every economic system is totally different”. Evidently the US has plans to be “totally different” from most international locations. For example, in November 2022, two days earlier than FTX filed for chapter, Coinbase CEO Brian Armstrong was a visitor on the Circle CEO Jeremy Allaire’s podcast, and said that “each main authorities just about goes to wish to have a CBDC”, whereas delineating the trail for the US would seemingly be totally different from the remainder of the world. “I feel within the US’s case, it’s going to find yourself utilizing USDC [the dollar-pegged stablecoin issued by Circle] as type of like a de facto CBDC.”

Within the WEF’s white paper, two US efforts associated to CBDCs are talked about: Undertaking Hamilton, the Boston Fed’s 2020 collaboration with the Massachusetts Institute of Know-how’s (MIT) Digital Forex Initiative; and the 2022 report by The New York Fed titled Undertaking Cedar. The previous, Undertaking Hamilton, centered totally on fee throughput of a retail-facing digital foreign money, whereas the latter, Cedar, was an experiment on a deposit token to be exchanged by banks throughout wholesale settlement. The delineation between Undertaking Hamilton and Undertaking Cedar is sort of equivalent to the fork within the highway at the moment dealing with the founding fathers of the approaching digital Federal Reserve.

In a February 2022 evaluation, Gerard DiPippo – an 11 yr veteran of the US intelligence group (particularly the CIA) who has lengthy been centered on financial points within the International South – said that:

“Greenback stablecoins have at the least one main benefit over a possible U.S. CBDC: they exist already. Even when Congress have been to resolve the Fed ought to create a CBDC, the method of growth, experimentation, and deployment would most likely take at the least a number of years.”

In that very same evaluation, revealed by the Nationwide Safety State-adjacent Heart for Strategic and Worldwide Research (CSIS), DiPippo added that: “America shouldn’t delay in establishing a regulatory framework to allow protected however speedy growth of greenback stablecoins to realize a first-mover benefit in associated funds and applied sciences.”

Certainly, simply as DiPippo famous, the digital greenback is already right here. The truth is, it has been right here for a very long time. A Fall 2021 piece from Harvard Enterprise Evaluate made the declare that “over 97% of the cash in circulation right this moment is from checking deposits – {dollars} deposited on-line and transformed right into a string of digital code by a business financial institution.” However whereas the overwhelming majority of greenback circulation could have been lowered to 1’s and 0’s on some non-public financial institution’s spreadsheet over the previous few a long time, the belongings that truly uphold the US greenback system — US Treasuries — have developed to the digital age a bit slower. Whereas packages like TreasuryDirect do exist, during which customers can arrange an account on-line and buy securities straight issued by the US Division of Treasury, the precise interbank securities clearing community had remained comparatively antiquated till the launching of FedNow this previous summer season.

FedNow, on first look, appears innocuous sufficient – a brand new communications instrument for Federal Reserve-partnered banks to change securities. However, on second look, its necessity within the twenty first century implementation of greenback hegemony turns into clear. The settlement and change of Treasuries, the asset that truly backs the digital {dollars} created from checking deposits by non-public capital creators, has now grow to be additional regulated, centralized, and managed.

A reverse repo, or a reverse repurchase settlement, is the popular methodology for banks to hunt yield by briefly loaning securities, particularly Treasuries, for money on account of the truth that every occasion bodily exchanges the belongings, with an settlement to repurchase the securities the subsequent day with an added service charge. Banks a lot choose to do that versus a extra conventional mortgage construction as a result of mitigated legal responsibility threat that comes downstream of bodily holding on to the collateral within the settlement. Say a cash-strapped financial institution has just lately secured a mortgage to satisfy present liquidity wants, however earlier than they’ll repay the mortgage, the fruits of monetary woes causes the financial institution to declare chapter and in the end be seized by authorities. The lending financial institution not solely loses out on its service funds, but in addition your complete legal responsibility of the mortgage principal. If they’d agreed to a reverse repo change, whereas the lender would nonetheless lose out on amassing their charges, they might at the least retain the rights to the exchanged Treasuries at the moment inside their custody.

The US banking system makes some huge cash by shopping for US Treasuries and utilizing them to create {dollars}. The US Division of Treasury additionally advantages because it is ready to service the price range of the US authorities by promoting its debt to the US banking system. Neither of those entities wish to muck up their racket: The US authorities doesn’t wish to be straight accountable for managing retail account balances for residents (as can be the case with a direct-issued greenback CBDC), and the largest banks actually don’t wish to lose their efficient monopoly of personal capital creation by letting some outsider fintech firm safe the contract for straight issuing digital {dollars} for the federal government. FedNow is strictly a wholesale product. The truth is, it isn’t actually a product in any respect ––there is no such thing as a token and it solely goals to permit regulators to extra intently surveil the change of Treasuries.

The buying of Treasuries, nevertheless, is quickly shifting in the direction of a wholly new buyer class: stablecoin issuers. Very like how a private-sector financial institution would buy government-issued securities to again the issuance of {dollars} in a retail checking account, stablecoin issuers reminiscent of Tether (USDT) or Circle (USDC) have grow to be net-buyers of short-term Treasuries known as T-bills. Tether CEO Paolo Ardoino tweeted in September 2023 that “Tether reached $72.5 billion publicity in US T-bills, being [a] prime 22 purchaser globally, above the United Arab Emirates, Mexico, Australia and Spain.” Simply three months later, in December 2023, Tether’s Treasury holdings have been over $90 billion. For reference, the biggest single holder of US Treasuries is Japan with simply over $1 trillion held –– Tether alone already instructions almost a tenth of their stability sheet. In our present excessive rate of interest surroundings, the yield from these brief length securities could be substantial, resulting in massive income streams for not solely these stablecoin issuers, however the firms and banks that custody their belongings.

Tether’s substantial Treasury holdings are distributed amongst three essential custodians: Charles Schwab, Constancy and Cantor Fitzgerald. Cantor Fitzgerald is maybe most well-known for having its flagship workplace destroyed in the course of the occasions of 9/11, however it continues right this moment as one of many 24 major sellers approved to commerce US authorities securities with the Federal Reserve Financial institution of New York. Earlier this month, Howard Lutnick, the CEO of Cantor Fitzgerald, made an look on CNBC Cash Movers Podcast during which he said “I’m an enormous fan of this stablecoin referred to as Tether…I maintain their treasuries. So I preserve their treasuries, and so they have a variety of treasuries.” He additional said his affinity for the corporate by making reference to Tether’s current pattern of blacklisting of retail addresses flagged by the US Division of Justice. “With Tether, you may name Tether, and so they’ll freeze it.”

Simply this October, Tether froze 32 wallets for alleged hyperlinks to terrorism in Ukraine and Israel. In November, $225 million was frozen after a DOJ investigation alleged that the wallets containing these funds have been linked to a human trafficking syndicate. This month alone, over 40 wallets discovered on the Workplace of Overseas Belongings Management’s (OFAC) Specifically Designated Nationals (SDN) Record have been frozen. Ardoino defined these actions by stating that “by executing voluntary pockets tackle freezing of recent additions to the SDN Record and freezing beforehand added addresses, we can additional strengthen the constructive utilization of stablecoin know-how and promote a safer stablecoin ecosystem for all customers.” Only a few days in the past, Ardoino claimed that Tether has frozen round $435 million in USDT for the US DOJ, FBI and Secret Service. He additionally defined why Tether has been so keen to assist the US authorities freeze funds – Tether is in search of to grow to be a “world class accomplice” to the US to “increase greenback hegemony globally.”

The stablecoin ecosystem, the place US dollar-pegged stablecoins dominate, has grow to be more and more intertwined with the larger US greenback system and – by extension – the US authorities. The DOJ has the retail-facing Tether on a leash after pursuing the businesses behind it for years and now Tether blacklists accounts every time US authorities demand. The Treasury advantages from the mass buying of Treasuries by stablecoin issuers, with every buy additional servicing the federal authorities’s debt. The non-public sector brokers and custodians that maintain these Treasuries for the stablecoin issuers profit from the primarily risk-free yield. And the greenback itself furthers its effort to globalize at excessive velocity within the type of USDT, serving to to make sure it stays the worldwide foreign money hegemon.

In impact, Treasuries are being purchased hand over fist, and {dollars} are being spent en masse. Very like the discrepancy between Bitcoin’s UTXO or cash mannequin and Ethereum’s account stability mannequin, Treasuries and {dollars} behave exceptionally in another way in financial phrases. A authorities may by no means straight concern what is called M0 –– base cash –– to retail accounts, and thus a CBDC may by no means function something however M1 — a programmable checking account that depends on belief in a monetary service supplier to be exchanged. Maybe a directly-issued US dollar-denominated CBDC is a red-herring. Simply ask the Fed.

For example, Federal Reserve Vice Chair for Supervision Michael Barr said this previous November that “There’s clearly a variety of innovation taking place within the non-public sector,” whereas later implying that the Federal Reserve has a “very robust curiosity” in regulating, approving and supervising US dollar-pegged stablecoin issuers. Deputy Secretary of the Treasury Wally Adeyemo just lately lobbied Congress on behalf of the US Treasury to increase the regulatory powers over dollar-denominated stablecoins past US firms and even US residents. “Laws may explicitly authorize OFAC to train extraterritorial jurisdiction over transactions in stablecoins pegged to the USD (or different dollar-denominated transactions) as they often would over USD transactions,” the proposal recommended, even for transactions that “contain no U.S. touchpoints.”

Final month, the Atlantic Council additionally wrote of “the present [Federal Reserve] coverage trajectory favoring non-public stablecoin issuance fairly than official CBDC issuance,” making observe of an August 8 regulation letter stating that “the Federal Reserve formally shifted its stance to advertise stablecoin issuance by banks.”

Over a yr earlier than Barr’s statements or the Atlantic Council’s publish, Bruno Sultanum, an economist within the Analysis Division on the Federal Reserve Financial institution of Richmond wrote in a July 2022 temporary that “privately issued stablecoins may very well be equal to CBDCs” and that “there could also be a pathway to create an efficient ‘artificial’ CBDC within the type of stablecoins. Extra usually, the discussions across the introduction of CBDCs ought to at all times embody an analysis of the potential of contemplating well-regulated stablecoins as a viable (and probably preferable) different.”

As well as, the aforementioned CSIS temporary authored by CIA veteran DiPippo mentions a number of architectures the US authorities may undertake for his or her digital greenback, whereas realizing the benefits of a bank-issued deposit token. “An artificial CBDC, isn’t actually a CBDC in any respect, as a result of the central financial institution wouldn’t be issuing the digital foreign money. An artificial CBDC is a stablecoin with a twist: the issuing monetary establishment would again its stablecoin with reserves on the Fed.” He then famous that “An artificial CBDC, or a system allowing the issuance of a number of totally backed greenback stablecoins, can be as protected as a CBDC whereas providing extra private-sector competitors and innovation.” In November 2021, the President’s Working Group on Monetary Markets (PWG), the Federal Deposit Insurance coverage Corp. (FDIC) and the Workplace of the Comptroller of the Forex (OCC) launched a joint report on stablecoins, which highlighted that stablecoins may enhance the US fee system however may additionally create monetary dangers if left unregulated. Typically, realizing any advantages from stablecoins would require authorities regulation.

In ready remarks this October, Barr said “analysis is at the moment centered on end-to-end system structure, reminiscent of how ledgers that file possession of and transactions in digital belongings are maintained, secured, and verified, in addition to tokenization and custody fashions.” Barr additionally made the declare that any USD-denominated token “borrows the belief of the central financial institution,” and thus “the Federal Reserve has a powerful curiosity in making certain that any stablecoin choices function inside an acceptable federal prudential oversight framework, so they don’t threaten monetary stability or funds system integrity.” As a result of reputation of and quantity current in each the Treasury and stablecoins markets, there are at the moment many non-public banks trying to digitize the securities market by creating an artificial deposit token that acts like Treasuries.

As well as, the current push within the US towards regulated stablecoins/deposit tokens and away from a direct-issued CBDC has different motives. Whereas this push is at the least partially motivated by the “unhealthy popularity” that the time period stablecoin has developed within the aftermath of the TerraLuna fraud in early 2022 and subsequent scandals within the crypto business, business banks – together with those who again Fluent Finance, R3 and their equivalents – wish to concern the stablecoins/deposit tokens themselves so as to proceed fractional reserve banking.

Fractional reserve banking, lengthy controversial on account of its function in facilitating financial institution runs and financial institution insolvency and characterised as some as little greater than embezzlement, has lengthy been a cornerstone of the US banking system. Nonetheless, the present stablecoin paradigm, together with that previously embraced by Fluent Finance, have fallen out of favor with business banks because the 1:1 peg signifies that banks must maintain onto equal reserves for each coin/token issued. In fractional reserve banking, banks have interaction in “credit score creation” by loaning out the majority of the cash deposited by its prospects and are unable to instantly (and even shortly) redeem prospects’ cash upon request – your complete objective of the 1:1 ratio that characterizes most of right this moment’s stablecoins. For banks to proceed “enterprise as typical”, the issuance of stablecoins and deposit tokens should come below their purview, versus present stablecoin issuers and even the Fed. Fluent Finance, as an organization closely influenced and guided by highly effective business banks, is clearly positioning itself to be a key a part of this bank-led digital greenback system.

In January 2023, Fluent’s Bradley Allgood instructed CoinDesk how the US has been establishing its choice for a private-public mannequin. He particularly pointed to the Federal Reserve Financial institution of New York and highlighted its initiatives in testing deposit tokens backing digital {dollars} for wholesale transactions in collaboration with main banks:

“Whenever you have a look at the Fed of New York and what they’ve been doing of their innovation workplaces, this has been setting the usual, with all of it leaning in the direction of wholesale, tokenized deposits or tokenized legal responsibility community settlement between financial institution to financial institution.”

Throughout a lot of 2022, and notably the timeframe during which Fluent Finance was forging its early partnerships together with with Farmington/Moonstone, the behind-the-scenes push to create an artificial CBDC for the US greenback within the type of regulated dollar-pegged stablecoins and/or deposit tokens was effectively underway. Fluent, from its earliest days, has sought to develop this artificial CBDC and make it interoperable with any future direct-issued CBDC from the Federal Reserve whereas additionally exporting this artificial greenback CBDC to the International South. In gentle of the corporate’s (and US+’s) trajectory, it now is smart to revisit the most definitely motivation behind Moonstone’s partnership with Fluent previous to FTX’s collapse in addition to the seemingly actual purpose behind Farmington’s transition into Moonstone.

The Bankman-Fried Stablecoin That Nearly Was

Previous to the collapse of the Sam Bankman-Fried-led change FTX, there was already appreciable hypothesis in regards to the uncommon relationship between FTX and its subsidiaries, Deltec and the dollar-pegged stablecoin Tether (USDT). For example, almost a yr earlier than FTX went below, Protos reported that “over two-thirds of all Tether minted throughout a number of years went to simply two crypto firms”, one among which was the FTX-linked Alameda Analysis, the identical Alameda Analysis that may later pour hundreds of thousands into Farmington State Financial institution throughout its suspect transition into Moonstone. Earlier that yr, Alameda govt Sam Trabucco primarily admitted on Twitter that Alameda would use its huge holdings of USDT to take care of USDT’s peg to the US greenback (one thing additionally admitted by former FTX govt Ryan Salame). By October of 2021, Alameda had been issued virtually $37 billion price of USDT and had instantly forwarded $30 billion of that to FTX. Round that very same time, FTX issued a $50 million mortgage to Deltec, which was a key financial institution for FTX and nonetheless is for Tether and whose chairman, Jean Chalopin, had just lately acquired Farmington State Financial institution.

Over the subsequent a number of months, Alameda Analysis and Sam Bankman-Fried himself would pour many hundreds of thousands into the Chalopin-controlled entity, making Farmington/Moonstone the latest entity of the Deltec-FTX-Tether nexus. This brings us to the large query: If Deltec and FTX have been so near Tether, why was the financial institution they managed – Farmington/Moonstone – in search of to accomplice so intimately with one other US dollar-pegged stablecoin – Fluent Finance’s US+?

For a number of years, and now greater than ever, Tether has been below heavy scrutiny from US authorities, notably the DOJ, and – given the US authorities’s push for regulated stablecoins/deposit tokens in lieu of a direct concern CBDC – it’s doable that Tether could not make the minimize as soon as these laws lastly come into power (although Tether’s current overtures to US authorities and Congress clearly search to forestall that). Tether, together with Deltec and fairly clearly FTX, have lengthy been suspected of partaking (or in FTX’s case, confirmed to have engaged) in financial institution fraud and a collection of illicit monetary actions. It appears as if highly effective forces deeply tied to Tether, particularly Chalopin and Bankman-Fried, have been in search of to make use of Moonstone and its partnership with Fluent’s US+ the best way the FTX internet of firms/banks had used Tether. This might have presumably allowed them to proceed their similar shady monetary machinations below the approaching regulatory paradigm.

Notably, in late October 2022, three days after the Chalopin/Bankman-Fried-affiliated Moonstone partnered with Fluent Finance, Sam Bankman-Fried said that FTX was on account of announce the now bankrupt change’s collaboration with an unspecified stablecoin “within the not-too-distant future.” One wonders if the hundreds of thousands in political donations made by Bankman-Fried (and probably these made by FTX govt Ryan Salame) in 2022 have been aimed toward wooing politicians to favor the deliberate FTX-affiliated stablecoin as a frontrunner for the approaching “digital greenback” paradigm.

In different phrases, the purpose was apparently to have the identical group of actors transition from the “untrusted” Tether stablecoin to the “trusted” US+ stablecoin. The truth that Fluent Finance, whose co-founders embody the alleged inventor of CBDCs and which was closely influenced from the beginning by highly effective business banks, claims to be a “reliable” different to Tether is deeply undermined and albeit unbelievable provided that they might agree to permit the identical untrustworthy actors deeply concerned in Tether’s questionable minting actions (and FTX’s brazen fraud) to mint their “regulatory compliant” and “trusted” US+ stablecoin.

The Public-Non-public Digital Greenback

Following the collapse of FTX, and later Moonstone, Fluent Finance has continued in pursuit of its final purpose – to create a “trusted” stablecoin and stablecoin protocol on behalf of the business banking giants it was at all times meant to serve. In a September 2023 op-ed for Cointelegraph tellingly entitled “CBDCs may help a extra secure economic system – if banks run the present,” Allgood made his allegiances clear. In that article, Allgood writes that “using CBDCs in an try and undercut, circumvent or cannibalize your complete business banking sector is as a lot a pipe dream for effectivity maximalists as it’s a recipe for failure.” “Business banking won’t be left at the hours of darkness ages,” he additionally claims.

In his protection of the business financial institution establishment, Allgood got here out in opposition to the prevailing stablecoin paradigm in a current interview with the IB Occasions, talking in favor of bank-issued and controlled stablecoins backed by deposit tokens. “Stablecoins haven’t panned out the best way most anticipated three years in the past.” In response to Allgood, deposit token fashions are actually “rising from the pack” of present stablecoin issuance because the “most promising stable-valued digital belongings.” He goes on to politically make clear that “stablecoins are usually not the unhealthy guys…simply the perfect effort from a earlier period.” On this interview and likewise the Cointelegraph article, Allgood makes it clear that Fluent Finance not solely possesses the mandatory digital infrastructure, but in addition the institutional connections to maintain non-public capital creation within the fingers of economic banks through deposit token structure.

Allgood additionally instructed the IB Occasions that “the sticking level with stablecoins is that their issuers are primarily lean startups…When you think about the inherent safety dangers, frequent depeggings and compliance points, it’s not obscure why stablecoins have had no success by any means choosing up traction in conventional use case situations.” The argument for transferring the reserves of stablecoins again into the fingers of the US banking system below the guise of additional stability appears logical solely till one remembers that Allgood’s favored custodians are the fractional reserve banking business –– who would be capable to have interaction on this controversial observe at a a lot bigger scale below this new paradigm. Banking the unbanked –– a standard trope from the stablecoin business –– additionally sounds good in idea, so long as you ignore who will get to really do the banking.

“If all goes effectively,” claims Allgood, “the worldwide adoption of CBDCs will marshal a brand new monetary paradigm the place central banks implement superior financial coverage on the wholesale degree whereas permitting business banks to do what they do greatest on the retail degree with stablecoins and deposit tokens.”

Whereas many rightly concern the hazard to particular person freedoms offered by government-issued CBDCs, this isn’t the paradigm being introduced into focus by former Moonstone accomplice Fluent Finance or different key actors in constructing out the way forward for government-approved digital currencies. As a substitute of giving central bankers full management over your funds by way of surveillance and programmability, it is going to be the large Wall Avenue banks –– who within the US, personal the Fed anyway – that can do the programming and surveilling. The additional blurring of the private and non-private banking sector stays a strong instrument of obfuscation for the digital greenback system to skirt constitutional violations of buyer rights within the type of warrantless asset seizure and information harvesting by a personal sector that totally collaborates with the general public sector. The digitization of the greenback, and the Treasuries that again them, leverage the databases of blockchains to not solely display reserves of deposits, but in addition to trace the customers of the system. “The FX settlement course of wants elevated transparency and traceability”, R3 CEO David Rutter as soon as defined. Rutter then boasted that his firm “is match to ship on each counts.”

The simulated concern of governments and central banks programming your foreign money to run out shall be conveniently eased by a public rejection of a directly-issued CBDC within the US by the Fed. The upholders of the established order hope that the realities of this false victory, and the stablecoin/deposit token system to be carried out in lieu of a direct-issue digital greenback, will go unnoticed by the American public, notably these segments of the inhabitants already cautious of CBDCs. No matter excuse or justification is given to maneuver the US – and far of the world – into this new monetary paradigm, relaxation assured that the identical outdated bankers and corporations – together with those that got here below scrutiny as a part of the FTX scandal – won’t solely keep, however achieve, unprecedented management over the monetary exercise and habits of each American and whoever else they resolve to dollarize.