(Bloomberg) — European stock futures rose while Japanese shares declined, as investors looked ahead to decisions from a slew of central banks this week.

Most Read from Bloomberg

European equity contracts rose 0.4%, following those in Australia and Hong Kong. The Nikkei 225 fell, dragging down the regional index. Futures for US stocks were steady after the S&P 500 rose 0.1% while the Nasdaq 100 slid 0.5%, as investors continue to rotate out of the tech megacaps that have powered the bull market.

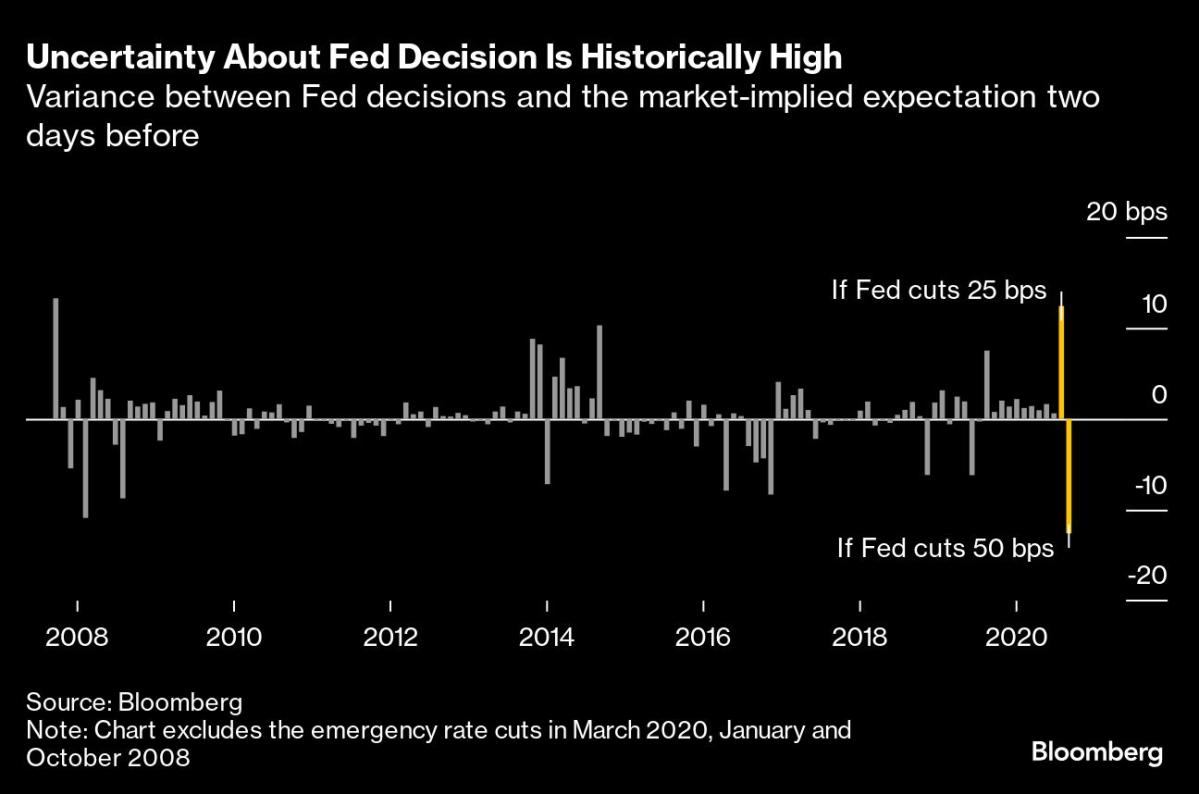

The dollar consolidated after a four-day decline as traders boosted bets the Federal Reserve will deliver a half-point rate cut Wednesday. Investors have been divided on the magnitude of a reduction, as US economic data have started to weaken, though inflation has remained sticky. US retail sales out later Tuesday may further inform the decision.

“August’s US retail sales report is, arguably, the most important of today’s releases, given that a soft print would likely see participants go ‘all-in’ on the idea of a jumbo 50 basis point Fed cut tomorrow,” wrote Michael Brown, a strategist at Pepperstone Group Ltd., in a note. “Though it’s tough to imagine an equally aggressive paring of dovish bets were the data to beat expectations.”

Read: The Fed Should Go Big Now and I Think It Will: Bill Dudley

In Hong Kong, Chinese appliance giant Midea Group Co.’s shares climbed as much as 9.5% in their debut, after robust demand for the biggest public stock offering in three years revives hopes for the city’s languishing market. Other in the pipeline in Hong Kong include ride-hailing company Didi Global Inc., which was forced to delist from the New York Stock Exchange by Chinese authorities.

Concern continues about weakness in China’s economy. Disappointing data over the weekend may add pressure on the authorities to ramp up fiscal and monetary stimulus if the nation is to reach this year’s growth target.

The country faces yet another challenge in proposed tariffs by the US in areas such as medical products. Malaysian glove-maker shares including Top Glove Corp surged on Tuesday after the US was expected to finalize tariffs on Chinese goods this month.

Trading in China, Taiwan and South Korea was shut for public holidays.

Meanwhile, the yen was steady after strengthening beyond 140 per dollar for the first time since July 2023 on Monday, as the Japanese currency extended its rally from the weakest point in nearly 38 years in July.

The yen has been steadily appreciating from market expectations that the interest rate differential between the US and Japan will narrow further leading to a decline in the export-heavy Japanese equities.

The upcoming Bank of Japan meeting may affect sentiment toward Japanese shares and, “should Ueda indicate an October rate hike is possible, USD/JPY and the Nikkei will likely come under renewed selling pressure,” said Tony Sycamore, an analyst at IG Australia Pty Ltd.

The BOJ is expected to stay on hold on Friday after raising rates twice this year with all 53 economists surveyed by Bloomberg said Ueda’s board will leave the benchmark rate at 0.25% when its two-day meeting concludes Friday.

Leveraged funds are diverging in their positions on the yen. Some short-term funds locked in profits ahead of the monetary-policy decisions this week, while others are looking to increase their long-yen positions on bets for a large rate cut by the Fed.

JPMorgan Chase & Co. is among firms raising its yen forecasts, citing expectations that US and Japanese interest rates will be normalized, and also potential weakness in the dollar.

In commodities, gold remained near record levels, with traders betting that it’ll benefit from a weaker US dollar and lower Treasury yields off the Fed decision. Other precious metals gained, with silver rising toward $31 an ounce, up for a seventh straight day and on pace for the longest stretch of daily gains since 2019. Oil edged higher.

Key events this week:

-

Germany ZEW, Tuesday

-

US business inventories, industrial production, retail sales, Tuesday

-

Eurozone CPI, Wednesday

-

Fed rate decision, Wednesday

-

UK rate decision, Thursday

-

US US Conf. Board leading index, initial jobless claims, US existing home sales, Thursday

-

FedEx earnings, Thursday

-

Japan rate decision, Friday

-

Euro-zone consumer confidence, Friday

Some of the main moves in markets:

Stocks

-

S&P 500 futures were unchanged as of 6:55 a.m. London time

-

Nasdaq 100 futures rose 0.1%

-

The MSCI Asia Pacific Index fell 0.1%

-

The MSCI Emerging Markets Index rose 0.4%

-

Japan’s Topix fell 1%

-

Australia’s S&P/ASX 200 rose 0.3%

-

Hong Kong’s Hang Seng rose 1.5%

-

Euro Stoxx 50 futures rose 0.4%

Currencies

-

The Bloomberg Dollar Spot Index was little changed

-

The euro was little changed at $1.1126

-

The Japanese yen was little changed at 140.67 per dollar

-

The British pound was little changed at $1.3204

Cryptocurrencies

-

Bitcoin rose 1.8% to $58,716.74

-

Ether rose 1.3% to $2,304.53

Bonds

-

The yield on 10-year Treasuries advanced one basis point to 3.63%

-

Germany’s 10-year yield declined three basis points to 2.12%

-

Britain’s 10-year yield declined one basis point to 3.76%

-

Australia’s 10-year yield advanced two basis points to 3.83%

Commodities

-

Spot gold fell 0.1% to $2,579.30 an ounce

-

West Texas Intermediate crude rose 0.8% to $70.63 a barrel

This story was produced with the assistance of Bloomberg Automation.

–With assistance from Jason Scott, Masaki Kondo and Jake Lloyd-Smith.

Most Read from Bloomberg Businessweek

©2024 Bloomberg L.P.