Schoolteachers, usually underappreciated and underpaid, have lengthy been society’s unsung heroes. Regardless of their modest salaries, many lecturers are quietly constructing vital wealth. Based on a analysis venture by Ramsey Options referred to as the “Nationwide Research of Millionaires,” many lecturers are discovering their approach into the millionaires’ membership.

Do not Miss:

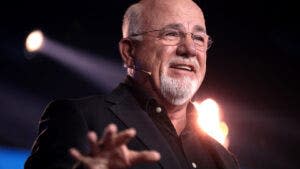

Dave Ramsey, a revered voice in private finance and CEO of Ramsey Options, introduced this shocking pattern to the limelight. “You don’t need to make an enormous earnings to construct wealth,” Ramsey mentioned. “You may’t earn your approach out of stupidity.” His phrases underscore a shocking actuality: Many millionaires aren’t excessive earners however good planners.

See Additionally: The variety of ‘401(okay)’ Millionaires is up 43% from final 12 months — Listed here are 3 ways to affix the membership.

Based on the U.S. Bureau of Labor Statistics, lecturers are on the checklist of careers most probably to have millionaires, with a median annual wage of $61,690, simply behind engineers and accountants. In the meantime, regardless of their hefty paychecks, physicians do not even crack the highest 5.

Based mostly on a survey of 10,000 millionaires, the report discovered that almost all of them didn’t come from well-off households. A staggering 79% didn’t inherit their fortune. As a substitute, they invested correctly – eight of ten had a 401(okay). Curiously, three-quarters of them didn’t maintain high-paying jobs, thus dispelling the parable that wealth is reserved for the superrich.

Trending: Warren Buffett flipped his neighbor’s $67,000 life financial savings right into a $50 million fortune — How a lot is that price as we speak?

“These persons are systematic,” Ramsey mentioned. “They work with plans and play by the principles.” He highlighted the significance of well-planned spending and investing habits, stating that 85% of millionaires use a procuring checklist, with 28% constantly sticking to it.

Noting that many are working exhausting to construct up their financial savings, Ramsey mentioned that among the engaging provides are certificates of deposit (CDs) with good rates of interest and stuck phrases.

One other avenue that Ramsey emphasised is high-yield financial savings accounts, which may yield returns exceeding 4%. “A high-yield financial savings account is a no brainer when you’re critical about rising your cash. It is about making your cash be just right for you,” he remarked.

Trending: A billion-dollar funding technique with minimums as little as $10 — you possibly can turn into a part of the following huge actual property growth as we speak.

He additionally touched on how ardour impacts monetary outcomes. “Don’t take a job simply because it pays,” he mentioned. “You ought to earn more money when you’re doing one thing you’re keen on. You’re good at it, you care, you’re inventive.” Nonetheless, he cautioned in opposition to the assumption {that a} excessive paycheck ensures wealth.

Reasonable-income earners, like lecturers, could make sufficient cash to turn into rich with cautious planning. “You don’t need to have a huge paycheck to have a safe monetary future,” Ramsey mentioned.

Ramsey’s insights lengthen to the medical subject, the place many medical doctors battle with debt and delayed investments regardless of their hefty wages.

Brent Lacey, the host of “The Scope of Observe” podcast, resonated with this sentiment, mentioning that physicians usually miss out on years of potential investments due to the load of scholar loans. “After enduring a lot sacrifice, they imagine it is lastly their flip to take pleasure in their earnings,” Lacey remarked, contrasting this together with his grandmother, a thrifty public schoolteacher who retired with a fortune.

Learn Subsequent:

“ACTIVE INVESTORS’ SECRET WEAPON” Supercharge Your Inventory Market Sport with the #1 “information & all the pieces else” buying and selling software: Benzinga Professional – Click on right here to start out Your 14-Day Trial Now!

Get the newest inventory evaluation from Benzinga?

This text ‘You Cannot Earn Your Approach Out of Stupidity’: Dave Ramsey On Why $60K-Incomes Academics Usually Grow to be Millionaires initially appeared on Benzinga.com

© 2024 Benzinga.com. Benzinga doesn’t present funding recommendation. All rights reserved.