Enterprise Product Companions (NYSE: EPD) has been a mannequin of consistency over time, and its second-quarter outcomes proceed to reveal this. Nevertheless, the corporate is within the means of trying to take development to a better stage over the following few years via numerous development initiatives.

Let’s take a better take a look at the midstream firm’s Q2 outcomes, distribution, long-term prospects, and whether or not now is an efficient time to purchase the inventory.

A constant performer

The important thing to Enterprise’s success over time has been consistency, which has helped the pipeline firm enhance its distribution for 26 straight years via numerous ups and downs within the power markets.

For Q2, the Enterprise noticed its whole gross-operating margin enhance practically 11% to $2.4 billion. Its adjusted earnings earlier than curiosity, taxes, depreciation, and amortization ( EBITDA ), in the meantime, climbed 10% to just about $2.4 billion.

It generated distributable money movement of $1.8 billion, and its adjusted free money movement (FCF) was $814 million. Its FCF was decrease in comparison with a yr in the past as the corporate elevated its capital expenditures (capex) on new development initiatives.

Enterprise slowed down its development initiatives throughout the pandemic however final yr began to ramp them up as soon as once more. Tasks, in fact, take time to be constructed and ramp up, and so the impression from this elevated spending will speed up over time.

The corporate plans to spend $3.5 billion to $3.75 billion in development capex this yr and one other $3.25 billion to $3.75 billion subsequent yr after spending about $3.5 billion in 2023. That compares to development capex of solely $1.4 billion in 2022.

It at present has $6.7 billion in initiatives which might be below building, with most set to be accomplished someday in 2025 or past. The corporate additionally simply introduced that it’ll broaden its Enterprise Hydrocarbons Terminal within the Houston Ship Channel. The mission will add extra propane and butane export capabilities, with section one of many mission set to be accomplished within the second half of 2025 and the second section to start service within the first half of 2026.

Enterprise has turn out to be very targeted on the export markets, and this mission will solely add to its robust liquefied petroleum gasoline (LPG) export place. The corporate can be trying to get into the oil export market with its proposed Sea Port Oil Terminal (SPOT) mission.

Over the previous 5 years, Enterprise has averaged a couple of 13% return on invested capital, so these development initiatives ought to present significant development to the corporate within the years forward. At an identical return, the roughly $10.5 billion in development capex spent between 2023 to 2025 ought to result in about $1.4 billion in incremental annual gross-operating margin for the corporate. That will equate to about 15% development from the $9.4 billion in gross-operating margin it generated in 2023.

Continued distribution development forward

Enterprise declared a quarterly distribution of $0.525 per unit for Q2. That was a 5% enhance yr over yr and a 2% enhance sequentially. The inventory now has a ahead yield of about 7.2%

It had a distribution-coverage ratio of 1.6 instances within the quarter primarily based on its distributable money movement, displaying that its distribution is properly coated.

It ended the quarter with leverage of three instances. It defines leverage as web debt adjusted for fairness credit score in junior subordinated notes (hybrids) divided by adjusted EBITDA. This leverage is taken into account low within the midstream house given the robust money movement these firms generate.

The corporate additionally spent $40 million shopping for again inventory within the quarter. Enterprise has about $1 billion left on its $2 billion repurchase plan.

With a powerful stability sheet and sturdy protection ratio, Enterprise appears to be like properly positioned to proceed to steadily enhance its distribution even because it will increase its capex to assist gasoline future development.

Is it time to purchase the inventory?

Enterprise has an extended historical past of being probably the most constant performers within the midstream house and is simply starting to see development choose up. It has probably the most engaging built-in programs within the U.S. and ought to be a powerful beneficiary of elevated power-consumption demand associated to synthetic intelligence (AI), in addition to export demand.

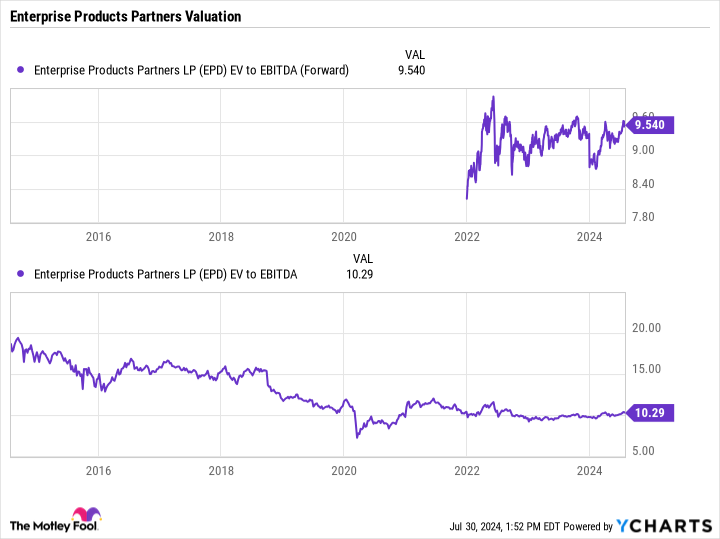

The corporate trades at a forward-enterprise value-to-adjusted-EBITDA (EV/EBITDA) a number of of about 9.5. This compares to a trailing EV/EBITDA a number of of over 15 earlier than the pandemic, whereas the midstream sector as a complete traded at a 13.5-plus a number of between 2011 and 2016 when the businesses have been typically in worse monetary form.

Notice that midstream firms are sometimes valued utilizing an EV/EBITDA a number of as a result of it takes into consideration their debt ranges and takes out noncash depreciation.

General, now appears to be like like a good time to purchase Enterprise’s inventory given its engaging valuation in comparison with historic ranges, constant efficiency over time, and the uptick in development the corporate ought to see within the coming years.

Do you have to make investments $1,000 in Enterprise Merchandise Companions proper now?

Before you purchase inventory in Enterprise Merchandise Companions, contemplate this:

The Motley Idiot Inventory Advisor analyst crew simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Enterprise Merchandise Companions wasn’t one in every of them. The ten shares that made the reduce may produce monster returns within the coming years.

Think about when Nvidia made this listing on April 15, 2005… should you invested $1,000 on the time of our suggestion, you’d have $657,306!*

Inventory Advisor offers traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 29, 2024

Geoffrey Seiler has positions in Enterprise Merchandise Companions. The Motley Idiot recommends Enterprise Merchandise Companions. The Motley Idiot has a disclosure coverage.

Constant Enterprise Product Companions Appears Able to Kick Development Up a Notch was initially revealed by The Motley Idiot