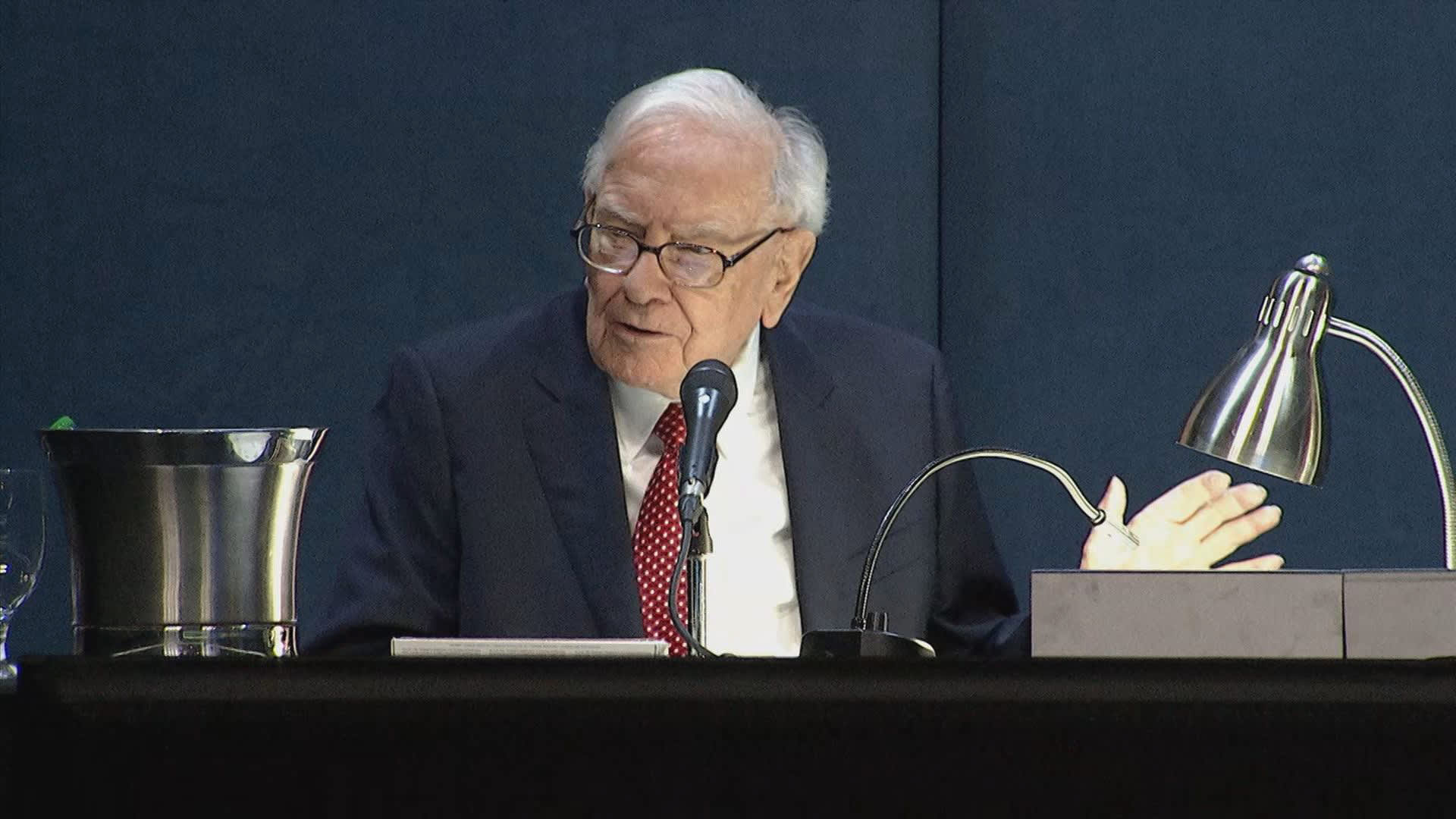

Warren Buffett speaks through the Berkshire Hathaway Annual Shareholders Assembly in Omaha, Nebraska on Could 4, 2024.

CNBC

This report is from this week’s CNBC’s “Inside India” e-newsletter which brings you well timed, insightful information and market commentary on the rising powerhouse and the large companies behind its meteoric rise. Like what you see? You may subscribe right here.

The massive story

Warren Buffett as soon as guess that an funding in an S&P 500 tracker would outperform most hedge funds.

But, that wager by the “Oracle of Omaha,” who held Berkshire Hathaway’s annual shareholder assembly over the weekend, would have additionally outperformed many different indexes too, together with the BSE India Sensex and the Nifty 50.

For native traders, Indian shares would have underperformed the U.S. benchmark by greater than 45 share factors since Buffett’s 2008 guess. For international traders, returns would have been worse in U.S. greenback phrases with a 280 share level hole between the 2 indexes.

It is usually a narrative that is taking part in out at the moment. The S&P 500 is up 9% this 12 months, whereas the Indian benchmark is struggling to remain within the black. It seems that India’s close to 8% GDP progress is not remodeling into inventory market returns.

So, what’s lacking?

“For those who have been a top-down investor, India seems wonderful as a result of it is acquired every thing going for it,” mentioned Jonathan Pines, a contrarian investor and portfolio supervisor at Federated Hermes, who believes Indian shares have a “fully loopy valuation.”

Pines believes the Indian financial system’s fast enlargement has been tied along with the beginning of latest companies and alternatives. However that has additionally meant vital competitors for the incumbents, a lot of that are listed on the inventory market.

“Even when India goes to get fast GDP per capita progress, it doesn’t suggest that all the inventory market goes to develop its earnings on the similar charge as a result of you are going to get competitors,” he added.

Setting apart the comparability with america, the place GDP per capita is greater than $76,000, it will even be unfair to match India with itself from a decade or two in the past, in line with Rajeev Agrawal, hedge fund supervisor and founding father of DoorDarshi Advisors.

India’s GDP per capita was $624 20 years in the past and has risen 300% since. Agrawal thinks breaching the $2,500 mark has meant that Indian shoppers now, for the primary time, can spend on discretionary objects, the hallmark of inventory market progress worldwide.

This 12 months has additionally been notably unfortunate for Indian inventory market traders because of the uncertainty added by politics.

Analysts level to hypothesis {that a} dip in voter turnout through the first two phases of the continuing common elections might imply that Prime Minister Narendra Modi’s BJP could win fewer parliamentary seats than anticipated.

The India VIX index, extra broadly often called a worry gauge, has risen for 11 straight days, the longest run since March 2020. The index hit a document low earlier than the election, however has since had its highest shut in additional than a 12 months.

Lastly, a number of Indian shares additionally seem to be deflating out of a bubble, in line with Kevin Carter, chief funding officer of the agency behind the India Web & Ecommerce ETF.

As an example, One97 Communications, the proprietor of fintech large Paytm and as soon as backed by Buffett, has fallen practically 80% since its IPO in 2021. Other than its valuation normalizing, certainly one of its former associates is coping with a regulatory disaster.

However market watchers say elevated volatility and lackluster index efficiency imply there’s cash to be made if traders look nearer.

“This entire story is so early in India, and sure, there was a pandemic-fueled bubble. However that does not imply that the chance for actual traders does not nonetheless exist,” Carter added. “For those who thought the Indian alternative regarded good earlier than, you possibly can 1715318252 get twice as a lot of it for a similar worth.”

Ignore the turbulence in Indian banks, like HDFC, because the central financial institution tightens the screws and as an alternative flip towards microfinance lenders akin to Ujjivan Monetary Providers, Agrawal mentioned.

The previous is down 12% over the previous 12 months, whereas the latter has greater than doubled.

Have to know

Modi casts his vote at election half-way level. India’s election crossed the half-way stage this week with counting set to start on June 4. Prime Minister Narendra Modi solid his poll on Tuesday within the Gandhinagar Lok Sabha constituency within the west of the nation. Modi’s shut aide, Amit Shah, is the BJP candidate there.

4 arrested on suspicion of duping males into preventing for Russia. 4 folks have been detained by Indian police on suspicion of luring younger males to combat for Russia in opposition to Ukraine. They have been reportedly promised profitable jobs or college locations. Thus far, about 35 folks have been lured into such conditions, in line with India’s Central Bureau of Investigation.

Mumbai Indians drop out of the Indian Premier League. The cricket membership on Wednesday was the first to be knocked out of the 2024 match. On the time of the keystroke, Royal Challengers Bengaluru have been dealing with Punjab Kings and had the higher hand. Virat Kohli and Rajat Patidar are on the wicket 95 for two.

What occurred within the markets?

The Indian inventory market indexes, the Sensex and Nifty 50, are having a depressing week — each down about 2%. The benchmarks have practically given up all their features for the 12 months, up by beneath 1% since January.

The ten-year Indian authorities bond yield crawled decrease within the final week to 7.13%. The Indian rupee dipped after which trimmed its losses in opposition to the U.S. greenback.

On CNBC TV this week, we had Praveer Sinha, the CEO of Tata Energy, who mentioned what the corporate is doing to spice up its renewable power capability. He predicted “big progress” within the nation’s energy demand over the subsequent decade.

We additionally had extra on Qualcomm, with Savi Soin, the president of the agency’s India unit, discussing alternatives within the Indian market.

And retaining with the tech theme, Ahmed Mazhari, the president at Microsoft Asia, spoke of the corporate’s investments in Asia. He mentioned India had a “nice variety of graduates” however questioned what number of of them have the “abilities and the proficiencies of at the moment.”

What’s taking place subsequent week?

The elections will proceed subsequent week with voting staggered till June 1 and counting beginning just a few days afterward.

Subsequent week, we’ll have a list for Aadhar Housing Finance, with shares out there on the secondary market of the NSE and BSE on Wednesday.

TBO Tek, a journey distribution platform, can even listing on Wednesday after the subscription interval closes Friday.