-

Nvidia reported its second-quarter earnings after Wednesday’s closing bell.

-

The chipmaker beat second-quarter income and EPS estimates.

-

Nonetheless, Nvidia’s inventory slid after its Q3 income steerage did not hit essentially the most bullish of expectations.

Nvidia’s delivered sturdy second-quarter earnings on Wednesday — however that wasn’t sufficient to satiate the sky-high expectations of some on Wall Avenue.

The corporate’s inventory, which is thought to fluctuate considerably within the wake of its earnings, was down greater than 5% in after-hours buying and selling after the corporate failed to fulfill the very best of analysts’ expectations for Q3 income steerage.

However the firm demonstrated that AI spending continues to be going sturdy.

The chipmaker notched $30.04 billion in income for the previous quarter, outpacing consensus estimates of $28.86 billion. Nonetheless, it was a slimmer income beat than current quarters.

The corporate additionally beat estimates for steerage, reporting it expects about $32.5 billion in Q3 income, in comparison with common estimates of $31.77 billion.

Nonetheless, that Q3 income forecast failed to fulfill a number of the loftiest expectations for the third quarter, or the Wall Avenue “whisper quantity” that some analysts hoped the corporate would hit. Dan Morgan, an investor at Synovus, stated the Wall Avenue whisper quantity was $33 billion to $34 billion.

Anticipation has been excessive for Nvidia’s earnings, because the agency has primarily grow to be a bellwether for the broader AI trade.

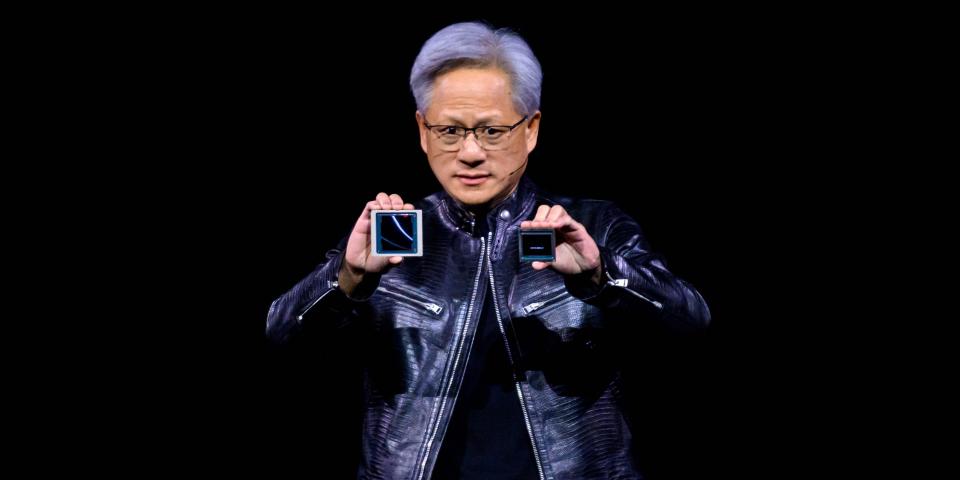

The large query on everybody’s thoughts was the standing of the much-anticipated Blackwell chips, the following era after the Hopper GPUs that tech corporations have been clamoring to get their arms on. Current reviews of a possible delay in Blackwell’s rollout drew considerations over the attainable trade influence.

Nvidia CEO Jensen Huang stated Blackwell demand was “unimaginable” and the corporate stated it anticipated to ship “a number of billion” in income from gross sales of the brand new chip structure in This fall. However it additionally acknowledged that manufacturing issues associated to Blackwell impacted gross margins up to now quarter.

“We shipped buyer samples of our Blackwell structure within the second quarter,” Nvidia’s CFO stated in ready remarks.

“We executed a change to the Blackwell GPU masks to enhance manufacturing yield,” she added. “Blackwell manufacturing ramp is scheduled to start within the fourth quarter and proceed into fiscal 2026.”

Huang stated demand continued to be “actually sturdy” for Nvidia’s present Hopper chips, and that AI corporations had been seeking to deploy their capital and construct out their knowledge facilities now with what was presently out there.

Whereas fielding questions from analysts, Nvidia’s CEO stated that the corporate is seeing the “momentum of generative AI accelerating.”

That is a wrap! Huang ends the decision with closing remarks and a abstract of his 5 foremost takeaways.

Along with emphasizing Hopper’s continued demand, Huang highlights the highest takeaways of the decision earlier than signing off.

His factors embrace that the chipmaker is on its journey to modernize a trillion {dollars} price of knowledge facilities from general-purpose to accelerated computing.

He additionally reminds analysts that Blackwell is an AI infrastructure platform, not only a GPU, and highlights its efficiency beneficial properties over Hopper.

Huang mentions the significance of NVLink, which is important for low latency, excessive output, and enormous language fashions.

Huang additionally briefly discusses the speedy acceleration of generative AI and the way it’s evolving into completely different modalities. He mentions how Nvidia can help completely different companies with AI developments and ends the decision.

The inventory continues to be buying and selling down greater than 5% as the decision concludes.

Nvidia’s CEO fields a closing query from analysts.

Huang talks up Nvidia’s strategy to the Blackwell system rack, and the varied configurations it is available in, and the logistics hubs the corporate has scaled out with companions to ensure it may well meet clients’ particular calls for for his or her knowledge facilities.

Demand for Hopper is predicted to proceed, nevertheless it’s not clear how a lot

Kress says Hopper will proceed to develop within the second half of the 12 months, however is not giving actual estimates on what’s anticipated within the third or fourth quarter.

Income from the start of Blackwell’s rollout will probably be on prime of that in This fall.

Up to now, the executives’ statements have not been capable of push the inventory out of the purple in after-hours buying and selling.

The inventory continues to be buying and selling down greater than 5% in after hours buying and selling halfway by means of the earnings name.

Huang talks about why Hopper demand continues to be excessive as Blackwell rollout approaches

Huang says demand for Hopper is “actually sturdy” whereas demand for Blackwell is “unimaginable.”

Nvidia’s CEO says gen AI corporations spend the overwhelming majority of invested capital into infrastructure, and these corporations “want it now” — that is the place Hopper chips come into play, as they’re out there now.

So whereas curiosity in Blackwell and its ramp is excessive, standing up Blackwell’s capability continues to be weeks or months away, and the Hopper collection is there to catch rapid demand.

Nvidia’s CFO talks concerning the enhance in sovereign AI income

Kress stated “there’s an increasing number of pleasure” round AI fashions and what they’ll supply to completely different international locations.

Nvidia’s CEO explains what’s taking place with gen AI proper now

Huang does a short dive into the state of gen AI following a query about how Nvidia is measuring buyer return and the way that impacts its capital expenditures.

“We’re seeing momentum of generative AI accelerating,” Huang says.

He mentions that frontier fashions are rising at a considerable charge and the trade is seeing the advantages of scaling.

To satisfy demand, Nvidia has to proceed to drive down vitality consumption and prices, the CEO says.

Huang says the change to the Blackwell GPU masks is full

“There have been no practical modifications obligatory,” Huang stated, reiterating that Blackwell manufacturing is predicted to start out within the fourth quarter.

It is time for analysts’ questions.

Questions from analysts have begun. The primary query is about every other modifications to the Blackwell system.

The CFO expects China to be a really aggressive market going ahead

Kress says knowledge middle income from China stays under earlier ranges as a result of export controls.

However knowledge middle income in China nonetheless grew sequentially within the second quarter and acted as a “vital contributor” to its complete knowledge middle income, the CFO says.

The earnings name has kicked off!

Nvidia CEO Jensen Huang is on the decision. CFO Colette Kress kicks off the decision and begins delivering ready remarks. The executives will discipline questions from analysts shortly.

Count on analysts to press for extra on anticipated Blackwell This fall gross sales

Nvidia stated it started transport buyer samples of its Blackwell structure in Q2 and expects manufacturing to ramp up in This fall and into the next 12 months.

However analysts will probably attempt to needle in on the anticipated “a number of billion {dollars} in Blackwell income” the corporate expects within the fourth quarter, searching for further colour from executives on how massive or small that quantity may very well be.

Emarketer analyst reacts to outcomes.

Emarketer expertise analyst Jacob Bourne tells BI that Nvidia continues to profit from Huge Tech’s funding in AI, which is fueling “huge demand” for Nvidia chips at the same time as a few of these corporations work to develop their very own rival chips.

“Nvidia as soon as once more delivered spectacular outcomes, beating expectations with margins that rival its earlier blockbuster quarters,” Bourne stated. “Regardless of rising financial uncertainties and AI bubble considerations.”

Bourne added that the discharge of Nvidia’s Blackwell chip will stay key in its continued dominance as corporations like AMD ramp up their efforts to compete within the chipmaking enviornment.

Nvidia’s CFO says manufacturing issues with the corporate’s new Blackwell chip had been partly liable for a dip in gross margin.

Gross margins, a typical measure of profitability within the chip enterprise, declined from the primary quarter of 2024 to the second quarter.

That was “primarily pushed by stock provisions for low-yielding Blackwell materials and the next combine of recent merchandise inside Information Middle,” the CFO writes within the earnings launch.

The inventory slides in after-hours buying and selling after the Q3 income forecast fails to prime essentially the most sky-high of analysts’ expectations.

Nvidia forecast third-quarter income of roughly $32.5 billion. That was under a number of the unofficial bullish estimates on Wall Avenue, often known as “whisper” numbers.

Forward of Wednesday’s outcomes, Dan Morgan, an investor at Synovus, stated the Wall Avenue whisper quantity was $33 billion to $34 billion.

Nvidia beats 2nd quarter income and earnings-per-share estimates, however gross sales outlook for Q3 did not surpass the very best of expectations.

2nd quarter

Income: $30.04 billion, estimate $28.86 billion

-

Information middle income: $26.3 billion, estimate $25.08 billion

-

Skilled Visualization income: $454 million, +20% y/y,

estimate $451.1 million -

Automotive income: $346 million, +37% y/y, estimate $347.9

million

Adjusted gross margin: 75.7% , estimate 75.5%

-

R&D bills: $3.09 billion, +51% y/y, estimate $3.08 billion

-

Adjusted working bills: $2.79 billion, +52% y/y, estimate

$2.81 billion -

Adjusted working revenue: $19.94 billion, estimate $18.85 billion

-

Adjusted EPS: 68c, estimate 64c

-

Free money move: $13.48 billion

Supply: Bloomberg

Wedbush’s Dan Ives touts Nvidia’s earnings as this 12 months’s most vital report.

Wedbush Securities’ Dan Ives stated now could be the time to seize the popcorn, as Nvidia’s earnings ought to blow Wall Avenue estimates out of the water.

The tech bull predicted that Nvidia will ship one other “drop the mic” efficiency, as urge for food for its {hardware} is stronger than ever.

In his view, earlier sector earnings point out that AI demand has not dissipated, spurring upside for Nvidia.

“The cloud numbers and AI knowledge factors from Redmond, Amazon, and Google had been very sturdy throughout earnings season the previous couple of months as this means huge enterprise AI demand is now underway,” he wrote in a brand new be aware on Wednesday.

Wedbush estimates that for every $1 spent on a Nvidia chip, there is a $8-$10 multiplier throughout the tech sector.

“We imagine that is a very powerful earnings report for the inventory market this 12 months and doubtlessly in years for the Avenue as Nvidia would be the earnings report heard all over the world,” Ives wrote.

Wedbush holds an “outperform” score on Nvidia.

Deutsche Financial institution expects earnings power as AI demand stays excessive.

Nvidia’s earnings will mirror previous quarter to ship one other estimate-beating report as AI computing demand stays intact, Deutsche Financial institution analyst Ross Seymore wrote.

“Whereas on the margin some could also be paring again orders forward of the launch of Blackwell, we nonetheless count on mixture demand traits to stay wholesome,” he wrote.

The financial institution cited Nvidia’s expertise roadmap as one cause for Wall Avenue to count on additional steerage power from the agency. Nonetheless, Seymore famous that shares within the firm are already totally valued, as traders are effectively acquainted with Nvidia’s fundamentals at this level.

Deutsche maintains a “Maintain” score on the agency.

Citi says Nvidia’s earnings might fail to dwell as much as the previous 4 quarters.

Citi stated Nvidia’s earnings will fall in need of the $2 billion estimate beat it achieved over the earlier 4 quarters, provided that the potential Blackwell hold-up might impede the agency’s efficiency.

Nonetheless, the financial institution nonetheless anticipates that Nvidia will outpace Wall Avenue forecasts by round $1 billion. Whole quarterly gross sales ought to attain $28.5 billion, Citi stated.

Citi analysts predict that consensus estimates will attain greater for the upcoming quarter, as Blackwell feedback from Nvidia ought to reassure traders a few sturdy outlook for the following calendar 12 months. Publish-earnings, Nvidia’s inventory is prone to attain recent 52-week highs.

Other than Blackwell’s attainable delay, traders will search steerage on Hopper demand, AI enterprise demand, and updates on Nvidia’s ethernet-based networking product, Spectrum X. They can even search feedback on sovereign AI threat and Chinese language GPU restrictions, Citi stated.

Citi maintains a “Purchase” score on Nvidia with a goal value of $150 per share.

Financial institution of America warns Nvidia earnings could also be an underpriced threat.

In keeping with Financial institution of America, there’s a chance that Nvidia’s report underwhelms bullish traders.

“NVDA outcomes have been a key driver of fairness indices, and traders could also be underpricing the danger of a disappointment,” analysts wrote, suggesting that S&P put choices are a superb commerce to hedge in opposition to this end result.

That is probably because the Blackwell delay might mute near-term upside, the financial institution stated in an earlier report.

Nonetheless, this challenge will extra probably take a look at third-quarter outcomes, and Nvidia has methods to dampen any adverse influence earlier than then, BofA added. For example, the agency might depend on bigger Hopper chip shipments to make up for the Blackwell provide crunch.

“We see any selloff as enhanced shopping for alternative as challenges will not be in demand, however in (solvable) provide that won’t basically derail NVDA’s longer-term momentum,” the be aware stated.

Robust Hopper demand this quarter ought to bolster gross sales to $28.6 billion, the financial institution stated, outpacing Nvidia’s $28 billion steerage.

Financial institution of America has a “Purchase” score on Nvidia and a value goal of $150 per share.

Goldman Sachs sees AI demand staying sturdy, fueling one other massive quarter.

Goldman analysts led by Toshiya Hari count on Nvidia’s income and earnings-per-share to beat estimates, because the agency’s fundamentals will assist extra upside.

Power will come from knowledge middle income and the corporate’s sturdy working leverage, Goldman stated. In the meantime, the financial institution cited that Nvidia’s {hardware} continues to be wanted by main cloud service computer systems, and the agency maintains its aggressive lead within the AI computing sector.

For traders involved that AI spending has not but yielded significant outcomes, Nvidia’s earnings ought to fight this narrative, Goldman stated.

“We count on Nvidia administration to supply ROI metrics out there from choose clients on this upcoming earnings name as a approach to instill confidence in traders,” Hari wrote.

Nonetheless, traders ought to anticipate some rapid volatility, Hari wrote, given the Blackwell chip delay.

However this will probably be a short-term headwind, and Nvidia doesn’t lack options. The influence will rely on three elements: the delay’s extent, whether or not clients are keen to tackle the older Hopper chip, and Nvidia’s capability to ramp up manufacturing of a simplified Blackwell mannequin.

Goldman holds a “Purchase” score on Nvidia and a value goal of $135 per share.

Nvidia’s 2nd-quarter consensus income estimate is $28.86 billion.

SECOND QUARTER

-

Income estimate $28.86 billion

-

Information middle income estimate $25.08 billion

-

Gaming income estimate $2.79 billion

-

Skilled Visualization income estimate $451.1 million

-

Automotive income estimate $347.9 million

-

Adjusted gross margin estimate 75.5%

-

R&D bills estimate $3.08 billion

-

Adjusted working bills estimate $2.81 billion

-

Adjusted working revenue estimate $18.85 billion

-

Adjusted EPS estimate 65c

Supply: Bloomberg

Learn the unique article on Enterprise Insider