Billionaire Paul Singer and his fund, Elliott Funding Administration, is making waves. The fund had been in lively discussions with Starbucks on a turnaround plan that subsequently noticed the corporate title a brand new CEO. It is also been in a really public struggle with Southwest Airways and simply nominated 10 new board members for the airline.

In tech land, in the meantime, the fund dumped its shares of Nvidia (NASDAQ: NVDA) whereas beginning a brand new place in Arm Holdings (NASDAQ: ARM).

The sale of Nvidia is not shocking after Elliott referred to as synthetic intelligence (AI) “overhyped” in a letter to shareholders earlier this month. He added that the know-how consumes an excessive amount of vitality and can by no means change into cost-efficient. The letter added that Nvidia was at the moment in “bubble land.”

As an alternative, it seems Singer and firm are inserting their bets on fellow chipmaker Arm within the know-how house.

What makes Arm completely different?

Whereas Nvidia has been drastically benefiting from elevated spending associated to the AI infrastructure buildout, Arm has been an enormous beneficiary of the proliferation of smartphones. In reality, its know-how could be present in nearly all smartphones across the globe.

Arm additionally has a really completely different enterprise mannequin than Nvidia. Whereas Nvidia designs it personal chips, Arm licenses its know-how to be used by different chipmakers. The corporate then collects royalties, based mostly on the variety of chips shipped constructed on its structure. As soon as its know-how is designed right into a product, Arm can acquire royalties for years and even a long time. The corporate has mentioned that almost half its royalty revenue comes from merchandise launched between 1990 and 2012.

Extra lately, Arm has been shifting prospects to a subscription mannequin the place they’ll get entry to a broad array of the corporate’s mental property. On the finish of Q2, it had 33 prospects utilizing its Arm Whole Entry platform and 241 utilizing its Arm Versatile Entry platform.

Whereas the corporate is the chief within the smartphone house, it is now seeking to take a significant share within the Home windows-based private pc (PC) market. The corporate has a objective of gaining no less than 50% market share within the house within the subsequent 5 years.

It is already in all Mac-based computer systems and can look to capitalize on PC makers making an attempt to make their laptop computer designs extra much like MacBook Airs. It is also been taking share within the automotive market, seeing progress of 28% within the vertical in Q2.

Whereas Elliott has lately mentioned that AI is overhyped, Arm has additionally been benefiting from the AI buildout. On its Q2 earnings name, the corporate mentioned it was seeing elevated licensing within the AI knowledge middle as a result of want for personalization, which then requires Arm-based chips.

The corporate additionally has a collaborative chip with Nvidia referred to as the Grace Hopper, which integrates an Arm-based central processing unit (CPU) with a Nvidia Hopper graphics proccessing unit (GPU). It’ll even be designed into Nvidia’s next-generation Grace Blackwell chip.

As well as, Arm know-how has been used for brand spanking new CPU knowledge middle chips from each Alphabet and Amazon. Whereas Arm is not benefiting as a lot as Nvidia from the buildout of AI infrastructure, it is nonetheless benefiting. In the meantime, cloud computing firms proceed to pour cash into constructing this infrastructure.

Is it time to purchase Arm?

Elliott’s funding in Arm doubtless extends a bit past the corporate to its largest shareholder Softbank (OTC: SFTBF), which owns about 90% of the chipmaker. In June, it was revealed that Elliott had taken an over $2 billion stake within the Japanese funding agency. Elliott has referred to as for Softbank to buyback $15 billion in inventory, whereas the corporate lately introduced a lesser $3.4 billion repurchase plan.

Given Elliott’s feedback on AI, the fund additionally in all probability would really like Softbank and Arm to maneuver away from their plans to develop their very own AI chips and construct out AI knowledge facilities across the globe. It is also potential that Elliott has taken an anti-AI stance to attempt to persuade Softball and Arm of this and, as a substitute, purchase again its inventory.

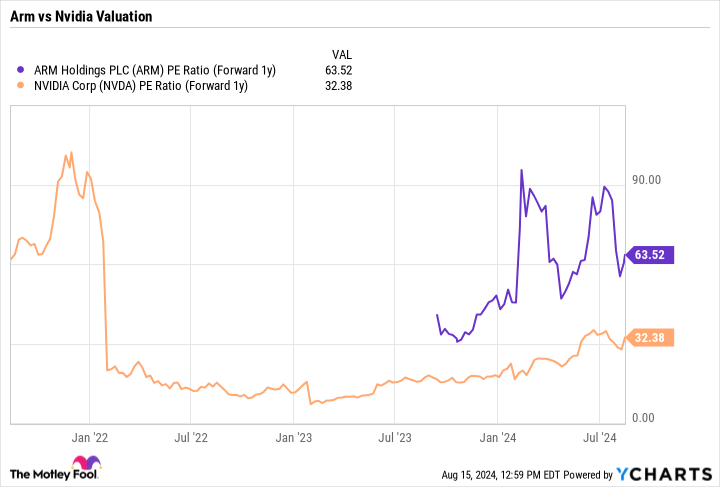

Elliott has stakes in each Softbank and Arm, so the fund’s final play is unknown. Taking a look at Arm in isolation, its inventory trades at a ahead price-to-earnings ratio (P/E) of 63.5 instances, based mostly on 2025 analyst estimates. That is exponentially dearer than Nvidia, though Arm arguably has one of the vital enticing enterprise fashions within the chip house, given the period of time it collects royalties on merchandise, in addition to the license income it generates.

Following Arm’s current pullback, I believe the inventory is extra enticing now than beforehand. Nonetheless, I would choose to take a begin place and dollar-cost common into the inventory on any future weak point than pile into it presently, given its valuation. In the meantime, if Elliott is appropriate that AI is overhyped, its Arm funding is not resistant to an AI downturn.

Do you have to make investments $1,000 in Arm Holdings proper now?

Before you purchase inventory in Arm Holdings, contemplate this:

The Motley Idiot Inventory Advisor analyst staff simply recognized what they consider are the 10 finest shares for traders to purchase now… and Arm Holdings wasn’t one in every of them. The ten shares that made the minimize might produce monster returns within the coming years.

Take into account when Nvidia made this listing on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $763,374!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of August 12, 2024

John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Geoffrey Seiler has positions in Alphabet. The Motley Idiot has positions in and recommends Alphabet, Amazon, Nvidia, and Starbucks. The Motley Idiot recommends Southwest Airways. The Motley Idiot has a disclosure coverage.

Billionaire Paul Singer Simply Bought Nvidia to Purchase This Chip Inventory was initially printed by The Motley Idiot