Some of the well-known entrepreneurs and philanthropists in latest historical past is Invoice Gates. As a co-founder of Microsoft (NASDAQ: MSFT), he helped pioneer fashionable computing and revolutionize how individuals talk and work.

Whereas he not manages the day-to-day enterprise at Microsoft, Gates continues to be an lively businessman. He and his ex-wife, Melinda French, constructed a charitable belief that’s now value roughly $46 billion. Maybe unsurprisingly, Microsoft shares make up the most important fraction of the Invoice & Melinda Gates Basis Belief — practically one-third of the portfolio’s whole worth.

Let’s check out Microsoft’s enterprise, and assess why the expertise inventory might be a terrific purchase for long-term buyers.

Microsoft is one among a sort

Microsoft was based 49 years in the past out of a Harvard dorm room. Initially identified for its Home windows working system, Microsoft has developed into a way more subtle enterprise during the last half-century.

The corporate has made numerous strategic acquisitions which have helped it turn out to be one of many world’s most diversified expertise platforms. Right now, Microsoft owns skilled social networking website LinkedIn in addition to online game large Activision Blizzard.

Whereas LinkedIn opened Microsoft as much as a wide range of completely different buyer bases together with gross sales and advertising and marketing professionals and company executives, Activision Blizzard represented an fascinating complement to the corporate’s present online game footprint in Xbox.

Furthermore, Microsoft is without doubt one of the most ubiquitous office productiveness platforms in the marketplace. The corporate’s Workplace Suite contains a number of the mostly used productiveness software program functions within the office, amongst them Excel and PowerPoint. As well as, the corporate’s well-liked Groups service competes with Zoom, Salesforce, and different video conferencing and chat suites.

However maybe Microsoft’s greatest latest success has been with cloud computing. Regardless of intense competitors from Amazon and Alphabet, the Azure cloud unit persistently stays one among Microsoft’s top-performing sources of progress.

Moreover, following a $10 billion funding in ChatGPT developer OpenAI, Microsoft is making it clear that synthetic intelligence (AI) will turn out to be more and more ingrained into its ecosystem and represents the following frontier within the firm’s evolution.

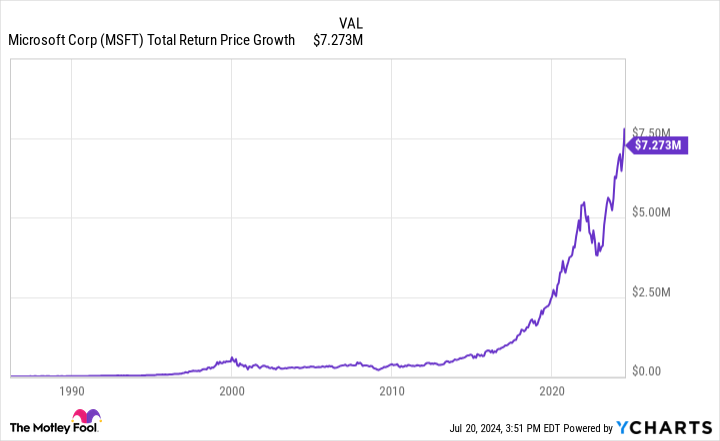

Holding Microsoft inventory for the long term has paid off in spades

The chart under illustrates the whole return of a $1,000 funding in Microsoft inventory on the time of its preliminary public providing. Clearly, proudly owning Microsoft for the lengthy haul has been each a profitable and clever choice. Nonetheless, holding onto any single inventory and reinvesting dividends for practically 50 years requires unwavering monetary self-discipline.

Is Microsoft inventory purchase proper now?

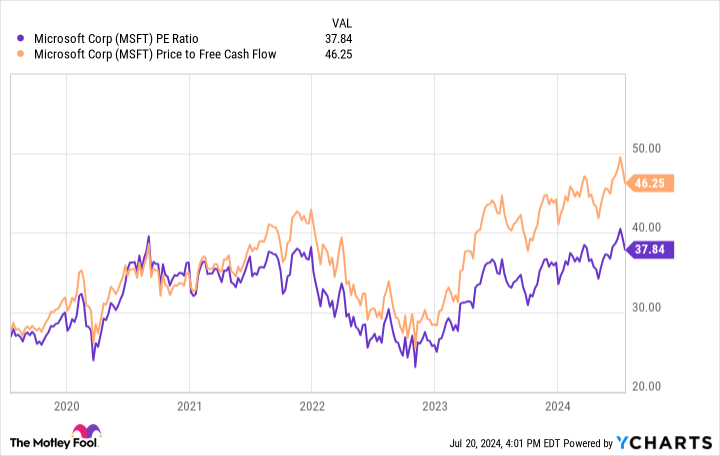

Microsoft shares at present commerce at a price-to-earnings (P/E) ratio of 37.8. In contrast, the common P/E of the S&P 500 is just 27.5. Not solely is Microsoft inventory buying and selling at a major premium to the broader market, however its P/E ratio and its price-to-free-cash-flow (P/FCF) a number of are each close to their five-year highs. Merely put, Microsoft isn’t an inexpensive inventory.

Nonetheless, that does not essentially make it a poor alternative. In reality, I might argue that Microsoft’s premium is well-deserved. The corporate has confirmed over the course of many years that it could actually persistently innovate and introduce services and products that can be utilized by customers throughout many various demographics and finish markets.

The long-term returns of proudly owning Microsoft inventory have been laborious to rival, and I feel the corporate’s latest chapter is simply starting to be written. AI is right here to remain in some kind or vogue for years to return, and Microsoft has a deep ecosystem into which it could actually combine new AI-powered companies — from the office to private computing, social networking, gaming, and extra.

Simply as the corporate disrupted and revolutionized private computing and cloud infrastructure, I see AI as a serious tailwind for Microsoft’s enterprise over the following a number of many years.

Whereas the inventory could also be a bit expensive, it is laborious to think about a case through which Microsoft’s progress prospects all of the sudden plateau or diminish. I feel now could be a good time to scoop up shares of Microsoft and put together to carry for the long term because the AI narrative continues to play out.

Do you have to make investments $1,000 in Microsoft proper now?

Before you purchase inventory in Microsoft, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Microsoft wasn’t one among them. The ten shares that made the minimize might produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… should you invested $1,000 on the time of our advice, you’d have $751,180!*

Inventory Advisor gives buyers with an easy-to-follow blueprint for fulfillment, together with steerage on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of July 22, 2024

John Mackey, former CEO of Entire Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Suzanne Frey, an government at Alphabet, is a member of The Motley Idiot’s board of administrators. Adam Spatacco has positions in Alphabet, Amazon, and Microsoft. The Motley Idiot has positions in and recommends Alphabet, Amazon, Microsoft, Salesforce, and Zoom Video Communications. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Billionaire Invoice Gates Has 33% of His $46 Billion Basis Invested In This As soon as-In-A-Era Synthetic Intelligence (AI) Inventory was initially printed by The Motley Idiot