Nvidia (NASDAQ: NVDA) is arguably the world’s hottest synthetic intelligence (AI) inventory, as evidenced by its 215% acquire prior to now 12 months alone. It is not a declare with out advantage, as a result of the corporate’s income greater than doubled in fiscal 2024 (which ended Jan. 28) on the again of its industry-leading AI knowledge heart chips.

But when traders need to know the place the AI {industry} is headed subsequent, it may be useful to know the place billionaires are placing their cash. Invoice Ackman, for instance, manages a $10 billion inventory portfolio for his hedge fund, Pershing Sq. Capital Administration, and he does not personal Nvidia in any respect.

As a substitute, Ackman owns a $1.9 billion place in Google mother or father Alphabet (NASDAQ: GOOG)(NASDAQ: GOOGL). Not solely has he made stable features on that funding already, however the inventory can be nonetheless low-cost and may very well be poised for additional upside because of the corporate’s AI initiatives.

Here is why it isn’t too late for traders to observe Ackman’s lead.

Microsoft created a chance for Ackman to purchase Alphabet

It is no coincidence Invoice Ackman purchased Alphabet inventory within the first quarter of 2023 when Microsoft (NASDAQ: MSFT) introduced its $10 billion funding in main AI startup OpenAI. Microsoft shortly built-in OpenAI’s ChatGPT expertise into its Bing search engine, in an try and disrupt Google’s 91% market share within the web search {industry}.

Conventional search engines like google like Google sometimes make the person sift via net pages for the knowledge they want, whereas Bing’s new chatbot interface can immediately present a direct reply to nearly any query. It is a much more handy expertise. Alphabet inventory plunged as a result of traders feared the corporate fell means behind Microsoft on the AI entrance, however Ackman seen that as a shopping for alternative.

In a current interview with David Rubenstein, Ackman mentioned Alphabet’s valuation had fallen a lot that he was getting an ideal deal on the corporate’s current companies, like search and YouTube, whereas getting its AI initiatives principally without spending a dime.

It is fascinating to notice that Ackman felt Alphabet’s AI expertise was neck-and-neck with OpenAI’s when he made the funding, despite the fact that Alphabet hadn’t launched its personal AI chatbot but.

Alphabet’s Gemini now outperforms OpenAI’s newest GPT-4 fashions

Shortly after Microsoft introduced its OpenAI funding, Alphabet reminded traders it had been engaged on AI for years. In any case, Google acquired AI startup DeepMind means again in 2014. That is why it took only some months to launch Google Bard, a chatbot designed to compete instantly with ChatGPT.

The standard of a generative AI software comes right down to the standard of the developer’s knowledge, and since Google has been the window to the web for many years, it arguably has extra helpful info with which to construct AI purposes than another firm.

Bard paved the way in which for Alphabet’s newest and best household of AI fashions known as Gemini, which have been launched in December. In response to Alphabet, Gemini outperforms OpenAI’s most superior GPT-4 fashions throughout most multimodal benchmarks. In different phrases, it is able to deciphering and producing textual content content material, pictures, movies, and laptop code extra precisely.

Alphabet introduced the discharge of Gemini 1.5, which is much more superior, in February. The corporate says it is higher at “in-context studying,” which means it may be taught new abilities from customers’ prompts without having further fine-tuning from builders. In a single check, Alphabet gave Gemini 1.5 a grammar handbook for a uncommon language known as Kalamang — which has fewer than 200 audio system worldwide — and it may translate it at the same stage to human topics who used the identical studying materials.

Gemini is now obtainable as a standalone chatbot, however its expertise can be woven into the normal Google Search engine to feed customers text-based responses of their search outcomes. That reduces the period of time customers must spend clicking via to third-party net pages for the knowledge they want, hanging a steadiness between conventional search and the chatbot expertise.

Ackman is sitting on massive features, however Alphabet inventory can nonetheless go greater

Ackman purchased the majority of Pershing Sq.’s Alphabet place within the first quarter of 2023, at an estimated common worth of $96.56. That means he is sitting on a 60% acquire based mostly on the inventory’s present worth of $154.85. Ackman added to his holdings within the second and third quarters of 2023, and he is sitting on a revenue on these positions, too. However it is not too late for traders to observe his lead, as a result of the inventory continues to be comparatively low-cost.

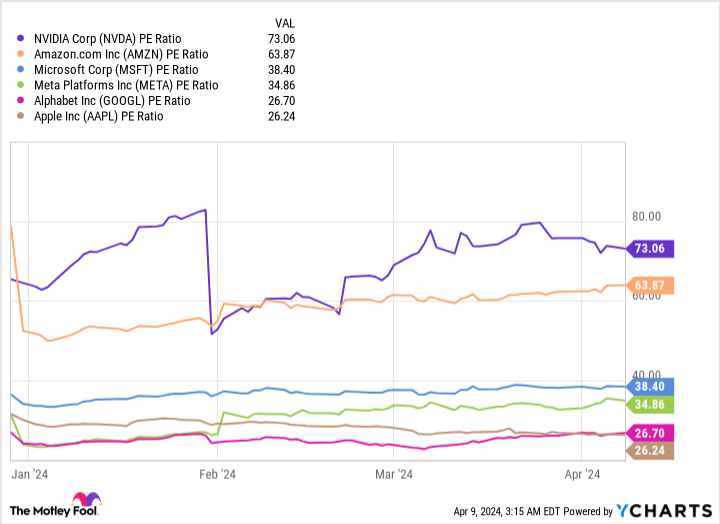

Alphabet generated a document $307.4 billion in income in 2023, with $5.80 in earnings per share (that’s, revenue). The latter locations Alphabet inventory at a price-to-earnings (P/E) ratio of 26.7. Which means Alphabet is the second-cheapest inventory among the many six U.S. tech giants valued at $1 trillion or extra:

The promoting {dollars} generated by Google Search nonetheless account for many of Alphabet’s income. Nonetheless, Google Cloud is the corporate’s fastest-growing phase because of its rising portfolio of AI companies. Companies and builders can entry the newest knowledge heart infrastructure and ready-made massive language fashions, together with Gemini, on Google Cloud to construct their very own AI purposes.

Alphabet can be weaving Gemini into its different merchandise, corresponding to Google Docs and Gmail, providing a productiveness increase to prospects who can now use AI to quickly craft content material in these purposes. Longer-term, Alphabet is reportedly negotiating with Apple to make Gemini the default AI chatbot on that firm’s gadgets, together with the iPhone. Particulars are scarce, however it may very well be an unbelievable alternative, contemplating Apple has an put in base of greater than 2.2 billion gadgets worldwide.

I believe Ackman made a spectacular wager on Alphabet, and his $1.9 billion place is more likely to proceed to develop in worth.

Do you have to make investments $1,000 in Alphabet proper now?

Before you purchase inventory in Alphabet, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they imagine are the 10 finest shares for traders to purchase now… and Alphabet wasn’t one in every of them. The ten shares that made the reduce may produce monster returns within the coming years.

Contemplate when Nvidia made this listing on April 15, 2005… in the event you invested $1,000 on the time of our suggestion, you’d have $522,969!*

Inventory Advisor gives traders with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than quadrupled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of April 8, 2024

Suzanne Frey, an govt at Alphabet, is a member of The Motley Idiot’s board of administrators. Randi Zuckerberg, a former director of market improvement and spokeswoman for Fb and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Idiot’s board of administrators. John Mackey, former CEO of Complete Meals Market, an Amazon subsidiary, is a member of The Motley Idiot’s board of administrators. Anthony Di Pizio has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Alphabet, Amazon, Apple, Meta Platforms, Microsoft, and Nvidia. The Motley Idiot recommends the next choices: lengthy January 2026 $395 calls on Microsoft and quick January 2026 $405 calls on Microsoft. The Motley Idiot has a disclosure coverage.

Neglect Nvidia: Billionaire Invoice Ackman Owns $1.9 Billion Price of This Synthetic Intelligence (AI) Inventory As a substitute was initially revealed by The Motley Idiot