Carl Icahn is likely one of the most well-known buyers in historical past. All through the Nineteen Eighties and Nineteen Nineties, he turned often called a company raider, shopping for up huge stakes in corporations in an try and pressure change. Over the a long time, he has gathered a multibillion-dollar fortune.

Icahn has by no means shied away from making huge bets. Proper now, he has practically his complete fortune — some $6.3 billion — tied up in a single inventory. Shares are at the moment priced at historic lows, probably making this a profitable strategy to wager alongside a legendary billionaire investor.

Billionaire Carl Icahn is betting on himself

It ought to come as no shock that Carl Icahn has the vast majority of his cash tied up in an organization named after himself: Icahn Enterprises (NASDAQ: IEP). Included in 1987, Carl Icahn has lengthy used Icahn Enterprises as his foremost funding automobile. He at the moment owns greater than 80% of the corporate, a stake value roughly $6.3 billion. In essence, Carl Icahn is totally in command of Icahn Enterprises, and the corporate’s inventory value is a direct results of his long-term decision-making skills.

Icahn Enterprises is a conglomerate enterprise. Which means it is a conglomeration of disparate companies, a lot of which don’t have anything to do with one another. As of final quarter, the online asset worth of those companies totaled round $4.8 billion. A few of that internet asset worth is comprised of varied actual property belongings, in addition to a handful of business and automotive companies. Round two-thirds of the worth, nonetheless, is tied up in simply two issues: a stake in CVR Vitality, an oil refiner, and a holding curiosity in Carl Icahn’s funding funds, which function individually from the corporate. So, whereas Carl Icahn has diversified the operation considerably, it’s closely reliant on the efficiency of each CVR Vitality and his funding funds.

Carl Icahn is probably going nicely conscious that Icahn Enterprises has concentrated its bets. These bets appear to signify the 2 areas by which he has the very best conviction. With a long-term monitor document of manufacturing multibillion-dollar fortunes, buyers can immediately wager alongside Carl Icahn just by buying shares of Icahn Enterprises.

One downside that does not make very a lot sense

It is a affordable technique to speculate alongside legendary billionaire buyers. Simply have a look at Berkshire Hathaway. Affected person buyers who trusted Warren Buffett have compounded double-digit annual returns for many years. However Icahn Enterprises is not Berkshire Hathaway. Not even shut. Since 1998, Berkshire Hathaway inventory has risen greater than 1,000% in worth. Icahn Enterprises inventory, in the meantime, has added simply 69% in worth. The corporate, nonetheless, has paid a daily stream of massive dividends. These dividends shut the hole considerably, with Icahn Enterprises delivering a 630% whole return over that interval. However there’s nonetheless no denying that Berkshire Hathaway has confirmed a superior long-term funding with far much less volatility. Plus, in case you had reinvested your Icahn Enterprises dividends again into Icahn Enterprises inventory, your whole returns would have been nicely under 630%.

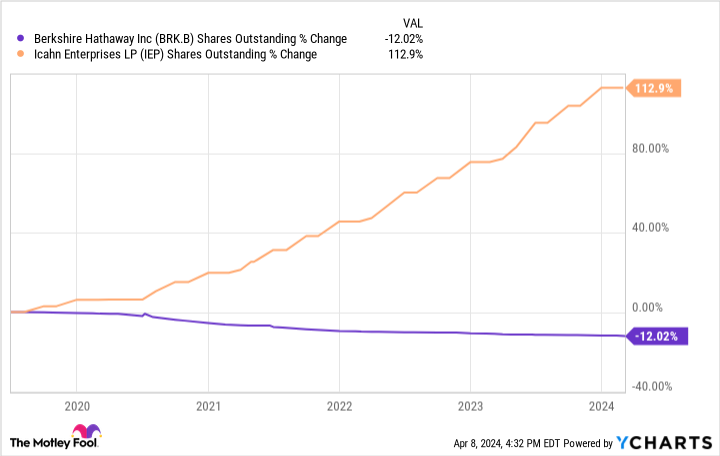

Why, then, does Icahn Enterprises inventory appear to commerce at a premium to Berkshire Hathaway? On a price-to-book foundation — a quite simple metric that gauges how a lot the market is keen to pay for an organization’s belongings — Icahn Enterprises at the moment trades at 2.3 instances guide worth. Berkshire, in the meantime, trades at simply 1.6 instances guide worth. There’s even motive to consider that Berkshire’s price-to-book a number of is overinflated, on condition that the corporate has repurchased tens of billions of {dollars} in shares over time. These repurchases created plenty of shareholder worth, however resulting from accounting guidelines, they’ve suppressed the corporate’s true guide worth. Icahn Enterprises, in the meantime, has been issuing new shares hand over fist. During the last 5 years, its share rely has exploded by 112%.

It is onerous to justify shopping for Icahn Enterprises over Berkshire Hathaway, particularly given the premium valuation. Icahn Enterprises’ portfolio of companies, it is onerous to argue that something must be valued above guide worth. The worth of the corporate’s curiosity in Carl Icahn’s funding funds, for instance, went from $4.2 billion final yr to only $3.2 billion as we speak. Its stake in CVR Vitality, in the meantime, which must be valued close to guide worth since it is a publicly traded asset, has fallen in worth from $2.2 billion to solely $2 billion over the identical time interval. The remainder of Icahn Enterprises’ belongings aren’t faring significantly better. Considered one of its automotive companies, for instance, entered chapter final summer season.

Carl Icahn is betting large sums of cash on Icahn Enterprises, however that is probably as a result of he has to. The corporate’s worth would probably collapse if he all of the sudden tried to promote all his shares. As a result of shares commerce at an inexplicable premium to Warren Buffett’s Berkshire Hathaway, buyers are probably higher off betting with that billionaire than this one.

Do you have to make investments $1,000 in Icahn Enterprises proper now?

Before you purchase inventory in Icahn Enterprises, take into account this:

The Motley Idiot Inventory Advisor analyst group simply recognized what they consider are the 10 greatest shares for buyers to purchase now… and Icahn Enterprises wasn’t considered one of them. The ten shares that made the lower might produce monster returns within the coming years.

Inventory Advisor gives buyers with an easy-to-follow blueprint for achievement, together with steering on constructing a portfolio, common updates from analysts, and two new inventory picks every month. The Inventory Advisor service has greater than tripled the return of S&P 500 since 2002*.

*Inventory Advisor returns as of April 8, 2024

Ryan Vanzo has no place in any of the shares talked about. The Motley Idiot has positions in and recommends Berkshire Hathaway. The Motley Idiot has a disclosure coverage.

Billionaire Investor Carl Icahn Is Betting $6.3 Billion on This 1 Inventory was initially revealed by The Motley Idiot