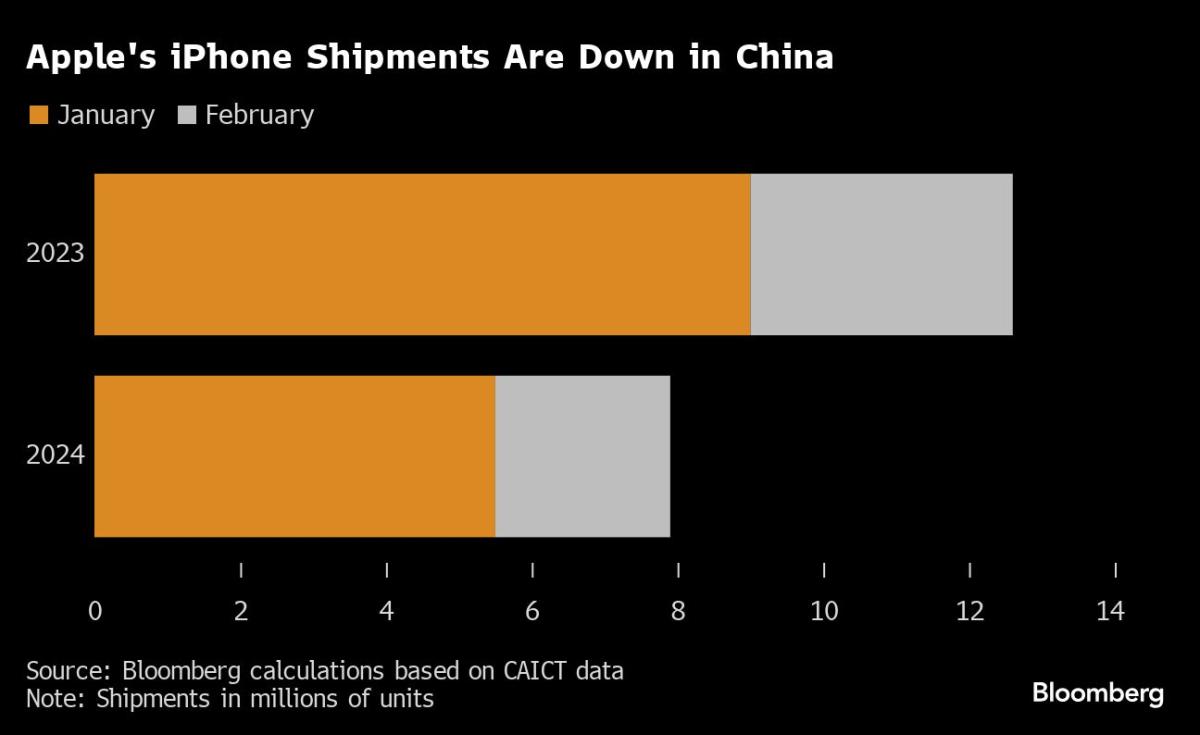

(Bloomberg) — Apple Inc.’s iPhone shipments slid a bigger-than-projected 10% within the March quarter, reflecting flagging gross sales in China regardless of a broader smartphone business rebound.

Most Learn from Bloomberg

The corporate shipped 50.1 million iPhones within the first three months, in accordance with IDC’s preliminary figures, falling shy of a median of analyst estimates compiled by Bloomberg of 51.7 million items for the interval.

The Cupertino, California-based firm has struggled to maintain gross sales on this planet’s largest smartphone market for the reason that debut of its newest iPhone era in September. The resurgence of Huawei Applied sciences Co., extra home competitors and a Beijing ban on overseas gadgets within the office have all weighed on gross sales.

The droop is particularly pronounced towards the backdrop of the general cell market registering its finest development in years. Smartphone makers shipped 289.4 million handsets within the interval, marking a 7.8% rise from the trough of a 12 months in the past, when many producers had been grappling with a surfeit of unsold gadgets. Samsung Electronics Co. regained the highest spot within the March quarter, whereas budget-focused model Transsion elevated shipments by 85% and Xiaomi Corp. bounced again to shut the hole on second-place Apple.

“The smartphone market is rising from the turbulence of the final two years each stronger and adjusted,” mentioned Nabila Popal, analysis director at IDC. “Whereas the highest two gamers each noticed unfavourable development within the first quarter, it appears Samsung is in a stronger place total than they had been in latest quarters.”

Outstanding Apple suppliers Hon Hai Precision Business Co., Murata Manufacturing Co., LG Innotek Co. and TDK Corp. fell in early Asia buying and selling on Monday, amid a broader selloff on fears of escalating battle within the Center East.

Through the pandemic, Apple’s iPhone confirmed the best resilience as shoppers pulled again from purchases of smartphones by most of its Android-powered rivals. That stock buildup led to aggressive pricing by Chinese language rivals like Xiaomi, which took months to exhaust their oversupply and are actually beginning to ramp shipments again up. Huawei’s shock return to prominence final 12 months — with its personal made-in-China chip and HarmonyOS working system on the Mate 60 collection — has been eroding Apple’s share of China’s premium market since August.

“Elevated competitors in China is a giant a part of Apple’s decline in Q1,” Popal mentioned. Elsewhere, plenty of areas began the 12 months with extra iPhone stock after heavy shipments within the last months of 2023, she added.

Common promoting costs for handsets are rising, as shoppers more and more go for premium fashions that they intend to carry on to for longer, IDC’s researchers discovered. Apple, which constantly maintains the very best ASP within the business, has led the way in which on this, with shoppers displaying a definite choice for its higher-tier fashions. Nonetheless, the corporate has this 12 months resorted to uncommon reductions to spur gross sales, with some retail companions in China taking as a lot as $180 off the common value.

In March, Apple opened a big new retailer within the middle of economic hub Shanghai, with Chief Govt Officer Tim Cook dinner in attendance. China is host to the corporate’s largest retail community outdoors the US and accounts for roughly a fifth of gross sales, that are nonetheless pushed by the iPhone. Lots of the attendees who spoke to Bloomberg on the Shanghai retailer launch had acquired their iPhones greater than two years in the past, nevertheless. And whereas these Apple followers mentioned they meant to stay inside the Apple ecosystem, some mentioned they had been additionally contemplating foldable gadget choices from rivals or Huawei’s Mate 60 successor.

What Bloomberg Intelligence Says

–With help from Jessica Sui.

(Updates with inventory reactions and commentary)

Most Learn from Bloomberg Businessweek

©2024 Bloomberg L.P.