It’s probably the most fundamental query buyers face: What shares to purchase? The markets are tossing up an enormous quantity of knowledge from tens of millions upon tens of millions of each day transactions, involving 1000’s of merchants, sellers, and brokers, and 1000’s of public shares. The information makes an imposing edifice – and is tailor made for information sorting instruments just like the Good Rating.

The Good Rating is an AI-powered pure language algorithm, refined sufficient to scan, acquire, collate, and analyze all these reams of knowledge – after which to match each inventory’s newest stats to a set of things recognized to match up with future share outperformance. The result’s distilled right down to a easy, simply readable rating, a single quantity on a scale of 1 to 10, displaying buyers at a look the probably most important monitor for any inventory. The ‘Excellent 10’ shares are the shares that clearly deserve a more in-depth look.

And when the Avenue’s analysts begin throwing their very own weight behind the Excellent 10s, that’s a double signal that buyers shouldn’t ignore.

With this as backdrop, we’ve used the TipRanks database to choose up the main points on a few shares which have earned the Good Rating’s Excellent 10. Right here’s the lowdown.

MGM Resorts (MGM)

The primary inventory on our listing, MGM Resorts, is greatest often known as one of many Vegas Strip’s venerable names. At present, the corporate is a member of the S&P 500 index and operates 31 resort and gaming locations all over the world, together with in Vegas but in addition in Maryland, Massachusetts, Michigan, Mississippi, and New Jersey, and internationally in China and Japan. The corporate’s main model, MGM Grand, is an icon of the Vegas Strip, but in addition varieties the core of the Detroit casinos within the Motor Metropolis’s revitalized downtown.

MGM has its arms in a number of segments of the leisure trade, from resort resorts to casinos, and regularly wraps them up into multi-faceted packages. The corporate’s leisure venues are primarily situated in prime locations, and vacationers can discover advantageous eating, reveals, spas, swimming pools, gaming – just about something they need, to make a memorable time.

Going ahead, MGM has a number of paths for growth. Legalized on line casino gaming is rising extra frequent within the US, and on-line gaming, notably sports activities betting, can also be increasing. Each supply pure avenues for MGM.

Turning to the monetary facet, MGM’s final quarterly report – for 4Q23 – confirmed a quarterly topline of $4.4 billion, up 22% year-over-year and a few $240 million over the estimates. The corporate’s non-GAAP earnings, of $1.06 per share, had been far stronger than the prior-year interval’s $1.54 loss – and had been 35 cents per share higher than the forecast. MGM Las Vegas Strip resorts are the strongest single a part of the corporate’s enterprise and accounted for $2.4 billion of the entire quarterly income. For 2023 as a complete, MGM generated $16.2 billion on the prime line, in comparison with $13.1 billion in 2022, and had a free money stream of $1.8 billion.

This inventory has caught the eye of Mizuho analyst Benjamin Chaiken, who notes that buyers can discover a number of photographs on aim with this inventory. Chaiken writes of MGM, “Our Purchase thesis is supported by three pillars: (1) we consider MGM is essentially mis-valued, whereby the US land primarily based operations alone (ex Macau and ex-sports betting) commerce for less than ~4.7x EBITDA, when M&A comps commerce for properly above that degree. (2) MGM has quite a few development alternatives within the close to/medium time period (e.g., Marriott resort partnership, potential Vegas Baccarat restoration, potential downstate NY On line casino growth, sports activities betting profitability inflection, and Macau upside pushed by market share development), in addition to long run (Japan On line casino growth and resort in Dubai). (3) We see a compelling FCF and inventory buyback worth creation path, whereby MGM may theoretically purchase ~ $4.5-5.0bn of inventory over the subsequent 5 years.”

The analyst’s Purchase ranking is complemented by a $61 value goal that factors towards a 32% potential acquire for the 12 months forward. (To look at Chaiken’s monitor file, click on right here)

The Mizuho view is one in all a number of bullish takes right here; the inventory has 14 latest analyst critiques that embody 12 Buys to 2 Holds, all for a Sturdy Purchase consensus ranking. The shares are buying and selling for $46.30 and the $56.46 common value goal implies a possible one-year upside of twenty-two%. (See MGM inventory forecast)

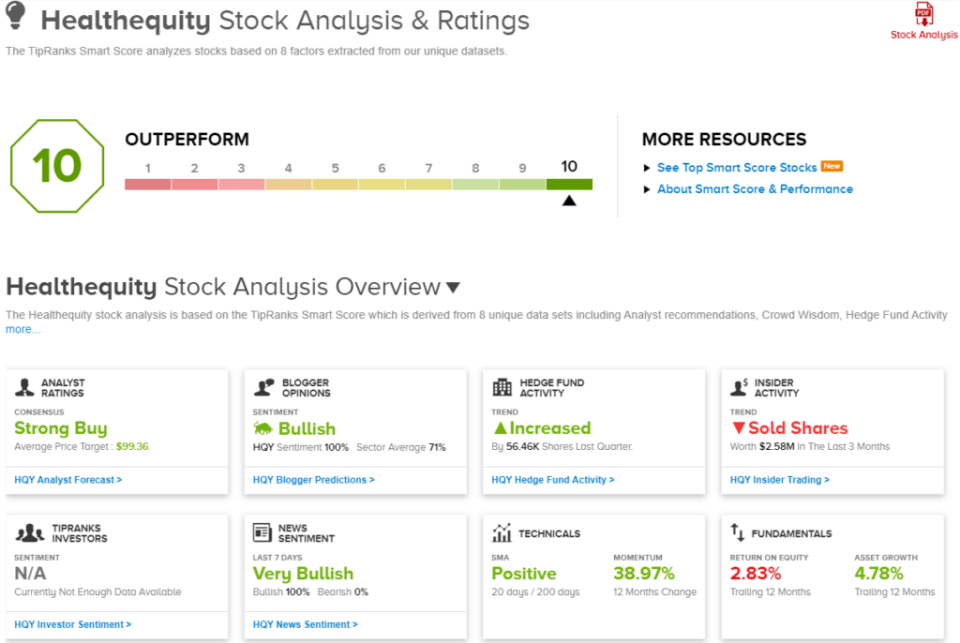

HealthEquity (HQY)

The second inventory on our listing operates on this planet of enterprise companies and monetary tech, the place it holds a number one place as a well being financial savings account and versatile spending account administrator. HealthEquity is an IRS-designated non-bank well being financial savings trustee, giving the corporate across-the-board eligibility for managing such accounts irrespective of which establishments really maintain the funds. This offers the corporate a strong basis to increase its position in a rising piece of the healthcare trade funding pie. HealthEquity works with a wide range of events – together with employers, profit advisors, and well being plan suppliers – to create a big set of financial savings applications for patrons to select from.

The healthcare trade is a rising area – it has been one of many constantly strongest job creators over the previous 12 months – and that has created loads of enterprise for HealthEquity.

The corporate’s monetary outcomes bear witness to that with revenues and earnings principally displaying an upward development for the previous couple of years. Within the final reported quarter, fiscal 4Q24 (January quarter), income hit $262.4 million, up 12% year-over-year and beating the forecast by $3.4 million. On the backside line, HealthEquity’s non-GAAP earnings got here to 63 cents per diluted share; this was 3 cents per share higher than the estimates and a big enhance from the 37 cents reported within the prior-year quarter.

This healthcare sector monetary firm has caught the eye of JMP analyst Constantine Davides, who’s impressed by the corporate’s capability to leverage excessive demand into concrete outcomes over an prolonged interval. The analyst writes, “We anticipate demand for HSAs to stay sturdy, as we consider excessive deductible well being plans (HDHPs) will stay a preferred selection for employers looking for reasonably priced insurance coverage choices for his or her workers. We’re constructive on HQY’s alternative to increase its HSA share features primarily based on its modern, purpose-built expertise platform, increasing community of strategic partnerships, breadth of options, and potential acquisition alternatives. Furthermore, we’re projecting HQY to meaningfully increase its margins and maintain its double-digit income development over the subsequent a number of years, pushed by our expectation for improved HSA money yields, underpinning HQY’s capability to probably double its adjusted web earnings per share by FY27.”

Quantifying his stance on HQY, the analyst places a Market Outperform (Purchase) ranking on the inventory, together with a $101 value goal that suggests a one-year upside potential of 27.5%. (To look at Davides’ monitor file, click on right here)

This bullish outlook is not any outlier, as demonstrated by the 11 unanimously constructive analyst critiques right here – which give the inventory its Sturdy Purchase consensus ranking. These shares have a present promoting value of $79.20 and their $99.36 common value goal is sort of as bullish because the JMP view, suggesting a 25.5% upside on the one-year horizon. (See HQY inventory forecast)

To search out good concepts for shares buying and selling at enticing valuations, go to TipRanks’ Greatest Shares to Purchase, a software that unites all of TipRanks’ fairness insights.

Disclaimer: The opinions expressed on this article are solely these of the featured analysts. The content material is meant for use for informational functions solely. It is extremely vital to do your personal evaluation earlier than making any funding.